- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Beginner's Must-Read: Step-by-Step Guide to the Full Cryptocurrency Remittance Process

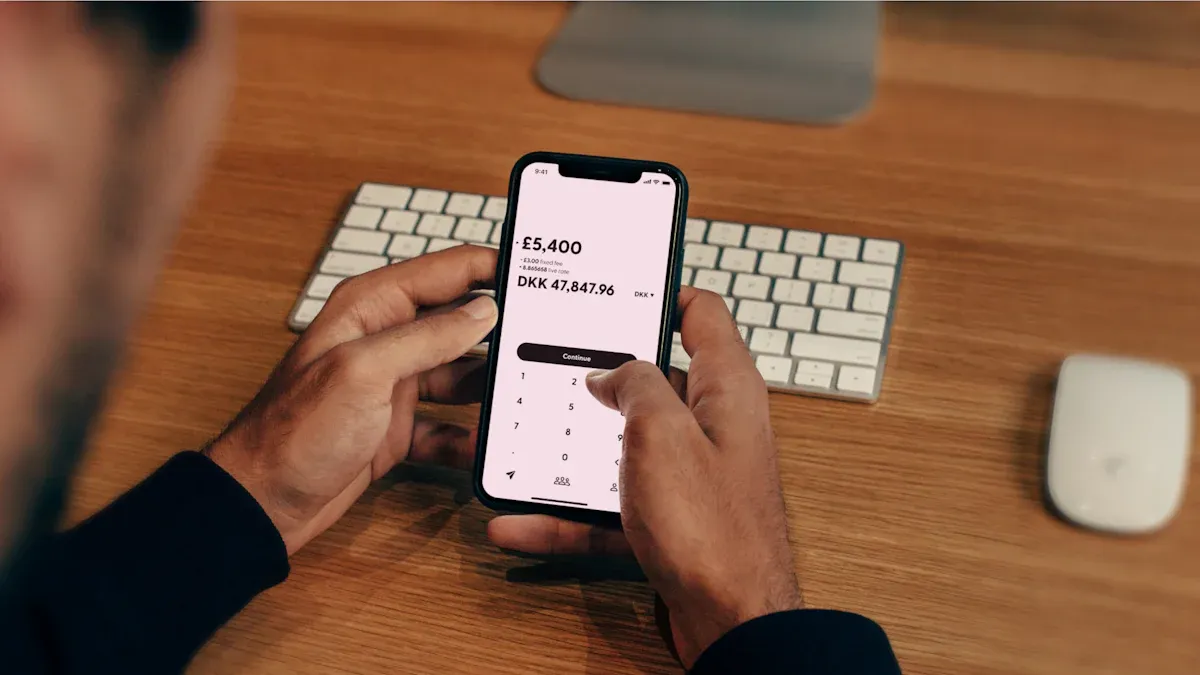

Image Source: unsplash

The core of cryptocurrency remittance is very simple and can be summarized into three key steps: obtaining recipient information, executing the transfer operation, and on-chain query confirmation. You can imagine it as sending a “valuable email,” where you need the correct “email address” (i.e., wallet address) and a reliable “postal system” (i.e., transfer network). This article will act like a manual, guiding you hand-by-hand through the entire cryptocurrency remittance process, giving you full confidence in your first operation.

💡 Why Choose Cryptocurrency Remittance? More and more people are choosing this method because it shows huge advantages in cost and speed.

| Type | Settlement Time | Transaction Cost |

|---|---|---|

| Stablecoin | Seconds to minutes; 24/7 | Usually below 1.5% |

| Traditional Bank Transfer | 1 to 5 business days | Global average 6.2% (for $200 transfer) |

This trend is also reflected in global user data, especially in high-adoption regions.

| Metric | 2025 Data | 2028 Prediction |

|---|---|---|

| Cryptocurrency remittance share of global remittance market | 3-6% | Approaching $1 trillion (total) |

| Transaction volume annual growth rate in high-adoption regions (Latin America and Africa) | About 50% | N/A |

| Proportion of U.S. remittance users adopting stablecoins (as of April 2025) | 26% | N/A |

Key Takeaways

- Cryptocurrency remittance has three main steps: obtaining recipient information, performing the transfer, and querying confirmation. It’s just like mailing an important letter.

- Before remittance, you need to prepare a digital wallet, purchase stable digital currency, and carefully verify the recipient’s address and network.

- During transfer, please first withdraw the funds to your own wallet, then initiate the transfer. Remember to set the transfer fee properly and carefully check all information.

