- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

A Deep Dive into Chase Business Account Services

Image Source: unsplash

A Chase business account gives your business access to a wide range of financial tools and support. Many business owners in the United States trust Chase, with between 14.7% and 23.3% of small businesses choosing it as their primary bank. You benefit from a strong network of branches and ATMs, reliable digital banking, and quick access to funds. Business owners often select Chase because it offers helpful customer service, advanced technology, and a variety of business account options. Understanding the chase business account requirements ensures you meet all the requirements for opening your business account and managing your business finances with confidence.

Key Takeaways

- Chase offers three main business checking accounts tailored for small, medium, and large businesses, each with different fees, transaction limits, and cash deposit allowances.

- You can manage your Chase business account easily using advanced digital tools like the Chase Mobile App and online banking, which provide security and convenience.

- Avoid monthly fees by meeting minimum balance requirements, using qualifying Chase business cards, or linking accounts to higher-tier services.

- Gather the right documents and understand your business structure before opening an account; some businesses can apply online, while others must visit a branch.

- Chase provides strong customer support, payment solutions, and credit options to help your business grow, but comparing alternatives can help you find the best fit for your needs.

Chase Business Account Overview

Image Source: unsplash

Why Choose Chase

You want a bank that supports your business at every stage. Chase stands out as a top choice for business owners across the United States. Chase bank offers a wide network with about 4,700 branches and 16,000 ATMs. You can access your funds and banking services almost anywhere. Chase business account holders benefit from advanced digital tools, strong security, and a dedicated business support team. Chase bank also provides flexible account options, so you can find the right fit for your business size and needs.

Chase earned six Coalition Greenwich Awards for U.S. Small Business Banking in 2025. This recognition shows Chase’s commitment to customer satisfaction and excellence. In 2018, Chase ranked highest in customer satisfaction in the J.D. Power National Banking Study. You can trust Chase to deliver reliable service and innovative solutions for your business.

Key Benefits

Chase business accounts offer several advantages that help you manage your business finances with ease:

- Multiple account options tailored for small, medium, and large businesses.

- Integration with payment tools like QuickAccept, which lets you process payments and receive next-day funding.

- High cash deposit limits, with up to $25,000 per cycle for premium accounts.

- Flexible fee waiver options to help you save money.

- Concierge support and advanced financial management tools for premium account holders.

- Rewards programs, such as the Ink Business card series, that offer generous bonuses and flexible redemption options.

- Enhanced security features, including credit monitoring and real-time transaction alerts.

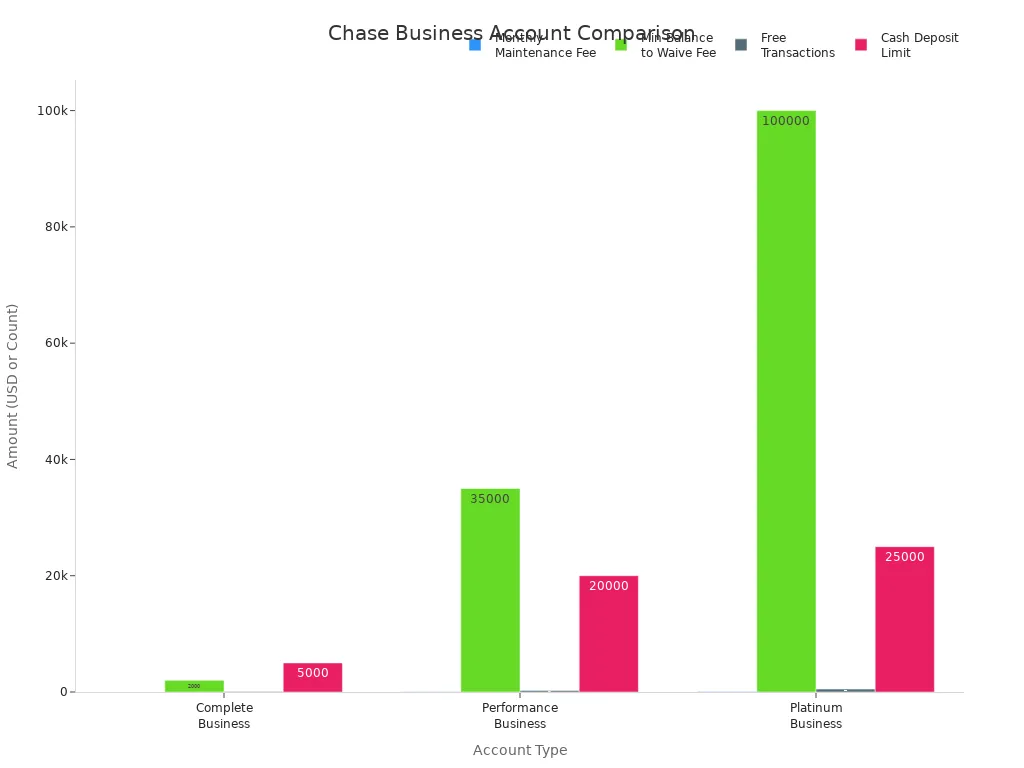

You can compare the main Chase business account types in the table below:

| Feature | Chase Complete Business Checking | Chase Performance Business Checking | Chase Platinum Business Checking |

|---|---|---|---|

| Recommended For | Small businesses | Medium businesses | Large, well-established businesses |

| Monthly Maintenance Fee | $15 | $30 | $95 |

| Minimum Balance to Waive Fee | $2,000 | $35,000 | $100,000 (single or combined accounts) |

| Free Transactions per Month | 100 | 250 | 500 |

| Cash Deposit Limit per Cycle | $5,000 | $20,000 | $25,000 |

| Wire Transfer Benefits | All incoming + 2 outgoing wires free | All incoming + 2 outgoing wires free | All incoming + 4 most expensive outgoing wires free |

| Account Opening Requirements | Visit branch with documentation; no minimum deposit | Visit branch with documentation | Visit branch with documentation |

Tip: Chase business account holders can use the mobile app to locate branches and ATMs, manage transactions, and monitor account activity in real time.

Chase Business Checking Accounts

Chase offers three main business checking accounts. Each account serves different business sizes and needs. You can choose the right account based on your transaction volume, cash deposit requirements, and the level of banking support you want.

Chase Complete Business Checking

Chase Complete Business Checking works best for small businesses and startups. You get unlimited free transactions each month, which helps you manage frequent payments and deposits without worrying about extra fees. The account allows up to $5,000 in cash deposits per month before fees apply. If you deposit more than this limit, Chase charges $2.50 for every $1,000 over $5,000. This account gives you access to Chase’s digital banking tools, including the Chase Mobile App and Chase Business Online. You can deposit checks remotely, pay bills, and transfer money from your phone or computer.

| Account Type | Monthly Free Transactions | Monthly Cash Deposit Allowance Before Fees |

|---|---|---|

| Chase Complete Business Checking | Unlimited | $5,000 |

| Chase Performance Business Checking | 250 | $20,000 |

| Chase Platinum Business Checking | 500 | $25,000 |

You benefit from strong fraud protection, account alerts, and the ability to delegate account access to your team. Chase bank’s wide network of branches and ATMs makes it easy to access your funds. This account suits you if you want simple, flexible banking with digital convenience.

Note: The $5,000 monthly cash deposit limit is higher than some entry-level accounts at other banks, but lower than Chase’s higher-tier options.

Chase Performance Business Checking

Chase Performance Business Checking targets mid-sized and growing businesses. You receive 250 free transactions per month and up to $20,000 in cash deposits before fees. This account includes no fees for all incoming wire transfers and two free outgoing wires per statement cycle. You can use over 4,700 branches and 15,000+ ATMs nationwide. Chase bank provides advanced digital banking tools, such as the Chase Mobile App and Chase Business Online, so you can manage your business account anywhere.

- Access to fraud protection services, including check verification and ACH transaction review.

- Optional debit card and interest-earning options.

- $30 monthly service fee, which you can waive by maintaining a $35,000 average daily balance in qualifying linked accounts.

- $0.40 fee per transaction after 250 transactions or $20,000 in cash deposits.

This account fits businesses that need more flexibility and higher transaction limits than basic accounts. If your business is growing and you want advanced cash management and payment processing, this account gives you the tools you need.

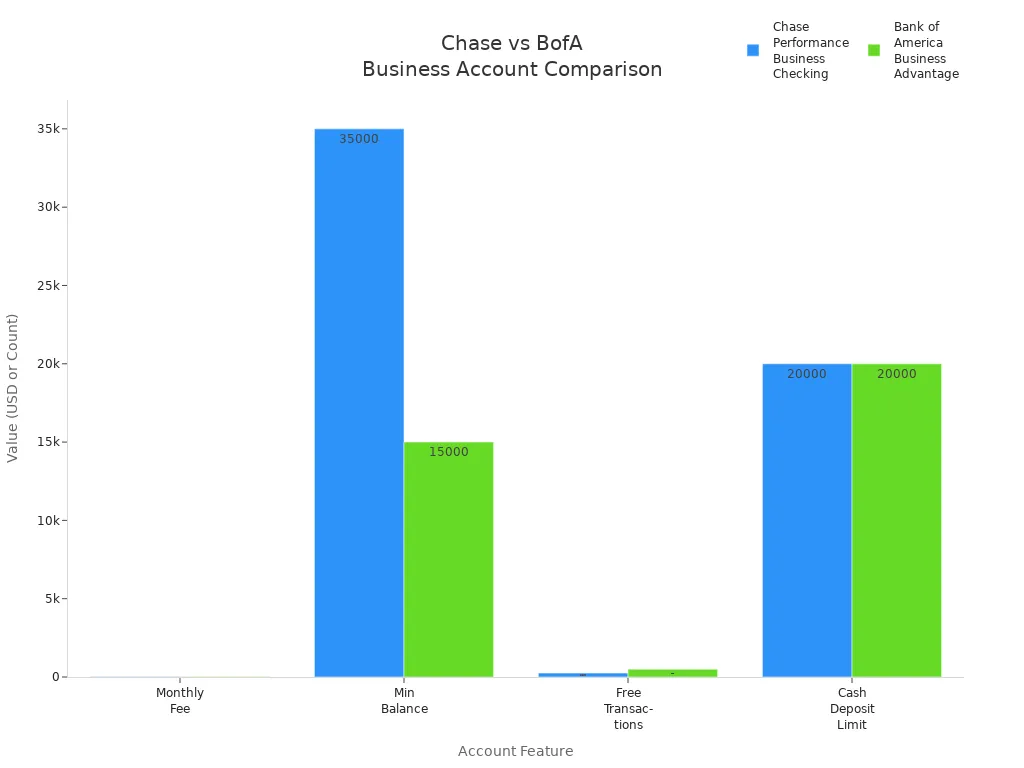

| Feature | Chase Performance Business Checking | Bank of America Business Advantage Relationship |

