- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How does an ACH debit transaction work

Image Source: unsplash

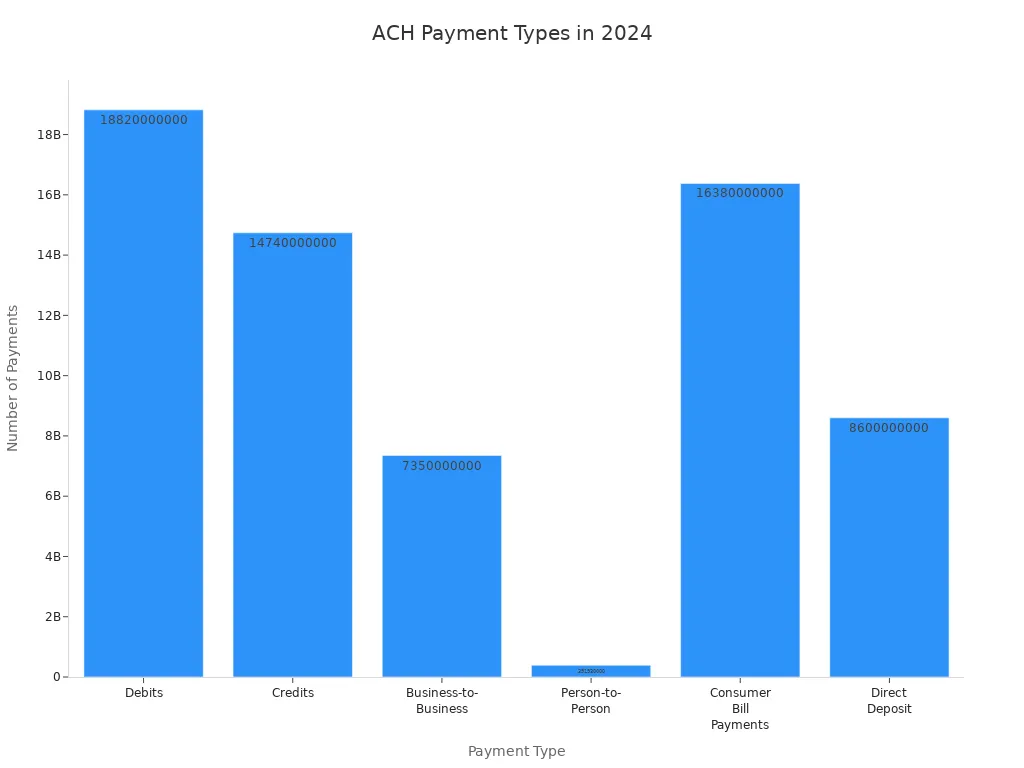

An ACH debit transaction lets you move money by pulling funds from your bank account after you approve the debit. The process starts with your authorization, then moves through processing and ends with settlement. You, as the payer, give permission for the payment. The payee, banks, and the automated clearing house (ACH) network handle the rest. ACH debit payments use your account and routing numbers to complete the transaction. In 2024, ACH payments reached 33.56 billion, with 18.82 billion debits, showing how important ACH debit is for moving money in the United States.

Key Takeaways

- You must give clear permission before a business can pull money from your bank account using ACH debit.

- ACH debit payments usually take 2 to 3 business days to complete, so plan payments early to avoid delays or fees.

- ACH debit offers a low-cost, secure way to pay bills, subscriptions, and make one-time or recurring payments.

- Banks and the ACH network use strong security tools like alerts and blocks to protect your money from fraud.

- Always check your account regularly and act quickly if you see unauthorized or unexpected payments.

ACH Debit Process

Image Source: pexels

Authorization

You start an ach debit by giving permission for a business or organization to pull money from your bank account. This step is called authorization. You may sign a form, check a box online, or give verbal approval over the phone. The business, called the originator, must get your clear consent before taking any money.

Note:

Federal law protects you during this step. The authorization must tell you how to stop or cancel the ach debit. You should know the amount and timing of each withdrawal before you agree. If you want to stop an ach debit, you can contact the business or your bank. If you have problems with unauthorized debits, you can reach out to state regulators or the Consumer Financial Protection Bureau (CFPB).

