- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Guide to Remitting Money to India: Best Methods, Cost Comparison, and Security Analysis

Image Source: pexels

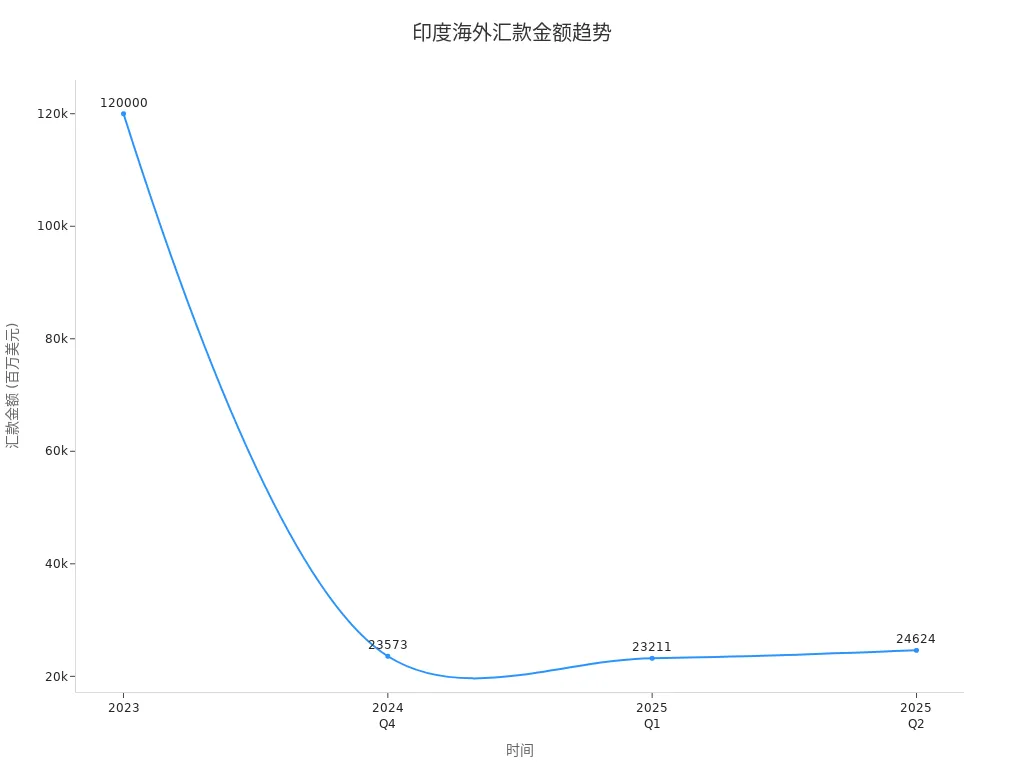

When searching for a remittance guide to India, you should focus on security, delivery speed, and fees. India has been the world’s largest remittance recipient since 2008, with total remittances reaching USD 120 billion in 2023. The table below shows the trend in remittance amounts in recent years:

| Time | Remittance Amount (Million USD) |

|---|---|

| 2023 | 120000 |

| 2024 Q4 | 23573 |

| 2025 Q1 | 23211 |

| 2025 Q2 | 24624 |

You can prioritize platforms that support local payment methods while focusing on the reliability of the service provider and real-time exchange rates.

Key Points

- When choosing a remittance method, focus on security, delivery speed, and fees to ensure funds arrive safely and efficiently.

- Bank transfers are suitable for users seeking low fees, while online platforms like Wise and Remitly offer faster delivery and transparent fee structures.

- When using digital wallets, ensure the platform’s security and coverage to avoid issues in areas with poor network connectivity.

- Before sending money, verify recipient information and real-time exchange rates to avoid losses due to errors.

- Regularly check platform security announcements to enhance awareness and ensure secure remittances.

Remittance Methods

Image Source: unsplash

Bank Transfers

Bank transfers are often the first method considered in a “guide to sending money to India.” You can use licensed banks in mainland China or Hong Kong to transfer funds directly to a recipient’s account in India. Bank transfers are typically divided into inward and outward remittances. Inward remittances refer to transfers from overseas to India, while outward remittances are from India to overseas. Banks offer various transfer methods, including checks, wire transfers, and paperless online services.

