- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Say Goodbye to High Fees: A Safe and Efficient Guide to Cross-Border Payments for International Students

Image Source: pexels

Study abroad costs in 2025 continue to rise. Are you worried about the annual $50,000 foreign exchange purchase limit? Facing high tuition fees, many families feel anxious, fearing that funds cannot be smoothly transferred abroad.

Rest assured. According to the latest policy, you can apply to the bank for excess foreign exchange purchase with your admission letter and tuition invoice. The single payment limit can be significantly increased, completely breaking the quota restriction and solving your core problem.

Key Points

- Chinese international students can apply to the bank for excess foreign exchange purchase with their admission letter and tuition invoice to pay tuition and living expenses, without being subject to the annual $50,000 limit.

- Bank wire transfer is the safest and most reliable way to pay large tuition fees, but you need to prepare materials such as ID card, admission letter, and tuition invoice.

- Third-party payment platforms such as Alipay and Flywire are suitable for paying small daily expenses. They are easy to operate and arrive quickly, but pay attention to the exchange rate difference.

- International credit cards are suitable for paying small emergency expenses, but the handling fees are high; Hong Kong accounts can serve as a fund transfer station to increase payment flexibility.

- You can manage exchange rate risks by monitoring exchange rates and using forward contracts, while study abroad loans serve as a backup plan in emergency situations.

2025 Study Abroad Cost Structure and Payment Policy Interpretation

The first step in planning study abroad finances is to clearly understand all potential expenses. This can help you create a practical budget and avoid unexpected funding gaps in the future. This chapter will guide you through a comprehensive overview of study abroad cost components and an in-depth interpretation of how to legally break through the foreign exchange purchase limit.

Comprehensive Budget: Overview of Tuition and Living Expenses

Your total study abroad expenses mainly consist of three major parts: tuition, living expenses, and other one-time fees.

- Tuition Fees This is the largest part of study abroad expenses. Tuition fees vary greatly depending on the country, school, and major. Taking the United States as an example, there is a significant difference between public and private universities. To give you a more specific idea, you can refer to the average tuition range for U.S. undergraduate universities in the 2024-2025 academic year:

Institution Type Average Annual Tuition (USD) Public Four-Year (In-State Students) $11,610 Public Four-Year (Out-of-State Students) $30,780 Private Nonprofit Four-Year $43,350 Note: These are just average figures. Tuition at top private universities may be much higher. Be sure to check the latest fee standards published on the official website of your desired school.

- Living Expenses Living expenses are more flexible and mainly depend on the city you are in and your spending habits. They mainly include:

- Accommodation: On-campus dormitories cost about $800 – $1,200 per month, while off-campus shared apartments range from $700 – $1,500.

- Food: If you cook for yourself, monthly expenses are about $250 – $400; choosing school cafeterias or eating out frequently will cost more.

- Transportation: In big cities, using public transportation monthly passes costs about $70 – $150.

For example, in a high-cost city like New York, monthly living expenses may be between $2,000 – $3,000.

- Other One-Time Expenses Before departure and upon initial arrival, you also need to prepare a sum of money for the following items:

- Visa application fee

- Airfare

- Health insurance

- Books and study supplies

- Emergency reserve fund

Policy Core: Compliant Ways to Break Through the $50,000 Limit

After understanding the total expenses, the biggest concern for many families is that the annual $50,000 personal foreign exchange purchase limit is not enough. Now, you can completely dispel this concern.

According to the current foreign exchange management policy in mainland China, foreign exchange purchases used to pay overseas education expenses can be applied for in excess.

Core Policy: You can apply directly to the bank counter with a genuine admission letter and tuition payment notice to handle excess foreign exchange purchase. This service is specifically for paying tuition and living expenses, and the single payment limit can be set according to the amount on your payment notice, usually far exceeding $50,000, solving the problem of large tuition payments.

This policy provides you with a completely compliant and safe channel for funds to go abroad. You no longer need to worry about quota issues or seek risky gray channels.

Pre-Payment Preparation: Essential Materials List and Process

To successfully complete excess foreign exchange purchase, it is crucial to prepare all necessary documents in advance. The entire process is not complicated; the key lies in the completeness and authenticity of the materials.

Process Overview:

- Collect Materials: Prepare originals and copies of all documents according to the list below.

- Go to the Bank: Bring all materials to the bank branch counter. It is recommended to choose a bank you commonly use, such as Bank of China or Industrial and Commercial Bank of China, which have more experience with such services.

