- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Your First Credit Card in the Philippines Tips for Choosing the Best Option

Image Source: pexels

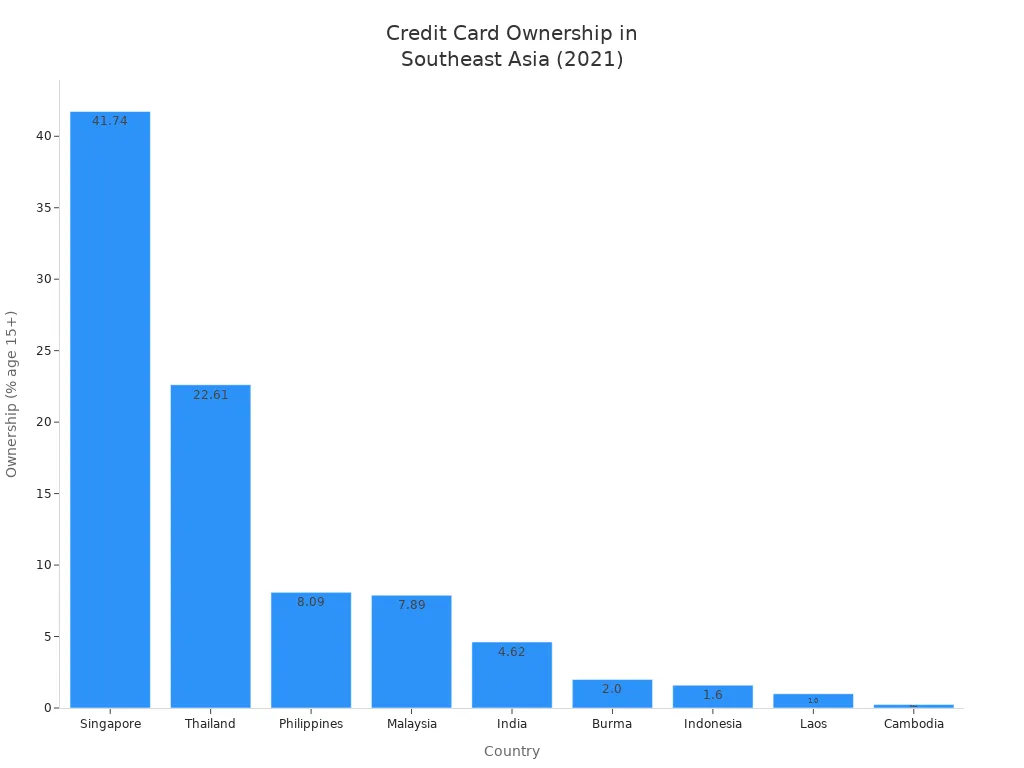

If you want to find the best credit card for beginners in the Philippines, start by looking at your spending habits and goals. Ask yourself what you want from your first credit card—maybe it’s low fees, good rewards, or an easy way to build credit. Only 8.09% of Filipinos aged 15 and above own a credit card, which means you’re not alone as a beginner.

To choose the right credit card, focus on offers with simple approval, low annual fees, and perks that match your lifestyle. The best credit card for beginners helps you build a strong credit history. With the right info, even credit card newbies can confidently choose the best credit card for starters. If you wonder how to get a credit card for the first time, remember that first-time credit card users succeed by starting smart. That’s how to choose the best credit card for beginners in the Philippines.

Key Takeaways

- Choose a credit card that fits your spending habits and offers rewards you can use, like cashback on groceries or fuel discounts.

- Compare fees, rewards, and approval requirements from different banks to find a card that matches your budget and lifestyle.

- Prepare all required documents and meet eligibility rules before applying to increase your chances of approval.

- Use your credit card responsibly by paying your bills on time, keeping your spending low, and checking your statements regularly.

- Start with beginner-friendly cards, such as secured cards, to build your credit history and gain financial confidence.

How to Choose the Best Credit Card

Know Your Needs

When you start looking for the best credit card for beginners, you need to think about your daily habits. Do you spend more on food, shopping, or gas? Picking a card that matches your lifestyle helps you get the most out of its features and benefits. Here are some things to consider:

- If you often buy fuel, look for credit card options that offer cashback or discounts at gas stations.

