- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Cash Out Cryptocurrency from Different Blockchains: Cross-Chain Trading Practical Tutorial

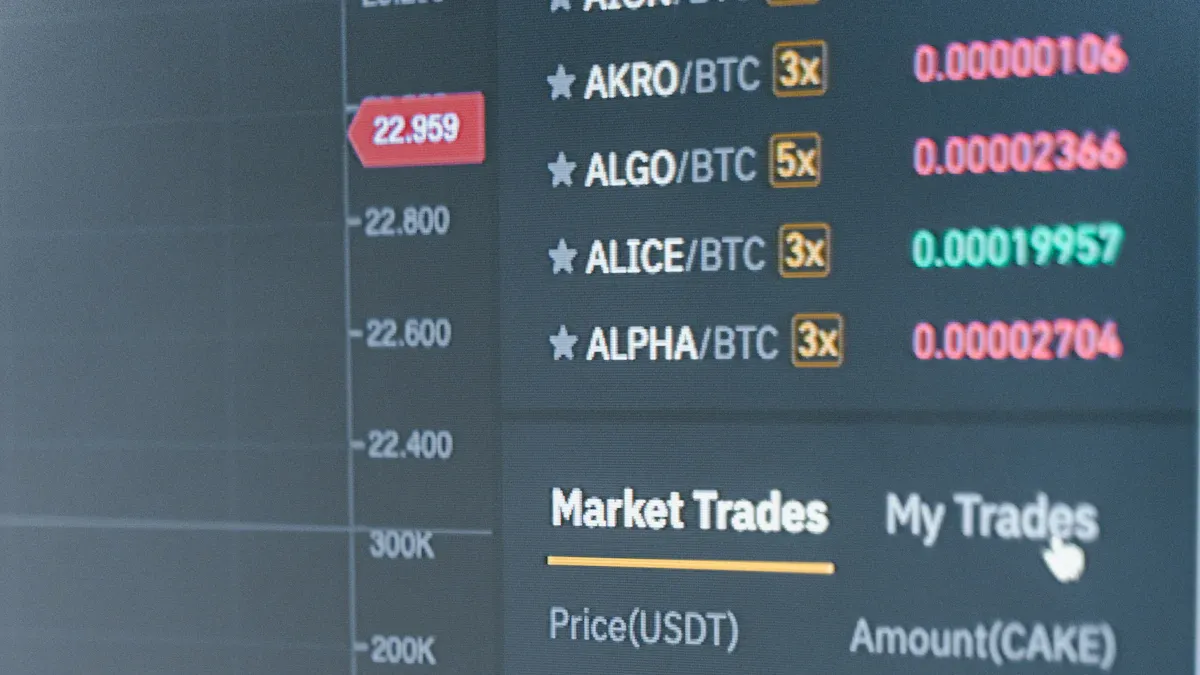

Image Source: unsplash

Are you troubled by assets scattered across different blockchains? We provide you with a clear three-step cash-out framework:

- Use cross-chain bridges or integrated wallets to aggregate assets to a mainstream blockchain.

- On that chain, swap the assets into stablecoins like USDT.

- Sell the stablecoins through the C2C function of centralized exchanges to obtain fiat currency.

Your goal is to solve the pain point of “assets scattered, no way to cash out.” This tutorial will guide you step by step to complete the entire process from multi-chain cryptocurrencies to your bank account.

Key Points

- Use the three-step method to cash out cryptocurrencies: first aggregate assets to a mainstream blockchain, then swap them into USDT, and finally sell through a centralized exchange.

- Aggregated cash-out is the best choice. It transfers all assets via cross-chain bridges to a mainstream blockchain, which can reduce total costs.

- Choosing a reliable cross-chain bridge is important. You need to check its total value locked (TVL), security audit reports, and community reputation.

- Swap cryptocurrencies into USDT on DEXs. USDT has good liquidity, fast trading speed, and can get you better prices.

- During C2C trading, confirm receipt of payment before releasing coins. Use a dedicated bank card and choose reputable merchants to protect your funds.

Asset Inventory and Cash-Out Strategy

Image Source: pexels

Before starting to cash out, you need to fully understand your asset situation. A clear inventory is the foundation for formulating the best strategy.

View Multi-Chain Asset Distribution

Your first step is to clearly see all your assets. Manually querying on various blockchain explorers is time-consuming and error-prone. Fortunately, you can use professional tools to simplify this process.

