- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Stop Blind Remittances! Verifying USDT Platform Legitimacy Has Never Been Easier

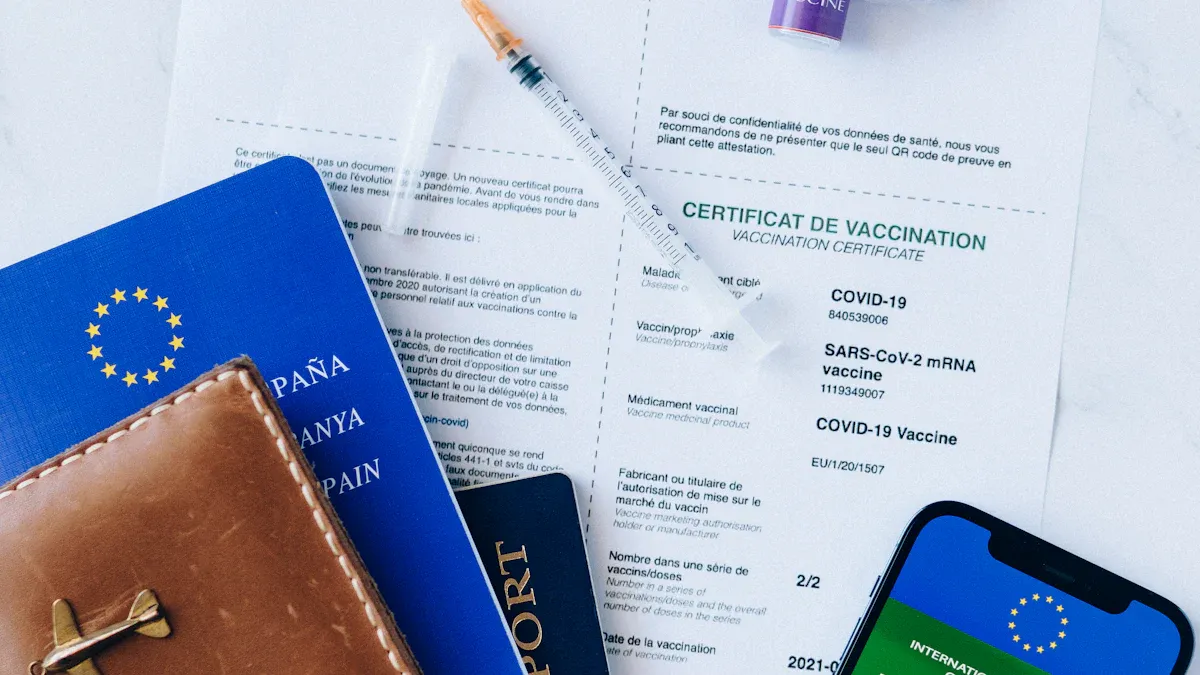

Image Source: pexels

You may be enjoying the convenience of cross-border remittances brought by USDT. Data shows that as of April 2025, 26% of U.S. remittance users have chosen to use stablecoins. However, behind the convenience lies huge risks.

The FBI reports that in 2024 alone, cryptocurrency-related scams caused up to $9.3 billion in losses.

Faced with endless scams, proactively verifying platform legitimacy before remittance is the primary step to protect your asset security.

Key Takeaways

- Before remittance, you need to verify the legitimacy of the USDT platform to protect your fund security.

- Check if the platform has financial licenses, such as the U.S. MSB license, which proves legal operation.

- Understand how the platform protects your money, such as using cold wallets to store most funds and having reserve proofs.

- Check if the platform publicly discloses team information and if official social media is active, showing transparency.

- View real user evaluations of the platform from multiple sources to understand actual service quality.

Review Legal Compliance: The Cornerstone of Verifying Platform Legitimacy

Image Source: pexels

Compliance is the first line of defense for security. Global regulators are continuously strengthening scrutiny of cryptocurrencies, and a platform without a legitimate license is like a ship without sailing permission, prone to capsizing at any time. Therefore, proactively verifying platform legitimacy is a key step you must complete.

Query Core Financial Licenses

A legitimate platform must hold financial licenses in its operating jurisdictions. These licenses mean the platform is supervised by regulatory bodies. You need to focus on the following license types:

- U.S. MSB License: Issued by FinCEN, required for businesses engaged in money services. You can directly visit the

MSB Registrant Searchpage on the FinCEN official website and enter the platform name for verification. - Hong Kong VASP License: Issued by the Hong Kong Securities and Futures Commission (SFC), mandatory for virtual asset service providers.

- Licenses in Other Regions:Singapore, Japan, the UK, and other countries have established clear licensing systems.