The table below shows the main advantages and disadvantages of bank transfers and wire transfers:

| Advantages/Disadvantages | Bank Transfer | Wire Transfer |

|---|---|---|

| Fees | Usually free, but fees may apply if limits are exceeded | Banks charge fees |

| Speed | May take up to three days | Instant |

| Security | Secure and reversible | Irreversible and relatively less secure |

| Information Requirements | Requires more information | Only requires recipient’s email or phone number |

| Use Case | Suitable for startups seeking low-cost transfers | Suitable for SMEs needing fast international payments |

When choosing bank transfers, you should focus on the reliability of the service provider. It’s recommended to prioritize bank services with SSL encryption and two-factor authentication. You can also check customer reviews to ensure the bank’s services are secure and reliable.

Fees and processing times for bank transfers vary by bank. The table below shows fees for some major banks in USD:

| Bank Type | Receiving Fee (USD) | GST Fee | Currency Conversion Markup | Possible Intermediary Fees | Notes |

|---|---|---|---|---|---|

| Licensed Hong Kong Bank A | $7–$14 | 18% | 1–2% | $10–$30 | Extensive branch network, slower processing |

| Licensed Hong Kong Bank B | $3–$10 | 18% | 1.5–2% | $10–$30 | Supports online tracking |

| Licensed Hong Kong Bank C | $3–$10 | 18% | 1–2% | $10–$30 | Strong global partnerships |

When processing transfers, you need to prepare recipient information in advance, verify real-time exchange rates and service fees, and ensure funds arrive safely.

Online Remittance Platforms

Online remittance platforms are becoming an increasingly popular choice in a “guide to sending money to India.” You can use international platforms like Wise and Remitly for fast and secure fund transfers. These platforms typically offer transparent fee structures and real-time exchange rates.

Wise is ideal for users needing transparent fees and multi-currency accounts. You can clearly see the fees and exchange rates for each transfer on the platform. Remitly emphasizes ease of use, suitable for less tech-savvy users, and supports fast delivery and cash pickup options.

The table below compares the main features of Wise and Remitly:

| Feature | Remitly | Wise |

|---|---|---|

| User Interface | Simple and intuitive, suitable for less tech-savvy users | Detailed display of rates and fees, easy to navigate |

| Mobile App | Fast transfers, supports biometric authentication | Multi-currency management, supports virtual card features |

| Customer Support | 24/7 support, focused on urgent transfers | Self-service resources with direct support channels |

| Suitable For | Users needing fast delivery or cash pickup options | Users needing transparent fees and multi-currency accounts |

| Speed | Funds arrive in minutes | Suitable for large transfers, transparent rates |

When choosing an online platform, you should ensure the provider uses SSL encryption and two-factor authentication. You can also check customer reviews to confirm the platform’s reliability. Many platforms offer lower fees than traditional banks and faster delivery, making them ideal for users needing flexible transfers.