- After transfer, use the transaction ID to query the transaction status on a blockchain explorer to ensure the money has been successfully sent.

- The most important point is to repeatedly verify the recipient address and transfer network. Once wrong, the money cannot be recovered.

Preparation Work Before Remittance

Image Source: unsplash

Before formally starting the cryptocurrency remittance process, sufficient preparation work is the key to ensuring fund security and quick arrival. This is just like packing luggage and confirming the route before a long trip. Below, we will break down three core preparation steps for you.

Create and Backup a Digital Wallet

Your digital wallet is your “bank account” for entering the crypto world, where all assets are stored. For beginners, choosing a secure and easy-to-operate wallet is crucial. For example, a wallet like Biyapay that supports multi-party computation (MPC) technology provides stronger security for your assets by removing the single-point risk of private keys.

There are many excellent wallets on the market for you to choose from based on your needs.

Security First: Backup Your “Lifeline” When creating a wallet, the system generates a set of “mnemonic words” (usually 12 or 24 words). This is the only way to recover your wallet. You must copy it down physically (for example, handwritten on paper) and store it in an absolutely safe place. Remember:

- Never share mnemonic words with anyone.

- Never take screenshots or store in the cloud.

- Consider using encrypted steel plates and other fireproof and waterproof tools for long-term backup.

Purchase Stablecoins for Remittance

Why do we recommend using stablecoins (such as USDT, USDC) for remittance? The answer is simple: stable value.

The value of stablecoins is 1:1 pegged to fiat currencies like the USD, avoiding violent price fluctuations of cryptocurrencies like Bitcoin. This means that if you remit $100 worth of stablecoins, the recipient basically receives $100, without shrinkage due to market fluctuations.

The steps to purchase stablecoins are usually very simple:

- Create an account on a compliant platform or exchange like Biyapay and complete identity verification.

- Bind your bank account or use other payment methods.

- Directly purchase the required amount of USDT or USDC.

Obtain and Verify Recipient Information

This is the step in the entire process that is most prone to errors and also the most critical. Before transferring, you must request and confirm two pieces of information from the recipient: recipient address and transfer network (chain).

These two pieces of information must completely match, just like the “street address” and “city” must both be correct when mailing a package. If the network is selected wrong, your funds will be permanently lost.

Please look at the examples below to understand the address formats of different networks:

| Blockchain Network | Address Format Example | Features |

|---|---|---|

| TRC20 (Tron) | TWsVAb9EWAgKdumTD7XoEdkvs7AoyvkgN7 | Address starts with T, fast transfer speed, low fees. |

| ERC20 (Ethereum) | 0x0e806cea8e5beba6df97354ef7f22b66c5a2ce82 | Address starts with 0x, most mature ecosystem. |

| BEP20 (BSC) | 0x0e806cea8e5beba6df97354ef7f22b66c5a2ce82 | Address format same as ERC20, starts with 0x. |

Verification Checklist: Best Practices to Prevent Asset Loss

- Careful Verification: Repeatedly check every character of the address, especially the first and last few characters.

- Confirm Network: Confirm again with the recipient that you are using the same transfer network.

- Small Amount Test: If it’s the first time or a large transfer, first send a very small amount (such as 1 USDT) for testing. After confirming the recipient has received it, proceed with the full transfer.

Detailed Explanation of the Cryptocurrency Remittance Process

Image Source: pexels

After completing the preparation work, you come to the core link of actual operation. This cryptocurrency remittance process is not complicated; as long as you remain careful and patient, you can complete it smoothly. We will break it down step by step, letting you see the operation points and safety notes for each step clearly.

Withdraw from Exchange to Wallet

Although you can directly remit from the exchange to the other party, we strongly recommend that you first “withdraw” the assets to your own personal wallet (such as Biyapay). This step is optional but crucial because it relates to your true control over the assets.

Storing assets in a personal wallet means the private key is controlled by you, and you are the sole owner of the assets. Leaving assets on the exchange is more like depositing money in a third-party institution, where you do not directly hold the private key.

Control Your Assets: Exchange vs. Personal Wallet Understanding the difference between the two can help you make a safer choice.

Feature/Risk Exchange (Custodial) Personal Wallet (Non-Custodial) Private Key Control You do not hold the private key; it is kept by the exchange. You fully control the private key. Core Risk Faces risks of exchange being hacked, going bankrupt, or regulatory freezing. Risk mainly from physical device loss or mnemonic word leakage. Fund Access Withdrawals may be affected by exchange operating status, limits, or maintenance. As long as you have the device or mnemonic words, you can access funds anytime. Security Responsibility Exchange bears part of the security responsibility. You bear full responsibility for your fund security.

