- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

5 Wise Alternatives with Lower Fees and Faster Transfers

Image Source: unsplash

Looking for alternatives to Wise for international money transfers? You have great options. The top 5 wise alternatives are PayPal, Revolut, Remitly, OFX, and Xe Money Transfer. Many people like these alternatives to Wise because they want lower fees, faster transfers, or extra business features. The global market for money transfers is huge—over $42 billion in 2025, with Wise competitors like PayPal and Revolut holding strong positions. You can find alternatives that match your needs and help you save money or time.

Key Takeaways

- OFX and Revolut offer low fees and transparent pricing, making them great choices for affordable international transfers.

- PayPal and Remitly provide very fast transfers, often in minutes, ideal for urgent money sending needs.

- Each provider has unique features: Remitly supports cash pickup, Revolut offers multi-currency wallets, and OFX suits large business transfers.

- Check fees, exchange rates, and transfer speed carefully before sending money to save costs and get the best service.

- Choose a provider based on your needs—fast delivery, low cost, business tools, or payout options—to send money with confidence.

Alternatives to Wise: Quick Comparison

Image Source: pexels

When you look for alternatives to Wise, you want to know how they stack up on fees, speed, and features. Here’s a quick table to help you compare the top five wise alternatives for international money transfers:

| Provider | Fees & Exchange Rates | Transfer Speed | Key Features |

|---|---|---|---|

| PayPal | Higher fees, especially with cards | Minutes to 1 day | Global reach, easy to use, supports Xoom |

| Revolut | Low to moderate, no hidden markups | Minutes to 2 days | Multi-currency accounts, app-based, budgeting |

| Remitly | Flexible: Express (higher), Economy (lower) | Minutes to 5 days | Cash pickup, mobile wallet, bank deposit |

| OFX | Zero transfer fees, great rates for large sums | 1-4 days | High limits, rate lock, business tools |

| Xe Money Transfer | Transparent fees, competitive rates | 1-4 days | High limits, app, no cash pickup |

Fees

You want low-cost international transfers, so fees matter most. OFX stands out for large cross-border transfers because it charges zero transfer fees and offers competitive exchange rates. This makes it a top choice for businesses and anyone moving large amounts. Revolut also gives you low-cost money transfers with no hidden markups, but some premium features need a monthly fee. Remitly lets you pick between fast and cost-effective transfers: Express costs more but is quick, while Economy is slower but cheaper. Xe Money Transfer keeps things clear with transparent fee structures and good rates, but it does not support cash pickup. PayPal, including its Xoom service, is easy to use but usually has higher fees, especially if you use a credit card.

Transfer Speed

Fast transfers can make a big difference. If you need your money to arrive quickly, PayPal and Remitly’s Express option can deliver funds in minutes. Revolut also processes many transfers within minutes, but some may take up to two days. OFX and Xe Money Transfer usually take one to four days, which works well for less urgent transfers. Remitly gives you a choice: pay more for speed or save with slower delivery. Wise competitors like TransferGo are known for the fastest international payment solution, but among these five, Remitly and PayPal lead for speed.

Key Features

Each provider offers something unique. PayPal gives you global reach and supports Xoom for fast transfers. Revolut lets you hold and spend in many currencies, making it a flexible international payment solution. Remitly supports cash pickup, mobile wallets, and bank deposits, which helps if your recipient does not have a bank account. OFX is great for businesses and large transfers, with tools like rate locks and high transfer limits. Xe Money Transfer is simple, offers transparent fee structures, and supports high-value transfers, but does not offer cash pickup.

Tip: If you want affordable money transfers with transparent fees, OFX and Revolut are strong choices. For fast and cost-effective transfers, Remitly’s Express service or PayPal’s Xoom can help you send money in minutes.