Digital Wallets

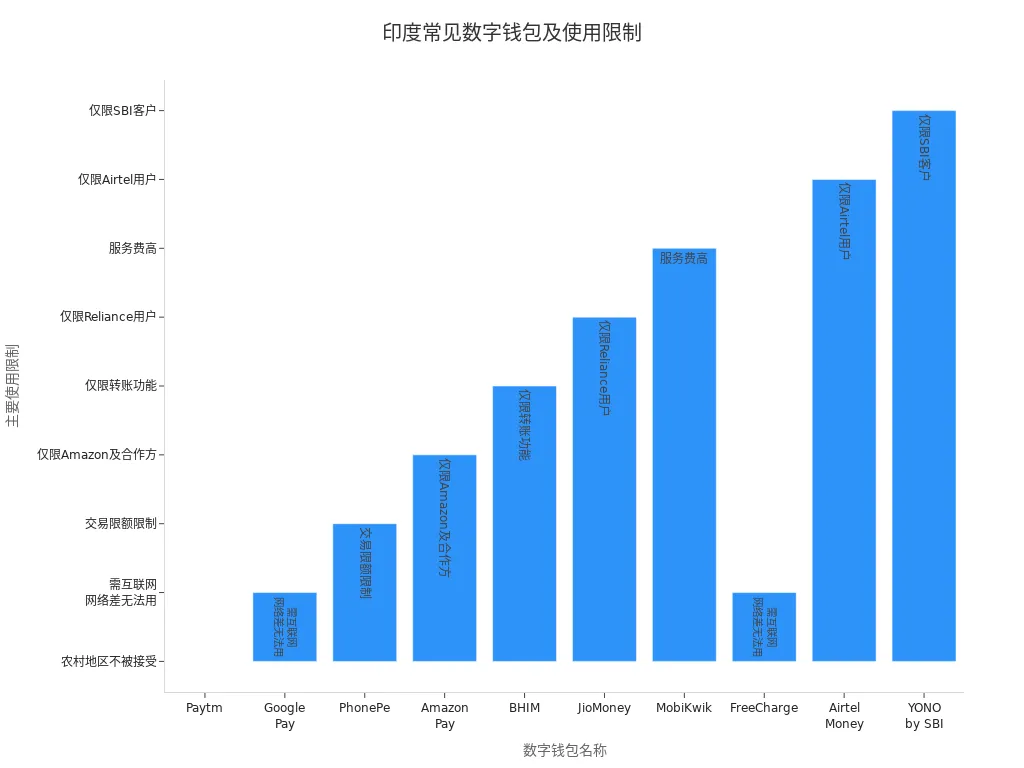

Digital wallets provide additional convenience in a “guide to sending money to India.” You can use mainstream digital wallets like Paytm, Google Pay, and PhonePe for remittances. These wallets support bill payments, mobile top-ups, and instant bank transfers, with some platforms also offering investment and shopping options.

The table below shows the features and limitations of common digital wallets:

| Digital Wallet | Features | Limitations |

|---|---|---|

| Paytm | Supports UPI payments, bill payments, recharges, movie bookings | May not be accepted in some rural areas |

| Google Pay | Instant bank transfers, widely accepted, secure experience | Relies on internet, unusable in areas with poor connectivity |

| PhonePe | Multiple services, user-friendly interface | Transaction limits may restrict large transfers |

| Amazon Pay | Primarily for Amazon and partner site payments | Limited to Amazon and partners |

| BHIM | Government-backed UPI app, direct bank transfers | Limited to transfers, lacks other wallet features |

| JioMoney | Recharges and utility bill payments, suitable for specific users | Mainly for specific service users, less convenient for others |

| MobiKwik | Supports bill payments, split bills, and investment options | May have service fees, higher costs for frequent use |

| FreeCharge | Bill payments and shopping discounts | Relies on internet, unusable in areas with poor connectivity |

| Airtel Money | Convenient for specific users for bill and recharge management | Limited to specific users, less convenient for others |

| YONO by SBI | Combines wallet and banking features, supports bill payments and shopping | Limited to specific bank customers |

When choosing a digital wallet, you should focus on the platform’s security and coverage. Some wallets may not be usable in rural areas or regions with poor network connectivity, and transaction limits may affect large remittances.

Other Methods

In addition to bank transfers, online platforms, and digital wallets, you can consider other methods for remittances. Trusted online remittance services are often the fastest and most secure options. These platforms offer competitive exchange rates, low fees, and instant delivery options. Digital services can deliver funds to Indian bank accounts or cash pickup points in minutes.

You can also consider the complementarities of the following methods:

- Digital Wallets: Such as PayPal, Google Pay, and PhonePe, supporting fast transfers and competitive rates.

- Remittance Apps: Such as Wise and Remitly, focused on international transfers with lower fees and better rates than banks.

- Cryptocurrency Transfers: Suitable for tech-savvy users, using digital currencies like Bitcoin, but compliance and security must be considered.

- Peer-to-Peer Transfers: Such as Venmo and Cash App, with some platforms supporting international transfers through partnerships.

