- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

My Stablecoin USDT International Payment Was Almost Scammed

Image Source: unsplash

A business owner recently initiated a stablecoin (USDT) international payment to a new overseas partner. The transaction process quickly became suspicious. The partner sent a forged payment confirmation and urged an immediate fund release. This tactic mirrors a recent fraud case where scammers converted $15,000 into USDT through an instant exchange.

- Tether’s chain settlement volume grew 24.8% in the first half of 2025.

- Active USDT holder addresses increased by 19.2% in the same period.

- Southeast Asia saw a 36% rise in on-chain volume, driven by B2B settlements.

This rapid adoption makes the stablecoin (USDT) international payment a prime target for increasingly sophisticated scams.

Core Points

- Independent verification is key in cryptocurrency transactions; do not trust screenshots provided by the counterparty.

- Use hardware wallets to protect large assets; they provide the highest level of security.

- Carefully verify recipient addresses to prevent fraud like “address poisoning.”

- Choose reputable, compliant trading platforms and check their reserve proofs.

- Retain all transaction records to handle potential disputes and audits.

Scam Review: My Stablecoin (USDT) International Payment Experience

Image Source: pexels

Transaction Start: A Seemingly Normal Request

The story begins with a routine business transaction. A business owner needed to pay a new overseas service provider a service fee worth thousands of dollars. To pursue efficiency and low costs, both parties agreed to use stablecoin (USDT) international payment. This is increasingly common in current B2B settlements. The service provider gave a TRC-20 network address, and the entire process appeared normal.

The Scammer’s Chain Trap

After the payment instruction was sent, the scam unfolded quickly. The counterparty soon sent a seemingly professional successful transaction screenshot and urged the business owner to confirm. This screenshot was very likely forged using tools like “Flash USDT Software”, which can simulate a real USDT transfer interface, but the funds never actually left the scammer’s wallet.

The scammer’s traps went beyond this; they employed multiple fraud strategies:

- Emotional and Trust Induction:Scammers build initial trust to lure victims into investing in recommended fake platforms, ultimately converting funds to USDT and absconding.

- Address Poisoning Attack:Scammers send zero-value transactions to the business owner’s wallet. The sender address in this transaction is extremely similar to the business owner’s usual counterparty. When the business owner pays next time, it’s easy to copy this “poisoned” address from history, sending funds directly to the scammer.

- Phishing Website Diversion:Some scammers provide a fake wallet check site, for example

usdtscanner[.]xyz. They claim you can verify transactions here, actually to trick users into connecting wallets and signing malicious contracts, stealing all assets.

Beware:The fake screenshots or messages sent by scammers aim to create urgency, making you release funds or proceed without verifying on the blockchain.

Critical Moment: How I Detected the Scam

Despite receiving the “payment complete” screenshot, the business owner stayed vigilant. He noticed his wallet balance unchanged. He did not trust the counterparty but insisted on independent verification via a blockchain explorer. This was the key step to detecting the scam.

He followed this standard verification process:

- Request Transaction Hash (TXID):He asked the counterparty for the complete transaction ID, a unique proof.

- Use Official Explorer:He opened the official TRON network explorer TRONSCAN, not any link provided by the counterparty.

- Verify Transaction Details:After entering TXID in the explorer, he found no such transaction. This directly proved the counterparty’s screenshot was forged. He also carefully checked the recipient address, confirming a slight difference from the previously communicated one, detecting the address poisoning attempt.

This close-call stablecoin (USDT) international payment experience highlights the critical importance of independent verification in cryptocurrency transactions. At any time, the only credible proof is the confirmation record on the blockchain explorer.

