Comparing MoneyGram Exchange Rates: All You Need to Know

Image Source: pexels

You may wonder if MoneyGram gives you better exchange rates than other money transfer services. MoneyGram often sets competitive rates, but the real value depends on both the MoneyGram Exchange Rates and the fees you pay. When you use MoneyGram for international transfers or sending money abroad, you want to know how much your recipient will actually get. Financial studies show that exchange rate margins and transfer fees can raise the total cost of international money transfers by 5% to 15%. These costs mean you might lose a significant part of your money transfer before it reaches your recipient. By understanding how MoneyGram handles transfers, you can make smarter choices when you compare international transfers and other money transfer services.

Key Takeaways

- MoneyGram adds a hidden markup to exchange rates, so you pay more than the real market rate when sending money.

- Transfer fees and exchange rate margins together affect the total cost; always check both before sending money.

- MoneyGram often offers better rates and lower fees for small transfers compared to Western Union and Ria, but rates vary by currency and method.

- Use MoneyGram’s online tools like the fee estimator and check live rates to find the best deal and avoid surprises.

- Timing your transfer on weekdays and choosing the right payment and delivery methods can save you money and speed up transfers.

MoneyGram Exchange Rates Overview

Image Source: unsplash

How Rates Are Set

You may notice that moneygram exchange rates change every day. MoneyGram sets these rates by looking at the mid-market exchange rate, which is the real value between two currencies. Instead of using this rate, MoneyGram adds a markup to it. This markup acts as a hidden fee inside the exchange rate. When you send money, you pay a little more than the base market rate. MoneyGram updates its exchange rates daily, and the rate you see at the time of your transfer is the rate you get. After the daily closing time, rates may change again. This means you should always check the current moneygram exchange rates before you send money.

Note: The exact margin between MoneyGram’s exchange rates and the mid-market rate can change. For some currency pairs, the margin is small, but for others, it may be higher. MoneyGram does not publish the exact margin for every transfer.

What Influences Exchange Rates

Many factors affect moneygram exchange rates. The type of currency you choose plays a big role. Some currencies, like the US dollar or euro, have stable exchange rates. Others can change quickly because of political events or economic news. The amount you send also matters. Larger transfers may get better rates, while smaller amounts might have higher margins.

Your payment method can change the cost too. If you use a credit card, you may pay higher fees and get a different exchange rate. The way your recipient gets the money—such as cash pickup or bank deposit—can also affect the rate and fees.

- Key factors that influence moneygram exchange rates:

- Currency type and country conditions

- Transfer amount

- Payment method (credit card, bank transfer, etc.)

- Delivery method (cash pickup, bank deposit)

- Timing of your transfer

Seasonal trends and global events can also impact exchange rates. For example, during holidays or big world events, demand for money transfers can rise. This can cause rates to change quickly. MoneyGram may adjust its rates and fees in response to these changes. You can often get better rates during weekdays when currency markets are most active.

Comparing Money Transfer Services

Image Source: pexels

MoneyGram vs. Western Union

When you compare MoneyGram and Western Union, you see that both companies have a strong global presence. They let you send money to many countries. You want to know which one gives you better exchange rates and lower fees for your international transfers.

MoneyGram and Western Union both set their exchange rates daily. They add a margin to the mid-market rate. This margin can change based on the currency and the amount you send. You may notice that MoneyGram exchange rates sometimes offer better value for small transfers. Western Union often charges higher fees, especially for certain destinations.

Here is a table that shows the average transfer fees for sending $500 internationally:

| Service | Transfer Fee (to Spain) | Exchange Rate Margin | Notes |

|---|---|---|---|

| MoneyGram | Similar to Western Union, sometimes lower | Present, varies | May offer better exchange rates for small amounts |

| Western Union | ~$38 (35 EUR) | Present, varies | Fees depend on payment and delivery method |

Note: Both services include a hidden cost in the exchange rate margin. You should always check the total cost before you send money.