When choosing a remittance method, you should prioritize the provider’s reliability and convenience. It’s recommended to review platform security measures and customer feedback to ensure fund safety. You also need to focus on real-time exchange rates and service fees to select the most suitable method in your “guide to sending money to India.”

Guide to Sending Money to India: Fees and Delivery Time

Fee Comparison

When choosing a remittance method, you should first focus on the fee structure. Fees vary significantly across platforms and banks. Wise and Remitly, as mainstream online platforms, offer transparent fees and easy comparison. Traditional banks, especially licensed Hong Kong banks, typically charge higher fees and may include multiple hidden costs.

The table below compares the main fees for Wise, Remitly, and licensed Hong Kong banks:

| Feature | Remitly | Wise | Licensed Hong Kong Bank |

|---|---|---|---|

| Sending Funds | $3.99 transaction fee (under $1,000); large amounts may have no fee but include rate markup | Transfer fees from 0.48% | 3-5% (large amounts); INR 500-1500 (small amounts) |

| Exchange Rate | 0.4%-1.4% markup | Mid-market rate, no additional markup | Rate markup 1-4% |

| Other Fees | Rate markup included in total cost | No hidden fees | May include intermediary bank fees, service fees, etc. |

Before sending money, you should carefully review all fees, including fixed fees, percentage-based fees, exchange rate differences, receiving fees, intermediary bank fees, service fees, commissions, compliance and regulatory fees, and cancellation or modification fees. This helps avoid losses due to hidden costs.

Exchange Rate Differences

Exchange rates are a key factor affecting the total cost in a “guide to sending money to India.” When sending money, you must pay attention to the gap between the provider’s offered rate and the mid-market rate. Most platforms add a markup to the mid-market rate, reducing the actual received amount.

You can see that exchange rate differences significantly impact total costs. Providers typically add a 1-4% markup to the mid-market rate. By actively comparing rates across platforms, you can save considerable costs. The most expensive remittance methods are often not those with the highest fees but those with the largest rate markups.

Tip: Before sending money, check real-time exchange rates on each platform to avoid losses due to rate fluctuations.

Delivery Speed

Delivery speed is another critical factor in your “guide to sending money to India.” Different methods have varying delivery times. Wise and Remitly offer faster online transfers, while traditional banks take longer to process.

The table below compares delivery times for major methods:

| Remittance Method | Description | Sending Time | Receiving Time | Paperwork | Notes |

|---|---|---|---|---|---|

| Bank Branch (SWIFT) | Traditional SWIFT wire transfer | 2–4 days | 1–3 days | High | Strong compliance but slow and costly |

| Online Banking | Digital forex transfer via internet or mobile banking | 1–3 days | N/A | Medium | Limited to specific purposes, faster |

| Forex Portal | Online-initiated transfers via forex markets | 2–4 days | N/A | Medium | Competitive rates, depends on bank processing |

| Remitly Express | Fast transfer | Minutes | N/A | Low | Suitable for urgent needs |

| Remitly Economy | Economy transfer | Several days | N/A | Low | Lower fees but slower |

| Wise | Bank transfer | 2–4 business days | N/A | Low | 60% instant, 95% within one day |

When choosing a method, balance delivery speed and fees based on the recipient’s needs and urgency. For fast delivery, prioritize Remitly’s Express service or Wise’s instant transfer options. For non-urgent transfers, choose lower-cost economy services.

Tip: Before sending money, verify real-time exchange rates and service fees to ensure funds arrive safely and efficiently.

Security and Risk Prevention

Image Source: unsplash

Security Measures

When choosing a remittance method, security is a top consideration. Mainstream remittance platforms and licensed Hong Kong banks implement multiple security technologies to protect your funds and personal information.

- Most platforms use end-to-end encryption to ensure transaction data cannot be intercepted during transmission.

- Platforms comply with international regulations, such as the Financial Conduct Authority (FCA) and General Data Protection Regulation (GDPR), to protect your privacy.

- Two-factor authentication (2FA) and multi-factor authentication (MFA) require multiple identity verifications to enhance account security.

- Some platforms support biometric login for secure and convenient account access.