- If you love eating out, choose cards with rewards for restaurant spending.

- For big purchases, cards with installment features and low interest rates can help you manage payments.

- Always check for low or waived annual fees so you do not pay extra for features you do not use.

- Make sure the card has strong digital security features to keep your information safe.

Tip: The best credit card for beginners is the one that fits your spending habits and gives you rewards you can actually use.

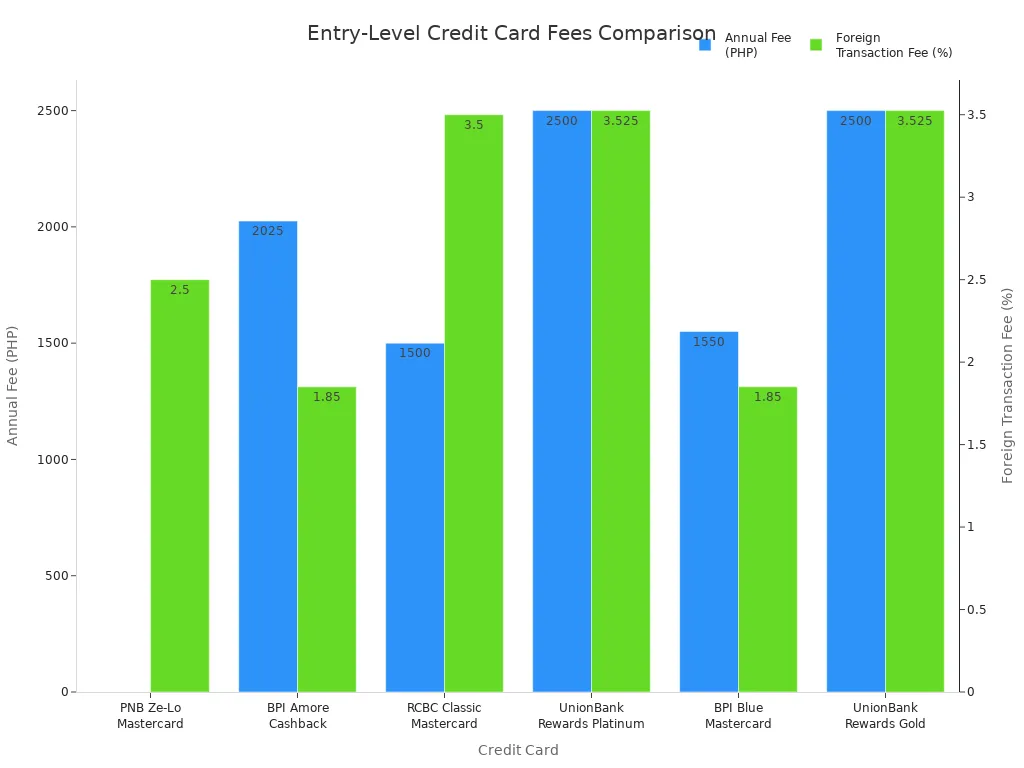

Compare Features

You should always do a credit card comparison before you apply. Each card has different features and benefits, so you want to see which one matches your needs. Here is a quick comparison of entry-level cards from major banks in the Philippines:

| Credit Card | Annual Fee (USD) | Eligibility | Foreign Transaction Fee | Cash Advance Fee (USD) | Key Features and Benefits |

|---|---|---|---|---|---|

| PNB Ze-Lo Mastercard | None | Age 21-65, min income $2,100 | 2.5% | $3.50 | No annual fee, installment features, electronic statements |

| BPI Amore Cashback Credit Card | $35 | Income & credit check required | 1.85% | $3.50 | Up to 4% cashback, installment features |

| RCBC Classic Mastercard | $26 | Age 18-65, proof of income required | 3.5% | $3.50 | Non-expiring rewards, travel insurance, lounge access |

| UnionBank Rewards Visa Platinum | $43 | Check with bank | 3.525% | $3.50 | Reward points (3x on shopping/dining), redeemable for cash/merchandise |

| BPI Blue Mastercard Rewards | $27 (waived 1st year) | Income & credit check required | 1.85% | $3.50 | Reward points, exclusive discounts via app |

| UnionBank Rewards Gold Visa | $43 | Bank approval required | 3.525% | $3.50 | Go Rewards membership, partner deals, welcome gift |

When you do a credit card comparison, look at the features and benefits that matter most to you. Some cards offer better rewards for shopping, while others focus on travel perks. Always check the annual fee and make sure the rewards you get are worth more than what you pay. The best credit card will have features that match your lifestyle and help you save money.