- Fill Out the Application: Under the guidance of bank staff, fill out the “Personal Foreign Exchange Purchase Application Form” and clearly indicate that the purpose of the purchase is “overseas study.”

- Handle Remittance: After approval, the bank will handle the foreign exchange purchase and subsequent wire transfer procedures for you.

Essential Materials List 📝

- Valid ID of the Applicant: Such as ID card.

- Admission Letter: Official Offer Letter issued by the school.

- Tuition/Living Expenses Payment Notice: Payment Invoice printed from the school website or sent via official email, which must include clear payee information (school name, account, address) and the amount due.

- Valid Visa or Endorsement: (If already obtained)

It is recommended that you call the bank customer service or local branch for confirmation before heading to the bank to ensure the list is complete and save your valuable time.

Bank Wire Transfer: The Reliable Choice for Large Tuition Payments

Image Source: unsplash

When you need to pay tens of thousands of dollars in tuition, bank wire transfer is the most traditional and reliable choice. It directly transfers funds from your mainland China bank account to the overseas account designated by the school, safely and traceably.

Complete Guide to Wire Transfer Operations

The process of operating a wire transfer is very straightforward. You can complete it by following these steps:

- Obtain Payee Information: Find all necessary payee information from the school’s payment notice (Invoice).

- Go to the Bank Branch: Bring your ID and all study abroad proof materials (admission letter, payment notice, etc.) to the bank.

- Fill Out the Remittance Application: Accurately fill out the “Outbound Remittance Application Form” under the guidance of the bank teller.

- Confirm and Pay: Carefully check all information, especially the payee’s name, account number, and SWIFT Code, and pay the amount and handling fees after confirming no errors.

Detailed Fee Breakdown: Handling Fees, Cable Fees, and Intermediary Bank Fees

Wire transfer fees mainly consist of three parts, with total fees usually between $30 - $80 USD, depending on the bank.

- Handling Fee: Charged as a certain percentage of the remittance amount, usually with minimum and maximum limits.

- Cable Fee: A fixed fee for sending the remittance instruction, generally $15 - $20 USD.

- Intermediary Bank Fee: This is the most uncertain fee. If there is no direct cooperation between your remitting bank and the receiving bank, the funds will be transferred through one or more “intermediary banks,” and each intermediary bank may charge a fee.

| Fee Type | Amount/Description |

|---|---|

| Intermediary Bank Fee | Varies |

Tip: Some banks offer a service that allows you to pay a fixed fee in advance to cover all potential intermediary bank fees, ensuring the payee receives the full amount.

Applicable Scenarios and Arrival Time

Bank wire transfer is most suitable for paying large, low-frequency amounts, such as tuition and accommodation prepayments. Due to its rigorous process, it provides the highest security for cross-border transfer of large funds.

Usually, the arrival time for wire transfers is 3-5 business days. However, this time will be affected by holidays, bank processing efficiency, and the number of intermediary banks.

Pitfall Avoidance Guide: How to Reduce Fees and Ensure Information Accuracy

Incorrect remittance information can lead to payment delays, failures, or even additional fees. To ensure your study abroad expenses arrive smoothly, please avoid the following common mistakes:

- Payee Information Errors: Incorrect spelling of the payee’s name, bank account number, or SWIFT/IBAN code are the most common reasons for remittance returns. Banks have extremely high requirements for the accuracy of this information.

- Incomplete Address Information: Be sure to provide the complete physical address of the payee (school), not a post office box.

- Compliance Review Issues: Large amounts or incomplete information may trigger the bank’s anti-money laundering review, causing transaction delays.

When filling out the application form, please double-check every letter and number. A tiny error can cause the funds to be returned, and the bank usually does not refund the handling fees already charged.

