- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Send USDT to Pakistan: 2025 Latest Low-Fee Guide

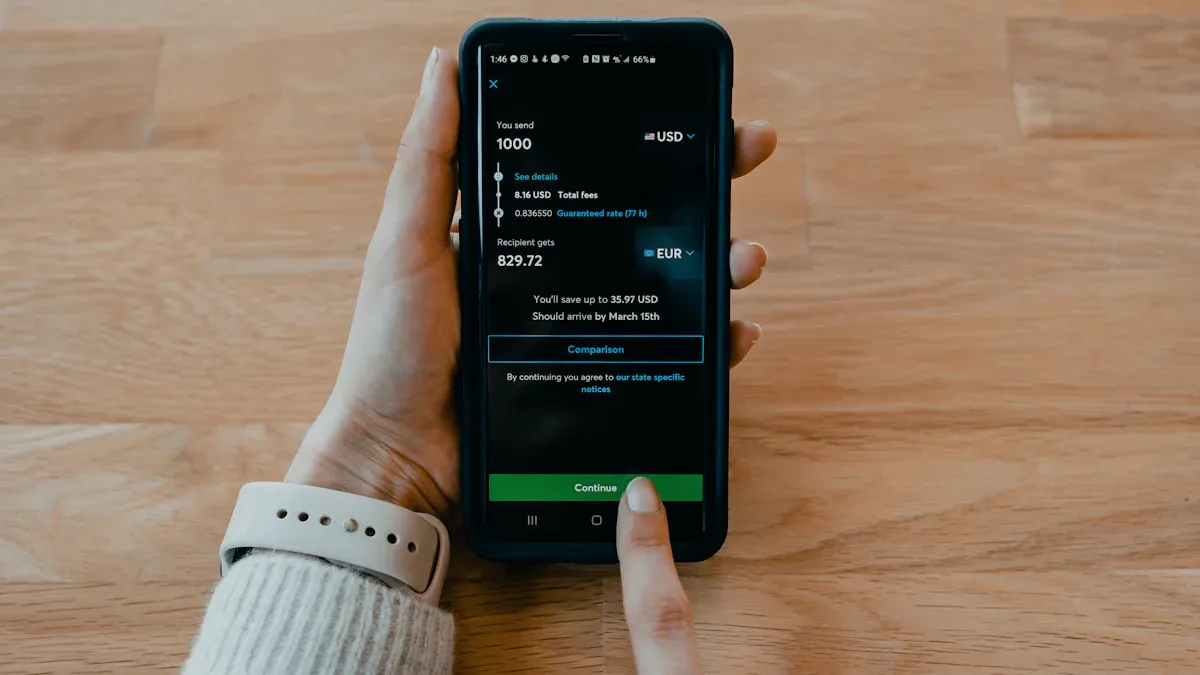

Image Source: pexels

Are you still troubled by high international remittance fees? Traditional banks or Western Union remittances have complex fee structures, not only including transfer fees but also hidden exchange rate markups. Even if they offer 0 USD fees for first online transfers over 200 USD, such promotions usually come with various restrictions.

Core Advantage: Remitting to Pakistan using stablecoin (USDT) can reduce total costs by up to 90%-95% and achieve near-instant cross-border transfers.

The entire process is very straightforward, requiring only three steps:

- You buy USDT.

- You transfer USDT to the recipient in Pakistan.

- The recipient sells USDT locally to exchange for Pakistani Rupees (PKR).

This guide will walk you through each step to ensure you complete the operation safely and efficiently.

Key Takeaways

- Remitting to Pakistan using USDT can save up to 90%-95% in fees, with very fast transfer speeds.

- The remittance process is divided into three steps: you buy USDT, transfer USDT to the recipient, and the recipient sells USDT for Pakistani Rupees (PKR).

- Choosing the TRC20 network for USDT transfer is very important, as its fees are low, usually less than 2 USD.