If you want to know how to choose the best credit card, start by listing your top spending categories. Then, compare features and benefits from different cards. This way, you can choose the right credit card for your needs and get the most value from your spending.

Key Factors for Credit Card for Beginners in the Philippines

Fees and Charges

When you look for a credit card for beginners in the Philippines, you want to check the fees and charges first. Some cards have no annual fee, while others may waive the fee for the first year. You also need to watch out for interest rates. Most beginner cards offer rates around 2% per month. Here’s a quick comparison of popular options:

| Credit Card Name | Annual Fee (USD) | Interest Rate (Monthly) | Notes on Fee Waiver or Requirements |

|---|---|---|---|

| PNB Ze-Lo Mastercard | 0 | 1.88% | No annual fee |

| RCBC Bankard / Flex Visa | 27 | 2% | Annual fee waived for first year |

| AUB Classic Mastercard | 0 | 2% | No annual fee; income requirement applies |

| HSBC Red | 45 | ~2% | Annual fee waived first year |

| EastWest Practical | 25 | 2% | Low income requirement |

| Citi Rewards Card | 0 (first year) | ~2% | No fee first year; rewards and discounts |

| Metrobank M Free Mastercard | 0 | N/A | No annual fee for life; low income needed |

This comparison helps you see which features and benefits fit your budget. Always check the fine print before you apply.

Rewards and Perks

You want a credit card that gives you something back. Many cards offer rewards points, cashback, or special perks. Some cards focus on shopping, while others give you travel benefits. Take a look at this comparison of rewards cards and what they offer:

| Credit Card Name | Key Rewards and Perks | Ideal For |

|---|---|---|

| UnionBank Rewards Credit Card | 3x points on shopping/dining; points for cash, gadgets, more | Everyday spenders |

| HSBC Live+ Credit Card | Up to 8% cashback on dining | Frequent diners |

| BPI Visa Signature Card | 2 points per $0.36 spend; travel insurance; lounge access | Travelers |

| Metrobank Titanium Mastercard | Points on groceries, gas, drugstores; travel insurance | Beginners with steady income |

| BPI Petron Card | 3% rebate on fuel; welcome fuel voucher | Drivers and commuters |

When you compare features and benefits, you can find a card that matches your lifestyle. Some cards even let you use rewards for installments or discounts.