Here are some key points about authorization:

- You must give permission for each ach debit transaction.

- You can revoke your authorization at any time.

- The business must explain how to stop or cancel the payment.

- You should always understand when and how much money will be withdrawn.

Initiation

After you authorize the ach debit, the business collects your account and routing numbers. These numbers identify your bank and your specific account. The business, or originator, sends a request to its bank to start the ach debit transaction. This bank is called the Originating Depository Financial Institution (ODFI).

The ODFI checks the business’s information and makes sure it follows the rules. The ODFI may ask for:

- The business’s name, taxpayer identification number, and location.

- Proof that you gave authorization for the ach debit.

- Details about the payment, such as the amount and date.

The ODFI sets limits and may require extra steps to manage risk. For example, it may ask for pre-funding or collateral if the business is new or the payment is large. The ODFI also checks if the business has a good record with ach transactions.

Tip:

Always double-check the account and routing numbers you provide. Incorrect numbers can delay your ach debit payment or cause it to fail.

ACH Network

The ach network is the system that moves your money from your account to the business. This network is also called the automated clearing house. It connects thousands of banks and credit unions in the United States. The ach network handles millions of ach debit payments every day.

Here is how the ach network works:

- The ODFI sends the ach debit request to the ach network.

- The ach network sorts and batches the requests.

- The ach network sends the request to your bank, called the Receiving Depository Financial Institution (RDFI).

The RDFI receives the ach debit request and checks your account. If you have enough money, the RDFI approves the payment. If there is a problem, such as not enough funds or a closed account, the RDFI can return the ach debit within 48 hours.

Here is a table showing the roles of the ODFI and RDFI:

| Role | Description |

|---|---|

| ODFI (Originating Depository Financial Institution) | Sends the ach debit request to the ach network. Checks the business’s information and follows regulatory rules. |

| RDFI (Receiving Depository Financial Institution) | Receives the ach debit request from the ach network. Withdraws money from your account and sends it to the business. Can return the ach debit if there is a problem. |

Note:

If both you and the business use the same bank, the ach debit may not go through the ach network. The bank handles the transfer internally.

Settlement

Settlement is the final step in the ach debit process. This is when the money actually moves from your account to the business’s account. The ach network and the banks work together to settle the payment.

Here is a typical timeline for an ach debit transaction:

- Day 0: You request the ach debit payment. Your bank holds the request until the next processing window.

- Day 1: The ODFI batches and sends the ach debit to the ach network. The ach network sorts and forwards it to the RDFI.

- Day 1-2: The banks settle the payment between themselves.

- Day 1-3: The RDFI posts the payment, and the business receives the money.

Several factors can delay settlement:

- If you start the ach debit outside banking hours, it may wait until the next business day.

- Weekends and holidays can slow down the process.

- The RDFI has up to 48 hours to return the ach debit if there is a problem.

- Verification steps, such as checking account details, can add time.

Most ach debit payments take 2-3 business days to complete. Some banks offer same-day ach for faster processing, but this may cost more. If you need to make a time-sensitive payment, start the ach debit 1-2 days before the due date.

Tip:

Always plan ahead when using ach debit payments. Check your account balance and start the payment early to avoid late fees.

ACH Debit Payments Use Cases

Image Source: unsplash

ACH debit payments give you a flexible way to move money for many needs. You can use an ach debit for both one-time and recurring payments. Many people and businesses choose ach debit payments because they are simple, secure, and cost-effective.

One-Time Payments

You might use an ach debit for a single payment when you pay a bill or make a purchase. For example, you can pay your utility bill, a government fee, or even taxes with an ach debit payment. Many businesses accept ach payments for high-value purchases because the transaction fees are lower than credit or debit cards. If you run a business, you can use ach debit payments to pay vendors or freelancers. This method works well for business-to-business (B2B) payments, which are growing in popularity as companies look for faster and more reliable ways to send money.