You may find that MoneyGram gives you lower fees for small international money transfers. Western Union sometimes charges more, especially if you pay by credit card or choose cash pickup. However, for some currency pairs, Western Union may offer better exchange rates. You should always compare the total amount your recipient will get.

MoneyGram vs. Ria

Ria is another popular money transfer service. You may want to know how MoneyGram compares to Ria for transfers to countries like India, Mexico, and the Philippines. Both companies use exchange rate markups and charge fees that depend on the route and payment method.

Here is a table that compares MoneyGram and Ria for popular destinations:

| Aspect | Ria | MoneyGram |

|---|---|---|

| Upfront Fees (India) | $1 plus exchange rate markup | Flat fee about $2.50 (UK to India, USD equivalent) |

| Upfront Fees (Mexico) | No upfront fee, exchange rate markup | Varies; flat or percentage-based fees |

| Upfront Fees (Philippines) | Not listed; similar fees | Not listed; fees vary |

| Exchange Rate Markup | Present, not always transparent | Present, reported up to 5% markup |

| Fee Structure | Varies by payment and payout method | Flat fees on popular routes; percentage fees for some transfers |

| Transfer Speed | Bank transfer ~4 days; card payments ~15 minutes | Not specified in detail |

| Network Advantage | Multiple payout options | Large global cash pickup network |

You may notice that Ria often advertises lower upfront fees, but the exchange rate markup can be higher. MoneyGram exchange rates sometimes give you better value, especially for small transfers. For some routes, Ria may offer lower fees, but you should always check the exchange rate margin. The total cost depends on both the fee and the exchange rate.

Tip: Always use the online calculators from each provider to see the exact amount your recipient will get. This helps you find better exchange rates and lower fees.

When you look at independent comparisons, you see that MoneyGram does not always have the best exchange rates. Wise, another money transfer service, often gives you better exchange rates and lower fees. This means your recipient gets more money. However, MoneyGram still offers a large network and fast transfers, which can be helpful if you need cash pickup.

MoneyGram’s exchange rates and fees for business transfers are usually less favorable than those for personal remittances. If you need to send money for business, you may want to look at other providers that offer more competitive exchange rates and lower fees.

Fees and Hidden Costs

Transfer Fees

When you send money with MoneyGram, you pay transfer fees that depend on several factors. The amount you send, the payment method, the delivery method, and the destination country all affect the final fee. MoneyGram shows you the exact fee before you complete your transaction. If you transfer money between MoneyGram Accounts, you do not pay a fee. Other methods, like using a debit card or sending to a bank account, have different charges. For example, using a MoneyGram Debit Card internationally adds a 3% foreign transaction fee. ATM withdrawals abroad cost an extra $3 plus 3%. These fees can change, so always check the latest rates before you make international transfers.

Note: MoneyGram must show you all transfer fees, exchange rates, and the amount your recipient will get before you pay. This rule comes from the Dodd-Frank Act and the Consumer Financial Protection Act. You should always review these details to avoid hidden charges.