- In P2P transactions, the recipient must confirm receipt of Pakistani Rupees (PKR) before releasing USDT—this is key to protecting fund safety.

- For security, always enable two-factor authentication (2FA) on exchange accounts and beware of online scams.

Preparation Before Remittance

Before starting the remittance, both you and your recipient in Pakistan need to complete some simple preparations. This process will lay a solid foundation for smooth subsequent transfers.

1.1 Choose and Register an Exchange

You need a cryptocurrency exchange to buy USDT with fiat currency (such as USD or HKD). Similarly, your recipient in Pakistan needs an exchange account to receive USDT and exchange it for Pakistani Rupees (PKR).

We recommend using global mainstream exchanges that operate well in Pakistan, such as Binance or OKX. These platforms support PKR trading and have a wide user base.

| Platform | Fee Structure | Supports PKR | Highlights |

|---|---|---|---|

| Binance | 0.01% maker/taker | Supports | Wide coin selection, has P2P market |

| BTCC | 0.05% fixed rate | Supports | Institutional-grade security, long history |

| MEXC Global | 0% maker/0.02% taker | Supports | Rich in emerging coins, social trading features |

| Bitget | 0.1% standard rate | Supports | Localized language support, compliant accounts |

After registration, both you and the recipient need to complete identity verification (KYC). This is a mandatory requirement for all compliant exchanges to ensure your fund safety. Usually, you need to prepare:

- Government-issued valid ID: Such as passport or driver’s license.

- Proof of Address: Utility bill or bank statement from the past three months.

- Facial Recognition: Complete a selfie or short video as prompted by the App.

1.2 Obtain Pakistan Receiving Address

After your recipient completes registration and verification on the exchange, the next step is to find their USDT receiving address. This address is equivalent to their cryptocurrency “bank account.”

The operation is very simple, using the Binance App as an example:

- Log in to the App and go to the “Assets” page.

- Click the “Deposit” button.

- Select the cryptocurrency

USDT. - On the network selection page, be sure to choose

TRC20 (TRON). - Copy the displayed address and send it to you.

Key Tip: Choose the Correct Network

Why must you choose TRC20? Because its transfer fees are extremely low. A USDT transfer fee is usually less than 2 USD, far lower than the dozens of USD often charged by another common network, ERC20 (Ethereum). Choosing TRC20 is core to achieving low-cost remittance.

How to Remit to Pakistan Using Stablecoin (USDT)

Image Source: unsplash

After completing preparations, you can now officially start the remittance process. This core part is divided into two steps: buying USDT and transferring it to the recipient. The entire process is much simpler than you imagine.

2.1 Step One: Buy USDT

Acquiring USDT is the first step in the entire process. You have two main ways to obtain USDT:

- Use fiat currency (such as USD) to buy directly.

- Exchange other cryptocurrencies you hold (such as Bitcoin BTC) for USDT.

For most first-time users, buying directly with fiat currency is the most straightforward method. Mainstream exchanges support multiple payment methods, making the purchase process very convenient.

| Payment Method | Advantages | Disadvantages |

|---|---|---|

| Credit/Debit Card | Fast, instant arrival | Fees usually higher |

| Bank Transfer (ACH/Wire) | Lower fees, suitable for large amounts | Arrival may take 1-3 business days |

| Apple Pay / Google Pay | Convenient and quick | May have amount limits, varying fees |

We use buying USDT via bank transfer on OKX exchange as an example to show specific operation steps:

- Deposit USD into Exchange Account:

- ACH Transfer:

- On the deposit page, select “Bank Transfer” or “ACH.”

- Choose your bound bank account.

- Enter the USD amount you wish to deposit.

- Check information and confirm the transaction.

- Wire Transfer:

- Select “Wire Transfer” as the deposit method.

- The exchange will provide recipient bank details (name, address, routing number, account number, and a unique memo or reference code).