- Common one-time ach debit payment examples:

- Paying a tax bill to the IRS

- Making a loan repayment

- Sending money to a friend or freelancer

- Paying for a large purchase at a retail or service business

Note:

Always check your account balance before you approve a one-time ach debit. This helps you avoid failed payments or extra fees.

Recurring Payments

Recurring ach debit payments help you automate regular bills. You can set up ach autopay for subscriptions, insurance premiums, or loan repayments. Many people use automatic debits for bills like utilities, gym memberships, or streaming services. When you choose recurring ach debit, the business pulls the money from your account on a set schedule. This saves you time and helps you avoid late fees.

- Popular recurring ach debit payment uses:

- Monthly subscription services

- Insurance premium payments

- Utility bills and loan repayments

- Scheduled B2B payments between companies

The main difference between one-time and recurring ach debit payments is automation. One-time payments require your approval each time. Recurring payments only need your authorization once, and then the business handles the rest. ACH debit payments offer flexibility, security, and convenience for both types of transactions.

ACH Payments vs. Other Methods

ACH Debit vs. Debit Card

When you use an ach debit, you allow a business to pull money from your bank account using your account and routing numbers. With a debit card, you pay by entering your card number and PIN or using a chip. Both methods move money from your account, but the process and timing differ.

- ACH debit payments often take 1 to 3 business days to complete. The business sends a request through the ach network, and your bank checks your balance before sending the money.

- Debit card payments usually process faster. The money leaves your account almost right away, and you get instant confirmation.

Fees for ach debit are usually lower than debit card fees. Many businesses prefer ach debit for large or recurring payments because it costs less. Debit cards work well for quick, everyday purchases.

Tip:

Use ach debit for bills or subscriptions. Use your debit card for shopping or when you need instant payment.

ACH Transaction vs. eCheck

You might see both ach transactions and eChecks as ways to pay without paper checks. They both use the ach network, but they work a bit differently. Here is a table to help you compare:

| Aspect | ACH Transaction | eCheck |

|---|---|---|

| Definition | Electronic funds transfer via ach network | Digital version of a paper check |

| Typical Use Cases | Recurring payments (utilities, payroll) | One-time payments |

| Authorization | Written, verbal, or electronic; stored for recurring | Customer authorizes each payment; info not stored |

| Processing Method | Uses enrollment forms; can update amounts automatically | Needs eCheck software; processes one-time transfers |

| Payment Timing | 3 to 7 business days | 3 to 5 business days |

| Fees | Varies; generally higher | Usually lower processing fees |

| Security Features | Standard ach security | Digital signatures, encryption |

Both ach debit and eCheck payments cost much less than paper checks. On average, businesses pay about $0.40 per transaction for ach payments, while paper checks can cost over $2.00 each.

ACH vs. Direct Deposit

You may wonder how ach debit compares to direct deposit. The main difference is the direction of the money. With ach debit, the business pulls money from your account after you give permission. With direct deposit, someone pushes money into your account, like when you get paid by your employer.

| Aspect | ACH Debit (Pull Payment) | Direct Deposit (Push Payment) |

|---|---|---|

| Transaction Direction | Money pulled from your account by payee | Money pushed into your account by payer |

| Initiator | Payee (after your authorization) | Payer (like employer or government) |

| Common Use Cases | Bill payments, subscriptions, loan payments | Payroll, tax refunds, government benefits |

| Payment Type | Pull payment | Push payment |

| Processing Time | 1 to 3 business days | 1 to 3 business days |

Both ach debit and direct deposit use the ach network. Direct deposit often posts faster because it needs less verification. You can use ach debit for paying bills, while direct deposit works best for receiving payments like your paycheck.