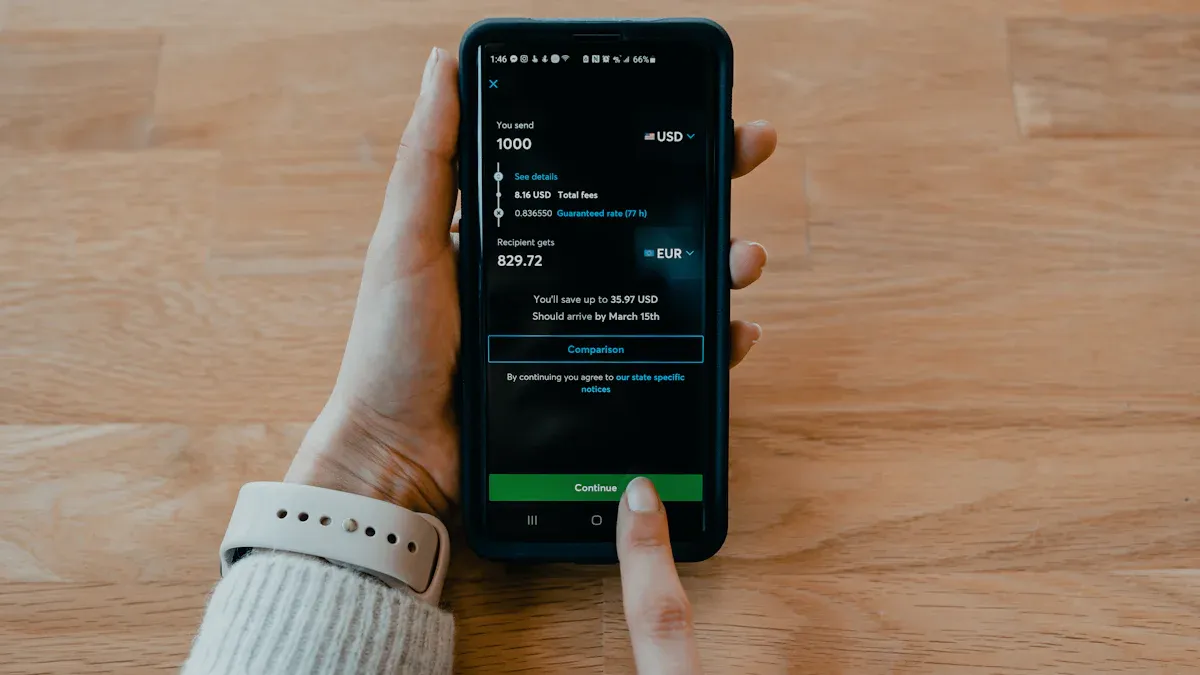

Third-Party Payments: Convenient and Efficient Helpers for Daily Expenses

Image Source: unsplash

After handling large tuition payments, you still need a convenient and quick way to pay daily expenses. Third-party payment platforms can meet this need perfectly. They are simple to operate and arrive quickly, making them an excellent supplement to bank wire transfers.

Mainstream Platform Comparison: Alipay vs. Flywire/EasyTransfer

The platforms you can choose are mainly divided into two categories:

- Comprehensive Payment Platforms: Represented by Alipay. You can find the “study abroad remittance” function in the Alipay app, which supports payments to mainstream institutions in multiple countries. Its biggest advantage is convenient operation, which you are very familiar with, and funds usually arrive within 1-3 business days.

- Vertical Education Payment Platforms: Represented by Flywire and EasyTransfer. These platforms focus on the education payment field and officially cooperate with thousands of institutions worldwide. They are usually directly embedded in the school’s payment system and support multiple payment methods including Alipay and WeChat Pay.

Core Difference: Alipay is you actively sending out, while Flywire/EasyTransfer is more like the school’s “official payment desk,” where you pay the school through them, and the process experience is more seamless.

Security and Compliance Examination

You may be concerned about the compliance of these platforms. Rest assured, all legitimate third-party cross-border payment services operating in mainland China must comply with the regulatory provisions of the People’s Bank of China and the State Administration of Foreign Exchange.

These platforms cooperate with licensed payment institutions or banks in mainland China to ensure that every transaction undergoes compliant declaration. This means that every penny you pay through them is completed within the framework allowed by national policy, and fund security is guaranteed.

Hidden Cost Analysis of Fees and Exchange Rates

When using third-party platforms, you need to pay attention to two parts of costs: explicit fees and hidden exchange rate differences.

Exchange Rate Markup: The exchange rate provided to you by the platform is usually slightly higher than the real-time interbank market rate (mid-rate). This difference is one of the platform’s profit sources.

Total fees usually include:

- Handling Fee: Charged per transaction, with a fixed amount. For example, Alipay’s single transaction handling fee is usually between 7 USD and 15 USD.

- Intermediary Bank Fee: This fee may not necessarily occur, but if the funds need to go through intermediary banks, it may be deducted.

- Exchange Rate Cost: This is the most hidden cost. Before payment, you can check the market mid-rate through websites like Google or XE and compare it with the exchange rate given by the platform to estimate this part of the cost.

Convenient Choice for Small Study Abroad Expense Payments

The real advantage of third-party platforms lies in handling small, high-frequency payment needs. For bank wire transfers, processing a 500 USD application fee and a 50,000 USD tuition fee have almost the same process and fixed costs, which seems like “making a mountain out of a molehill.”