- Log in to your online banking or visit a branch and initiate the transfer using this accurate information. Be sure to fill in the correct reference code, otherwise it may cause deposit delays.

- ACH Transfer:

- Buy USDT with Deposited USD:

- When USD is successfully deposited and shown in your exchange account balance, you can buy cryptocurrency.

- Go to the platform’s “Buy” or “Trade” page.

- Select the cryptocurrency you want to buy, here

USDT. - Enter the USD amount you plan to spend.

- Ensure the payment source is your USD balance.

- Carefully review transaction details, including the USDT amount you will receive and any fees.

- Confirm the purchase.

Safety First: Enable Two-Factor Authentication (2FA) Before binding a bank account, be sure to enable two-factor authentication (2FA) on your exchange account. This adds a crucial layer of security to prevent unauthorized access.

2.2 Step Two: Transfer USDT to Pakistan

Once you have USDT in your account, the next step is to send it to your recipient in Pakistan. This process in the crypto world is called “withdrawal,” meaning withdrawing from your exchange account to an external address. This is the key link to achieving low-cost remittance to Pakistan using stablecoin (USDT).

Before operating, be sure to confirm the following information with the recipient multiple times:

- USDT Receiving Address: A long string of letters and numbers.

- Transfer Network: Must be TRC20 (TRON).

Operation Guide: Using Withdrawal from Binance as Example

- Log in to your Binance account and go to the “Wallet” page.

- Click “Withdraw.”

- Select the cryptocurrency to withdraw,

USDT. - Paste the USDT withdrawal address obtained from the recipient.

- In the Network option, select

TRC20. The system will auto-match, but you still need to verify carefully. - Enter the USDT amount you want to transfer.

- Click “Preview Withdrawal” and carefully check address, network, and amount.

- After confirming all information is correct, click “Confirm Withdrawal” and complete security verification as prompted (such as email code, phone code, or 2FA code).

Operation Guide: Using Withdrawal from OKX as Example In OKX, you need to first add the recipient’s address to the “External Wallet” whitelist.

- Add External Wallet: On the “Withdrawal” page, select “External Wallet,” click “Add External Wallet,” enter the recipient’s address, and complete verification as prompted.

- Initiate Withdrawal:

- Re-enter the “Withdrawal” section and select

USDT. - Choose the external wallet address you just added.

- Select

USDT-TRC20as the withdrawal network. - Enter the withdrawal amount and confirm the transaction.

- Re-enter the “Withdrawal” section and select

Transaction Tracking and Confirmation After submitting the transfer, how do you confirm the recipient received it? Every blockchain transaction has a unique transaction ID (also called TxID or Hash). You can copy this ID and query it on the corresponding blockchain explorer. For the TRC20 network, use the TronScan explorer. Simply paste the transaction ID or recipient’s wallet address into the search box to see all details of the transfer, including whether the status is “Success.”

Through the above steps, you have successfully completed the operation of remitting to Pakistan using stablecoin (USDT). Funds usually appear in the recipient’s exchange account within minutes, far faster than traditional banks.

Pakistan Receipt and Withdrawal

Image Source: pexels

When USDT safely arrives in your recipient’s exchange account, the entire process enters the final and most critical step: exchanging these digital dollars for usable Pakistani Rupees (PKR). This process is mainly completed through the exchange’s built-in P2P (Peer-to-Peer) platform.

3.1 Step Three: Sell USDT in Pakistan for PKR

The P2P platform is like an online marketplace. You can post a “Sell USDT” ad here or directly select a buyer seeking USDT for a transaction. The buyer will transfer PKR directly to you via local payment methods, and after you confirm receipt, you release USDT to them.

P2P Platform Operation Process (Using OKX as Example)

- Enter P2P Market: In the exchange App, find the “P2P Trading” or “C2C Trading” entry and select the “Sell” tab.

- Set Transaction Parameters: Choose the coin to sell

USDTand the fiat to receivePKR. - Select Buyer: Browse the buyer list. You need to carefully screen and choose a reliable counterparty (screening tips in the next section).