Exchange Rate Margins

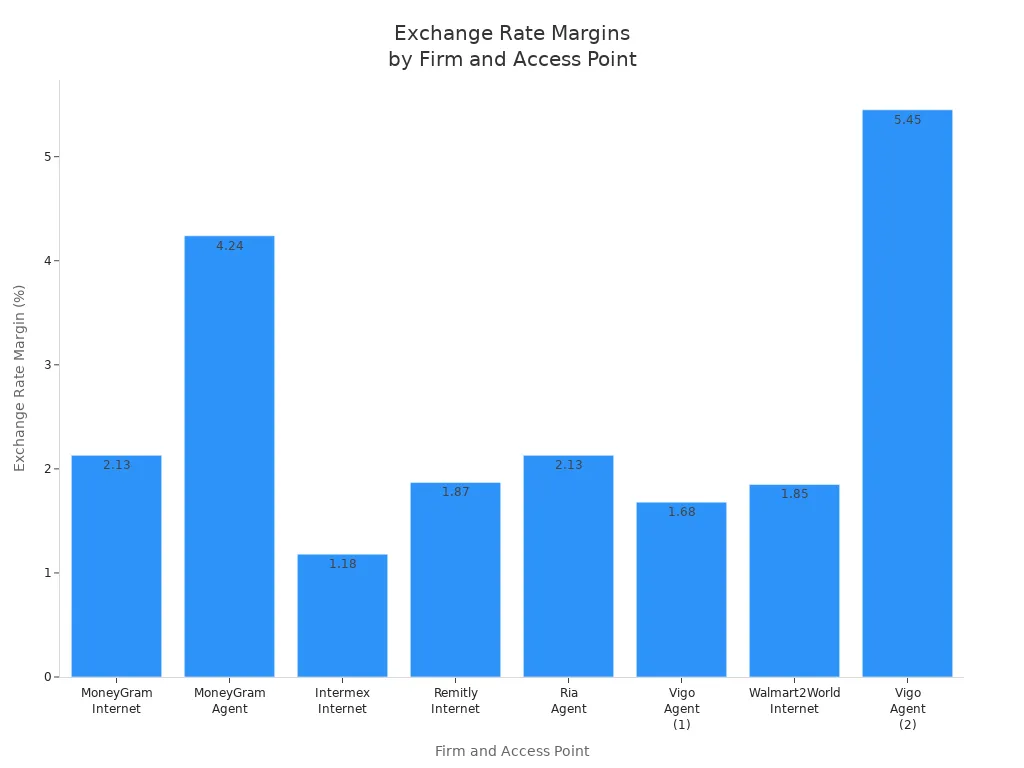

MoneyGram does not use the mid-market exchange rate. Instead, it adds exchange rate markups to the rate you see. These markups act as hidden costs in many transfers. The margin can change based on how you send money. For online transfers, the average exchange rate margin is about 2.13%. At agent locations, the margin can reach 4.24%. This is higher than some competitors, but not the highest in the industry.

| Firm | Access Point | Exchange Rate Margin (%) |

|---|---|---|

| MoneyGram | Internet | 2.13 |

| MoneyGram | Agent | 4.24 |

| Intermex | Internet | 1.18 |

| Remitly | Internet | 1.87 |

| Ria | Agent | 2.13 |

| Vigo | Agent | 1.68 |

| Walmart2World | Internet | 1.85 |

| Vigo | Agent | 5.45 |

Calculating Total Cost

You need to look at both transfer fees and exchange rate markups to find the real cost of international money transfers. For example, if you send $1,000 from the United States to Nigeria, MoneyGram charges a fee of $5.99 online or $8.00 at an agent. The exchange rate margin ranges from -2.56% to 3.74%. The total cost can be as low as $2.88 or as high as $13.48, depending on how you send the money.

| Sending Method | Access Point | Fee (USD) | Exchange Rate Margin (%) | Total Cost (%) | Total Cost (USD) |

|---|---|---|---|---|---|

| MoneyGram | Agent | $8.00 | -2.56 | 1.44 | $2.88 |

| MoneyGram | Internet | $5.99 | 3.74 | 6.74 | $13.48 |

Hidden charges can also come from intermediary banks. These banks help move money between countries and may add extra fees that you do not see upfront. Multiple banks can add their own charges, which lowers the amount your recipient gets. To avoid losing money, always ask about hidden charges and compare providers before making international transfers.

How to Get the Best MoneyGram Exchange Rate

Checking Live Rates

You want to make sure you get the best value when you send money. MoneyGram updates its exchange rates often. You can check live rates on the MoneyGram website or app before you start your transfers. This step helps you see exactly how much your recipient will get. Many financial experts suggest comparing rates from different providers at the same time. You can use online comparison tools like CompareRemit to see if MoneyGram offers the best deal for your transfer. Always check for hidden fees that may affect the total amount your recipient receives.