|---|---|---|

| Monthly Fee | $30 | $29.95 |

| Minimum Balance to Avoid Fee | $35,000 daily | $15,000 monthly |

| Free Transactions per Month | 250 | 500 |

| Free Cash Deposits per Month | First $20,000 | First $20,000 |

| Out-of-Network ATM Fees | Free (third-party fees may apply) | $2.50 per transaction |

| Payment Solutions | Chase Merchant Services included | N/A |

Chase Performance Business Checking stands out for its ATM fee structure and payment solutions. You benefit if you use out-of-network ATMs or need merchant services. However, Bank of America offers more free transactions and a lower minimum balance to avoid fees.

Chase Platinum Business Checking

Chase Platinum Business Checking is designed for large, established businesses with high transaction volumes and cash flow needs. You receive 500 free transactions per month and up to $25,000 in cash deposits before fees. This account includes unlimited incoming wire transfers and four free outgoing wires each month. You also get access to premium customer support and a wide range of Chase business services, such as merchant services, cash management, and fraud protection.

- $95 monthly fee, waived if you maintain a $100,000 average daily balance or $50,000 with Chase Private Client Checking.

- Unlimited electronic deposits and high monthly caps on non-electronic deposits and debits.

- Access to over 4,700 Chase bank branches and premium support.

- Physical debit cards with unlimited purchases and advanced cash management tools.

This account works best for businesses that handle large cash volumes, require frequent in-person banking, and value premium service. You must provide two forms of ID, tax identification, and business documentation to open this account.

Note: The $25,000 monthly cash deposit limit is among the highest in the industry, making this account ideal for businesses with significant cash handling needs.

Online and Mobile Banking Features

All Chase business checking accounts include robust online and mobile banking features. You can manage your business account through Chase Business Online or the Chase Mobile App. These tools let you deposit checks remotely, send and receive payments with Zelle, schedule bill payments, and set up account alerts. Fraud protection services and the Access & Security Manager help you control account permissions and protect your business funds.

| Feature | Description | Business Operation Enhancement |

|---|---|---|

| Chase Business Online | Manage accounts, monitor activity, enroll in fraud protection, and make payments | Enables secure, comprehensive account management from any location |

| Chase Mobile App | On-the-go account management, mobile check deposit, payments via Zelle and wires | Provides flexibility and speeds up deposits and payments |

| Fraud Protection | Positive Pay, Reverse Positive Pay, ACH Debit Block | Protects business funds from fraud |

| Access & Security Manager | Delegate account permissions and cash management tasks | Supports secure team collaboration |

| Account Alerts | Email and push notifications for account and transaction updates | Keeps you informed in real time |

You gain flexibility and security with these digital tools, making it easier to manage your business finances wherever you are.

Account Features

Digital Banking Tools

You gain powerful digital banking tools when you open a chase business account. These tools help you manage your business finances quickly and securely. You can access your account 24/7, so you do not need to visit a branch for most tasks. Here are some ways chase digital banking tools improve your experience:

- You manage transactions and financial issues anytime with online access.

- The mobile app lets you deposit checks, pay bills, transfer money, and apply for loans on the go.

- You complete banking tasks faster with quick online or app-based transactions.

- You review financial statements and transactions digitally, which helps you monitor cash flow.

- You integrate your chase account with budgeting and financial management apps for better oversight.

- You order checks or update cards digitally, saving time.

- Chase uses secure systems to protect your privacy and prevent fraud.

- Real-time payments and faster processing improve your business cash flow.

- You enjoy a personalized experience, switching between digital self-service and personal banker support as needed.

These features make it easier to track money habits and make smart financial decisions for your business.

