- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Exploring the Possibility of Zero Fees: In-Depth Analysis of Cutting-Edge Cross-Border Payment Technologies

Image Source: unsplash

The global average cost of remittances reaches approximately 6.5%, directly hitting the pain point of high fees in traditional cross-border payments. Cutting-edge technologies such as blockchain, P2P networks, API gateways, and Central Bank Digital Currencies (CBDCs) are providing critical pathways to reduce payment costs. Research predicts that by 2030, blockchain technology alone could save banks up to $10 billion in cross-border settlement costs.

When technology drives fees close to zero, what does this mean for individuals and businesses?

Key Points

- Blockchain technology reduces intermediary links through peer-to-peer transactions, significantly lowering cross-border payment fees.

- P2P networks match local liquidity pools, providing individual users with exchange rates close to the mid-market rate, optimizing small-value cross-border payments.

- API gateways aggregate global payment methods and use intelligent routing and virtual bank accounts to help enterprises reduce cross-border collection costs.

- Central Bank Digital Currencies (CBDCs), such as the mBridge project, promise real-time, low-cost international settlements but face technical and policy challenges.

- Individuals and enterprises should select appropriate payment technologies based on their needs to achieve optimal costs while paying attention to compliance and security.

Blockchain Technology: The Disruptor Reshaping Cost Structures

Image Source: unsplash

Blockchain technology, through its decentralized nature, offers a fundamental solution to the high costs of cross-border payments. It restructures the trust mechanism of traditional finance, making transactions no longer reliant on massive centralized institutions.

Principle: Peer-to-Peer Transactions Bypassing the SWIFT Network

Traditional international wire transfers rely on the SWIFT network, a complex system composed of multiple correspondent banks. When two banks lack a direct cooperative relationship, funds must pass through one or more intermediary banks. This process is not only time-consuming but also incurs service fees at each intermediary layer, ultimately leading to high costs.

Blockchain is entirely different. It uses distributed ledger technology to allow transactions to be completed directly under the joint verification of network participants. This peer-to-peer (P2P) model bypasses the traditional correspondent banking network, fundamentally reducing intermediary links.

- SWIFT Model: Sender → Bank A → Correspondent Bank B → Correspondent Bank C → Recipient Bank D → Recipient

- Blockchain Model: Sender Wallet → Blockchain Network → Recipient Wallet

This change makes fund transfers as direct as sending an email, significantly improving efficiency and reducing costs.

Application: Advantages and Challenges of Stablecoin Payment Solutions

To address the price volatility of cryptocurrencies like Bitcoin, stablecoins pegged 1:1 to fiat currencies such as the USD emerged. Among them, USDT and USDC dominate the market, together accounting for over 90% of the stablecoin market cap. Payment platforms like Biyapay leverage the characteristics of stablecoins to provide users with low-cost, high-efficiency global payment services.

However, the widespread adoption of stablecoins also faces severe regulatory challenges. Global regulators are actively taking action:

- Compliance Requirements: The EU’s MiCA regulation and U.S. regulatory drafts require stablecoin issuers to hold 1:1 cash or highly liquid asset reserves and comply with strict anti-money laundering (AML) and know-your-customer (KYC) rules.

- Consumer Protection: Regulators mandate issuers to provide audited reserve proofs to ensure transparency and user asset safety.

These regulatory measures protect users but also increase compliance costs and operational complexity for stablecoin payment solutions.

Comparison: Cost-Benefit of Cryptocurrency vs. Traditional Wire Transfers

When directly comparing stablecoin-based payments with traditional wire transfers, the cost advantage is extremely clear. A traditional wire transfer typically costs $25 to $50, plus hidden exchange rate markups. In contrast, stablecoin transfers over blockchain networks usually have fees below $1.

| Comparison Dimension | Traditional Wire Transfer (SWIFT) | Stablecoin Transfer (e.g., USDC) |

|---|---|---|

| Transaction Fee | $25 - $50, plus hidden exchange rate spread | Usually below $1 |

| Arrival Speed | 1-5 business days | Within minutes |

| Transparency | Complex fee structure, intermediary fees opaque | Clear fees, transaction records publicly verifiable |

This enormous cost difference is driving more individuals and businesses to explore and adopt blockchain-based payment methods.

