- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What Are the Costs of Using Bank of America Cards Abroad

Image Source: pexels

When you use your Bank of America card abroad, you often face foreign transaction fees. Most Bank of America cards charge a 3% fee for each international purchase or ATM withdrawal. Some cards, such as the Bank of America Travel Rewards Credit Card, do not charge foreign transaction fees. If you withdraw cash from an ATM, you may also pay a $5 fee unless you use a partner ATM. Using your card abroad can add up in costs, so knowing these details helps you manage your money better.

Key Takeaways

- Most Bank of America cards charge a 3% fee on purchases and ATM withdrawals made outside the U.S., which can add up quickly.

- Using ATMs abroad usually costs a $5 fee plus the 3% foreign transaction fee, but you can avoid the $5 fee by using partner ATMs in the Global ATM Alliance.

- Some Bank of America credit cards, like the Travel Rewards card, do not charge foreign transaction fees and offer extra travel benefits.

- Plan your cash withdrawals carefully to avoid multiple fees and consider ordering foreign currency in advance to save money.

- Choosing the right card and using partner ATMs helps you save money and enjoy better rewards when traveling internationally.

Bank of America Foreign Transaction Fee

When you travel or shop outside the United States, you need to understand how foreign transaction fees work with your Bank of America cards. These fees can affect both your debit and credit card purchases, as well as ATM withdrawals. The standard foreign transaction fee for Bank of America is 3% of the transaction amount. This rate sits at the higher end of the industry average, which ranges from 1% to 3% among major U.S. banks. The 3% fee includes about 1% for the payment processor, such as Visa or Mastercard, and 2% for Bank of America. Even though 3% may seem small, it can add up quickly if you make frequent or large international transactions. You should also know that Bank of America may apply this fee even if you make a purchase in U.S. dollars, as long as the transaction is processed outside the United States. For the most accurate details, review your card agreement or contact Bank of America customer service.

Debit Card Fees

When you use your Bank of America debit card for a foreign debit card purchase or an ATM withdrawal abroad, you usually pay a 3% foreign transaction fee. This fee covers currency conversion fees and processing costs. The table below shows the main differences between point-of-sale purchases and ATM withdrawals with your debit card:

| Fee Type | Point-of-Sale Purchases Abroad | ATM Withdrawals Abroad |

|---|---|---|

| Foreign Transaction Fee | 3% | 3% (foreign currency conversion fee) |

| Out-of-Network ATM Fee | N/A | $5 flat fee |

| Additional ATM Owner Fee | N/A | Possible extra fee from ATM owner |

If you make a foreign debit card purchase at a store or restaurant, you pay only the 3% fee. If you withdraw cash from an ATM, you pay the 3% fee plus a $5 out-of-network ATM fee. The ATM owner may also charge an extra fee. These extra charges can make ATM withdrawals much more expensive than using your card for purchases. You should also watch out for dynamic currency conversion offers at foreign ATMs, as these can add more costs to your transaction.

Credit Card Fees

Most Bank of America credit cards charge a 3% foreign transaction fee on international purchases. This fee applies to each purchase made outside the United States. The following table lists some common Bank of America credit cards and their foreign transaction fees:

| Card Type | Foreign Transaction Fee |

|---|---|

| Customized Cash Rewards | 3% |

| Customized Cash Rewards Secured | 3% |

| Unlimited Cash Rewards | 3% |

| Susan G. Komen Cash Rewards | 3% |

| Bank Americard | 3% |

| BankAmericard Secured | 3% |

| BankAmericard for Students | 3% |

| Cash Rewards for Students | 3% |

| Unlimited Cash Rewards for Students | 3% |

The 3% fee applies after currency conversion. If you use a Mastercard, the mastercard foreign transaction fee is included in this 3%. This means you do not pay an extra fee on top of the 3% for using a Mastercard. The same rule applies to Visa cards. If you travel often or make many international purchases, these fees can add up quickly.

No-Fee Card Options

You can avoid foreign transaction fees by choosing credit cards with no transaction fees. Bank of America offers several options, such as the Bank of America Travel Rewards Credit Card. This card does not charge foreign transaction fees, making it a good choice for international travelers. The table below highlights the main features of this card:

| Card Name | Foreign Transaction Fees | Credit Score Requirement | Annual Fee | Intro Bonus | Additional Benefits for Preferred Rewards Members |

|---|---|---|---|---|---|

| Bank of America Travel Rewards | None | 630-850 (Good to Excellent) | None | 25,000 points after spending $1,000 in 90 days | Earn 25%-75% more points on every purchase |

You also get other benefits with no foreign transaction fees cards, such as travel accident insurance, lost luggage reimbursement, and trip cancellation coverage. The Bank of America Premium Rewards card is another strong option. It offers 60,000 bonus points after you spend $4,000 in 90 days, 2 points per dollar on travel and dining, and 1.5 points on other purchases. Preferred Rewards members can earn even more points. These cards also provide flexible redemption options, including cash back, travel bookings, and point transfers to airline and hotel partners.