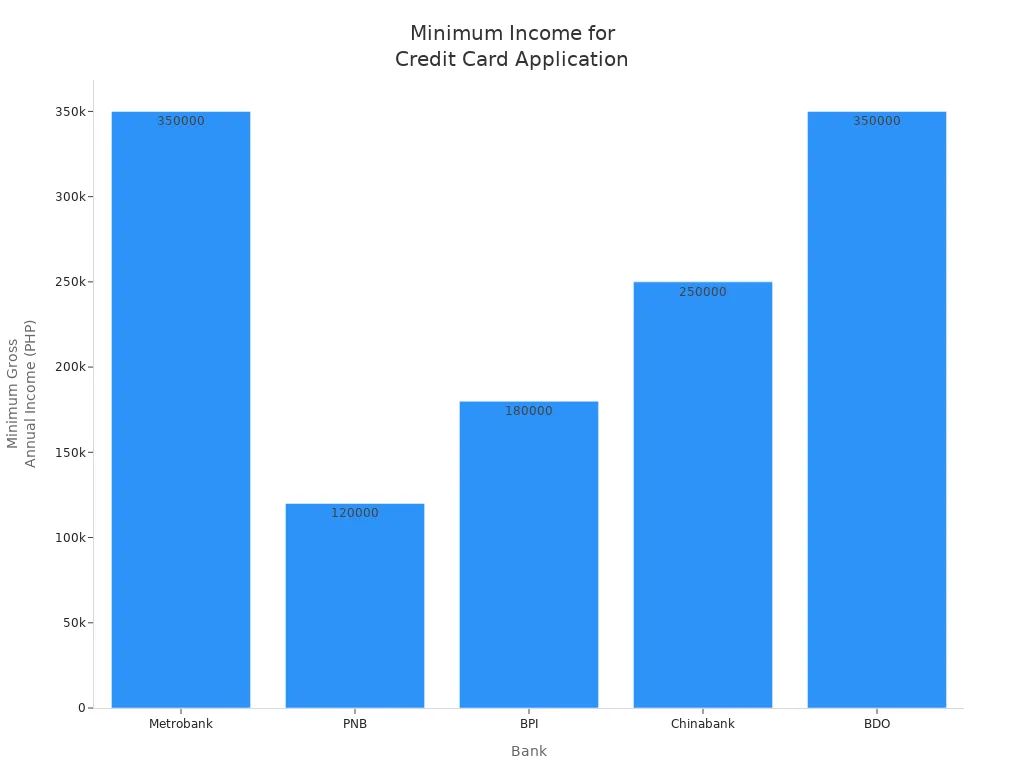

Approval Requirements

Every credit card has its own application requirements. You need to check your age, income, and documents before you apply. Most cards for beginners ask for proof of income and a valid ID. Some cards have lower income requirements, which makes approval easier. Always read the application requirements carefully. If you meet them, your chances of approval go up.

Tip: Prepare your documents early. This makes your application smoother and faster.

Security

Security is a must-have feature for any credit card. Look for cards with strong digital protection, like OTPs and fraud alerts. Many cards offer 24/7 customer support if you spot something wrong. Some even have features that let you lock your card from your phone. When you compare features and benefits, always check what security offers come with the card. Good security gives you peace of mind and protects your money.

Best Credit Card for Starters

Top Picks

You want to start your credit journey with the right card. Many banks in the Philippines offer beginner-friendly credit cards that make it easy for you to get approved and enjoy useful benefits. Here are some of the best credit cards for starters:

| Credit Card Name | Annual Fee (USD) | Main Benefits | Approval Ease |

|---|---|---|---|

| Security Bank Fast Track Secured | 0 | Guaranteed approval, no income requirement, builds credit history | Very high (secured) |

| BPI Express Start Card | 0 | Low deposit, easy approval, helps build credit | High (secured) |

| PNB Ze-Lo Mastercard | 0 | No annual fee, installment features, e-statements | High |

| BPI Amore Cashback | 35 | Up to 4% cashback, installment plans | Moderate |

| RCBC Classic Mastercard | 26 | Non-expiring rewards, travel insurance | Moderate |

| UnionBank Rewards Visa Platinum | 43 | 3x points on shopping/dining, flexible rewards | Moderate |

| BPI Blue Mastercard | 27 (waived 1st yr) | Reward points, exclusive app discounts | Moderate |

| Citi Simplicity+ | 0 (first year) | No late fees, no annual fee first year, simple terms | Moderate |

| Metrobank Titanium Mastercard | 43 | Points on groceries/gas, travel insurance | High |

| Petron BPI Card | 27 | 3% fuel rebate, welcome fuel voucher | Moderate |

| Bank of Commerce Classic Mastercard | 27 | Basic rewards, easy application | Moderate |

| RCBC Flex Visa | 27 | Flexible rewards, waived annual fee first year | Moderate |

| AUB Easy Mastercard | 0 | No annual fee, flexible payment schedules | High |

| BDO ShopMore Mastercard | 27 | Points for shopping, exclusive deals | Moderate |

Note: Secured cards like the Security Bank Fast Track Secured Credit Card and BPI Express Start Card guarantee approval even if you have no credit history. You only need to make a deposit as collateral.

Many of these starter credit cards offer low or no annual fees. Some even waive the fee for the first year. You can find cards that give you cashback, points, or fuel rebates. These offers help you save money and get more value from your spending.

