- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

MoneyGram USD Exchange Rate Analysis: How to Get a Better Transfer Experience with Remitly

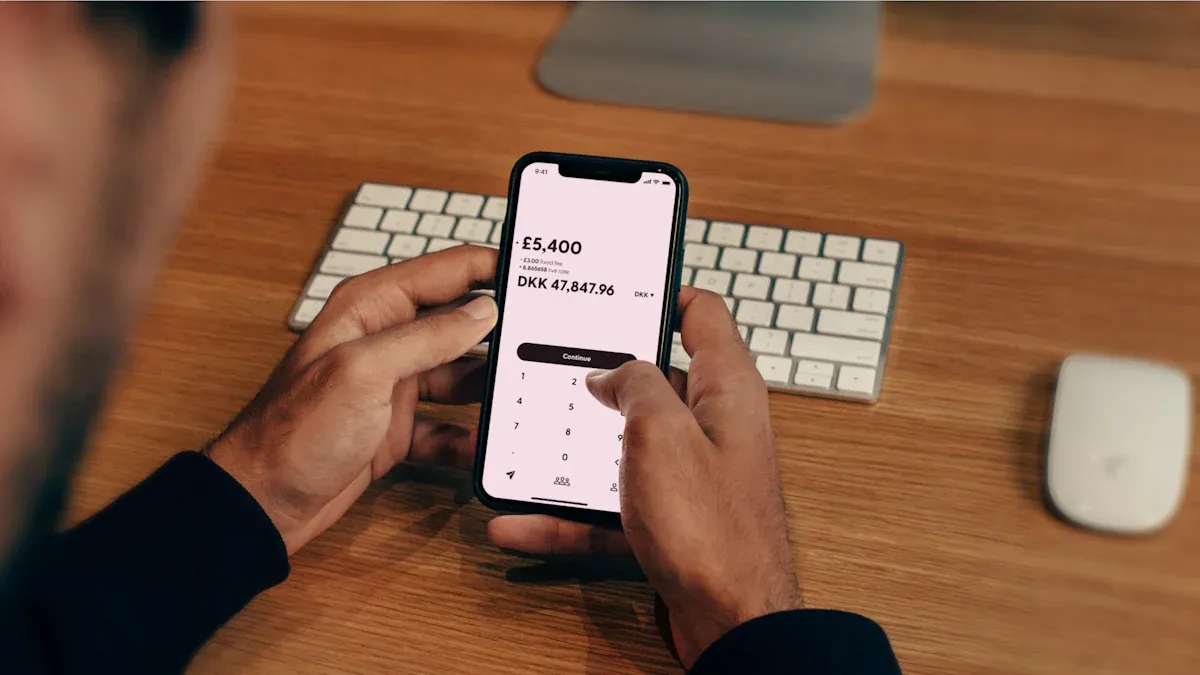

Image Source: unsplash

MoneyGram USD exchange rates frequently fluctuate. Many users focus on how to get better exchange rates when transferring money to China/Mainland China. Remitly typically offers more competitive exchange rates. Users also compare fees and delivery speed. > Choosing the right platform helps save costs and improve the experience. Monitoring real-time exchange rate changes is crucial.

Key Takeaways

- Monitoring real-time changes in MoneyGram USD exchange rates and choosing periods with higher rates can increase the received amount.

- Remitly generally offers lower fees and faster delivery, suitable for frequent remitters.

- When choosing a remittance platform, compare exchange rates and fee structures to select the most cost-effective option.

- Providing accurate recipient information can effectively avoid transfer delays and enhance transaction security.

- Utilize Remitly’s first-time transfer discounts and referral rewards to reduce costs and increase received amounts.

MoneyGram USD Exchange Rate Comparison

Image Source: unsplash

Exchange Rate Fluctuations

MoneyGram USD exchange rates change daily. The platform adjusts rates based on market conditions and the target currency. Users transferring to China/Mainland China often find rates differ from the previous day.