Tip: If you travel often, using a card with no foreign transaction fees can save you a lot of money. You also get better rewards and travel protections compared to cards that charge these fees.

By choosing the right card and understanding the fee structure, you can manage your spending and avoid unnecessary charges when making a foreign debit card purchase or using your credit card abroad.

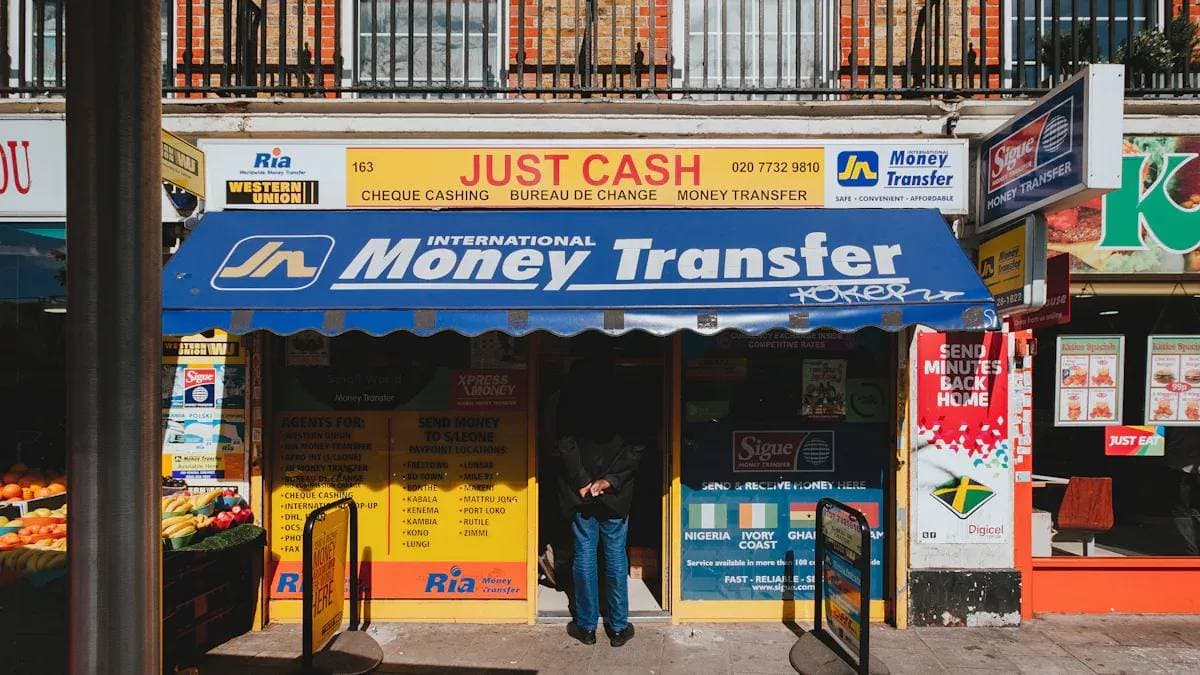

Bank of America ATM Fees Abroad

Image Source: unsplash

Standard ATM Fees

When you make a foreign ATM withdrawal with your Bank of America card, you usually pay a $5 fee for each transaction. This fee applies every time you take out cash from an ATM outside the United States. On top of the $5 charge, you also pay a 3% foreign transaction fee on the total amount you withdraw. For example, if you withdraw $60, you pay $5 plus $1.80 (which is 3% of $60), making your total fees $6.80 before any other charges. These fees can add up quickly if you use ATMs often during your travels. Always check your withdrawal amount and plan ahead to avoid making many small transactions.

Note: The $5 fee and the 3% foreign transaction fee apply to each foreign ATM withdrawal, no matter which country you visit.

Global ATM Alliance

Bank of America partners with several international banks through the Global ATM Alliance. If you use your card at an ATM operated by one of these partner banks, you do not pay the $5 usage fee or the ATM operator’s access fee. However, the 3% foreign transaction fee still applies. This partnership helps you save money when you travel to countries where alliance banks operate. Here is a table showing some of the main alliance banks and their coverage areas:

| Coverage Area | Alliance Bank Member |

|---|---|

| United Kingdom | Barclays |

| France | BNP Paribas and affiliates |

| Germany, Spain | Deutsche Bank |

| Canada, Mexico, Chile, Peru, Caribbean nations | Scotiabank |

| Australia, New Zealand | Westpac and affiliates |

| Ukraine | Ukrsibbank |

| Turkey | TEB |

You can also use China Construction Bank ATMs in China to avoid the $5 fee. Always look for these partner banks when you need to make a foreign ATM withdrawal.