Using the Fee Estimator

MoneyGram provides a fee estimator tool on its website. You can enter the amount you want to send, the destination country, and your payment method. The tool shows you the total cost, including both the transfer fee and the exchange rate. This helps you understand the real cost of your transfers before you pay. You can also see how different payment methods, such as credit cards or bank transfers, change the fees. Credit cards often have higher fees, so choosing a debit card or online transfer can save you money.

Tip: Use the fee estimator to compare different options. Try changing the amount or payment method to see how it affects the total cost.

Timing Your Money Transfer

The timing of your transfers can make a big difference. Exchange rates can change quickly because of economic news or political events. MoneyGram rates may be less favorable during weekends or holidays. Experts recommend sending money on weekdays when currency markets are open. You can also set up rate alerts to notify you when rates improve. If you plan to send large amounts, consider splitting your transfers or waiting for a better rate. Always balance speed and cost to get the most value from your MoneyGram transfers.

Note: Monitoring exchange rates and using MoneyGram’s tools can help you save money and avoid surprises.

Other Factors in Money Transfer

Speed and Delivery Options

You want your money to reach your recipient quickly and safely. MoneyGram gives you more transfer options than many other services. You can send money online, through the app, or by visiting an agent. Your recipient can get the funds in several ways, such as bank deposit, mobile wallet, or cash pickup. These choices give you more payment options and help you find the best fit for your needs.

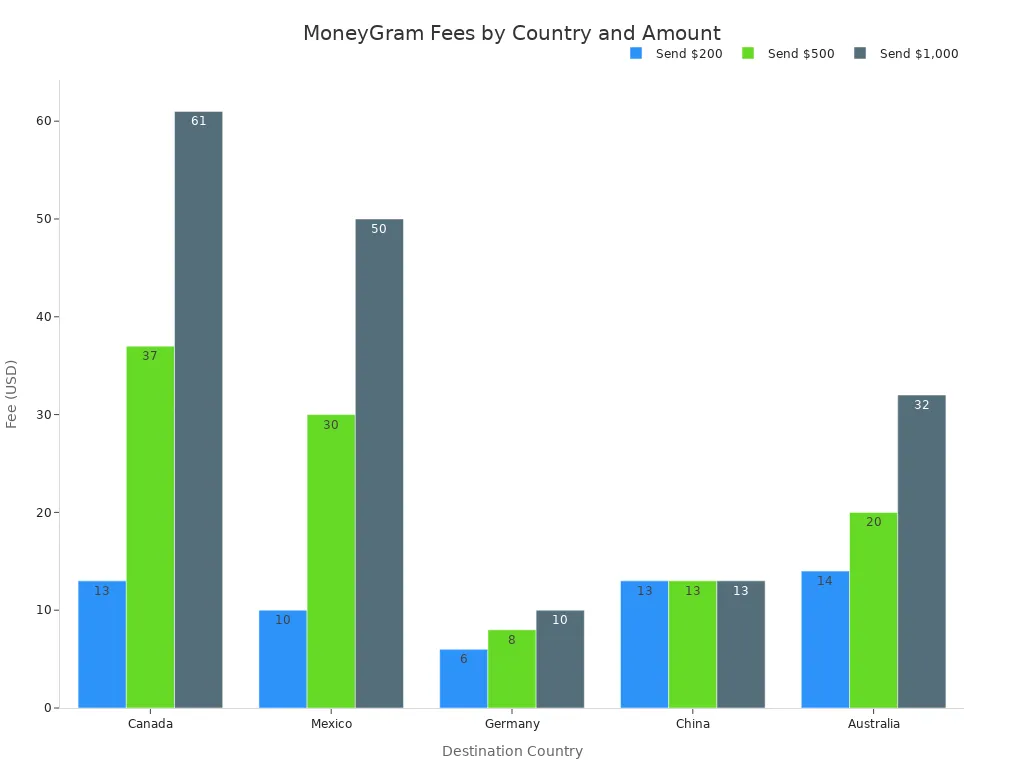

Transfer speed depends on how you pay and how your recipient receives the money. If you use a debit card, you often get faster transfer speeds, sometimes within minutes. Bank transfers may take longer. Cash pickup locations are available in many countries, but they can come with higher fees. The table below shows how fees change based on the destination and amount sent:

| Destination Country | Fee for Sending $200 | Fee for Sending $500 | Fee for Sending $1,000 |

|---|---|---|---|

| Canada | Around $13 | Around $37 | Around $61 |

| Mexico | Around $10 | Around $30 | Around $50 |

| Germany | Around $6 | Around $8 | Around $10 |

| China | Around $13 | Around $13 | Around $13 |

| Australia | Around $14 | Around $20 | Around $32 |

You may notice that faster transfer speeds often cost more. Cash pickup options usually have higher fees, but they give your recipient quick access to funds. If you want to save money, you can choose slower delivery methods. MoneyGram’s customer support can help you pick the right option for your needs. You can also reach out to customer support if you have questions about fees or delivery times.

Country and Currency Coverage

MoneyGram stands out by offering better coverage than many other money transfer services. You can send money to over 200 countries and territories. This wide reach means you have more transfer options and can send funds to places that other services may not support. MoneyGram also provides more payment options, so you can choose the method that works best for you.

You will find thousands of cash pickup locations worldwide, making it easy for your recipient to collect money. Some countries, like China and Germany, offer both bank deposit and cash pickup locations. This flexibility gives you better coverage and helps you reach more people. If you need help, MoneyGram’s customer support is available in many languages and can answer your questions about supported countries and currencies.

MoneyGram’s customer support team can guide you through the process if you need help with more transfer options or have trouble finding a location. You can contact customer support by phone, email, or chat. They can also help you understand which countries have faster transfer speeds and which have more cash pickup locations. Good customer support makes your transfer experience smoother and safer.

Tip: Always check with customer support before you send money to a new country. They can tell you about fees, delivery times, and more transfer options.

You see that MoneyGram stands out for clear fees and reliable transfers, but its exchange rates often lag behind top competitors. Customer reviews praise transparency and ease of use, though some users find better value elsewhere.

Before you send a money transfer, always check live rates and use MoneyGram’s online tools to compare total costs. You get the best deal by reviewing both fees and exchange rates, and by comparing with other money transfer services.

FAQ

How can you contact customer support if you have a problem with your transfer?

You can reach customer support by phone, email, or live chat on the MoneyGram website. The support team answers questions about transfers, fees, and exchange rates. You can also use the app to connect with support for quick help.

What should you do if your recipient does not receive the money?

First, check your transfer status online or in the app. If you see a delay, contact customer support for help. The support team can track your transfer and explain any issues. You can also ask support for updates on delivery times.

Can you get help in different languages from customer support?

Yes, customer support offers help in many languages. You can ask for support in English, Spanish, French, and more. The support team can answer questions about transfers, fees, and exchange rates in your preferred language.

What information do you need when you contact support?

You should have your transaction number, the amount sent, and your recipient’s details ready. This helps support find your transfer quickly. Customer support may also ask for your contact information to provide better support and follow up if needed.

Comparing exchange rates shows one key truth: hidden markups and high transfer costs reduce what your recipient actually receives. With BiyaPay, you get real-time market exchange rates with no hidden margins, international remittance fees as low as 0.5%, and same-day delivery to most countries and regions worldwide. Whether you are supporting family or managing cross-border business, BiyaPay ensures your money arrives fast, securely, and with maximum value.

Start saving on every transfer today—sign up at BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Zelle Wire Transfer or ACH? Clearing Up the Confusion

What Are the Daily Limits for Chase Accounts?

How to Fill Out a CVS Money Order A 2026 Guide

The 18 Best Apps to Earn Real Cash This Year

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.