USDT Secure Operations: Wallet and Transaction Guide

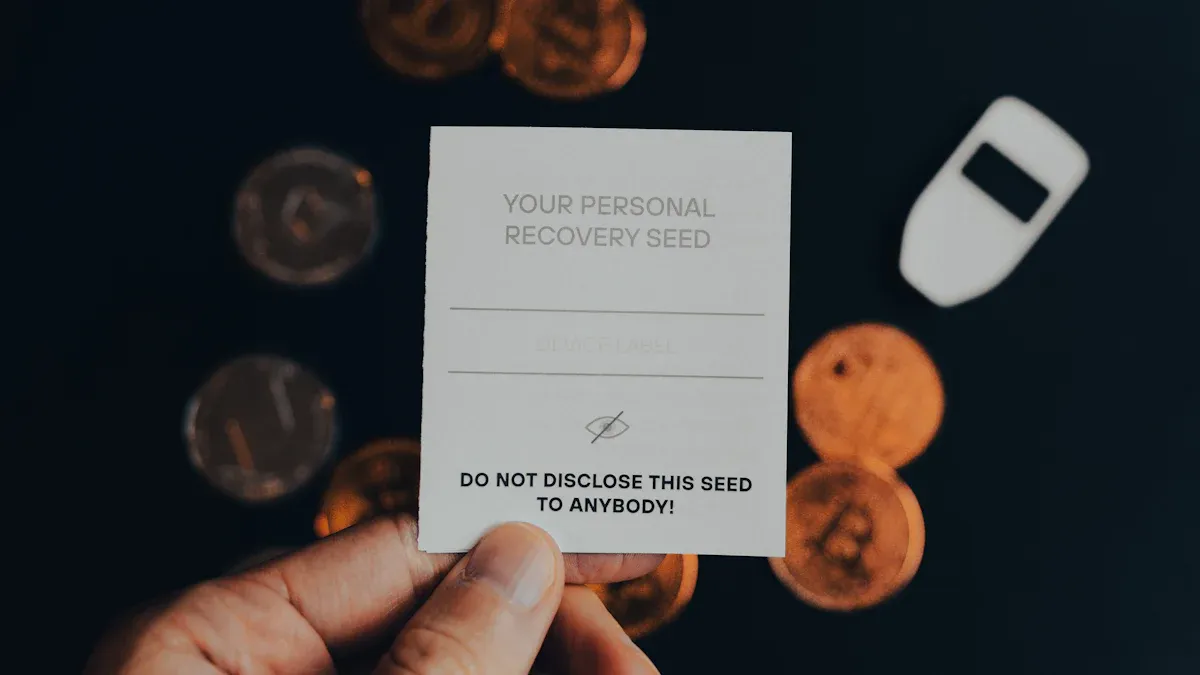

Image Source: unsplash

After the scam scare, we must recognize that tools are neutral; security depends on the user’s knowledge and habits. Establishing a complete secure operation process is the first and most important defense for protecting digital assets. This guide provides comprehensive advice from four core links: wallets, networks, platforms, and transaction verification.

Wallet Choice: Hardware Wallet as the First Defense

Wallets are the entry for managing private keys and assets; their security directly determines fund survival. Wallets mainly divide into hot wallets (software wallets) and cold wallets (hardware wallets), differing essentially in security.

- Hot Wallets (Software Wallets):Such as MetaMask or Trust Wallet, these are always online. They facilitate high-frequency trading or DeFi interactions but face higher hacker and phishing risks due to constant connectivity.

- Cold Wallets (Hardware Wallets):Such as Ledger or Trezor, these are physical devices. They generate and store private keys offline, signing transactions internally, isolating internet threats. For long-term holding or large assets, hardware wallets are the recognized safest storage.

Pro Tip:Best practice is a dispersion strategy. Store most infrequently used assets in hardware wallets, keeping only small amounts in software wallets for daily transactions. This is like keeping most cash in a bank safe and carrying pocket change.

For businesses or teams managing funds together, consider multi-signature (Multisig) wallets. These require multiple confirmations to authorize transactions, greatly enhancing security.

- Eliminate Single Points of Failure:Multisig needs multiple private keys for approval. For example, a “2-of-3” multisig remains safe even if one key is lost or stolen, as attackers cannot gather two signatures.

- Strengthen Internal Controls:In enterprises, multisig acts as an approval process, preventing individual abuse and ensuring collective decisions for fund movements.