Wise Alternatives: Provider Reviews

PayPal

PayPal stands out as one of the most recognized alternatives to Wise. You probably know PayPal for online shopping, but you can also use it for international money transfers. PayPal lets you send money to over 200 countries and regions. It supports many payment methods, including credit cards, bank accounts, and PayPal balance. Transfers between PayPal accounts are instant, but moving funds to a bank account can take a few days.

How does PayPal compare to Wise?

Wise focuses on low fees and real exchange rates. PayPal charges higher fees, especially for currency conversion and credit card payments. Wise is more transparent about costs, while PayPal’s fees can add up quickly. However, PayPal offers more payment options and is accepted by many online stores and businesses.

Main Features:

- Wide global reach

- Instant transfers between PayPal accounts

- Supports credit cards, bank accounts, and PayPal balance

- E-commerce integrations and invoicing

- Buyer and seller protection

Pros and Cons:

| Pros | Cons |

|---|---|

| No setup fees | High international transaction fees (4.4% + $0.30) |

| Wide acceptance | Currency conversion markups |

| Strong security | Account freezing issues |

| Quick, secure transfers | Slow dispute resolution, poor customer service |

Tip: If you want an international payment solution for e-commerce or need to send money quickly to someone with a PayPal account, PayPal is a solid choice. Watch out for high fees and possible account holds.

Best Use Cases:

- E-commerce sellers and buyers

- Peer-to-peer payments

- Sending money to friends or family who already use PayPal

- Businesses needing mass payouts or global payment acceptance

Revolut

Revolut is a digital banking app that gives you a multi-currency wallet and many financial tools. You can hold, exchange, and spend in over 30 currencies. Revolut is popular with frequent travelers and businesses that need to manage money in different countries.

How does Revolut compare to Wise?

Wise offers more currencies and always uses the mid-market exchange rate. Revolut gives you a monthly no-fee currency conversion limit, but charges a 0.5% fee if you go over. On weekends and holidays, Revolut adds a 1% markup. Wise is more transparent with fees, but Revolut offers more financial services, like savings, investing, and crypto trading.

Main Features:

- Multi-currency support with instant currency exchange

- Physical and virtual cards for spending

- Budgeting tools and spending analytics

- Instant transfers between Revolut users

- Local bank account details in select countries

- Business accounts with bulk payments and app integrations

Pros and Cons:

| Pros | Cons |

|---|---|

| Fast transfers, often within minutes | Fees for currency exchange outside market hours |

| Multi-currency wallet | Limited to 30+ currencies |

| Great for frequent travelers | Some features require paid plans |

| Business tools and integrations | Customer support can be slow |

Note: Revolut is a strong international payment solution for travelers and businesses. You get flexibility, budgeting tools, and the ability to send money quickly. Just keep an eye on fees if you exchange money on weekends or need advanced features.

Best Use Cases:

- Frequent travelers who need to spend in different currencies

- Businesses managing global teams

- Users who want to invest or save in multiple currencies

- Sending money to friends or family abroad

Remitly

Remitly focuses on fast, flexible international money transfers, especially for personal remittances. You can choose between Express (faster, higher fee) and Economy (slower, lower fee) options. Remitly supports cash pickup, mobile wallets, and bank deposits, making it easy for recipients without a bank account.

How does Remitly compare to Wise?

Wise is best for transparent, low-cost transfers to bank accounts. Remitly gives you more delivery options, including cash pickup and mobile wallets. Remitly’s Express service can deliver funds in minutes, while Wise usually takes 1-2 days.

Main Features:

- Express and Economy transfer options

- Cash pickup at thousands of locations

- Mobile wallet and bank deposit support

- Strong presence in Latin America and Southeast Asia

- 24/7 multilingual customer support

Pros and Cons:

| Pros | Cons |

|---|---|

| Fast, reliable transfers | High fees for Express service |

| Multiple payout options | Fluctuating exchange rates |

| User-friendly app | Account suspensions without clear reasons |

| Transparent pricing | Mixed customer support reviews |

Tip: Remitly is a great choice if you need to send money quickly to family or friends who want cash pickup or mobile wallet delivery. It’s one of the best alternatives to Wise for speed and flexibility.