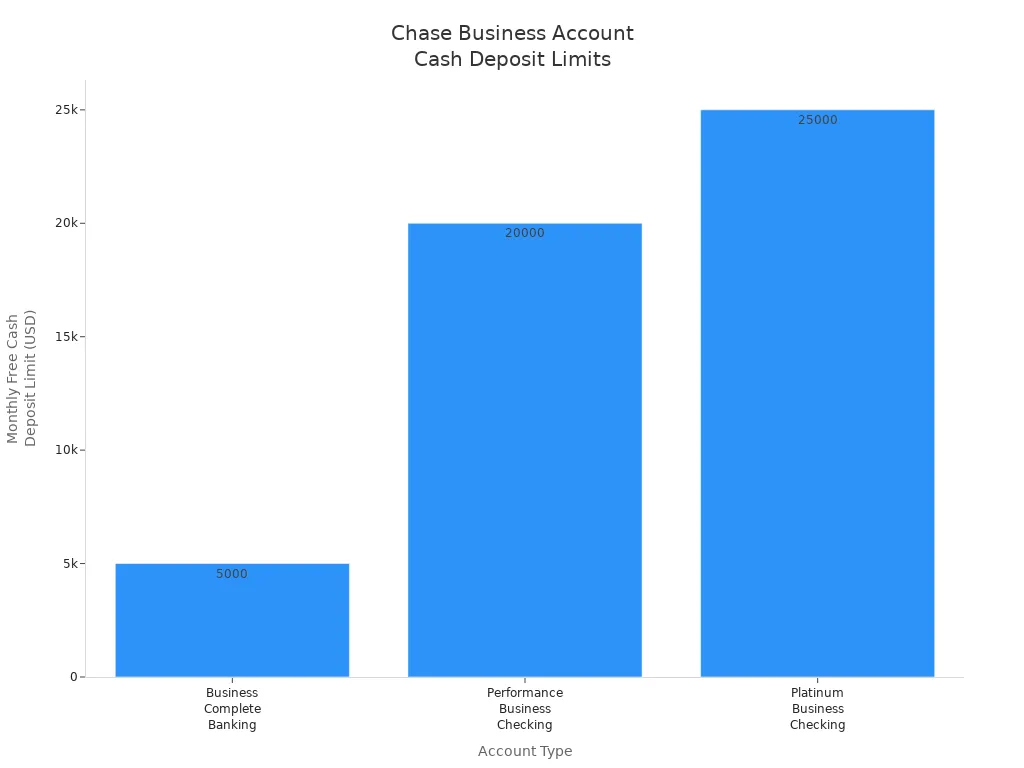

Cash Deposit Limits

Chase sets monthly cash deposit limits for each business account type. These limits affect how much cash you can deposit without paying extra fees. The right limit depends on your business model and cash flow needs. The table below compares chase and other banks:

| Account Type | Fee-Free Monthly Cash Deposit Limit | Free Monthly Transactions | Business Model Impact |

|---|---|---|---|

| Chase Business Complete Banking | $5,000 | 100 | Good for small to medium-sized businesses with moderate cash flow needs. |

| Bank of America Fundamentals | $7,500 | 200 | Supports businesses with higher cash flow requirements. |

| Bank of America Relationship | $20,000 | 500 | Ideal for businesses with substantial cash flow and transaction volumes. |

If your business handles large amounts of cash, you may need a higher-tier chase account or a different bank. Always review your cash flow to choose the best fit.

Tip: Exceeding your monthly cash deposit limit may result in extra fees, so track your deposits closely.

Linking Personal and Business Accounts

Chase allows you to link your personal and business accounts for easier money management. You can transfer funds between accounts, pay yourself, and keep business and personal finances separate. This feature helps you avoid mixing funds, which is important for tax and legal reasons. You also get a clear view of your business cash flow and spending. Linking accounts saves time and reduces errors when moving money. Chase’s digital tools make this process simple and secure, giving you more control over your business finances.

How to Choose a Chase Business Account

Assessing Business Needs

Selecting the right Chase business account starts with a clear understanding of your business operations. You need to look at how your business handles money every day. Start by asking yourself these questions:

- How much money do you plan to deposit and keep in your account each month?

- How often do you visit branches or ATMs for your business?

- What is your average number of transactions per month?

- Do you accept card payments or need special payment tools?

- How important is it for you to have a trusted business banker for advice?

- What size is your business, and how fast is it growing?

- What documents do you have ready for opening an account?

- Do you want to keep your personal and business finances separate for tax and legal reasons?

You should also prepare the right documents, such as your EIN, business registration, and identification. Some accounts require an initial deposit. Keeping your business and personal finances separate helps you protect your business, makes taxes easier, and builds business credit.

Tip: Talk to a Chase business banker if you need help matching your business needs to the right account.

Account Comparison

Chase offers several business checking accounts. Each account fits a different business size and transaction volume. You need to compare features, fees, and benefits to find the best match for your business.

Key factors to consider include your monthly transaction volume, the amount of cash you deposit, and how often you use branch services. Some accounts work best for businesses that make mostly electronic deposits. Others offer more free transactions or higher cash deposit limits for larger businesses. Monthly maintenance fees can add up, but you can often avoid them by keeping a minimum balance or linking accounts.

You should also look at extra fees for services like wire transfers or cashier’s checks. Make sure you understand the account opening requirements for your business type, such as sole proprietorship, partnership, LLC, or corporation.

Here is a checklist to help you compare Chase business accounts:

- Estimate your monthly transaction volume.

- Calculate your average monthly cash deposits.

- Decide if you need frequent branch access.

- Check if you can meet minimum balance requirements to waive fees.

- Review the types of payments you accept.

- Gather required business documents.

- Consider if you need advanced features like wire transfers or merchant services.