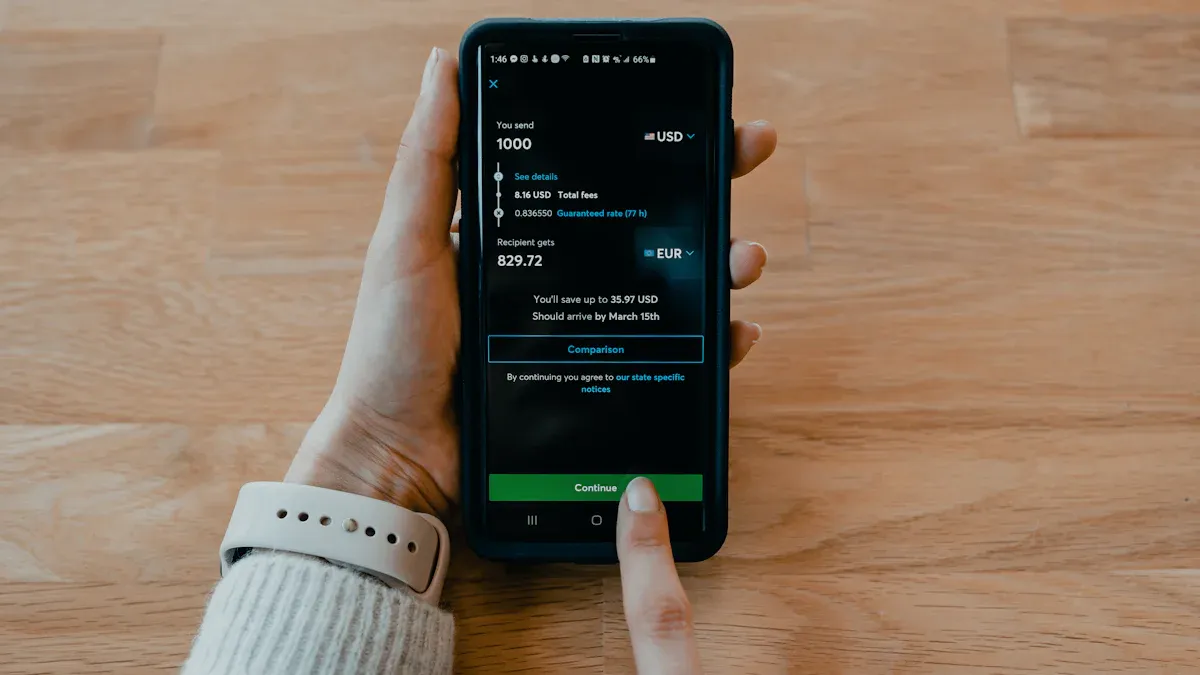

P2P Networks: Optimizing Individual Cross-Border Payment Experience

Image Source: unsplash

Unlike blockchain’s disruptive nature, P2P (Peer-to-Peer) networks optimize existing financial infrastructure through a clever model, particularly suited for individual users’ small-value cross-border payment needs. It acts like a global fund “intelligent dispatch center,” greatly enhancing efficiency and transparency.

Principle: Intelligent Matching and Hedging via Local Liquidity Pools

The core principle of P2P platforms is to avoid physical cross-border fund flows. They establish local bank accounts in major countries or regions worldwide, forming a vast liquidity pool network. When users need to perform currency conversion, the platform searches within its system for a user with the exact opposite demand for matching.

For example, when a U.S. user wants to remit to Europe:

- The user deposits USD into the P2P platform’s local bank account in the U.S.

- The platform’s intelligent system matches a European user who needs to convert EUR to USD.

- The platform directly pays the equivalent EUR from its European liquidity pool to the U.S. user’s recipient.