Best Use Cases:

- Sending remittances to family in countries with limited banking access

- Fast transfers for emergencies

- Recipients who prefer cash pickup or mobile wallets

OFX

OFX specializes in large international money transfers. You can send money to over 190 countries, but you need to transfer at least $1,000 USD. OFX charges no fees for transfers above $10,000 USD and offers competitive exchange rates, especially for big amounts.

How does OFX compare to Wise?

Wise works well for small and medium transfers with no minimum amount. OFX is better for large transfers, thanks to no fees and lower exchange rate margins as the amount increases. OFX also offers advanced business tools, like forward contracts and market orders, which Wise does not.

Main Features:

- No transfer fees for amounts above $10,000 USD

- Competitive exchange rates for large sums

- Currency risk management tools

- 24/7 phone support and dedicated account managers

- Business accounts with mass payouts and global currency accounts

Pros and Cons:

| Pros | Cons |

|---|---|

| No fees for large transfers | $1,000 USD minimum transfer |

| Great rates for high-value transfers | $15 fee for transfers under $10,000 USD |

| Advanced business tools | Not ideal for small transfers |

| Personalized support | Exchange rate markup (0.4%–1.5%) |

Note: OFX is a top international payment solution for businesses and individuals who need to move large sums. You get secure transfers, expert support, and tools to manage currency risk.

Best Use Cases:

- Businesses making mass payouts or paying overseas suppliers

- Individuals transferring large amounts for property or investments

- Users who want personalized service and advanced currency tools

Xe Money Transfer

Xe Money Transfer is known for its global reach and simple process. You can send money to over 170 countries with competitive rates. Xe offers high transfer limits and a user-friendly app, making it easy to manage international payments.

How does Xe compare to Wise?

Wise is more transparent with fees and uses the mid-market exchange rate. Xe offers competitive rates but may include a small markup. Xe supports more countries, but does not offer cash pickup. Both services are regulated and secure.

Main Features:

- Transfers to 170+ countries

- Competitive exchange rates

- High transfer limits

- User-friendly app and website

- Strong security with two-factor authentication

Pros and Cons:

| Pros | Cons |

|---|---|

| Broad global coverage | No cash pickup option |

| Simple, easy-to-use platform | Exchange rate markup |

| High transfer limits | Less transparent fees than Wise |

| Secure and regulated | Customer satisfaction varies |

Tip: Xe is a good alternative if you want to send money to a wide range of countries and need high transfer limits. It’s easy to use and offers secure transfers, but always check the final rate before you confirm.

Best Use Cases:

- Sending money to countries not covered by other providers

- High-value transfers

- Users who want a simple, secure way to manage international payments

Side-by-Side Comparison

Image Source: pexels

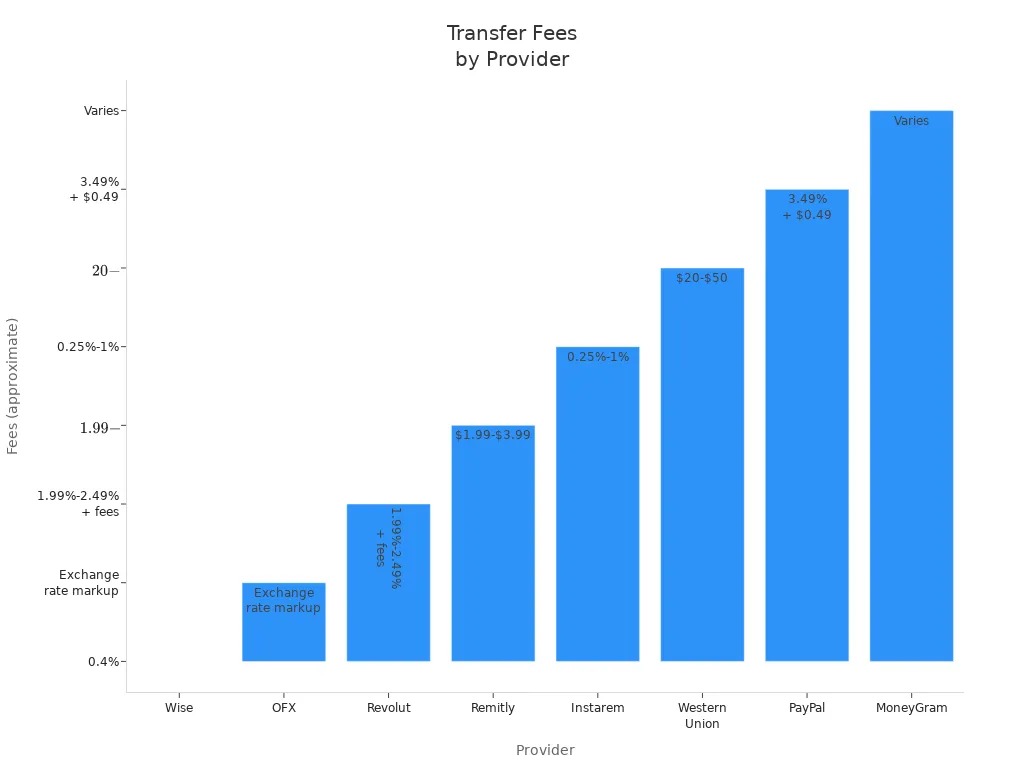

Fees Breakdown

When you compare money transfers, fees can make a big difference. Some providers show you all costs up front, while others add hidden charges or mark up the exchange rate. Here’s a quick look at how the main Wise alternatives stack up:

| Service | Transfer Fees | Exchange Rate Margin | Transfer Limits | Hidden Charges / Notes |

|---|---|---|---|---|

| Payoneer | 0%–3% (3% for credit cards) | ~2% above mid-market rate | $5,000 daily | Complex pricing, business only, extra withdrawal fees |

| OFX | No fee for most transfers | Small margin on exchange rate | $1,000 minimum | Best for large transfers, no cash pickup, no multi-currency accounts |

| WorldRemit | Varies by method | Markups on exchange rates | $5,000 USD/EUR | Fees depend on method and country, cash pickup limited |

| Revolut | Starts at 0.8% + 2¢, free up to limit | Real-time rates, no hidden charges | Varies, higher on paid | Extra fees for weekend or over-limit exchanges, ATM fees after threshold |

| Wise | Flat fee + % (e.g., $0.33 + 0.51%) | No markup, mid-market rate | N/A | Transparent fee structures, extra fees for some payment methods |

You want low-cost money transfers, so always check both the transfer fee and the exchange rate margin. Wise and Revolut lead with transparent fee structures, but OFX is best for large amounts because it skips fixed fees.

Tip: Watch out for cross-border fees and foreign exchange costs, especially if you use credit cards or need fast and cost-effective transfers.

Speed

Fast transfers help when you need money to arrive quickly. Wise uses a special network to move money fast. In early 2024, 60% of Wise transfers arrived instantly, 80% within an hour, and 95% within 24 hours. PayPal also sends money between users right away, but you might pay more for this speed. Remitly offers both fast and slower options, depending on what you choose. OFX and WorldRemit can take 1–4 days, especially for bank transfers.

