- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Do MoneyGram Money Orders Expire? Analysis of Validity Period, Fees, and Security

Image Source: pexels

You might ask: Do money orders expire? MoneyGram money orders do have an expiration date. You need to carefully check the date information printed on the money order. After the expiration date, the money order may not be cashed normally. It’s recommended to verify the money order upon receipt and plan its usage time appropriately to avoid financial loss.

Key Takeaways

- MoneyGram money orders have an expiration date, so be sure to check the date on the money order and cash it promptly to avoid financial loss.

- Money orders not cashed within the validity period may incur monthly service fees, reducing the actual amount received.

- When handling a money order, understand the associated fees and policies to avoid increased costs due to errors.

- When using a money order, be cautious of common scams to ensure transaction safety and protect personal information.

- Upon receiving a money order, immediately check its expiration date and details, and plan the cashing time appropriately.

Do Money Orders Expire?

Expiration Date Explanation

You might wonder whether money orders expire. MoneyGram money orders do have an expiration date, which is usually clearly indicated on the money order. Upon receiving a money order, it’s recommended to check the expiration date information immediately. Different regions and banks (such as licensed Hong Kong banks) may have varying regulations when processing money orders. When using MoneyGram money orders in Mainland China, you also need to pay attention to the specific requirements of local banks.

Tip: You can find detailed information about service fees and expiration dates on the back of the money order. This helps you plan the money order’s usage time in advance to avoid unnecessary losses.

You may find that MoneyGram money orders do not truly expire. Even if you don’t cash them within a year, they remain valid. However, after one year, banks may start charging monthly service fees. These fees are deducted directly from the money order amount, reducing the amount you receive. You can check the specific fee structure in the “service fee” section on the back of the money order, typically priced in USD.

Handling Expired Money Orders

You might also wonder what to do if a money order expires. While MoneyGram money orders don’t become completely invalid like some financial products, if you fail to cash them for an extended period, banks will charge service fees as per regulations. Each month of delay reduces the money order’s value. You need to act promptly to avoid losing more funds due to accumulated service fees.

The table below compares the expiration and fee conditions for different remittance products:

| Remittance Product | Expiration Status | Fee Status |

|---|---|---|

| MoneyGram Money Order | Does not expire, but may incur service fees after one year | Monthly service fees after one year, reducing value |

| Electronic Transfer | Does not expire | Typically no additional fees |

| Other Remittance Products | Does not expire | Fees vary by service |

When handling money orders in Mainland China or Hong Kong, it’s recommended to proactively consult bank staff to confirm whether money orders expire and understand the relevant fee policies. If you find that a money order has not been cashed for over a year, you should cash it as soon as possible to minimize service fee losses. You can also check the latest policies through the bank’s website or customer service hotline to ensure fund safety.

Reminder: Each time you receive a MoneyGram money order, promptly check its expiration date and plan the cashing time appropriately. This maximizes the protection of your financial interests.

Usage Period

Checking the Expiration Date

After receiving a MoneyGram money order, the first step is to check its expiration date. You can find the relevant date information directly on the money order. In most cases, the expiration date is clearly marked on the front or back. If you’re handling money order transactions at banks in Mainland China or Hong Kong, it’s recommended to consult bank staff about the specific cashing period. Policies may vary by bank and region, with some banks not charging fees within the first year of issuance, but service fees may apply after one year.

Tip: You can check the money order’s detailed expiration date and related policies through the bank’s website, customer service hotline, or at the counter. This helps you plan fund arrangements in time to avoid unnecessary losses.

The table below shows how different global institutions handle MoneyGram money order expiration dates:

| Source | Expiration Date Explanation |

|---|---|

| Global Banks | Money orders typically do not expire, but holding fees may apply after several years if unclaimed. |

| Ace Money Transfer | No uniform standard; validity is generally 6 months to 1 year. |

| Money Hop | Expiration policies vary by institution; overdue money orders may lose value or incur additional fees. |

When checking, pay special attention to the money order and bank’s instructions to ensure fund safety by avoiding oversight of the expiration date.

Precautions

When using MoneyGram money orders, you need to note several key issues. First, you should cash the money order within its validity period to avoid service fees. If you delay for an extended period, banks may deduct monthly USD service fees from the money order amount, reducing the amount you receive. You also need to store the money order securely to prevent loss or damage. When filling out information, carefully verify details such as the recipient’s name and amount to ensure accuracy. Errors in filling out information may render the money order uncashable, potentially leading to financial loss.

- After receiving a money order, it’s recommended to immediately check its expiration date and details.

- When handling money orders in Mainland China or Hong Kong, proactively consult the bank to understand the latest policies.

- Avoid losses due to expiration, loss, or errors in filling out information.