There are currently two main ways to aggregate and view your assets:

- Use Integrated Wallets: Many modern wallets have powerful asset management functions. For example, the OKX Web3 Wallet provides you with a unified dashboard that supports over 70 networks, automatically identifying and displaying your tokens, NFTs, and DeFi positions on different chains without manual network switching.

- Use Asset Dashboard Tools: These are websites or apps specifically for tracking portfolios.

Tool Name Main Features Suitable Users DeBank Extensive support for EVM chains, providing detailed DeFi protocol data and risk assessment. Deep DeFi players. Zapper Simple interface, one-stop management and investment of DeFi assets. DeFi beginners or users seeking simple operations. Zerion Aggregates various DeFi protocols, provides a unified view, and supports trading functions. DeFi investors seeking integrated trading functions.

With these tools, you can have a clear overview of your entire asset portfolio.

Plan the Best Cash-Out Path

After a clear inventory, you need to plan how to most efficiently convert these scattered assets into fiat currency. There are mainly two approaches:

- Path One: Decentralized Cash-Out. Swap assets into stablecoins on each blockchain separately, then deposit them to exchanges for sale.

- Path Two: Aggregated Cash-Out. Transfer all assets via cross-chain bridges to a mainstream blockchain (such as BSC or Polygon), uniformly swap into stablecoins, and then centrally deposit to an exchange for sale.

Your choice will directly affect the final funds you receive. You need to focus on two factors: transaction fees (Gas Fee) and asset liquidity. Gas fees vary greatly across chains, and high fees can seriously erode your profits.

Comparison of Pros and Cons of the Two Paths

To help you make a decision, let’s compare the two paths:

Decentralized Cash-Out (Path One)

- Advantages: Direct process; if the asset amount on a chain is small and Gas fees are low, it may be faster.

- Disadvantages: Tedious operations, requiring switching between multiple platforms; if involving multiple chains, cumulative Gas fees and exchange deposit fees can be very high.

Aggregated Cash-Out (Path Two)

- Advantages: Clear process, only one swap and one withdrawal on the target chain, easy to manage, usually lower total costs.

- Disadvantages: Adds a cross-chain operation step, requiring payment of cross-chain bridge fees and bearing corresponding smart contract risks.

For most users, “Aggregated Cash-Out” is the more recommended choice. Although it has one extra step, it is more organized overall, easier to control costs, and perfectly fits the core idea of our “three-step cash-out method.”

Cross-Chain Trading Practical Tutorial

Image Source: pexels

Now that you have planned the “aggregated cash-out” path, we will enter the most critical practical operation phase. This chapter will teach you hand-by-hand how to use cross-chain tools to safely and efficiently transfer assets from one chain to another.

Core Tool: Selection of Cross-Chain Bridges

Cross-chain bridges are your core tool for asset transfer. You can think of them as bridges connecting two independent “highways” (blockchains), allowing your “truck” (assets) to pass smoothly.

Faced with numerous cross-chain bridges on the market, manual selection is time-consuming and complex. Therefore, we recommend using tools that integrate cross-chain functions.

Efficient Shortcut: Use Cross-Chain Aggregators

Tools like OKX Web3 Wallet have built-in powerful cross-chain aggregators. How do they simplify operations for you?

- Intelligent Routing Algorithm: It automatically analyzes paths from dozens of cross-chain bridges and decentralized exchanges (DEXs).

- Find the Optimal Solution: The algorithm comprehensively considers fees, speed, and slippage, recommending the lowest-cost and fastest cross-chain solution.

- One-Stop Experience: You don’t need to jump between multiple websites; just input the start and end points in the wallet, and the program handles the rest automatically.

Although aggregators are very convenient, you still need to know how to evaluate the security of a cross-chain bridge, as your assets will pass through its smart contracts. You can examine from the following three aspects:

- Total Value Locked (TVL): Higher TVL usually means more user trust and better liquidity.

- Security Audit Reports:

- Check if the project has been audited by multiple well-known security companies.

- Carefully read the audit reports to confirm no unrepaired high-risk vulnerabilities.

- Understand the project team’s response and fixes for discovered issues.

- Community Reputation:

- Active communities (such as Discord, Telegram) are signs of healthy project development.

- Observe community member feedback and the efficiency of official issue resolution.

- Comprehensively evaluate its market reputation through forums and expert reviews.