Platforms like Wise use this model to build a local payment network covering over 160 countries. It allows users to create local account details for over 9 major currencies (such as bank codes or routing numbers), making international client payments function like local transfers, thereby avoiding high international collection fees.

Advantage: Achieving Exchange Rates Close to Mid-Market Rate

Traditional banks typically add an opaque spread to the mid-market rate to profit. P2P platforms break this rule, with one of their main advantages being the provision of rates close to the real mid-market exchange rate.

Platforms like CurrencyFair and Wise publicly claim to offer users the “fairest” rates obtained in real-time from independent sources. By matching users’ conversion needs, they effectively bypass bank and intermediary markups. Research claims that this model’s transaction costs are on average several times cheaper than banks, saving users significant hidden costs.

Limitation: Liquidity Constraints on Transaction Amounts and Currencies

Despite the significant advantages of the P2P model, it is not without limitations. Its efficient operation heavily relies on “liquidity,” meaning there must be sufficient complementary user demands in the liquidity pools.

- Currency Restrictions: For some exotic currencies with low trading volume, platforms may struggle to find matching counterparties, resulting in unavailable services or poor rates.

- Amount Caps: To ensure system stability and regulatory compliance, platforms typically set limits on single or periodic transfer amounts. For example, certain transfers initiated from the U.S. may have a 30-day limit of $14,999.99.

- Not Zero Fees: Although exchange rates are transparent, platforms still charge small service fees to sustain operations, such as proportional currency conversion fees or fixed withdrawal fees. This makes P2P models achieve extremely low fees but still fall short of completely free.

API Gateways: Enterprise-Level Cross-Border Payment Solutions

For enterprises needing global collections, API (Application Programming Interface) gateways provide a powerful and flexible solution. They simplify complex global payment networks into a single integration point, greatly reducing technical barriers and operational costs.

Technology: Payment Aggregation and Intelligent Routing Algorithms

The core of API gateways lies in “aggregation.” Service providers like Stripe and Adyen integrate mainstream local payment methods worldwide through a single API interface. This means enterprises do not need to individually connect to Brazil’s PIX, Mexico’s OXXO, or Southeast Asia’s GrabPay; one integration enables them to offer global customers familiar and trusted payment options.

Furthermore, these platforms employ “intelligent routing” algorithms to optimize every transaction. This technology acts like an intelligent traffic control system, selecting the highest success rate and lowest cost payment path in real-time based on customer location, transaction currency, and historical data.

For example, when a German customer pays a U.S. merchant with a Mastercard, the system may determine that processing through a European acquiring institution yields a 15% higher approval rate than through a U.S. institution. This dynamic optimization can increase payment approval rates by 10-15% on average and recover up to 30% of initially failed transactions.

Innovation: How Virtual Bank Accounts Avoid Intermediary Bank Fees

Another key innovation of API gateways is providing virtual bank accounts. This technology allows enterprises to obtain local bank account details in major global markets (such as the U.S., Europe), such as USD account routing numbers or EUR IBANs.

When customers pay, funds are deposited directly into this local account, making the entire process like a local transfer (such as U.S. ACH or Europe’s SEPA). This model completely bypasses the SWIFT correspondent banking network relied upon by traditional wire transfers, thus eliminating layered intermediary fees. Through this approach, enterprises can control per-transaction costs at extremely low levels, sometimes as low as 0.3%.

Scenario: Global Collection Strategies for E-Commerce and SaaS Enterprises

For e-commerce and SaaS (Software as a Service) enterprises, API gateways are ideal strategies for achieving global collections. Traditional international credit card payments not only have unstable success rates but also high fees, with cross-border transaction fees and currency conversion fees adding up to 2% to 5% or more of the transaction amount.

In contrast, enterprises adopting API gateways can formulate superior collection strategies:

- Increase Payment Success Rate: By offering local payment methods, payment success rates can rise above 85%, effectively reducing customer churn.

- Reduce Development Costs: The single API integration model can cut payment-related engineering time by 80%, allowing technical teams to focus on core business.