Third-party platforms are perfect for the following scenarios:

- Paying school application fees

- Paying accommodation deposits

- Paying small bills or purchasing study materials

These platforms provide an almost instant payment experience, allowing you to easily handle it with your mobile phone, greatly saving time and effort, and are ideal tools for managing scattered study abroad expenses.

Credit Card Payments and Other Emergency Solutions

In addition to bank wire transfers and third-party platforms, you should also understand some backup solutions. They can provide convenience in specific situations or help you out in emergencies.

International Credit Cards: Advantages and Limits of Online Payments

You can use international credit cards that support foreign currency payments (such as Visa or Mastercard) to pay directly on the school website.

- Advantages: Extremely convenient operation, instant payment confirmation, suitable for paying small amounts such as application fees and deposit fees.

- Disadvantages:

- Higher Fees: Schools usually charge 2%-3% card processing fees, much higher than wire transfers.

- Limit Restrictions: Your credit card’s single payment limit and total credit limit may not be sufficient to cover large tuition fees.

Credit cards are convenient supplementary tools but not suitable as the main method for paying large tuition fees.

Hong Kong Accounts: Flexible Transfer Stations for Large Funds

Opening a bank account in Hong Kong can serve as a flexible transfer station for your fund arrangements. You can first legally transfer funds from mainland China to your same-name account in Hong Kong, and then pay tuition from the Hong Kong account.

This provides you with a payment channel that is not subject to mainland China’s single transaction limits, increasing the flexibility of fund operations. You can more conveniently conduct global payments and investment management through the online banking system of Hong Kong licensed banks.

Exchange Rate Risk Management Strategies

Exchange rate fluctuations will directly affect your study abroad costs. You can consider using some financial tools to lock in exchange rates and avoid risks.

- Forward Contract: You can agree with the bank on a future date to purchase foreign currency at today’s exchange rate. For example, you lock in an exchange rate of 1 USD to 0.95 EUR. Even if the exchange rate becomes unfavorable three months later, you can still pay tuition at the locked favorable rate.

- Currency Option: This gives you the “right” but not the “obligation” to purchase foreign currency at an agreed price in the future. If the exchange rate is favorable to you, you can abandon the option and exchange at the market rate; if the exchange rate is unfavorable, you can exercise the option to protect yourself from losses.

Emergency Funds: The Backup Value of Study Abroad Loans

Study abroad loans should be regarded as the last safety net, not the preferred solution. When unforeseen emergencies occur, it can provide necessary help.

When to Consider Emergency Loans?

- Sudden family accidents leading to financial difficulties.

- Interruption of main income sources, such as family member unemployment.

- Any situation that causes you to urgently need funds to maintain your studies and life.

Such loans are usually used to pay living expenses, medical expenses, or purchase study supplies to help you through temporary difficulties.

I hope this summary table can help you make a choice. The key to dealing with payment challenges is a combination strategy: use bank excess foreign exchange purchase to pay large tuition fees, and cooperate with third-party platforms to handle daily expenses.

| Payment Method | Recommended Scenarios | Amount Suggestion | Pros / Cons |

|---|---|---|---|

| Bank Wire Transfer | Large Tuition | > $10,000 | Pros: Safe and compliant / Cons: Slightly slower process |

| Third-Party Payment | Living Expenses/Miscellaneous Fees | < $5,000 | Pros: Convenient operation / Cons: Exchange rate premium |

| International Credit Card | Emergency/Online Payment | < $1,000 | Pros: Instant arrival / Cons: High handling fees (2-3%) |

Wishing you smooth completion of financial preparations and a worry-free start to your wonderful study abroad journey.

FAQ

When is the best time to exchange currency to get the most value?

You can continuously monitor exchange rate trends and buy in batches when the exchange rate is more favorable. For large tuition fees, you can also consult the bank to see if you can use tools like forward contracts to lock in the exchange rate in advance and avoid the risk of future exchange rate fluctuations.

Can the wire transfer voucher be used as proof of funds for visa applications?

Of course it can. The wire transfer receipt issued by the bank is strong payment proof. You can include it with your bank deposit certificate and other materials as part of the visa fund proof, which can clearly show the visa officer the legitimate use of funds.

Why is the payee on the school website not the school itself?

This is normal. Many overseas institutions authorize officially cooperating third-party payment platforms (such as Flywire) to collect tuition on their behalf. As long as you operate through the payment portal on the school website, the funds are safe. Please pay with confidence.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.