Practical Case: Cross-Chain Solana Assets to BSC

Let’s learn through a specific case how to transfer assets (e.g., USDC) from the Solana chain to the BNB Smart Chain (BSC). Solana is known for its extremely low latency, while BSC has a vast DeFi ecosystem and high throughput, making it very convenient to aggregate assets here.

Operation Steps:

- Open Cross-Chain Tool: Open your OKX Web3 Wallet, find the “Trade” function, and select “Cross-Chain.”

- Set Cross-Chain Parameters:

- From: Select the

Solanachain and the token you want to cross-chain, e.g.,USDC. - To: Select

BNB Chain (BSC)and the token you wish to receive, alsoUSDC. - Input Amount: Enter the quantity of assets you plan to transfer.

- From: Select the

- Select Optimal Path: The system will automatically analyze and recommend paths. Currently, there are over 18 bridges connecting Solana and BSC, and the aggregator will screen the best option based on real-time data. You will see clear fee estimates (in USD) and expected arrival time.

- Authorize and Confirm Transaction: Carefully verify all information, especially if the receiving address is correct. After confirmation, click “Swap” or “Cross-Chain” and authorize the transaction in the wallet.

- Wait for Transaction Completion: After submission, patiently wait. Since both Solana and BSC are high-performance networks, the cross-chain process is usually fast. Some advanced bridge solutions can even complete in 10 seconds, though some may take a few minutes. You can see real-time progress on the tool interface.

Confirm Cross-Chain Asset Arrival

After the transaction, the most important step is to confirm your assets have safely arrived at the target wallet.

How to Check?

- Most Direct Method: In your wallet, switch the network to the target chain (e.g., BSC) and check if your USDC balance has updated.

- Use Asset Dashboard Tools: Open websites like DeBank or Zapper, enter your wallet address. These platforms automatically fetch your assets across all supported networks, and you can see changes on the BSC chain in one interface.

- Manually Verify on Block Explorers: Find the transaction hash (TxID) in the cross-chain tool. One hash corresponds to the source chain (Solana), another to the target chain (BSC). You can view the sent transaction on Solscan and the received transaction on BscScan.

What if Assets Don’t Arrive?

Don’t panic in this situation; your funds are rarely lost permanently. Handle it as follows:

- Be Patient: Network congestion can cause delays; wait longer than estimated.

- Check Transaction Status: View on the cross-chain bridge’s transaction records or block explorer if the transaction is truly “successful.”

- Contact Support: If not arrived after a long time, immediately contact the official support of the cross-chain bridge (usually in their Discord channel). Provide source and target chain transaction hashes; they will assist in querying or handling.

- Note Refund Logic: Most failed cross-chain transactions automatically refund to your source chain wallet. If the swap fails but cross-chain succeeds, you may receive a “wrapped token” on the target chain, requiring manual further swapping.

Through the above steps, you have successfully aggregated assets scattered across different chains to a mainstream blockchain. The next step is to swap them into stablecoins to prepare for final cash-out.

Swap to Stablecoins and Cryptocurrency Cash-Out

Congratulations! You have completed the most complex cross-chain part and successfully aggregated assets to a mainstream blockchain. Now, you are just two steps away from cashing out cryptocurrencies: swap to stablecoins and sell securely through an exchange.

Swap to USDT on DEX

Before depositing assets to a centralized exchange (CEX), it is strongly recommended to first uniformly swap them to USDT on a decentralized exchange (DEX).

Why USDT? Because it is like the dollar in the digital world, with the best liquidity and widest acceptance, allowing you the fastest transaction speed and best prices in the C2C market.

Operation Process:

- Choose a High-Liquidity DEX: On the BSC chain, there are many excellent DEXs to choose from. High liquidity means less slippage and more USDT swapped. Refer to the following mainstream DEX data.

DEX 24-Hour Trading Volume (USD) Supported Blockchains Uniswap V3 $2.6B BSC (BNB Chain) PancakeSwap AMM V3 $2.4B BSC (BNB Chain) Uniswap V4 $1.0B BSC (BNB Chain) PancakeSwap Infinity $311.6M BSC (BNB Chain) SushiSwap $1-5M BNB Chain - Connect Wallet and Select Trading Pair: Visit the chosen DEX website (e.g., PancakeSwap), connect your Web3 wallet. On the Swap page, select your held token above and USDT below.