ACH Debit Security and Issues

Timing

When you use an ach debit, you may wonder how long it takes for the payment to clear. The time frame depends on several steps in the process. Most ach debit payments settle in 2 to 4 business days. Some banks offer same-day ach, but you must submit your payment before the cutoff time. If your bank or the business needs to review the transaction, the process can take up to 6 business days. Weekends and holidays do not count toward this time. The table below shows the typical timing for each stage:

| Stage | Typical Time Frame | Notes on Variability and Conditions |

|---|---|---|

| Submission to Funding | 1–2 business days | Initial processing period for standard ACH |

| Settlement (Standard ACH) | 2–4 business days | Can extend up to 6 business days due to risk or underwriting |

| Settlement (Same-Day ACH) | 1–2 business days | Requires submission before cutoff time; may extend if reviewed |

| Detailed Timeline Example | Up to 6 business days total | Includes initiation, processing, risk checks, and final settlement |

| Exclusions | Weekends and holidays excluded | Only business days count towards settlement time |

| Factors Affecting Timing | Merchant risk, transaction type, underwriting policies | These can delay settlement beyond typical time frames |

You should plan your ach debit payment early to avoid late fees or missed deadlines.

Security Features

Banks and the ach network use many tools to keep your debit transactions safe. You can find several layers of protection when you use ach debit payments:

- Multi-factor authentication adds extra security when you log in or approve a payment.

- Debit blocks and filters let you control which businesses can pull money from your account.

- ACH Positive Pay allows your bank to review and approve debits before they post.

- Transaction alerts notify you about large or unusual ach debit activity.

- Regular account monitoring helps you spot unauthorized payments quickly.

- Banks teach you and their staff about ach fraud risks and how to prevent them.

- Fraud detection tools, such as TrueACH®, help stop fraud before it causes losses.

- Strong password rules protect your online banking access.

- Secure APIs and balance monitoring help banks catch suspicious activity.

You should use these features to protect your money and keep your ach debit payments secure.

Common Issues

You may face some problems with ach debit payments. The most common issues include unauthorized debits, returned payments, and delays. Debit blocks are one of the best ways to stop unauthorized or fraudulent debits. You can set up a full block to stop all ach debits or a partial block to allow only certain businesses. These blocks are easy to manage and add a strong layer of security. If you use a block, you may need to contact your bank to approve specific payments.

Other tips for safe ach debit use:

- Check your account often for unexpected debits.

- Set up alerts for large or new payments.

- Use strong passwords and update them regularly.

- Contact your bank right away if you see a payment you did not approve.

Tip:

Always review your bank statements and act fast if you notice any problems. Quick action helps you recover your money and keeps your account safe.

You play a key role in every ACH transaction. You authorize the debit, and your bank and the business handle the rest. ACH offers many benefits:

- Lower costs and faster payments than paper checks

- Fewer errors and better control over cash flow

- Easy setup for recurring payments

You should also know the drawbacks:

- ACH works only with US accounts

- Processing can take up to three business days

- Fraud and payment returns can happen

Stay safe by checking your account often, keeping records, and following updates from NACHA.

FAQ

What information do you need to set up an ACH debit payment?

You need your bank account number and routing number. The business may also ask for your name and contact details. Always check that you give the correct numbers to avoid payment errors.

Can you cancel an ACH debit payment after you authorize it?

Yes, you can cancel an ACH debit. Contact the business or your bank as soon as possible. You should act before the payment processes. Some banks may charge a fee for stopping a payment.

Are ACH debit payments safe?

ACH debit payments use strong security tools. Banks use multi-factor authentication, debit blocks, and transaction alerts. You should check your account often and use strong passwords to keep your money safe.

How do ACH debits compare to wire transfers?

ACH debits cost less than wire transfers. Wire transfers move money faster, often within hours, but usually cost $15–$50 per transaction. ACH debits take 1–3 business days and cost less than $1 per payment.

ACH debit transactions may be a cost-effective option within the U.S., but when it comes to moving money internationally, users often face higher fees, slower settlement times, and limited reach. That’s where BiyaPay changes the game. With real-time exchange rates, seamless fiat-to-crypto conversion, and a transparent 0.5% remittance fee, BiyaPay enables you to send funds across most countries worldwide with confidence. Unlike ACH, which can take days, BiyaPay delivers same-day exchange and same-day arrival, making global payments faster and more reliable.

Streamline your payments today — register with BiyaPay and experience secure, low-cost, worldwide transfers.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.