Who Each Card Suits

Choosing the best credit card for starters depends on your needs and lifestyle. Here’s a quick guide to help you decide which card fits you best:

- Security Bank Fast Track Secured Credit Card

You want the highest approval rate. You have no credit history or bad credit. You can provide a deposit as collateral. This card helps you build your credit score from scratch. - BPI Express Start Card

You want a secured card with a low deposit. You are a first-time applicant who wants to establish a credit history. This card is easy to get and helps you learn how to manage credit. - PNB Ze-Lo Mastercard

You want no annual fee and simple features. You prefer a card that is easy to maintain. This card suits you if you want to avoid extra charges. - BPI Amore Cashback

You spend a lot on groceries or dining. You want to earn cashback on daily expenses. This card gives you up to 4% cashback and installment options. - RCBC Classic Mastercard

You want rewards that never expire. You travel sometimes and want insurance coverage. This card offers travel perks and flexible rewards. - UnionBank Rewards Visa Platinum

You love shopping and dining out. You want to earn more points for every purchase. This card gives you 3x points on select categories. - BPI Blue Mastercard

You want a card with reward points and app discounts. You like using digital banking features. This card is good for tech-savvy starters. - Citi Simplicity+

You want a card with no late fees and simple terms. You do not want to worry about extra charges. This card is easy to use and manage. - Metrobank Titanium Mastercard

You want points for groceries, gas, and drugstores. You have a steady income and want travel insurance. This card is flexible for everyday spending. - Petron BPI Card

You drive often and want fuel rebates. You want to save money on gas. This card gives you a 3% rebate and a welcome voucher. - Bank of Commerce Classic Mastercard

You want a basic card with easy application. You are new to credit cards and want simple rewards. This card is a good entry-level choice. - RCBC Flex Visa

You want flexible rewards and a waived annual fee for the first year. You want to try out credit card benefits without long-term costs. - AUB Easy Mastercard

You want no annual fee and flexible payment schedules. You want to control your payment dates. This card is great for budget-conscious starters. - BDO ShopMore Mastercard

You love shopping and want exclusive deals. You want to earn points for every purchase. This card is perfect for frequent shoppers.

Tip: If you want the easiest approval, choose a secured card like Security Bank Fast Track Secured Credit Card. You do not need a high income or credit history. You only need to provide a deposit.

Starter credit cards in the Philippines offer many options for new users. You can find cards with low fees, easy approval, and useful rewards. These beginner-friendly credit cards help you build your credit history and enjoy practical benefits. When you compare credit card options, look for offers that match your spending habits and financial goals. The best credit card for starters gives you the right mix of approval ease, rewards, and savings.

How to Apply for a Credit Card

Image Source: pexels

Prepare Documents

You need to get your documents ready before you start the credit card application process. Banks in the Philippines usually ask for a few basic papers. Here is what you should prepare:

- Completed credit card application form

- Data privacy consent form

- Recent 1x1 ID picture

If you work for a company, you also need:

- Latest income tax return

- Employment certification

- Pay slips for the last three months

- Valid photo ID with your signature

- Proof of billing address

If you run your own business, you should have:

- Business registration papers

- Latest income tax return with audited financial statements

- Valid photo ID with your signature

- Proof of billing address

Tip: Prepare all your documents before you start. This makes the application process faster and easier.

Check Eligibility

You must meet the application requirements set by each bank. These usually include age, income, and employment status. Here is a quick look at what some major banks require:

| Bank | Age Requirement | Minimum Gross Annual Income (USD) | Employment Status Requirement |

|---|---|---|---|

| Metrobank | 18 to 70 years old | $6,300 | Employed: Regular employee with proof; Self-employed: Business with audited financials |

| PNB | 21 to 65 years old | $2,160 | Employed: Regular employee for at least 1 year; Self-employed: Profitable business for at least 2 years |

| BPI | At least 21 years old | $3,240 | Employed: Proof of employment and income; Self-employed: Active business with audited financials |

| Chinabank | 21 to 55 years old | $4,500 | Employed: Regular employee; Self-employed: Business operating legally for at least 2 years |

| BDO | 18 to 70 years old | $6,300 | Employed: Regular employee with proof; Self-employed: Business with audited financials |

Always check the application requirements for your chosen bank. If you meet them, you have a better chance of approval.

Application Steps

You can follow these steps to complete your credit card application:

- Choose the card that fits your needs and check its application requirements.

- Gather all the needed documents.