- Authorize and Execute Swap: Enter the amount to swap; the DEX will display the estimated USDT received. For the first trade of a token, perform an “Approve” operation to allow the DEX smart contract to use your token. After approval, click “Swap” and confirm the transaction.

Security Tip: How to Avoid Swapping to Fake USDT?

Scammers create fake coins with identical names and icons. The token’s contract address is its unique “fingerprint”. You must verify the official USDT contract address through trusted channels.

- Visit Authoritative Market Websites: Open CoinMarketCap or CoinGecko.

- Search USDT: Find Tether (USDT) in the search results.

- Copy Official Contract Address: In the contract address section, find the address for the BSC chain and copy it.

- Paste and Verify in DEX: Paste this address into the DEX token selection box to import the officially certified USDT for trading.

Withdraw from Wallet to Exchange

Once all assets in your wallet are USDT, the next step is to send it to a centralized exchange that supports C2C trading, such as OKX or Binance.

This process is simple, but details determine success or failure.

- Obtain Deposit Address on Exchange: Log in to your exchange account, go to “Assets” or “Wallet” page, select “Deposit.” Choose

USDTas the coin, then select the correct deposit network, e.g.,BSC (BEP20). The exchange will generate a unique deposit address for you. - Initiate Transfer from Wallet: Open your Web3 wallet, select USDT, click “Send.” Paste the just-copied exchange deposit address into the recipient address field, enter the amount, and ensure the network is also

BSC (BEP20). - Confirm and Send: Carefully verify the address and network, authorize the transaction after confirmation. In a few minutes, your USDT will appear in the exchange’s funding account.

Common Mistakes to Avoid During Withdrawal

- Wrong Network Selection: The most common and fatal error. If transferring from BSC, the exchange deposit network must also be BSC (BEP20). Wrong network may lead to permanent asset loss.

- Copying Wrong Address: Before transfer, verify the first and last few characters of the deposit address multiple times. One wrong character sends your funds nowhere.

- Forgetting to Fill Memo/Tag: Some exchanges (like EOS network) require a Memo (tag) with the deposit address. Forgetting it means funds won’t auto-credit; contact support for manual processing.

Securely Sell Through C2C Trading

This is the final step of cash-out and involves real-person trading, requiring extra caution. C2C (Customer-to-Customer) or P2P (Peer-to-Peer) trading means you directly sell USDT to buyers on the platform, who pay you fiat via bank transfer, etc.

Golden Rule: Confirm receipt of payment before releasing coins

This mechanism is like an escrow transaction. When you place a sell order, the platform locks your USDT. After the buyer pays, you must log into your bank App or online banking, personally confirm the money has arrived and the amount is correct, then click “Confirm Receipt and Release Coins” on the exchange.

How to Screen a Reliable Buyer?

In the C2C market, you will see many “merchants” with hanging orders. Choosing a good counterparty is crucial. Focus on the following indicators:

- Verified Merchants: Prioritize merchants with a yellow “V” mark next to their name. They have paid a deposit to the platform and have higher credibility.

- Completion Rate and Volume: Choose merchants with completion rates above 98% and high total completed orders. This indicates rich experience and smooth trading.

- Positive Feedback Rate: Higher positive feedback rates reflect real past seller experiences.

- Registration Time: Longer registration time usually means more stable and reliable merchants.

Detailed Steps for Securely Selling USDT:

- Post Sell Ad or Choose Buyer: In the exchange’s C2C section, select a buyer with a suitable bid and sell directly to them.

- Wait for Buyer Payment: After ordering, the order page shows buyer payment info. Patiently wait for their operation; don’t urge.

- Verify Receipt Information: When the buyer marks “I have paid,” this is the most critical step.

- Log into your receiving account; don’t rely on any SMS notifications or screenshots sent by the other party.

- Confirm the received amount matches the order amount exactly.

- Check if the payer’s name matches the buyer’s real name displayed on the platform.

- Confirm and Release Coins: After confirming funds are correct, return to the exchange order page and click “Confirm Receipt and Release Coins.” The platform will release the locked USDT to the buyer.

- Beware of Payment Remarks: Remind buyers not to include sensitive words like “USDT,” “Bitcoin,” or “cryptocurrency” in transfer remarks to avoid bank risk control on your receiving account.

Following the above steps, you can safely and smoothly convert your crypto assets into cash in your bank account.