Key factors affecting MoneyGram USD exchange rates include:

- Target currency

- Market volatility

- Economic environment

MoneyGram’s exchange rates are primarily influenced by the two currencies involved in the transaction. Each currency may have multiple rates, and these rates constantly change. The platform adjusts rates based on the currency being transferred, leading to increases or decreases in rates.

Global economic conditions also impact MoneyGram USD exchange rates. For example, inflation, interest rate changes, and geopolitical instability can cause rate fluctuations. The strength of the USD, trade balances, and foreign investment also affect Remitly’s exchange rates.

Unstable economic periods may lead to exchange rate fluctuations. For instance, when transferring during uncertain times, rates may be lower than normal due to economic volatility.

During economic downturns, exchange rates are typically less favorable, reducing the overall value of remittances. When the economy is stable or growing, platforms may offer better rates. When demand for a currency is high, its value rises, allowing users to get better exchange rates.

Users should monitor real-time changes in MoneyGram USD exchange rates before transferring. Choosing periods with higher rates helps increase the received amount.

Real-Time Data Analysis

When choosing a remittance platform, users often compare MoneyGram USD exchange rates with Remitly’s real-time data. The table below shows the latest exchange rates and fees for both platforms:

| Provider | Exchange Rate | Transfer Fee | Amount Received |

|---|---|---|---|

| MoneyGram | 57.1613 | 1.99 USD | 57,047.50 PHP |

| Remitly | 55.4649 | 0.00 USD | 55,464.94 PHP |

As shown in the table, MoneyGram’s USD exchange rate is slightly higher than Remitly’s, but Remitly waives fees for the first transfer. The actual amount received is affected by both exchange rates and fees.

Compared to licensed banks in Hong Kong, MoneyGram and Remitly have lower exchange rate markups. Banks typically add about a 5% profit margin to exchange rates, reducing the amount received. Platforms like Wise and OFX use mid-market rates with transparent fees, which may be more advantageous in some cases. Remitly offers free first transfers, with subsequent fees ranging from 1.99–4.99 USD, making it suitable for frequent remitters.

Global economic changes also affect MoneyGram USD exchange rates and Remitly’s rates. Oil price changes, economic sanctions, or interest rate adjustments can lead to rate fluctuations. When economic conditions improve, exchange rates may rise, allowing users to receive higher amounts.

Users should regularly check the platforms’ published real-time rates and choose the transfer timing based on their needs. Selecting the right platform and timing can improve remittance efficiency and the amount received.

Fees and Delivery Speed

Fee Comparison

Users often focus on fee structures when choosing a remittance platform. MoneyGram and Remitly have distinct fee structures. The table below shows the main fee ranges for both platforms:

| Service Provider | Fee Range | Notes |

|---|---|---|

| MoneyGram | $1.99-$6.99 | Depends on transfer corridor and method |

| Remitly | $1.99-$4.99 (fixed fee) 0.49%-3.99% (percentage fee) | Depends on transfer corridor |

MoneyGram’s fees typically vary based on the transfer amount and recipient country. Remitly offers both fixed and percentage-based fee options, allowing users to choose based on their needs.

Beyond visible fees, users should be aware of hidden costs. MoneyGram USD exchange rates sometimes differ from market rates, leading to potential additional costs during currency conversion.

- MoneyGram’s exchange rates may differ from market rates, affecting the amount received.

- Other fees may arise due to payment methods or local regulations, further impacting the total amount.

- During periods of exchange rate volatility, transaction fees may increase, especially when rates fluctuate significantly.

Licensed banks in Hong Kong typically charge higher fees and add markups to exchange rates. In contrast, Remitly and MoneyGram have lower rate markups and more transparent fees. When transferring to China/Mainland China, users should compare each platform’s fee structure in advance to select the most cost-effective option.

Delivery Time

Delivery speed is another key factor for users. MoneyGram and Remitly perform differently in terms of delivery time.