- Fill out the credit card application form. You can do this online or at a bank branch.

- Submit your documents and wait for the bank to review your application.

- If approved, you will get your card and can start using it.

Note: Some banks let you track your application process online.

Tips for Approval

You want to boost your chances of getting approved. Here are some tips:

- Make sure you meet all the application requirements before you apply.

- Double-check your documents for errors or missing info.

- Keep your credit card application honest and clear.

- Avoid applying for many cards at once. Too many applications can lower your chances.

- If you wonder how to get a credit card for the first time, start with a card that has simple application requirements.

A smooth application process starts with good preparation. When you follow these steps, you make it easier to get your first credit card.

Responsible Use of Credit Card for Beginners

Image Source: pexels

Pay On Time

Paying your credit card bill on time is the most important habit you can build as a beginner. When you pay before the due date, you avoid late fees and high interest. Try to pay more than the minimum amount. This helps you lower your balance faster and keeps your credit score healthy. Setting up automatic payments can help you never miss a due date. If you miss a payment by more than 30 days, your credit score can drop a lot. Always check your statement for the due date and plan your payments.

Manage Spending

It’s easy to spend more than you planned with a credit card. To avoid this, create a budget and stick to it. Only use your card for things you can pay off each month. Keep your balance low compared to your credit limit. This is called a low credit utilization ratio, and it helps your credit score. Review your statements often to spot any charges you don’t recognize. If you can’t pay the full balance, pay as much as you can to reduce interest costs.

Tip: Assign your card for specific uses, like groceries or gas, to control spending.

Build Credit

Using your card wisely helps you build a strong credit history. Good habits like paying on time and keeping balances low show banks you are responsible. Avoid applying for too many new cards at once. Each application can lower your score a little. If you are a supplementary cardholder, you can also build credit if the main cardholder uses the card well. Over time, these habits make it easier to get loans or better cards.

Avoid Pitfalls

Many first-time users fall into common traps. Watch out for these mistakes:

- Spending too much and building up debt you can’t pay off

- Not having a plan to repay your balance

- Taking cash advances, which have high fees and interest

- Missing the fine print on fees, interest rates, or rewards

- Relying on short-term loans with high interest

To avoid these problems, always read your card’s terms, set spending limits, and review your card’s features every year. If you ever feel lost, ask your bank for help or advice.

Note: Bad credit habits can make it hard to get loans, rent a home, or even get a job in the future. Responsible use helps you avoid these problems and gives you more financial freedom as one of the new credit card starters.

Choosing your first credit card in the Philippines feels easier when you know what to look for. Compare cards based on fees, rewards, and approval requirements. Pick one that matches your lifestyle. Use your card wisely by following these habits:

- Pay your balance in full and on time.

- Keep your spending below 30% of your credit limit.

- Check your statements for errors.

- Set reminders for payments.

- Never share your card details.

Start strong and build good credit habits. You can take the next step with confidence.

FAQ

What is the minimum income to get a credit card in the Philippines?

Most banks require a minimum annual income of around $2,100 to $6,300. Check your chosen bank’s website for the latest requirements. You can use XE.com to see the current exchange rate for USD to PHP.

Can students apply for a credit card?

Yes, you can apply if you are at least 18 years old and meet the bank’s requirements. Some banks offer starter or secured cards for students. You may need a deposit or a guarantor.

How long does credit card approval take?

Banks usually process applications within 5 to 14 business days. If you submit complete documents, you may get approved faster. Some banks offer online tracking for your application status.

What happens if I miss a payment?

You will pay a late fee and interest on your balance. Missing payments can lower your credit score. Always pay on time to avoid extra charges and protect your credit history.

Choosing your first credit card in the Philippines is a key step to building credit, but high fees and unfavorable exchange rates can complicate international spending. BiyaPay offers a cost-effective alternative with remittance fees as low as 0.5%, outpacing many credit card fees. It supports same-day transfers to most countries, ensuring fast, secure access to funds. Real-time exchange rate queries and seamless fiat-to-digital currency conversion make global payments easy. Register quickly and securely without branch visits, ideal for beginners managing cross-border expenses. Start your financial journey smarter—sign up for BiyaPay for low-cost, reliable international transactions.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.