- Create Sell Order: Click the “Sell” button next to the selected buyer and enter the USDT amount you want to sell.

- The system will automatically calculate and display the estimated PKR amount you will receive.

- Choose Receipt Method: Select your preferred receipt method to receive PKR. You need to bind your receipt account in P2P settings in advance.

- Wait for Payment: After submitting the order, wait for the buyer to pay your receipt account. After the buyer completes payment, they will click the “I have paid” button.

- Confirm Receipt and Release:

- After the buyer confirms payment, you must log in to your bank or e-wallet App to personally verify full PKR receipt.

- After confirming no issues, return to the exchange App and click “Confirm Receipt and Release Assets.”

Mainstream Local Receipt Methods in Pakistan

For smooth receipt, your recipient needs at least one mainstream local payment account in Pakistan. Here are a few recommended options:

| Payment Method | Type | Features |

|---|---|---|

| Easypaisa | Mobile Wallet | Large user base, convenient transfers, one of the most common in P2P. |

| JazzCash | Mobile Wallet | Powerful features, deeply integrated with banking and identity systems. |

| Bank Transfer | Traditional Bank | Supports large transactions, almost all P2P users support it. |

| RAAST | Instant Payment System | Instant payment system launched by the State Bank of Pakistan, free and seconds to arrive. |

In-Depth: Advantages of RAAST and JazzCash

RAAST is Pakistan’s first instant payment system, greatly improving transfer efficiency.

- Instant Arrival: Receipt is instant, no waiting.

- Free Transactions: Receiving via RAAST is completely free.

- Simplified Operation: Recipient only needs to provide a RAAST ID tied to a phone number or a QR code, no need to remember complex bank accounts (IBAN).

- Wide Compatibility: Most banks and wallets, including Easypaisa, Standard Chartered, MCB, support RAAST.

JazzCash provides diverse transfer services, very flexible.

- Can transfer to any mobile account in Pakistan.

- Can transfer to unbanked persons via National ID (CNIC).

- Can deposit directly to any linked bank account in Pakistan.

3.2 Ensure P2P Transaction Safety

Behind the convenience of P2P transactions lie certain risks. Learning to screen counterparties and follow safety principles is the final barrier to successfully completing remittance to Pakistan using stablecoin (USDT).

How to Screen Reliable Buyers?

In the P2P market buyer list, you can see each person’s transaction data. Focus on the following indicators:

- Completion Rate: Look for buyers with over 95% completion rate. High rate means good reputation and few unexplained cancellations.

- Trade Volume (Trades): Buyers with more trades are usually more experienced and smoother in process. A user with thousands of trades is far more reliable than one with just a few.

- Positive Feedback Rate: P2P exchanges allow mutual ratings after trades. Spend a few seconds checking buyer history to build trust and ensure trading only with trustworthy users.

- Payment Method: Ensure they support your desired receipt method, such as Easypaisa or your specific bank.

Core Safety Principle: Unshakable Golden Rule

You must, must, must log in to your bank App or e-wallet, personally confirm Pakistani Rupees (PKR) have fully arrived, then return to the exchange and click the [I have received payment and release] button.

- Do not trust any screenshots: Any payment screenshots sent by the buyer may be fake. The only credible proof is the balance shown in your own account.

- Do not yield to urging: Some scammers urge you to release USDT quickly for various reasons. Stay calm and verify receipt yourself.

- Cryptocurrency transactions are irreversible: Once you click release, USDT is transferred to the counterparty’s account; this transaction cannot be revoked or recovered.

Strictly follow this principle to maximize avoidance of fraud risks in P2P transactions and securely obtain funds.

Cost and Risk Analysis

Understanding the complete costs and potential risks of remitting to Pakistan using stablecoin (USDT) helps you make wiser decisions. Although this method has extremely low costs, you still need to note several key points.