When MoneyGram USD exchange rates fluctuate, delivery speed may be affected. In most cases, MoneyGram completes transfers within a few hours to one day. However, in special cases, transactions may be delayed. Main reasons include:

- Security concerns, especially for large transfers.

- The legitimacy of the transfer purpose affects processing speed.

Remitly typically completes transfers within minutes to a few hours, suitable for users needing fast delivery. Some users report delays with Remitly in the following cases:

- Inconsistent recipient name or address, requiring identity verification documents.

- Issues with the sender’s account or payment method, requiring additional documents.

- Security concerns, especially for large transfers to high-fraud or high-money-laundering-risk countries, where platforms require extra verification.

- Special transfer purposes, such as supporting charities or large purchases, where platforms conduct additional checks.

To avoid delays, users should provide accurate and detailed transfer purpose information.

Tip: Users should review MoneyGram USD exchange rates and delivery times in advance and choose based on their needs. Remitly excels in fees and delivery speed, making it suitable for frequent remitters and those with high delivery time requirements.

Security and User Experience

Security Measures

Both MoneyGram and Remitly prioritize remittance security. Both platforms employ multiple technical and managerial measures to protect user funds and personal information.

MoneyGram implements advanced encryption and monitoring systems to ensure the security of every USD remittance transaction. They require recipients to provide valid identification to prevent funds from going to illegitimate accounts. Each transaction has a cap, typically not exceeding $10,000, effectively reducing fraud and money laundering risks. MoneyGram does not allow credit card transactions; all operations must be completed with cash, checks, or debit cards, reducing the risk of identity theft.

Remitly also uses high-standard data encryption to protect user information from leaks. They comply with international anti-money laundering and anti-fraud regulations, regularly reviewing transaction processes. The platform manually reviews suspicious transactions to ensure funds safely reach recipient accounts in China/Mainland China.

Both platforms provide compliance resources for agents and partners to help them adhere to relevant regulations. Users should prioritize these security measures when choosing a remittance service to minimize financial risks.

Tip: Users should verify recipient information before transferring to ensure accuracy and validity, enhancing remittance security.

User Feedback

User experience is a key metric for evaluating remittance platforms. Remitly and MoneyGram show clear differences in performance on mainstream review platforms. The table below shows their ratings on Trustpilot:

| Service Provider | Platform | Average Rating | Positive Review Rate | Negative Review Rate |

|---|---|---|---|---|

| Remitly | Trustpilot | 4.6/5 | 86% | 6% |

| MoneyGram | Trustpilot | 1.2/5 | N/A | 92% |

| MoneyGram UK | Trustpilot | 1.5/5 | N/A | 90% |

Remitly receives high user satisfaction. Users generally find its remittance process simple, with fast delivery and responsive customer service. The platform supports multiple remittance methods, catering to different user needs.

As a traditional remittance provider, MoneyGram has extensive offline locations and diverse remittance channels. Some users appreciate its face-to-face service and global coverage. However, in terms of customer service and online experience, users report dissatisfaction, mainly regarding delivery delays and slow customer service responses.

Overall, Remitly excels in service diversity and user experience, making it suitable for users needing efficient and convenient transfers to China/Mainland China. MoneyGram is better suited for users preferring traditional offline services or needing large cash transactions.

Remitly Remittance Guide

Image Source: unsplash

Registration Process

Users need to complete account registration before using Remitly for USD remittances. The process is simple and suitable for beginners.

- Users must create an account via the Remitly website or app using an email address.

- Select the currency, amount, and delivery speed.

- Choose a bank account as the receiving method based on the recipient’s region.

- Enter the recipient’s name and relevant information.

- Provide payment information and confirm the transfer.

During registration and remittance, the platform may require users to upload identification documents. Common document types are listed here:

| Document Type | Description |

|---|---|

| Valid Photo ID | Includes driver’s license, passport, visa, or other government-issued ID. |

| Proof of Address | May require utility bills or bank statements to enhance security. |

Remitly may require additional identity verification based on the transfer amount and destination. Users should prepare relevant documents in advance to ensure smooth registration and remittance.