If you have questions, such as “Do money orders expire?”, you can consult bank staff or customer service at any time to ensure your funds’ safety.

Fees

Image Source: pexels

Transaction Fees

When purchasing a MoneyGram money order, you’ll first encounter a purchase transaction fee. Generally, the fee varies depending on the money order amount and purchase location. When buying a money order at a bank counter in China/Mainland China or Hong Kong, you typically need to pay a certain fee. The table below shows the typical fee range for MoneyGram money orders:

| Fee Range | Description |

|---|---|

| $0.35-$2.00 | Typical fee range for purchasing a money order |

| Maximum Limit | Money orders are typically limited to $1,000 |

| Use Case | Commonly used for small payments |

When cashing or withdrawing a money order, some cashing locations may charge additional fees. Policies and fee standards vary by cashing location. You need to provide valid identification to complete the cashing process. When requesting a refund or copy of a money order, you’ll also incur processing fees. For example, requesting a copy incurs an $18 processing fee.

- Cashing locations may charge fees to cash MoneyGram money orders.

- Policies may vary by cashing location, with differing fees.

- Most cashing locations require identification to cash a money order.

- Requesting a money order refund incurs a processing fee, varying by face value.

- Requesting a copy of a money order incurs an $18 processing fee.

Other Fees

If you fail to cash a money order within the specified period, you may face additional fees. While MoneyGram money orders don’t become completely invalid, banks will start charging monthly service fees after one year. These fees are deducted directly from the money order amount, reducing the amount you receive. Many users report that fees for expired money orders and the reissuance process often cause dissatisfaction, and customer service is frequently criticized for handling these fees.

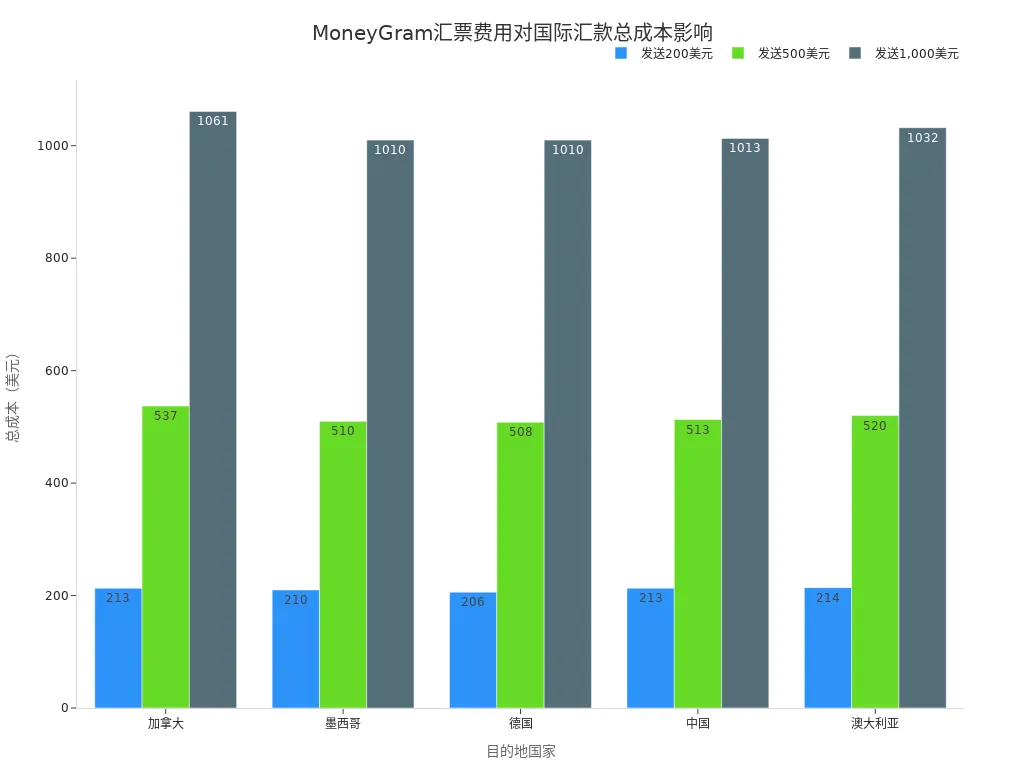

When handling international remittances, fees impact the total cost. The table below shows MoneyGram’s total fees for different remittance amounts to various countries:

| Destination Country | Sending $200 | $500 | $1,000 |

|---|---|---|---|

| Canada | $213 | $537 | $1,061 |

| Mexico | $210 | $510 | $1,010 |

| Germany | $206 | $508 | $1,010 |

| China | $213 | $513 | $1,013 |

| Australia | $214 | $520 | $1,032 |

When handling money orders in China/Mainland China or Hong Kong, it’s recommended to understand all related fees in advance and plan the money order’s usage time to avoid increased costs due to expiration or errors.