- 24-hour transaction monitoring and layered firewalls detect and block suspicious activities promptly.

When using platforms recommended in the “guide to sending money to India,” prioritize those with these security measures.

| Regulation | Impact |

|---|---|

| Foreign Exchange Management Act (FEMA) | Ensures the legality and security of international remittances, preventing financial crimes. |

| Anti-Money Laundering (AML) and Know Your Customer (KYC) | Ensures funds are not used for illegal activities, enhancing transaction transparency. |

| Liberalised Remittance Scheme (LRS) | Regulates remittable amounts and purposes to ensure compliance. |

| SWIFT System | Provides secure cross-border payments, adhering to regulatory frameworks. |

Common Risks

During the remittance process, you may encounter various risks:

- Potential Fraud: Scammers may impersonate recipients or platforms to trick you into transferring funds.

- Exchange Rate Fluctuations: Currency rate changes can affect the amount received.

- Processing Delays: Bank system failures or incorrect information may extend delivery times.

- Transaction Fees: Fees vary significantly across providers, impacting total costs.

- Regulatory Compliance: Non-compliance with regulations may lead to funds being rejected or legal risks.

Data shows that India reported 3,596 fraud cases in 2021-22, with a total fraud value of approximately USD 155 million, a 34% increase from the previous two years. Victims include educated individuals and retirees, with increasingly sophisticated fraud tactics.

User Prevention Tips

You can take the following measures to reduce risks and ensure fund safety:

- Choose regulated, reputable remittance companies and prioritize platforms with traceable transfers.

- Verify recipient identity before sending money to avoid losses due to errors.

- Monitor exchange rate changes and choose platforms that allow real-time rate locking.

- Learn to identify fraud signs, such as urgent requests or overly friendly language.

- If you encounter suspicious activity, contact the bank or platform customer service immediately and pause operations.

When following the “guide to sending money to India,” regularly check platform security announcements to enhance awareness and ensure secure remittances.

Operational Process and Considerations

Bank Transfer Process

When sending money to India through licensed Hong Kong banks, you need to prepare relevant information and documents in advance. Banks typically require detailed recipient information. The table below lists common required information:

| Required Information | Description |

|---|---|

| Recipient Bank Name | Name of the recipient’s bank |

| Bank Address | Detailed address of the recipient’s bank |

| Bank Account Number | 5-20 digits |

| IFSC Code | 11-character code, usually starting with 4 letters |

| Recipient Email Address | For receiving notifications |

| Contact Information | Recipient’s contact phone number |

| SWIFT Code | Bank identification code for international transfers |

| Purpose of Transfer | Must be selected from the bank’s provided list |

You also need to provide the recipient’s full name (in Latin characters), account number, and transfer purpose. The bank will verify this information to ensure fund safety. When processing, prepare all materials in advance to avoid delays due to missing information.

Online Platform Operational Steps

When using online platforms like Wise or Remitly to send money, the process is straightforward. You can follow these steps to complete a transfer:

- Enter the amount you wish to send and select a payment method (e.g., bank account, credit card, or debit card).

- Choose a delivery method, such as bank deposit, UPI, or cash pickup, and provide relevant details.

- Enter the recipient’s name, phone number, and other contact information.

- Add your payment details.

- Carefully review all transfer information and click send once confirmed.

During the process, verify recipient information and exchange rates to ensure accuracy. Platforms typically display fees and delivery times in real-time, making it easy to choose.

Digital Wallet Usage Tips

When using digital wallets (e.g., Paytm, Google Pay, PhonePe) for remittances, consider the following points:

- Convenience and Speed: You can complete payments quickly with a tap or QR code scan.

- Enhanced Security: Platforms use encryption and biometric authentication to improve account security.

- Cost-Effectiveness: Most digital wallet transactions are free or have minimal fees.

- Security Risks: Be cautious of hacking and data breach risks, and avoid using insecure devices.

- Device Dependency: Ensure your phone or device is functional.

- Limited Acceptance: Some rural areas or merchants may not support digital wallet payments.

When choosing a digital wallet, prioritize security and coverage to ensure smooth remittances.

