- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Wise Remittance Amount and Fee Cap Guide: Latest Insights and Optimization Tips

Image Source: pexels

Wise provides clear standards for remittance amounts and fees. You can send up to the equivalent of $10 million in a single transfer, with fees as low as 0.43%. If your single remittance does not exceed approximately $2,500, the system automatically waives the fee.

| Item | Value |

|---|---|

| Remittance Limit | $10 million |

| Fee | As low as 0.43% |

| Free Remittance Condition | ≤$2,500 |

| You can flexibly choose remittance methods based on different amounts, effectively saving on remittance amounts and fees, and improving fund transfer efficiency. |

Key Points

- Wise allows a single remittance up to $10 million, ensuring flexibility for large fund transfers.

- When a single remittance does not exceed $2,500, Wise waives the fee, helping users save costs.

- Fees are calculated as a percentage, with higher amounts incurring higher fees, though some currencies enjoy reduced fees for large remittances.

- Wise provides transparent fee details, allowing users to check all fees in real time, avoiding the hassle of hidden fees.

- By reasonably splitting remittance amounts and choosing appropriate currencies, users can effectively optimize remittance costs and improve fund transfer efficiency.

Remittance Amount and Fee Rules

Image Source: pexels

Amount Limit

When using Wise for international remittances, you first need to consider the amount limit. Wise allows a single remittance up to $10,000,000 USD. This limit applies to most currencies and countries, but some regions have different regulations. For example, if you send funds from mainland China, the system will automatically adjust the limit based on local regulations. When transferring large amounts in the U.S. market, you typically face no restrictions, but it’s recommended to check the specific limit for the target currency and country on the Wise website in advance.

Tip: If you plan multiple large remittances, you can pre-plan each amount to avoid operation failures due to exceeding the limit.

Minimum Amount

Wise also has a minimum amount requirement for single remittances. The minimum remittance amount for most currencies is $1 USD. Some special currencies or routes may have higher minimums. For example, recipient banks in certain emerging market countries may require a minimum of $10 USD. Before proceeding, you can enter the amount on the Wise platform, and the system will automatically indicate whether it meets the minimum requirement, avoiding failed remittances due to amounts being too small.

Fee Calculation Method

Wise charges fees based on a percentage system. Each time you send a remittance, the system automatically calculates the fee based on the remittance amount. Generally, the higher the amount, the higher the total fee, but some currencies offer reduced fees for large remittances. For example, after June 18, 2025, the fee for USD to VND (Vietnamese Dong) was reduced. You can check the specific fees for each remittance in real time on the Wise website, where the system clearly displays all details without hidden fees.

| Remittance Amount (USD) | Fee Rate | Notes |

|---|---|---|

| ≤2,500 | 0% | Fee-free |

| 2,501-100,000 | 0.43% | Standard rate |

| >100,000 | 0.40% | Reduced for some currencies |

During actual operations, you can optimize the remittance amount and fee structure by splitting amounts, choosing currencies or routes with lower fees, thereby saving costs and improving fund transfer efficiency.

Fee Caps and Transparency

Fee Cap Rules

When using Wise for international remittances, one of your main concerns is whether there’s a fee cap. Wise sets fee caps for certain currencies and remittance routes. For example, when sending USD from the U.S. market, the system automatically calculates the fee, but once the amount reaches a certain threshold, the fee stops increasing. This allows you to confidently transfer large amounts without worrying about fees rising indefinitely.

For currencies like USD and EUR, Wise sets a maximum fee standard based on the remittance amount and fee ratio. For instance, if you send $500,000 USD, the system calculates the fee based on the standard rate, but if the cap is reached, the fee will not increase further. You can check the specific cap rules for each currency on the Wise website. Note that some emerging market currencies or special routes may not have a fee cap, and fees are dynamically calculated based on the actual amount.