Security

Image Source: pexels

Anti-Counterfeiting Measures

When using MoneyGram money orders, you can verify authenticity through various anti-counterfeiting features. MoneyGram money orders use thermochromic marks, which fade and reappear when touched with a finger. The money order has a serrated edge on one side, an important design to prevent forgery. You’ll also find that the money order comes with a detachable receipt for easy record-keeping and verification.

Each time you receive a money order, it’s recommended to carefully inspect these anti-counterfeiting features. If the money order lacks these features, consult bank staff immediately to avoid financial risks.

According to the latest statistics, the consumer fraud complaint rate for MoneyGram money orders was only 0.009% in 2022, consistently declining over the past eight years. The table below shows the relevant data:

| Statistical Year | Consumer Fraud Complaint Rate |

|---|---|

| 2022 | 0.009% |

| Past Eight Years | Consistently Declining |

You can see that MoneyGram money orders’ security measures are highly effective in practice.

Risk Prevention

When using money orders, you should remain vigilant against common scams. Scammers may post low-priced goods online, inducing you to pay via MoneyGram. Some may impersonate family members or law enforcement, claiming urgent fund needs. Others may send fake checks or money orders, asking you to cash them and transfer funds. You may also encounter romance scams or phone-based scams targeting seniors, including identity theft.

You can take the following measures to reduce risks:

- Provide valid government-issued identification, such as a driver’s license or passport.

- Ensure the name on the ID matches the transaction information.

- Keep the transaction reference number confidential, sharing it only with the intended recipient.

- Use a credit or debit card for identity verification in online transactions.

- Check with local MoneyGram agents or the company website for additional identification requirements.

- Use encryption technology to protect online transactions.

- Verify the recipient’s identity before transacting and monitor for suspicious behavior.

- Learn to recognize common scams to enhance fraud awareness.

When handling money orders in China/Mainland China or Hong Kong, it’s recommended to consult bank staff proactively to understand the latest security policies. Over the past decade, MoneyGram has advanced its digital transformation, enhancing security technology but facing compliance challenges. You should stay vigilant, use money orders appropriately, and ensure your funds’ safety.

When using MoneyGram money orders, focus on these key points:

- The expiration date is printed on the money order, and it becomes invalid after expiration, with no option for replacement or refund. You should cash it before the deadline to avoid financial loss.

- Fees include convenience fees, transaction fees, processing fees, and mailing fees, priced in USD, varying by location.

- Each money order typically has a maximum limit of $1,000, with high security, but you must store it securely to prevent risks.

You can choose the appropriate money order service based on your needs, research the provider’s fees and processing times, and evaluate customer service and security features. Plan money order usage appropriately to ensure fund safety.

FAQ

Where can I check the expiration date of a MoneyGram money order?

You can find the expiration date directly on the money order. It’s typically printed on the front or back. It’s recommended to check the date immediately upon receiving the money order to avoid expiration.

Can I cash it after it expires?

If you haven’t cashed it within a year, banks will charge monthly service fees. You can still cash it, but the amount received will be reduced. It’s advisable to cash it as soon as possible.

What should I do if I lose a MoneyGram money order?

If you lose a money order, contact the bank or MoneyGram customer service immediately. You need to provide relevant proof. The bank will assist with a refund or reissuance, which may incur a USD processing fee.

What documents are needed to cash a MoneyGram money order?

When cashing a money order in China/Mainland China or Hong Kong, you need to provide valid identification, such as a passport or driver’s license. The bank will verify the information to ensure fund safety.

Navigating MoneyGram money orders can feel limiting, with expiration concerns, monthly service fees eating into funds, and fraud risks posing threats—especially when capped at $1,000 for larger cross-border needs. BiyaPay offers a smarter, more versatile global remittance solution to sidestep these hurdles. With fees as low as 0.5%, it outshines traditional bank charges, supporting instant conversions across 30+ fiat currencies and 200+ cryptos with transparent rates, ensuring no surprise deductions shrink your transfers. A quick signup unlocks same-day remittances to most countries worldwide, ideal for everything from small daily payments to substantial international transfers.

BiyaPay’s cutting-edge end-to-end encryption safeguards every transaction, eliminating risks like those tied to money order scams. Plus, within the same platform, you can trade US and Hong Kong stocks without an offshore account, with zero-fee contract orders to diversify your portfolio effortlessly. Start today with BiyaPay! Use the Real-Time Exchange Rate Query to calculate exact delivery amounts and streamline your planning. Explore Stocks to fuel your investment journey. Join BiyaPay now to break free from money order constraints, enjoying fast, secure, and cost-effective global transfers that keep your funds flowing freely.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.