Cash-Out Risks and Safety Precautions

You have mastered the entire cash-out process, but safety is always first. Understanding and avoiding risks ensures your funds are securely pocketed. This chapter reveals risk points to watch in the three key links.

Security Risks of Cross-Chain Bridges

Cross-chain bridges are hubs connecting different blockchains but may also be the most vulnerable link. Historically, many major security incidents occurred on cross-chain bridges.

Major Historical Cross-Chain Bridge Attacks

Attack Incident Loss Amount (USD) Brief Reason Ronin Bridge Over $600 million 5 of 9 multi-sig private keys stolen Solana Wormhole Over $300 million Smart contract vulnerability exploited Harmony Bridge About $100 million 2 of 5 multi-sig private keys stolen

These attacks expose common security weaknesses of cross-chain bridges:

- Private Key Leakage: Many bridges rely on multi-signature for transaction authorization. If the centralized entity or individual managing keys is attacked, attackers can withdraw funds.

- Smart Contract Vulnerabilities: Complex code logic may have undiscovered flaws. Some projects lack comprehensive security audits, leaving opportunities for hackers.

- Centralization Risks: Some bridges have too few validation nodes, forming single points of failure; once breached, consequences are dire.

Gas Fee Cost Considerations

Gas fees are the “fuel” you pay for operations on the blockchain. Although a single fee may be low, multiple operations accumulate into significant expenses. Gas fees vary greatly across networks.

- Ethereum: Highest fees; during peak times, one transaction may cost several dollars or over $20.

- BNB Smart Chain (BSC): Very low fees; one transfer usually costs just a few cents.

- Solana: Extremely low fees, almost negligible, usually less than one cent.

How to Effectively Save Gas Fees?

- Choose Low-Fee Networks: Aggregate assets to low-cost blockchains like BSC or Solana for operations.

- Choose Trading Timing: Trade during low-congestion periods (e.g., weekends or non-working hours) for lower fees.

- Batch Process Transactions: If possible, combine multiple small operations into one transaction to save multiple Gas payments.

C2C Trading Anti-Account Freeze Guide

C2C trading directly involves fiat and is the step requiring most caution. If your receiving bank account is risk-controlled due to funds from unknown sources, it may face freezing. Banks have strict anti-money laundering (AML) obligations and take action on suspicious transactions.

To protect your bank account, follow these best practices:

- Use Dedicated Card: Prepare a rarely used bank card specifically for C2C receipts, separate from your salary or main savings card.

- Control Transaction Frequency and Amount: Avoid large, high-frequency transactions in a short time. Receiving large amounts in a single day (e.g., over $10,000) significantly increases bank attention.

- Keep Account Active: Maintain normal spending records on this dedicated card, such as for daily shopping or bill payments, to appear as a normal personal account.

- Choose Reputable Merchants: Trade only with merchants of long verification time, high completion and positive feedback rates; they usually understand risk control better.

Adhering to these rules greatly reduces the risk of bank account issues during cryptocurrency sales.

Now, you have mastered the most efficient cash-out process:

- Inventory assets

- Cross-chain aggregation

- Swap to stablecoins

- C2C sale

Remember, safety is the cornerstone of all operations. At every step, carefully verify addresses and authorizations to avoid losses from momentary negligence.

We encourage you to first try with small amounts. Once familiar with the entire process, handle larger cryptocurrency transactions to ensure everything is foolproof.

FAQ

If I have only a few dollars of assets on a certain chain, is it worth cross-chaining?

It depends on Gas fees. If your asset value is less than the estimated cross-chain and swap fees, the operation may not be cost-effective.

You can temporarily hold these small assets, wait for lower network fees, or treat them as the cost of network interaction.

If cross-chain trading fails, will my money be lost?

Your funds are usually safe. In most cases, failed transactions automatically refund to your original chain wallet.

- First confirm the transaction status on the block explorer.

- If not refunded after a long time, immediately contact the official support of the cross-chain bridge and provide the transaction hash.

What kind of bank account should I use for C2C receipts?

You should use a dedicated bank card separate from your main funds account. For example, some users choose licensed bank accounts opened in financial centers like Hong Kong, as they have more mature frameworks for handling funds from different sources.

Do I need to pay taxes on income from C2C cash-out?

Tax rules are very complex and vary by your jurisdiction. Converting digital assets to fiat is usually a taxable event. We strongly recommend consulting a professional tax advisor to ensure legal compliance.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.