Network Choice: Why TRC-20 Is So Popular

USDT issues on multiple blockchains, with TRON’s TRC-20 format widely popular due to advantages, especially in small high-frequency payments.

| Feature | ERC-20 (Ethereum) | TRC-20 (Tron) |

|---|---|---|

| Transaction Fees | Higher, usually $5 - $15 USD, higher during congestion | Extremely low, usually under $2 USD |

| Transaction Speed | Slower, about 35–60 seconds, minutes during congestion | Extremely fast, usually confirmed in 3–5 seconds |

TRC-20’s low fees and high speed make it the preferred choice for many in stablecoin (USDT) international payments. However, this convenience hides risks. TRON has smart contract vulnerabilities like reentrancy attacks and integer overflows, exploitable by malicious developers. Additionally, low costs make TRC-20 a hotspot for scams like “address poisoning.” Users must stay more vigilant with transaction details while enjoying convenience.

Platform Choice: Reputation and Reserve Proofs

Choosing a reputable and compliant trading platform is crucial. For OTC or daily conversions, platform security, transparency, and compliance are primary. For example, platforms like Biyapay supporting multi-network USDT conversions and global payments provide convenient channels, but users must assess security measures themselves.

Transparency is key in stablecoins. The two mainstream USD stablecoins USDT and USDC differ here.

| Feature | USDC (Circle) | USDT (Tether) |

|---|---|---|

| Reserve Transparency | Monthly audited reserve reports by independent firms, clear asset composition. | Quarterly reserve proofs, historically penalized for opacity. |

| Regulatory Compliance | Issued by US-regulated institutions, actively complies with laws. | Complex regulatory status, less transparent than USDC. |

Due to USDC’s superior transparency and compliance, many institutions and cautious users prefer it.

Also, for centralized exchanges, check Proof of Reserves (PoR). This verifies exchange-held user assets match ledger records. Major exchanges like Binance publish PoR reports regularly with Merkle Tree tools for users to verify account inclusion in audits, confirming asset safety.

Transaction Verification: Fraud Prevention Checklist

Careful pre-transfer verification is the final barrier against fraud. Always follow this checklist:

- Verify Recipient Address:Critical step. When copying from history, check character by character to avoid “address poisoning.” For first-time or large transactions, strongly recommend confirming via phone or video on a second channel.

- Send Test Transaction:Before new address transfers, send a tiny amount (e.g., $1 USD). Proceed with large amounts only after counterparty confirms receipt.

- Confirm Network Selection:Ensure your transfer network (e.g., TRC-20, ERC-20) matches the recipient’s address network. Wrong network causes permanent loss.

- Check Transaction Fees:Confirm sufficient native tokens (e.g., TRX, ETH) for network Gas fees.

- Use Address Scanning Tools:Before important transactions, use blockchain analysis tools (like Btrace or Scorechain) to check if the recipient address is linked to illegal activities or flagged high-risk.

- Final Confirmation:On the wallet final screen, recheck displayed recipient address, amount, and total cost. This is your last chance to cancel.

Remember:In crypto, on-chain transactions are irreversible. Never skip any verification step due to counterparty urgency. Your caution is the only guarantee for your assets.

USDT Cross-Border Payment Compliance and Future Trends

As stablecoin payments grow, global regulators accelerate compliance frameworks. Users in USDT cross-border transactions must focus on technical security and understand/comply with requirements. This protects assets and is essential for industry maturity.

Understanding KYC and AML: Why Verify Identity

Compliant platforms require identity verification based on two key principles: Know Your Customer (KYC) and Anti-Money Laundering (AML).

KYC requires virtual asset service providers (VASPs) to collect and verify user identity. This usually includes:

- Personal Information:Full name, date of birth, and address.

- Identity Proof:Government-issued ID, like passport.

- Background Screening:Check official databases if user is a politically exposed person (PEP) or sanctioned.

These fulfill AML obligations. Organizations like FATF require crypto platforms to monitor suspicious activities. Platforms use blockchain analysis to track illicit flows, preventing money laundering. Choosing strict KYC/AML platforms reduces risks of unintentional illegal involvement.