The table below compares the main Chase business checking accounts:

| Account Name | Best For | Monthly Fee | Free Transactions | Cash Deposit Limit | Fee Waiver Requirement | Extra Features |

|---|---|---|---|---|---|---|

| Chase Complete Business Checking | Small businesses, startups | $15 | 100 | $5,000 | $2,000 minimum balance | Digital tools, QuickAccept payments |

| Chase Performance Business Checking | Growing businesses | $30 | 250 | $20,000 | $35,000 average daily balance | Free incoming wires, 2 free outgoing |

| Chase Platinum Business Checking | Large, established businesses | $95 | 500 | $25,000 | $100,000 average daily balance | Premium support, 4 free outgoing wires |

Note: If your business makes many electronic deposits and has low cash needs, Chase Complete Business Checking may be your best option. If you need more free transactions or higher cash deposit limits, consider Performance or Platinum accounts.

Choosing the right Chase business account depends on your business’s unique needs. Review your transaction habits, cash flow, and growth plans. Compare account features and fees carefully. This approach helps you avoid unnecessary costs and ensures your business has the banking support it needs.

Opening a Chase Business Account

Image Source: pexels

Eligibility

You must meet specific chase business account requirements before you open a new account. Chase sets different requirements for each business structure. The table below shows who must be present and what identification you need for each type of business:

| Business Structure | Who Must Be Present at Account Opening | Identification Requirements | Tax Identification Number Accepted | Online Application Availability |

|---|---|---|---|---|

| Sole Proprietorship | Owner (single owner); Both owners if spousal sole proprietorship; Trustee(s) if living trust; Agent if Power of Attorney | Two forms of ID; one must be government-issued | SSN, ITIN, or EIN | Only single-owner sole proprietorships supported online |

| Limited Liability Company | All Members (member-managed) or All Managers (manager-managed); Authorizing rep if owner is another business | Two forms of ID; one must be government-issued | EIN required; Single-member LLCs may use SSN or ITIN | Single-member or single-manager LLCs supported online |

| Corporation | Authorizing representative (President, Secretary, Assistant Secretary, Acting Secretary) | Two forms of ID; one must be government-issued | EIN required | Privately held S- and C-Corporations with one authorizing rep supported online |

Note: Only privately held businesses with simple ownership structures can apply online. Nonprofits and complex business types must visit a branch.

Required Documents

You need to gather the right documents to meet chase business account requirements. The documents you need depend on your business type. Here is a quick guide:

- Sole Proprietorship: Two forms of personal ID, tax ID (SSN, ITIN, or EIN), Assumed Name Certificate (if using a DBA), and business license if required.

- LLC: Two forms of personal ID, tax ID (EIN or SSN/ITIN for single-member LLCs), Articles of Organization, and Active Status Verification.

- Corporation: Two forms of personal ID, tax ID (EIN), Certified Articles of Incorporation, and Active Status Verification.

- Partnership: Two forms of personal ID for all general partners, tax ID, and partnership agreement or formation documents.

Tip: Always bring original documents and check state-specific requirements before your visit.

Online Application Steps

You can start your chase business account application online if you own a sole proprietorship, a single-member LLC, or a privately held corporation with one authorizing representative. Follow these steps:

- Check if your business meets chase business account requirements for online applications.

- Gather all required documents and identification for your business structure.

- Go to the chase website and select the business account you want.

- Enter your personal and business details as requested.

- Upload or provide information from your documents.

- Review your application and submit it online.

If you own an LLC with multiple members, a partnership, or a nonprofit, you must visit a chase branch to complete your application. All authorized signers should be present or pre-authorized and must visit the branch within 30 days.

Note: Chase only supports online applications for privately held businesses with simple structures. Other business types must complete the process in person.