Withdrawal Operation Process:

- Add Withdrawal Address: On the exchange’s withdrawal page, select the coin you want to withdraw (such as USDT), then click “Add New Address”. Enter your personal wallet’s recipient address and select the correct transfer network (such as TRC20).

- Enable Address Whitelisting: For ultimate security, it is strongly recommended to enable the “address whitelist” function. This function ensures your assets can only be withdrawn to pre-approved addresses. Even if the account is stolen, hackers cannot transfer funds to their own addresses.

- Initiate Withdrawal Request: Enter the withdrawal amount, then submit the request.

- Complete Security Verification: The exchange will require you to perform multiple security verifications, which is a key line of defense to protect your assets. Common verification combinations include:

- Email Verification Code: Check your registered email, enter the received code. Pay attention to whether the email contains your set “anti-phishing code”, which is a unique security phrase that can help you identify official emails and prevent being scammed.

- SMS Verification Code: Enter the code received on your phone.

- Google Authenticator (2FA): Open your 2FA app, enter the displayed 6-digit dynamic password.

After completing the above steps, wait a few minutes, and the assets will appear in your personal wallet.

Initiate Transfer from Wallet

Now, your stablecoins are safely stored in your personal wallet and can be remitted at any time. Taking a wallet like Biyapay as an example, the operation interface is usually very intuitive.

- Select Asset and Operation: On the wallet’s main interface, find the stablecoin you hold (such as USDT), click to enter the asset page, then select the “Send” or “Transfer” function.

- Fill in Transfer Information:

- Recipient Address: Paste the wallet address you previously obtained and verified from the recipient.

- Transfer Network: Confirm again that you have selected the network matching the other party’s address (such as TRC20, ERC20).

- Transfer Amount: Enter the amount you want to remit.

- Preview Transaction: Before clicking next, the wallet will display a transaction preview page, allowing you to check all information one last time.

This clear cryptocurrency remittance process design aims to help users reduce operational errors.

Set Reasonable Miner Fee (Gas Fee)

During transaction preview, you will see an item called “miner fee” or “network fee” (Gas Fee). You can understand it as courier fee. The higher the courier fee you pay, the more willing the courier (miner) is to prioritize delivering your package (transaction), and the faster the arrival speed.

Most wallets (such as Biyapay) provide several preset levels for you to choose based on needs:

- Slow: Lowest fee, but transaction confirmation time may be longer, suitable for non-urgent transfers.

- Average: Moderate fee, balanced speed, recommended for most situations.

- Fast: Highest fee, transaction will be prioritized, almost immediately confirmed, suitable for urgent situations.

Fees vary greatly across networks. For example, transferring USDT on the TRC20 network usually only costs less than $1, while on Ethereum (ERC20) during busy periods, fees may reach 5 to 30 dollars. You can use online Gas trackers (such as Bitget Gas Tracker, Blocknative) to view real-time network fees and help you make decisions.

Final Confirmation and Authorization of Transaction

This is the final step in the entire cryptocurrency remittance process and the moment you authorize the funds to leave you. On the final confirmation page, please carefully verify the following information:

- Recipient Address: Check one last time that the address is completely correct.

- Transfer Amount: Confirm the amount is correct.

- Network Fee: Understand the fee you are paying for this transaction.

Warning: Beware of “Blind Signing” Risk “Blind signing” refers to authorizing a transaction without fully seeing and understanding the transaction details. This is like signing a blank check, extremely dangerous. Malicious programs may disguise as normal transactions to trick you into authorizing, thereby stealing your assets. Therefore, whenever, you must carefully verify all transaction details on your device (especially hardware wallets) before signing and authorizing.

After confirming all information is correct, enter your wallet password or use biometrics (fingerprint/face ID) to authorize the transaction. If you are using a hardware wallet like Ledger or Trezor, you also need to perform physical button confirmation on the device, which provides top-level security for your assets because the private key never leaves the offline hardware device.

Once the transaction is sent, it cannot be revoked. Now, your task is to wait for the transaction to be confirmed on the blockchain.

Tracking and Confirmation After Remittance

You have successfully sent the transaction, but this does not mean the end. The next steps are to track the transaction status and finally confirm receipt, just like querying logistics information after sending a package, allowing you to have a clear understanding of the funds’ whereabouts.