Reminder: When sending large remittances from licensed banks in mainland China or Hong Kong, it’s advisable to check the fee cap policy for the target currency in advance and plan the remittance amount to avoid unnecessary costs.

| Currency | Fee Cap (USD) | Applicable Routes | Notes |

|---|---|---|---|

| USD | 1,500 | U.S. → Global | Standard routes, capped |

| EUR | 1,200 | Europe → Global | Some routes capped |

| VND | None | U.S. → Vietnam | No cap, dynamic calculation |

You can flexibly choose remittance currencies and routes based on your needs, making full use of the fee cap policy to optimize the remittance amount and fee structure.

Fee Transparency

Wise maintains a policy of full fee transparency. Before each remittance, the system automatically displays all fee details, including the fee, exchange rate, and expected receipt amount. You don’t need to worry about hidden fees or additional charges. Both the Wise website and app support real-time fee inquiries, allowing you to stay updated on the latest fee policies and remittance amount standards.

When operating, simply enter the remittance amount and recipient currency, and the system will instantly calculate all fees. Wise does not charge any hidden fees, and all fee items are clearly listed. You can intuitively understand the cost of each fund transfer through the fee breakdown.

- Fees are available for real-time checking

- No hidden fees

- Exchange rates and fees are fully transparent

Tip: Before sending a remittance, you can simulate different amounts and currencies multiple times, compare fees and exchange rates, and choose the optimal plan to ensure fund safety and cost control.

When using Wise in the U.S. market or mainland China, you can always enjoy a transparent fee policy, allowing better management of fund transfers and improved remittance efficiency.

Fee Dynamics and Currency Differences

Fee Adjustments

When using Wise for international remittances, you need to stay aware of dynamic fee changes. Wise periodically adjusts fees for various currencies based on market conditions and operational costs. On June 18, 2025, Wise reduced fees for some currencies. For example, when sending USD to VND (Vietnamese Dong) from the U.S. market, the fee rate was lowered, allowing you to save more on large remittances.

Wise announces the latest fee adjustments on its website and app in advance. You can check the latest fee standards for each currency at any time. After entering the remittance amount, the system automatically displays the applicable rate, so you don’t need to worry about additional costs due to policy changes. It’s recommended to check the latest fee announcements before each remittance to plan fund transfers reasonably.

Tip: If you plan large remittances, pay attention to currencies and routes with reduced fees and choose the optimal timing for operations.

Currency Differences

Remittance fees and amount limits vary significantly across currencies and countries. When choosing a remittance currency, you need to understand the specific rules for each currency. The table below shows fees and amount limits for common currencies:

| Currency | Single Transaction Limit (USD) | Standard Fee Rate | Notes |

|---|---|---|---|

| USD | 10,000,000 | 0.43% | Commonly used in the U.S. market |

| EUR | 8,000,000 | 0.45% | Applicable to European routes |

| VND | 5,000,000 | 0.40% | USD to VND fee reduced |

When sending USD from the U.S. market, the amount limit is high, and fees are relatively favorable. If you choose other currencies like EUR or VND, the system automatically adjusts the limit and rate based on the currency and route. Some emerging market currencies may not have a fee cap, and fees increase with the amount.

When receiving funds at licensed banks in Hong Kong, the system adjusts the amount limit and fees based on Hong Kong and the target country’s regulatory requirements. You can check the detailed rules for each remittance in real time on the Wise platform to ensure fund safety and compliance.

Suggestion: In practice, compare fees for different currencies and routes to choose the most suitable remittance plan.

Optimizing Remittance Amounts and Fees

Optimization Tips

When using Wise for remittances, you can employ simple methods to effectively reduce costs. First, you can reasonably split large remittances. For example, if a single remittance exceeds the fee cap threshold, you can divide the amount into multiple transfers to leverage the fee cap policy and reduce total costs. You can also monitor exchange rate fluctuations and choose times with favorable rates to increase the received amount.

If you need to send funds to licensed bank accounts in Hong Kong, it’s advisable to check the fee cap standards for the target currency in advance. You can simulate different amounts on the Wise platform, compare fees and received amounts, and select the optimal plan.

Additionally, you can use Wise’s real-time fee calculation tool to plan each remittance amount and fee in advance, avoiding cost increases due to improper amount settings.