4.1 Fee Structure of USDT Remittance

The fees for the entire remittance process mainly consist of three parts, with total erosion rate usually far lower than traditional methods.

- Fee for Buying USDT: When buying USDT with fiat on the exchange, the platform charges a small fee. Fees vary by exchange and payment method.

| Exchange Name | Typical Fee Range | Notes |

|---|---|---|

| Binance | About 0.1% | Discounts available using platform coin |

| Kraken Pro | 0% - 0.40% | “Instant buy” option may have higher fees |

| Coinbase | Relatively higher | Known for user-friendly interface and high security |

- Network Transfer Fee: This is the fee paid to the blockchain network when transferring USDT from your exchange to the recipient’s exchange. Choosing TRC20 network, this fee is usually less than 2 USD, very low.

- Spread When Selling USDT: When the recipient sells USDT on P2P platform, the buyer’s bid is slightly below market price. This tiny spread is the main cost of P2P transactions.

4.2 Potential Risks and Mitigation Methods

Understanding and mitigating risks is prerequisite for safely using cryptocurrency.

-

Regulatory Policy Risk The Pakistan government is actively changing its stance on cryptocurrency. Authorities have established a dedicated committee (PVARA), aiming to regulate cryptocurrency services according to international standards (such as FATF). This means future transactions will be more standardized, but policies are still developing.

Mitigation Method: Always use international mainstream exchanges complying with local KYC (identity verification) and AML (anti-money laundering) regulations. These platforms are better able to adapt to policy changes and protect your assets.

-

Market Volatility Risk USDT is a stablecoin pegged 1:1 to USD, but its price occasionally experiences very slight fluctuations, possibly deviating from 1 USD.

Mitigation Method: Quick in and out. Transfer immediately after buying USDT; recipient sells on P2P for PKR as soon as received. This minimizes USDT holding time, avoiding price fluctuation risks.

-

Account Security Risk Exchange account security is crucial; protect it like a bank account.

Mitigation Methods:

- Enable Two-Factor Authentication (2FA): This is the most important security measure. Even if password leaks, hackers cannot log in or withdraw without your 2FA code.

- Use Strong Password: Create a complex password with uppercase/lowercase letters, numbers, and symbols.

- Beware of Phishing: Do not click links in suspicious emails or SMS. Always log in to your exchange account from official website or App.

In summary, USDT remittance has obvious advantages in cost, speed, and convenience. Your total fees can be controlled between 0.1% and 1%, with funds arriving in minutes.

Remember three key safety steps:

- Safely buy USDT.

- Always choose TRC20 network for transfer.

- On P2P platform, confirm PKR receipt before releasing assets.

Final Recommendation: If you are a beginner, be sure to fully test the process with a small amount (e.g., 10 USDT) first. In the crypto world, safety is always first.

FAQ

Is Remitting USDT in Pakistan Legal?

Pakistan is actively establishing cryptocurrency regulations. You should choose international mainstream exchanges complying with KYC (identity verification) and AML (anti-money laundering) rules. These compliant platforms can better adapt to policy changes and provide protection for your assets.

How Long Does the Entire Remittance Process Take?

USDT transfer on TRC20 network usually takes just a few minutes. From buying USDT to the recipient successfully selling on P2P for PKR, the entire process can be completed in as fast as 30 minutes, far exceeding traditional bank speeds.

Is There a Minimum Amount Limit for Remittance?

Cryptocurrency transfers themselves have no minimum amount limit. But exchange P2P platforms usually have minimum transaction amounts, generally a few USD. We strongly recommend testing the full process with a small amount (such as 10 USDT) first.

What If I Fill in the Wrong Receiving Address?

Important Warning: Cryptocurrency transactions are irreversible. If you send USDT to the wrong address, funds will be permanently lost and unrecoverable. Therefore, before confirming transfer, you must repeatedly verify the accuracy of the receiving address and transfer network (TRC20).

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.