Important Note Please note that FinCEN clearly states that registration information on its website is self-provided by businesses and does not represent government endorsement or certification of their operations’ legitimacy. You should use official website query results as one reference for verifying platform legitimacy, not the sole basis.

Carefully Read User Agreements and Privacy Policies

The user agreement is the legal contract between you and the platform. Spending a few minutes reading it can help you avoid huge future losses. You need to carefully check how the platform handles your data and funds, and under what circumstances it may restrict your account. Especially in regions like mainland China, improper USDT transactions may lead to risks such as bank account freezes, making understanding the platform’s compliance measures crucial.

Beware of Unfair Overlord Clauses

Many scam platforms bury traps in lengthy agreements. You should be particularly vigilant about the following unfair clauses:

- Unilateral Modification Rights: The platform reserves the right to modify terms at any time without notifying you.

“We may, at our sole discretion, modify these terms at any time… Your continued use of our services after any such modifications constitutes your acceptance of the modified terms.”

- Liability Exemptions: The platform disclaims any responsibility for service interruptions, data loss, or hacker attacks, providing services “as is”.

- Hidden Fees: Fee structures are unclear, with unexpected charges appearing only during withdrawals or transactions.

You can use in-page search (Ctrl+F) to quickly locate these risk points by searching keywords like “modify (amend)”, “fee”, “liability”.

Assess Fund Security: Confirm Your Assets Are Protected

Image Source: unsplash

After legal review, the next step is to deeply assess how the platform protects your funds. A compliant platform must have robust technical security measures. This is the core part of verifying platform legitimacy before USDT remittances.

Check Cold-Hot Wallet Separation Mechanism

Think of the platform’s wallets as a bank’s vault and counter.

- Cold Wallet: Like the bank’s main vault, it is completely offline, used to store most user assets, effectively resisting online hacker attacks.

- Hot Wallet: Like the bank’s counter, it stays online for handling daily quick withdrawals, storing only a small amount of funds.

Data shows that over 80% of vulnerability attacks in 2025 target hot wallets. Therefore, a responsible platform stores over 95% of assets in cold wallets. Platforms like Biyapay under regulation usually also adopt multi-signature (Multisig) or multi-party computation (MPC) technology, meaning any large fund transfer from cold wallets requires approval from multiple independent managers, like opening a safe needing multiple keys, greatly enhancing security.

Verify Proof of Reserves and Audit Reports

How do you confirm the assets on the platform really exist? The answer is Proof of Reserves (PoR).

Proof of Reserves is a verifiable audit report proving the platform holds assets sufficient to cover all user deposits 1:1.

Legitimate platforms regularly hire independent third-party audit firms (e.g., The Network Firm) for audits. They usually use a technology called “Merkle Tree” allowing you to personally verify if your funds are included in the audit. You simply enter your account information via the platform’s tool to confirm your assets are safe.

Verify KYC and AML Processes

Being required to submit identity proof and address proof during registration is not a hassle but an important signal of platform protection.

- KYC (Know Your Customer): The platform verifies your identity (e.g., ID card, passport) to ensure every user is real.

- AML (Anti-Money Laundering): The platform monitors transaction activities, automatically identifying and blocking suspicious fund flows to prevent illegal use.

A platform skipping or simplifying KYC processes is highly likely to facilitate criminals, ultimately harming all normal users. Platforms like Biyapay strictly enforcing KYC and AML, though with more steps, precisely prove their compliant operations and commitment to user asset protection.

Examine Operational Transparency: Only Those Daring to “See the Light” Are Reliable

A platform unwilling to disclose information is like a trading counterparty hiding in the dark; you cannot judge its true intentions. Operational transparency is the cornerstone of building trust, directly relating to the platform’s long-term stability and your fund security. A platform daring to expose its operational details to the light is more trustworthy.

Why is transparency so important?

- Enhances User Confidence: Public operational strategies and financial status reduce uncertainty, building trust between platform and users.

- Reduces Fraud Risk: When team backgrounds, company info, and operational data are reviewable, illegal activities and fraud are harder to hide.

- Promotes Long-Term Development: Transparency helps attract quality partners and loyal users, laying a foundation for healthy platform growth.

Verify Team Background and Company Information

A legitimate platform will never be secretive about its team and company entity. You should first look for core team member introductions and company registration info on the official website’s “About Us” page.

Next, you need to personally verify this information’s authenticity. You can query through public business registration databases:

- U.S. Companies: Most business info can be found on the Secretary of State website in the registration state.

- UK Companies: Free queries available on the Companies House website.

- Other Regions: Many countries and regions have similar official business registration bodies.

If a platform cannot provide clear team info or its company info cannot be verified through official channels, this is an extremely dangerous signal. Completing this step is key to verifying platform legitimacy.