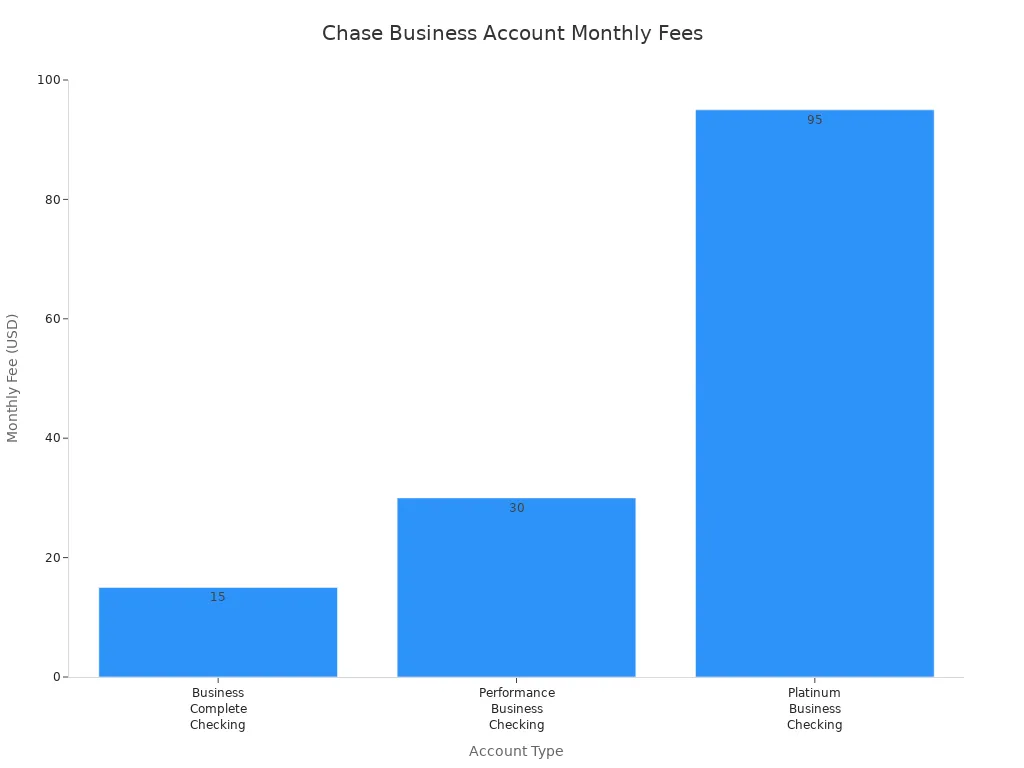

Chase Business Account Fees

Monthly Fees

You need to understand the monthly fees before you open a chase business account. Each account type has a different fee and set of included services. The table below shows the monthly fee, how you can waive it, and what services come with each account:

| Account Type | Monthly Fee | Fee Waiver Condition | Included Free Transactions | Included Cash Deposits per Cycle | Included Wire Transfers (Outgoing) | Additional Included Services |

|---|---|---|---|---|---|---|

| Chase Business Complete Checking | $15 | $2,000 minimum daily balance or $2,000 spend on Chase Ink Business card | 100 | $5,000 | N/A | Mobile app, online banking, 15,000+ ATMs, QuickAccept, fraud protection |

| Chase Performance Business Checking | $30 | $35,000 average daily balance | 250 | $20,000 | 2 free outgoing wires | Unlimited electronic deposits, Positive Pay, unlimited incoming wires, branch access |

| Chase Platinum Business Checking | $95 | $100,000 average daily balance in qualifying accounts | 500 | $25,000 | 4 free outgoing wires | Unlimited electronic deposits, Positive Pay, concierge support, cash management services |

You can see that higher-tier chase business accounts offer more free transactions and higher cash deposit limits. These accounts also include extra services like advanced fraud protection and cash management tools.

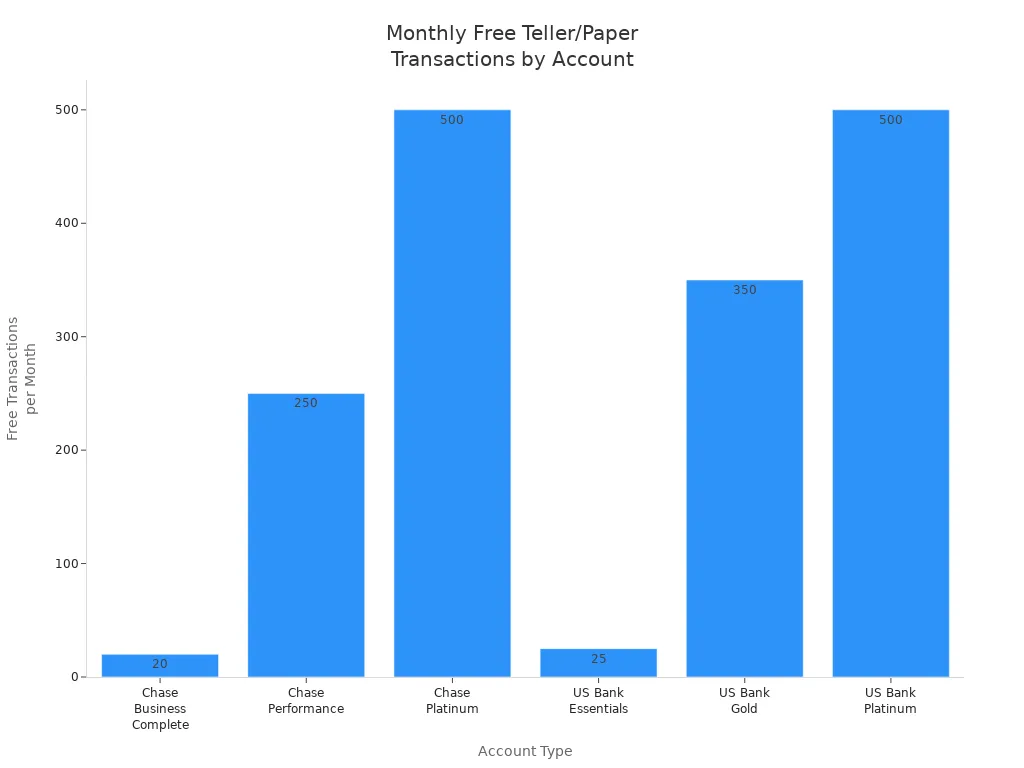

Transaction Limits

Each chase business account has its own transaction limits. These limits affect how many free teller or paper transactions you get each month. Digital transactions are unlimited for all chase business accounts. The table below compares chase with other banks:

| Account Type | Monthly Free Transactions (Teller/Paper) | Monthly Free Digital Transactions | Monthly Cash Deposit Allowance | Monthly Fee (Waivable) |

|---|---|---|---|---|

| Chase Business Complete Banking | 20 | Unlimited | $5,000 | $0 |

| Chase Performance Business | 250 | Unlimited electronic deposits | $20,000 | $30 |

| Chase Platinum Business | 500 | Unlimited electronic deposits | $25,000 | $95 |

| U.S. Bank Business Essentials | 25 | Unlimited digital transactions | 25 cash deposit units* | $0 |

| U.S. Bank Gold Business | 350 | N/A | 125 cash deposit units* | $20 |

| U.S. Bank Platinum Business | 500 | N/A | 250 cash deposit units* | $30 |

*Cash deposit units are calculated by dividing each cash deposit by 100 and rounding to the nearest whole number.

Chase gives you unlimited digital transactions, which helps if your business uses online banking. If you need more teller or paper transactions, you may want to look at higher-tier chase accounts or compare with other banks.

Note: If you go over your free transaction or cash deposit limit, chase charges extra fees. Always track your business activity to avoid surprises.

Ways to Waive Fees

You can avoid monthly fees on your chase business account by meeting certain requirements. Here are some common ways to waive these fees:

- Maintain a minimum daily balance in your account.

- Make qualifying purchases with a Chase Ink business card.

- Deposit a set amount using Chase QuickAccept or other eligible payment solutions.

- Link your account to a Chase Private Client Checking or similar account.

- Provide proof of military status if you qualify.

The table below summarizes the requirements for each account:

| Account Type | Monthly Fee | Requirements to Waive Fee |

|---|---|---|

| Chase Business Complete Checking | $15 | $2,000 daily balance OR $2,000 in QuickAccept deposits OR link to Private Client Checking |

| Chase Performance Business Checking | $30 | $35,000 balance across business accounts |

| Chase Platinum Business Checking | $95 | $100,000 balance across business accounts |

Tip: Review your business cash flow and banking habits. Choose the chase business account that matches your needs and helps you avoid unnecessary fees.

Additional Chase Business Services

Business Support Team

You receive more than just a bank account when you open a business account with chase. The business support team provides a wide range of services to help you manage and grow your business. You can access:

- Business checking accounts for every stage of your business journey.

- Payment solutions that let you accept credit cards securely.

- Business credit cards with rewards and cash back offers.

- Business loans, including SBA loans and lines of credit, to support growth.

- Business savings accounts to help you plan for the future.

- Educational resources such as courses, articles, and coaching.

- Local support and digital tools for easy financial management.

- Fraud and security services to protect your business from threats.

- Pay and transfer services for quick payments to employees and vendors.

These services help you streamline your finances, protect your assets, and access expert advice. You can use chase’s educational resources to learn new skills and make better business decisions.

Credit and Financing Solutions

Chase offers a variety of credit and financing options to help your business succeed. You can choose from several business credit cards, each designed for different spending needs. For example, the Ink Business Preferred card earns 3X points on select categories, while the Ink Business Unlimited card gives you 1.5% cash back on all purchases. The Ink Business Cash card provides 5% cash back in select categories.

You can also apply for a business line of credit, which gives you flexible access to funds for up to five years. Chase offers SBA loans, including the SBA 7(a) and SBA 504 programs, with loans up to $5 million and terms up to 25 years. These loans help you buy equipment, expand your business, or manage cash flow. You may also qualify for commercial real estate loans and business term loans. Chase encourages you to speak with a business banker to find the best financing solution for your needs.

Chase Ink Business Card Offer

Chase Ink Business Cards give you powerful rewards and benefits. The Ink Business Preferred card offers 3X points on select business categories and a valuable sign-up bonus. You get travel benefits like trip cancellation insurance and lost luggage reimbursement. Purchase protection covers new items for 120 days, and you can get free employee cards.

The table below compares the main Ink Business Cards:

| Feature / Benefit | Ink Business Preferred | Ink Business Cash | Ink Business Unlimited | Ink Business Premier |

|---|---|---|---|---|

| Rewards Structure | 3X points on select categories (up to $150K/year), 1X on others | 5% cash back on office supplies & telecom (up to $25K/year), 2% on gas & restaurants, 1% unlimited | 1.5% unlimited cash back on all purchases | 2.5% cash back on purchases $5,000+, 2% on others |

| Points Redemption | Cash back, travel, gift cards, partner transfers | Same as Preferred | Same as Preferred | Same as Preferred |

| Employee Cards | Free | Free | Free | Free |

| Travel Protection | Comprehensive | Basic | Basic | Comprehensive |

| Purchase Protection | Yes | Yes | Yes | Yes |

You can redeem points for cash back, travel, or gift cards through Chase Ultimate Rewards. These cards help you manage business expenses and maximize rewards based on your spending habits.