- Simplify Compliance Processes: Built-in KYC (Know Your Customer) and AML (Anti-Money Laundering) tools help enterprises quickly enter new markets while avoiding compliance risks.

In this way, complex cross-border payment processes are simplified into an efficient, low-cost automated system, providing enterprises with a solid foundation for global market competition.

Central Bank Digital Currency (CBDC): A National-Level Future Vision

When payment technology innovation escalates from enterprise to national level, Central Bank Digital Currency (CBDC) becomes the core of envisioning future payment systems. It represents digital cash backed by national credit, designed to address efficiency and cost issues in existing financial systems from a top-down perspective.

Outlook: Potential of Multilateral Projects like mBridge

Multilateral CBDC projects are key to exploring future payment forms, with the mBridge project particularly noteworthy. Initiated by the Digital Currency Institute of the People’s Bank of China, the Hong Kong Monetary Authority, the Bank of Thailand, and the Central Bank of the UAE, the Saudi Central Bank has recently joined.

The core goal of the mBridge project is clear: to use dedicated distributed ledger technology (DLT) to create a platform capable of supporting real-time, peer-to-peer transactions, thereby completely bypassing the slow and expensive links in traditional correspondent banking systems.

The project has entered the Minimum Viable Product (MVP) phase, with its potential validated in early pilots:

- Real Transaction Testing: In the 2022 pilot, 20 commercial banks from four regions participated, completing real transactions totaling over $22 million.

- Huge Efficiency Gains: Transaction times shortened from 3-5 days to seconds, achieving near-instant settlement.

- Significant Cost Reduction: Direct bank connections enable substantial transaction cost reductions.

The mBridge project demonstrates CBDC’s immense potential in simplifying international trade and enhancing financial transaction efficiency, laying the foundation for a unified global payment framework.

Impact: Technical and Policy Barriers to a Zero-Fee Era

Despite the promising outlook for projects like mBridge, achieving a globally unified, zero-fee CBDC system faces enormous technical and policy barriers. This is not a simple technical upgrade but a systemic project involving global collaboration.

The primary technical challenge is “interoperability.” Different countries develop CBDCs based on varying technical architectures and domestic priorities. For example, some systems are based on Corda blockchain, while others use Quorum, making direct communication between systems extremely difficult. Enabling all participants to process transactions on a shared digital ledger is currently unfeasible.

Moreover, policy and sovereignty issues are deeper barriers. Each country has independent legal and regulatory frameworks and monetary policies. Establishing a unified payment system requires high consensus among nations on data privacy, AML compliance, and monetary sovereignty. These complex coordination efforts mean the zero-fee CBDC era will not arrive overnight.

Technological advancements provide diverse paths to reduce payment costs. Users selecting appropriate solutions based on their needs is key to cost optimization.

- Individual Users: Can combine stablecoins to reduce a $200 remittance cost from about $6.08 to under $1. However, users must beware of fraud risks on unregulated platforms and choose compliant service providers.

- Enterprise Users: Can use API gateways to prioritize local currency settlements and leverage multi-currency accounts to plan fund repatriation cycles, thereby maximizing cost savings.

Looking ahead, technology continues to drive down cross-border payment costs, with zero fees already possible in specific payment corridors.

FAQ

How should individual users choose the most suitable cross-border payment method?

The choice depends on specific needs.

- Small, Frequent Remittances: P2P networks (like Wise) are often better due to transparent exchange rates and lower fixed fees.

- Pursuing Ultimate Low Cost: Using stablecoins (like USDC) on compliant platforms can reduce fees to under $1, but users must bear operational risks themselves.

Is using stablecoin payments absolutely safe?

Safety is not absolute. It highly depends on the service provider’s compliance level and reserve transparency. Users should choose regulated platforms and securely store their private keys. Any digital asset transaction carries technical and market volatility risks.

Does zero fees mean completely free?

Not entirely. “Zero fees” advertised by platforms usually means waiving service commissions. However, users may still need to pay blockchain network fees (Gas Fee) or bear hidden exchange rate spreads. Before transacting, users must carefully verify all potential costs.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.