Observe Official Channel Activity

A healthy operating platform’s official social channels (e.g., Twitter, Telegram) must be active and professional. You can observe from these aspects:

- Update Frequency: Does the platform regularly post updates on product features, security maintenance, and company news? Per industry standards, security updates should be at least monthly, and high-risk vulnerabilities must be fixed within 48 hours and announced.

- Communication Quality: Is the team willing to openly engage with the community via AMA (Ask Me Anything)? Do they positively respond to user questions and criticisms?

- Community Atmosphere: Observe discussion vibes in communities (e.g., Telegram groups). A healthy community should have real users discussing products, not filled with bots and meaningless hype.

You can reference the following data to judge if a platform’s community activity meets industry standards:

| Metric | Platform Performance | Industry Average |

|---|---|---|

| Twitter Followers | 157,000 | 89,000 |

| Telegram Members | 42,500 | 31,000 |

| Community Positive Sentiment | 54.05% | 48% |

If a platform’s official channels are long silent or evade key user questions, you should question its reliability heavily.

Analyze Real User Reputation: See the Truth from Multi-Source Feedback

Official promotions and carefully selected testimonials cannot fully replace real user feedback. How a platform performs in actual use is best spoken by genuine users. By analyzing multi-source reputation, you can piece together the platform’s most authentic side.

Cross-Verify Evaluations Across Platforms

Do not just look at the platform’s official site or a single review site. You need to act like a detective, cross-verifying information across platforms for a comprehensive, balanced view. Communities and third-party review sites like Reddit, Twitter, and Trustpilot are excellent sources for unfiltered opinions.

You can follow these steps to systematically assess user reputation:

- Broad Search: Enter keywords in search engines like “platform name + complaints”, “platform name + customer service”, or platform name + Reddit”.

- Focus on Recent: Prioritize reviews from the past 6-12 months to reflect current service quality.

- Look for Patterns: Note recurring praises and complaints. Do many praise withdrawal speeds, or commonly complain about slow customer support?

Practical Tip: Discussions on Reddit are especially valuable. Posts like “Has anyone used XX platform?” often draw the most authentic conversations and specific personal experiences.

Identify Fake Positive and Malicious Negative Reviews

In the sea of information, you also need the ability to distinguish true and false reviews. Both fake positives and malicious negatives can mislead your judgment.

Fake Positive Reviews usually have these characteristics:

- Overly Generic Language: Reviews full of enthusiasm but lacking specific feature descriptions or personal experience details.

- Marketing Terminology: Frequent use of promotional language like “guaranteed profits”, “best choice”, sounding more like ads than user shares.

- Concentrated Posting Times: Large numbers of positives appear in a short period, with highly similar wording and formats.

Similarly, you need to distinguish legitimate negative criticism from pure malicious attacks. The table below can help you judge:

| Feature | Legitimate Negative Review | Malicious Attack Review |

|---|---|---|

| Specificity | Details specific issues encountered, e.g., “Withdrawal stuck in review for 24 hours”. | Vague complaints, e.g., “This platform sucks!” without details. |

| Language | Relatively objective wording, aiming to solve issues. | Full of emotional, inflammatory language, even personal attacks. |

| Focus | On product or service functional defects. | Attacks company staff or mentions unrelated topics. |

By carefully discerning, you can filter noise and hear truly valuable user voices.

Now, you have mastered a complete verification method. Please remember these four core steps:

- Review legal compliance

- Assess fund security

- Examine operational transparency

- Analyze real reputation

Your asset security is always first. If any step shows a danger signal during verification, please decisively abandon using the platform.

Hope you apply this method in practice to confidently and safely complete every USDT remittance.

FAQ

What should I check first?

You should first verify the platform’s financial licenses. A platform without legitimate regulation has extremely high risks. Please visit regulatory official sites, like U.S. FinCEN, to confirm registration info. This is the first step to ensure your fund security.

What if platform information is not transparent?

If you cannot find the platform’s team background or company registration info, immediately stop using it. A legitimate platform will not hide its core information. Lack of transparency is one of the most common characteristics of scam platforms; you should decisively abandon it.

The platform has no license but good reputation; can I use it?

We do not recommend it. Good reputation can be faked, but legitimate financial licenses cannot. Legal compliance is the cornerstone of platform security. For your asset safety, always choose platforms with proper licenses.

Will using USDT in mainland China affect my bank account?

Yes, risks exist. Improper operations may lead to your mainland China bank account being frozen. Choosing platforms strictly enforcing KYC and AML processes and considering using Hong Kong licensed bank accounts for operations can effectively reduce risks.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.