Remittance Steps

Remitly’s remittance process is clear, with users following prompts to complete operations.

- First, log into the account and select “China/Mainland China” as the recipient country.

- Choose USD as the sending currency and enter the transfer amount.

- Enter the recipient’s name and bank account details, verifying all information.

- Select a payment method, such as debit card, credit card, or bank transfer.

- Confirm all details are correct and submit the transfer request.

During operation, users may encounter the following common issues:

- Transaction not completed after funds are sent, requiring troubleshooting.

- Platform requests additional identity verification, with slow review progress.

- Transaction disappears during processing, with no specific error message.

- Verification page inaccessible, requiring a new link.

To avoid delays, users should promptly submit all required documents and regularly check transaction history. If verification or transaction issues arise, contact Remitly customer support to confirm status.

Discounts and Tips

Remitly offers various discounts for new and referred users. The table below lists some common promotions:

| Discount Description | Code | Conditions | Validity Period |

|---|---|---|---|

| $10 off first transfer to Mexico | 10-OFF-MX-AFF | New customers, one-time use | Feb 8, 2022 - Mar 4, 2022 |

| $20 off first transfer | N/A | New customers, one-time use | N/A |

Users can also earn rewards by referring friends:

- Refer a friend to register and complete their first transaction, and both parties receive a $20 reward.

- First-time remitters can enjoy up to $20 off their transfer.

Tip: Users should check Remitly’s website or app for the latest promotions before transferring. Utilize first-time transfer and referral rewards to reduce costs. Transfer during high-rate periods and combine with platform discounts to increase the received amount.

Remitly excels in exchange rates, fees, and delivery speed. When transferring to China/Mainland China, users benefit from a more transparent fee structure and faster delivery experience.

- Exchange rates are updated in real-time, allowing users to monitor platform data.

- Fees are lower than licensed Hong Kong banks, suitable for frequent remitters.

- Fast delivery meets urgent funding needs.

Users should regularly compare platform rates and policies based on their needs to choose the most suitable remittance method.

FAQ

Which platform offers better exchange rates, Remitly or MoneyGram?

Remitly generally offers more competitive USD exchange rates. Users can compare real-time rates and fees to choose the best option. The actual amount received is affected by both exchange rates and fees.

How fast can transfers to China/Mainland China arrive?

Remitly can deliver in as little as a few minutes. MoneyGram typically takes a few hours to one day. Delivery speed depends on the transfer amount, recipient bank, and review process.

What identity verification documents are needed for transfers?

Users must provide valid identification, such as a passport or driver’s license. In some cases, platforms may require proof of address, such as bank statements or utility bills.

How are transfer fees calculated?

Remitly and MoneyGram fees vary based on transfer amount, recipient country, and payment method. Remitly offers some fee-free transfers, while MoneyGram fees range from $1.99-$6.99.

Is transferring to China/Mainland China safe?

Both Remitly and MoneyGram use encryption and compliance measures. Platforms review transactions to ensure fund safety. Users should verify recipient information to avoid financial risks.

While MoneyGram’s USD exchange rates offer some appeal, their volatility and markups frequently result in hidden costs and reduced recipient amounts, compounded by fees ranging from $1.99 to $6.99. For a more predictable and economical remittance journey, turn to BiyaPay. With transfer fees dipping to just 0.5%, BiyaPay leverages real-time rates to sidestep common exchange pitfalls, delivering superior value on every transaction.

BiyaPay enables effortless swaps between various fiat currencies and digital assets, spanning most countries and regions globally, with registration in moments and same-day delivery options. Additionally, without the need for an overseas account, you can dive into stocks trading on US and Hong Kong exchanges, enjoying zero fees for contract placements. Sign up with BiyaPay today and harness the real-time exchange rate checker to capture optimal moments, transforming your global financial operations into a seamless, secure process.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.