Pre- and Post-Remittance Verification

Before and after sending money, carefully verify the following information to ensure transaction safety:

- Before sending, confirm the recipient’s name, bank account number, SWIFT code, and branch information are accurate.

- Check the exchange rate and expected delivery time to understand the actual received amount.

- After sending, the bank or platform will notify you of transaction progress via SMS or app.

- After the recipient receives funds, some banks may hold funds temporarily for compliance checks, requiring the recipient to provide documents (e.g., contracts, payment invoices, or purpose codes).

- Avoid common mistakes, such as not comparing providers, using insecure devices, or misunderstanding delivery times. You can reduce risks by comparing fees and rates and ensuring device security.

Tip: Before and after each remittance, double-check all critical information to ensure funds arrive safely and efficiently.

When choosing a method to send money to India, refer to the table below for user feedback and expert analysis on Wise and Remitly:

| User Feedback | Evaluation |

|---|---|

| Delayed Transfers and Poor Customer Service | Some users reported these issues |

| Fast Transfers and Competitive Rates | Many users, especially new customers, are satisfied |

| Low-Cost Options | Experts consider Remitly a low-cost option, especially for India |

| Better Rates | Remitly often offers better rates than Wise for first-time users |

You should prioritize the following factors when choosing a remittance method:

- Exchange rates affect the amount received.

- Transfer speeds typically range from 48 to 72 hours, with some methods faster or slower.

- Additional fees include forex conversion taxes, transfer fees, and remittance service taxes.

Digital platforms are evolving, with technologies like AI and blockchain improving remittance security and efficiency. Based on your needs, consider fees, speed, and security to choose a reliable provider and ensure funds arrive safely.

FAQ

How do I choose the most suitable platform for sending money to India?

You can compare platforms’ fees, exchange rates, and delivery speeds. Prioritize regulated, well-reviewed platforms. Also, focus on the platform’s security measures and customer service.

What basic information is needed to send money to India?

You need the recipient’s name, bank account number, SWIFT code, IFSC code, and bank name. Some platforms also require contact details and the purpose of the transfer.

Are there limits on remittance amounts?

Most platforms and licensed Hong Kong banks impose caps on single or daily remittance amounts. Check specific limits on the platform or bank’s website. Some platforms support large transfers but require additional reviews.

How long does it take for a remittance to arrive?

Delivery time depends on the method. Wise and Remitly typically deliver in 1-2 days. Traditional banks may take 2-4 business days. Holidays or incorrect information may cause delays.

What should I do if a remittance fails?

First, verify recipient information and account status. If the funds still haven’t arrived, contact the platform or bank’s customer service promptly. Most platforms support refunds or reprocessing.

When crafting a remittance strategy to India, you might appreciate how platforms like Wise and Remitly deliver transparent fees and swift arrivals (e.g., Wise’s 60% instant, Remitly Express in minutes), yet encounter hurdles: Remitly’s 0.4%-1.4% rate markup and $3.99 transaction fee (for small amounts), Wise’s transfer fees starting at 0.48% but reaching $23.53 (for large sums), traditional banks’ 3-5% costs with 2-4 day delays, and digital wallets like Paytm’s limited rural reach—all vulnerable to exchange volatility and compliance checks, inflating expenses or causing holdups amid India’s 2025 remittances exceeding $120 billion.

BiyaPay emerges as a comprehensive upgrade in cross-border finance, tackling these issues head-on. Our real-time exchange rate query grants instant mid-market rates to sidestep markups. Fees as low as 0.5% enable conversions across 30+ fiat currencies and 200+ digital assets, serving India and 100+ countries with same-day delivery and no rigid limits. A key edge: BiyaPay’s unified platform allows US and Hong Kong stocks trading sans overseas accounts, with zero fees on contract orders—transforming remittances into growth opportunities. Licensed via US MSB and beyond, fortified by 256-bit encryption and real-time fraud alerts for robust compliance and security.

Register now at BiyaPay to embrace low-cost, ultra-fast global remittances paired with savvy investing, streamlining your India transfers with effortless, value-driven efficiency!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.