Additional Operator Fees

Even when you use your Bank of America card abroad, local ATM operators may charge extra fees. These fees vary by country and bank. Some banks in places like Costa Rica, Albania, or Jamaica do not charge extra fees, while others in Croatia or Turkey may charge a fixed amount per withdrawal. For example, in Croatia, some banks charge around $5 to $6 per transaction. In Turkey, you might pay up to $1.50 at certain banks, but others are free. These operator fees come on top of the $5 Bank of America fee and the 3% foreign transaction fee, unless you use a Global ATM Alliance partner. Always check the ATM screen for fee notices before you complete your international ATM withdrawal.

Avoiding Foreign Transaction Fees

Image Source: pexels

Choosing No-Fee Cards

You can save money by selecting credit cards with no transaction fees. Many travelers choose the best no foreign transaction fee credit cards to avoid extra charges when making purchases abroad. These cards do not add foreign transaction fees to your bill, so you keep more of your money. If you travel often, look for cards that offer rewards and travel benefits along with no foreign transaction fees. You should review your card’s terms before your trip to make sure you have the right card for using your card abroad.

Using Partner ATMs

When you withdraw cash overseas, using partner ATMs can help you avoid high fees. Bank of America works with global banks to waive the $5 withdrawal fee and the 3% currency conversion fees at partner ATMs. This partnership means you do not pay the usual charges that come with non-partner ATMs. The table below shows how fees compare:

| Fee Type | Fee Amount | Reimbursement Eligibility |

|---|---|---|

| In-Network ATM Withdrawal | $0 | N/A |

| Out-of-Network ATM Withdrawal | $2.50 + ATM operator fee | Varies by Preferred Rewards status |

| International ATM Withdrawal | $5.00 + 3% conversion fee | Varies by Preferred Rewards status |

By staying in-network or using partner ATMs, you avoid paying multiple fees. This strategy helps you reduce the total cost of accessing cash while traveling.

Practical Tips

You can further lower your costs by planning your currency exchanges in advance. If you order more than $1,000 in foreign currency online, you avoid the $7.50 delivery fee. Ordering ahead lets you lock in the exchange rate and avoid poor rates or extra fees at your destination. You can pick up your currency at a financial center or have it delivered. This approach gives you better control over your spending and helps you avoid last-minute surprises. Always check your card’s terms and plan your withdrawals to minimize foreign transaction fees.

You face several costs when using your card abroad. The table below summarizes the main fees:

| Card Type / Account | Foreign Transaction Fee | Additional Fees |

|---|---|---|

| Most Debit Cards | 3% | $5 ATM fee |

| Most Credit Cards | 3% | N/A |

| No-Fee Credit Cards | None | Annual fee |

To reduce foreign transaction fees, follow these steps:

- Select cards with no foreign transaction fees.

- Use partner ATMs to avoid extra withdrawal charges.

- Review your card terms and plan your spending before you travel.

Always check your account details and prepare in advance to avoid unexpected charges.

FAQ

What is the standard foreign transaction fee for Bank of America cards abroad?

You pay a 3% fee on each purchase or ATM withdrawal processed outside the United States. This fee applies even if the transaction is in U.S. dollars.

How can you avoid the $5 ATM withdrawal fee when traveling?

You can use ATMs that belong to the Global ATM Alliance. These partner ATMs waive the $5 withdrawal fee. The 3% foreign transaction fee still applies.

Do all Bank of America credit cards charge foreign transaction fees?

No, some cards do not charge these fees. For example, the Bank of America Travel Rewards Credit Card and the Premium Rewards Credit Card have no foreign transaction fees.

What fees should you expect when withdrawing cash from a non-partner ATM abroad?

| Fee Type | Amount |

|---|---|

| ATM Usage Fee | $5 per withdrawal |

| Foreign Transaction Fee | 3% of withdrawal |

| Operator Fee | Varies by ATM owner |

You may pay all three fees if you use a non-partner ATM.

Navigating foreign transaction fees with Bank of America cards can erode your travel budget, especially with 3% fees on purchases and ATM withdrawals, plus potential $5 ATM charges. BiyaPay offers a smarter alternative with remittance fees as low as 0.5%, significantly undercutting typical bank charges. Supporting same-day transfers to most countries, BiyaPay ensures quick, secure access to your funds. Its real-time exchange rate queries and fiat-to-digital currency conversion simplify international spending. Registering is fast, secure, and requires no in-person visits, ideal for travelers. Save on fees and streamline your global transactions—sign up for BiyaPay today for cost-effective, reliable payments abroad.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.