Key Points for Secure OTC Trading

For large stablecoin (USDT) international payments, OTC is common. Choose reputable OTC platforms. Prioritize those authorized in major centers (US, EU) complying with global standards.

A reliable OTC platform should have:

- Asset Security:Provide cold storage, segregated wallets, and PoR.

- Settlement Capability:Support direct fiat settlement, e.g., convert stablecoins to USD and deposit to designated Hong Kong-licensed bank accounts.

- Transparent Records:Provide clear post-trade proofs and auditable reports.

Pro Tip:Before trading, both parties must agree in writing on price, quantity, and settlement date. This confirmation links execution and back-office settlement, avoiding fund disputes.

Global Regulatory Trends: MiCA and Hong Kong New Rules

Crypto regulation moves from vague to clear. Latest in two centers:

- EU Markets in Crypto-Assets Regulation (MiCA):Gradually implemented since June 2024, strict on stablecoin issuers. For example, issuers must hold 1:1 liquid reserves and accept regular audits. This greatly improves stablecoin transparency and reliability.

- Hong Kong VASP Licensing Regime:Since June 2023, all Hong Kong virtual asset trading platforms (VATPs) must obtain SFC licenses. Licensed platforms comply with strict client asset protection and AML rules, providing stronger user protection.

These measures signal industry normalization, helping expel bad actors.

Save Transaction Records: Handle Disputes and Audits

Regardless of size, retaining complete records is good practice. These are crucial for business disputes, tax reporting, or regulatory audits.

Users export transaction history via blockchain explorers (like TRONSCAN, Etherscan) by entering wallet addresses for CSV downloads. Note these tools handle one network at a time with basic info. For multi-chain users, portfolio trackers like Zerion conveniently gather and organize all data.

The business owner’s experience reveals a fact. Stablecoin (USDT) international payments are efficient, but users must stay vigilant. Protect assets by:

- Using hardware wallets for large assets.

- Choosing compliant and transparent platforms.

- Repeatedly verifying TRC-20 etc. addresses.

- Retaining all transaction proofs for verification.

Crypto’s golden rule is “Not your keys, not your coins”. This emphasizes self-custody. Not controlling private keys means not truly owning assets. Historically, entrusting keys to third parties (exchanges) caused catastrophic losses.

| Exchange Name | Loss Amount (Estimated) | Year | Loss Cause |

|---|---|---|---|

| Mt. Gox | 850,000 Bitcoin (then ~$450M) | 2014 | Exchange hot wallet private key stolen |

| Bitfinex | 120,000 Bitcoin (now >$3B) | 2016 | Hackers stole Bitcoin from user wallets |

| Binance | 7,000 Bitcoin | 2019 | Hackers stole API keys and 2FA via phishing, viruses |

| Coincheck | $523M (XEM) | 2018 | Hot wallet attacked, lacking multisig |

| FTX | Over $600M | 2022 | Security breach drained hot wallets, founder accused of misappropriation |

Readers are welcome to share anti-scam experiences in comments. Remember, self-protection is paramount.

FAQ

What If I Accidentally Send USDT to the Wrong Address?

Blockchain transactions are irreversible. Funds sent to wrong addresses are usually unrecoverable. Users must repeatedly verify recipient addresses before every transfer. This is the most critical step; any oversight may cause permanent loss.

Why Is TRC-20 Network Popular Yet Risky?

TRC-20 is popular for low fees (usually under $2 USD) and fast speeds. However, low costs make it a hotspot for scams like “address poisoning.” Users must stay more vigilant with details while enjoying convenience.

Is a Hardware Wallet Necessary for Ordinary Users?

For large or long-term unused assets, hardware wallets are necessary. They provide top security.

- Offline Storage:Private keys never touch the internet, isolating hacks and viruses.

- Secure Signing:All transactions confirmed internally, preventing malware tampering.

How to Correctly Verify a USDT Transaction?

Note:Never confirm receipt based solely on counterparty screenshots.

The only credible proof is blockchain explorer records. Users should request transaction hash (TXID) and independently query on official explorers (like TRONSCAN or Etherscan), verifying recipient address, amount, and status.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.