Alternatives to Chase

Comparing Other Banks

When you look for a business bank account, you want to compare features, fees, and service quality. Chase stands out with its large branch network and advanced digital tools. However, other banks may offer benefits that fit your business better. The table below shows how chase compares to Capital One for business accounts:

| Aspect | Chase Business Accounts | Capital One Business Accounts |

|---|---|---|

| Geographic Availability | Branches in 48 states (except Alaska and Hawaii) | Branches in 6 states + Washington D.C. |

| Monthly Fee | $15 with multiple ways to waive | $15 waived only with $2,000 average balance |

| Transaction Limits | Unlimited free digital transactions; 20 free paper/teller transactions per month | Unlimited free digital transactions |

| Cash Deposit Limit | $5,000/month; $2.50 per $1,000 over limit fee | $5,000/month; $1 per $1,000 over limit fee |

| ATM Network | 15,000 ATMs; $3 out-of-network fee | 70,000+ fee-free ATMs; $2 out-of-network fee |

| ACH Fees | Charges $2.50 for first 10 ACH payments, then $0.15 each | Unlimited free ACH payments |

| Welcome Bonus | Offers cashback bonuses for new accounts | No welcome bonuses |

| Payment Processing | Faster same-day access to funds via Chase QuickAccept | Next-day deposits |

| Customer Satisfaction | Generally positive for customer support and fast settlement; some complaints about high balance requirements and account restrictions | Reports of slower ACH transfers and occasional unexplained account locks |

| Overall Recommendation | Better all-around provider due to branch network, product selection, and merchant services | Better for cost-conscious customers prioritizing lower fees on deposits and ACH payments within limited service area |

You see that chase offers more locations and faster payment processing. Capital One provides lower fees for some services and a larger ATM network. Your business may benefit from one or the other, depending on your needs.

When to Consider Alternatives

You should consider alternatives to chase if your business values lower fees, more personal service, or operates in a limited region. Smaller businesses sometimes find chase’s monthly fees and transaction limits challenging. Regional banks like 1st Bank offer lower monthly fees, fewer transaction limits, and more personalized support. If your business does not need a large branch network or advanced digital tools, a local bank may fit better.

| Factor | Chase (National Bank) | 1st Bank (Regional Bank) |

|---|---|---|

| Customer Service Style | Structured, corporate with dedicated teams; priority service for premium accounts | Personalized, local relationships; long-term client support |

| Geographic Coverage | Extensive nationwide presence with 4,700+ branches across all lower 48 states | Regional focus in Colorado, Arizona, California with ~100 branches |

| Fee Structure | Monthly fees ($15, waivable), tiered transaction limits, wire transfer fees | Lower monthly fees ($5-$15), fewer transaction limits, competitive wire fees |

| Transaction Limits | 100-500 free transactions depending on account tier | 150-400 free transactions depending on account tier |

| Digital Banking Capabilities | Advanced: QuickAccept, mobile deposits, real-time alerts, integration with accounting | Basic: standard mobile deposits, online bill pay, basic fraud alerts |

| International Banking | Comprehensive multi-currency, wire transfers, global payment solutions | Basic international services via correspondent banks |

| Treasury Management | Sophisticated tools: cash flow analytics, automated payments, multi-account mgmt | Fundamental tools: cash flow monitoring, basic payment processing |

| Ideal Business Circumstances | Businesses needing extensive branch access, advanced digital tools, international | Small/medium businesses valuing personalized service, lower fees, local focus |

| Fee Sensitivity | May be costly for smaller businesses not meeting waiver criteria | More suitable for smaller businesses to avoid high fees |

Note: If your business needs advanced digital banking, a wide branch network, or international services, chase remains a strong choice. If you want lower costs and closer relationships, a regional bank may serve you better.

You have many options when choosing a chase business account. Each account type offers unique features and meets different business requirements. Review your business needs, check your eligibility, and gather all required documents.

- Confirm your business structure and registration.

- Prepare your business and personal information.

- Select the right account and apply online or in person.

Contact a chase business specialist if you need help with the process.

FAQ

What documents do you need to open a Chase business account?

You need two forms of identification, your business registration documents, and your tax identification number. You may also need an operating agreement or partnership agreement, depending on your business structure.

Can you open a Chase business account online?

You can open a Chase business account online if you own a sole proprietorship, a single-member LLC, or a privately held corporation with one authorizing representative. Other business types must visit a branch.

How do you avoid monthly fees on Chase business accounts?

You can avoid monthly fees by maintaining the required minimum balance, using a Chase Ink business card for qualifying purchases, or linking your account to a Chase Private Client Checking account.

Tip: Review your account activity each month to ensure you meet the fee waiver requirements.

Can you switch from another bank to Chase easily?

You can switch to Chase by gathering your business documents, opening a new account, and transferring your funds. Chase provides support and checklists to help you move your payments and deposits smoothly.

While a Chase business account gives you reliable banking in the U.S., many companies still face high fees and delays when paying suppliers or partners abroad. BiyaPay helps you solve this gap with real-time exchange rates, international transfers starting at just 0.5%, and support for both fiat and digital currencies. With same-day transfers available, your business can keep cash flow smooth and costs under control.

If you want to complement your Chase account with a smarter way to handle global payments, explore BiyaPay today.

Start now—it only takes minutes to register with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.