Tip: When transferring large amounts in the U.S. market, avoid peak times and choose weekday mornings for faster processing and lower fees.

Notes

Before sending a remittance, be sure to check Wise’s latest policies and fee announcements. Fee standards and amount limits may adjust based on market changes, and some currency policies may update at any time. Regularly check the Wise website or app to stay informed about the latest remittance amount and fee rules.

Also, note that some special currencies or routes may not have a fee cap, and fees will increase with the amount. When operating, verify all fee details to avoid additional expenses due to overlooked details.

If sending funds from mainland China, understand local regulatory requirements in advance to ensure compliance and safety.

Operation Process and FAQs

Image Source: unsplash

Remittance Process

When using the Wise platform for international remittances, the process is straightforward. You simply register an account, select the remittance amount and currency, enter recipient information, confirm fee details, and complete the payment. Wise automatically calculates fees and exchange rates based on your chosen currency and route, with all fees clearly displayed. You can operate anytime via the Wise website or app without complex procedures.

Wise’s remittance speed stands out among mainstream platforms. According to official data, over half of remittances can arrive within 20 seconds. Most major currency transfers take a few hours to one business day. When sending USD from the U.S. market to a licensed bank account in Hong Kong, funds typically arrive on the same day. The table below compares Wise’s transfer speed with other mainstream remittance services:

| Remittance Service Provider | Transfer Speed |

|---|---|

| Wise | A few hours to 1 business day (major currencies) |

| OFX | 1-2 days (major currencies) |

| Western Union | Same day to 5 business days (depending on currency) |

| Currency Fair | Same day to 2 business days (major currencies) |

| TorFX | Same day to 2 business days (major currencies) |

You can see that Wise has a clear advantage in speed and convenience, making it ideal for fund transfer needs requiring quick arrival.

Frequently Asked Questions

When using Wise for remittances, you may encounter common questions. Below are official answers to help resolve your doubts quickly:

- Are there limits on remittance amounts?

Wise sets a limit on single remittances, typically $10,000,000 USD. Some currencies or routes may have different regulations, so it’s recommended to check in advance. - How are fees calculated?

Wise uses a percentage-based system, with fee caps for some currencies. You can view all fee details in real time before sending. - How long does it take for a remittance to arrive?

Most major currencies arrive within a few hours, while some routes may take one business day. The system displays the estimated arrival time during operation. - Are there hidden fees?

All Wise fees are transparent, with no hidden charges. You can check details in real time on the website or app.

Reminder: Before sending, simulate different amounts and currencies multiple times, compare fees and arrival times, and choose the optimal plan to ensure fund safety and cost control.

If you have other questions, you can visit the Wise Help Center for the latest official answers.