Find and Use Transaction ID (TxID)

After the transaction is sent, the system generates a unique credential called the transaction ID (Transaction ID), also known as transaction hash (TxID/Hash). This is your only clue to track this remittance on the blockchain.

You can find it on the platform where you initiated the transfer:

- Sent from Wallet: Open your wallet app, find the recent transfer in “Transaction History” or “Activity” records, click details to see and copy the transaction ID.

- Sent from Exchange: Log in to your exchange account, find the corresponding record in “Withdrawal History” or “Account Activity”, the transaction ID is usually clearly listed.

The transaction ID is a long string of characters. Formats vary slightly across different blockchains, but the function is the same.

| Blockchain | Format Features | Example |

|---|---|---|

| Ethereum (ERC20) | Starts with 0x, followed by 64 characters | 0x2a1f…f6a7 |

| Bitcoin (Bitcoin) | 64 hexadecimal characters | 4b8e…e6f7 |

Use Blockchain Explorer to Query Status

After obtaining the transaction ID, you need to use a “blockchain explorer” to query. You can think of it as the official, public “logistics query system” for each blockchain network.

- Select the Correct Explorer: Based on the transfer network you used, visit the corresponding explorer.

Blockchain Network Common Explorer TRC20 (Tron) TRONSCAN ERC20 (Ethereum) Etherscan BEP20 (BSC) BscScan Bitcoin Blockchain.com - Query Transaction: Paste your transaction ID into the explorer’s search box, then press enter.

- View Status: The explorer will display all details of the transaction. You need to focus on “Transaction Status” and “Confirmations”.

Transaction Status Interpretation

- Pending: The transaction has been sent and is queuing for miner processing.

- Success: The transaction has been packed into a block and completed successfully.

- Failed: The transaction failed due to some error (such as insufficient Gas fee). Note that even if it fails, the miner fee you paid will not be refunded.

“Confirmations” refer to how many new blocks have been generated after the block containing your transaction. The more confirmations, the more irreversible and secure the transaction.

How to Confirm the Recipient Has Received the Funds

The most direct confirmation method is to have the recipient check their own wallet. When the blockchain explorer shows the transaction as “Success” and has a certain number of confirmations (usually within a few minutes), the recipient’s wallet balance will update.

If the recipient says they have not received it, you can send them the transaction ID and explorer query screenshot, which is sufficient to prove you have successfully completed the transfer. Common reasons for delays include network congestion or your set miner fee being too low. As long as the transaction status is successful, the funds will eventually arrive.

At this point, the entire cryptocurrency remittance process is fully completed.

Congratulations! Now you have mastered the complete knowledge of cryptocurrency remittance. Let’s quickly review the core trilogy:

- Prepare Information: Create a wallet and obtain accurate recipient address and network.

- Execute Operation: Initiate transfer from the wallet, set reasonable network fee.

- Query Confirmation: Use transaction ID to track status on blockchain explorer.

Security Warning: The Most Critical Step The place in the entire process that is most prone to errors and has the most serious consequences is repeatedly verifying the recipient address and transfer network. A tiny mistake can lead to permanent loss of funds. For example, traders have lost nearly $70 million in assets to scammers due to “address poisoning” scams. Please remain vigilant.

Now, don’t be afraid. You can start practicing with a very small transfer (for example, 1-5 USDT). After operating it once by hand, you will fully master this process and conduct every future remittance with full confidence.

FAQ

What if I transfer to the wrong address?

Blockchain transactions cannot be revoked. After transferring to the wrong address, funds usually cannot be recovered. This is why we emphasize that you must repeatedly verify the address before sending. Conducting a small amount test is the best prevention method.

Can I cancel a transfer that has already been sent?

No. Once a transaction is broadcast to the blockchain network, it cannot be canceled or withdrawn. It is not like a bank transfer that can be stopped. So before clicking “Send”, please ensure all information is accurate.

Why does my transfer show “Processing” for a long time?

This usually has two reasons: network congestion or your set miner fee (Gas Fee) is too low. Miners prioritize transactions with higher fees. If the transaction is not urgent, you can wait patiently. If urgent, next time choose the “Fast” speed level.

TRC20, ERC20, which network should I choose?

You must choose the network that is exactly the same as the recipient’s. Which network to choose is not up to you but determined by the type of recipient address. If the network is chosen wrong, your funds will be permanently lost.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.