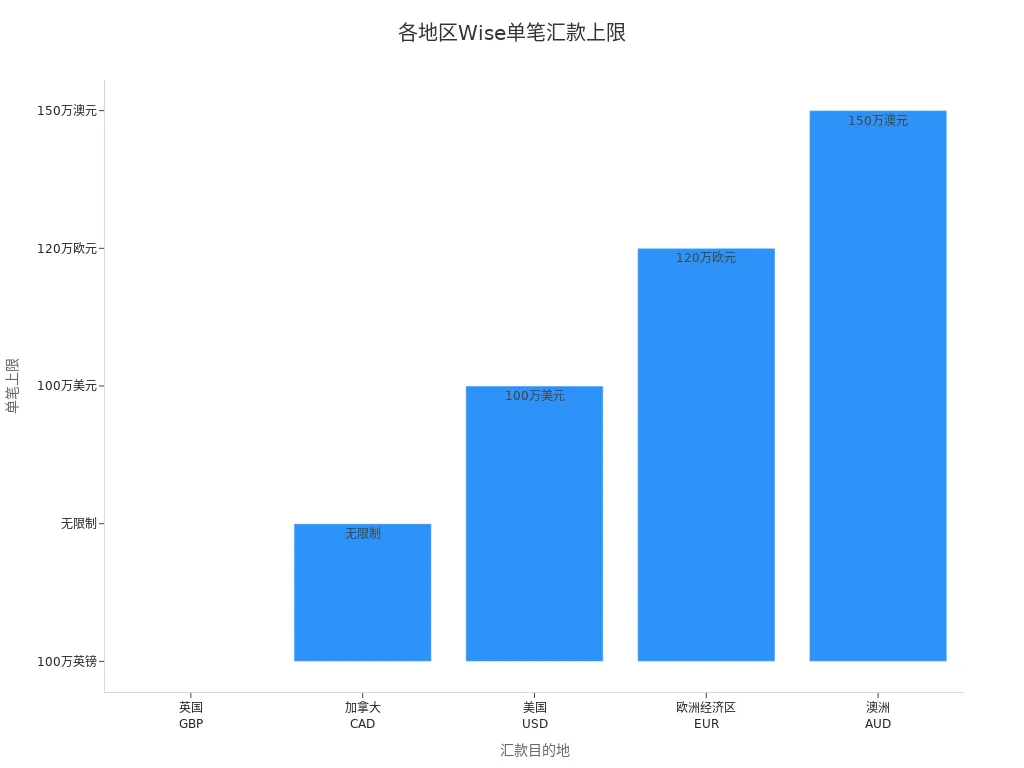

When using Wise for remittances, you can flexibly choose amounts and enjoy a transparent fee cap policy. The table below shows single remittance limits for different regions, all in USD:

| Remittance Destination | Maximum Single Transaction Limit (USD) |

|---|---|

| UK | Approx. 1,270,000 |

| Canada | No limit |

| U.S. | 1,000,000 |

| European Economic Area | 1,300,000 |

| Australia | 1,000,000 |

You can reasonably split amounts based on your needs and leverage fee discounts to maximize cost savings. It’s recommended to regularly check Wise’s official policies to ensure each remittance is compliant and arrives safely.

FAQ

Are there limits on remittance amounts?

When sending via the Wise platform, the single remittance limit is typically $10,000,000 USD. Some currencies or routes have different regulations, which you can check on the Wise website.

How are fees calculated?

Each time you send a remittance, Wise automatically calculates the fee based on the amount. Most currencies use a percentage system, with fee caps for some currencies. You can view fee details in real time.

How long does it take for a remittance to arrive?

After completing a remittance, most major currencies arrive within a few hours. Some routes may take one business day. The system displays the estimated arrival time.

Are there hidden fees?

When sending via the Wise platform, all fees are transparent. The system lists all fee items, so you don’t need to worry about hidden or additional charges.

Can I send remittances to licensed banks in Hong Kong?

You can send remittances to licensed bank accounts in Hong Kong via Wise. The system automatically calculates fees and exchange rates. You can check amount limits and fee standards in advance.

You have gained a full understanding of the latest Wise remittance limits and fee caps, clearly grasping the $10 million single-transfer ceiling, the percentage-based fee structure, and the fee cap policies for certain currencies. While utilizing Wise for international fund transfers, you certainly want to maximize its advantage of transparent, low rates, avoiding unnecessary costs due to improper amount setting or a lack of awareness of rate dynamics.

However, for users with global asset allocation needs, who require flexibility between fiat and digital assets, or who seek more advanced financial services, Wise’s service scope may not fully satisfy their requirements. You may need a more comprehensive FinTech platform that integrates cross-border remittance, asset management, and investment.

BiyaPay is your ideal platform for achieving these higher-level financial needs. We not only provide real-time exchange rate inquiry and conversion services for fiat currencies, with remittance fees as low as 0.5% and zero commission on contract limit orders—offering low-cost cross-border transfers similar to Wise—but also support same-day fund arrival. Crucially, you can manage global asset allocation, including US and Hong Kong stocks, without needing a complex overseas account, and benefit from the seamless conversion between fiat and digital currencies like USDT. Register quickly with BiyaPay now, and use one single account to address all your remittance, investment, and global asset management needs!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.