| Provider | Payment Methods | Typical Speed | Notes |

|---|---|---|---|

| Wise | Bank, card | Instant to 1 day | Most arrive within an hour |

| PayPal | Debit, credit, PayPal balance | Instant | Higher fees for fast transfers |

| Remitly | Bank, cash, mobile wallet | Minutes to 5 days | Express is fastest, Economy is cheaper |

| OFX | Bank only | 1–4 days | Best for large transfers |

| Revolut | Bank, card | Minutes to 2 days | Fast for many countries |

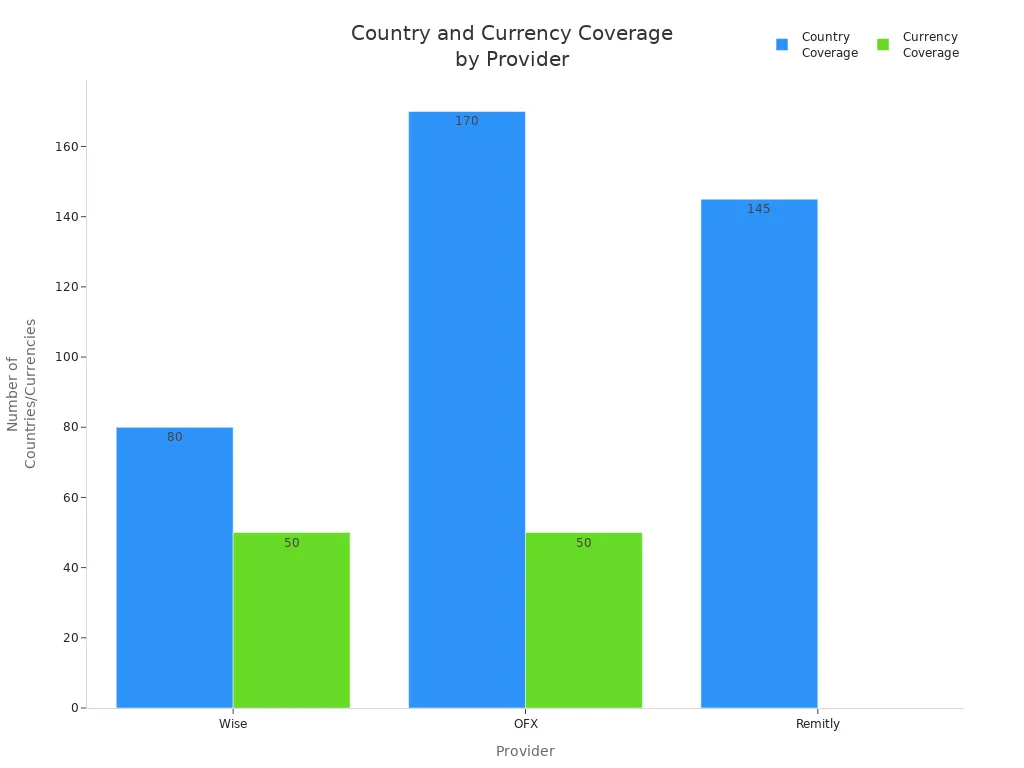

Coverage

You want to send money to as many places as possible. OFX leads with support for over 170 countries and 50 currencies. Wise covers 80+ countries and 50+ currencies. Remitly reaches 145+ countries, but not all payout methods are available everywhere.

| Provider | Country Coverage | Currency Coverage |

|---|---|---|

| OFX | 170+ | 50+ |

| Wise | 80+ | 50+ |

| Remitly | 145+ | N/A |

User Experience

You want a service that is easy to use and clear about costs. Wise gets high marks for its simple app, real-time updates, and clear pricing. Many users say Wise makes affordable money transfers easy. Some alternatives, like PayPal and Payoneer, have higher fees and less clear pricing. Remitly and OFX work well for special needs, like cash pickup or large transfers, but may not be as simple for everyone.

| Platform | User Experience Issues | Comparison to Wise |

|---|---|---|

| Payoneer | Account fees, withdrawal costs | Wise is more transparent and has lower fees |

| Remitly | Less competitive rates on express, variable fees | Wise offers better rates and more transparency |

| PayPal | Higher fees, less clear rates | Wise is cheaper and easier to understand |

| OFX | No major issues, but best for large transfers | Wise is better for small, everyday transfers |

| Revolut | No major issues, good for travelers | Wise supports more currencies and countries |

Note: If you want fast transfers and clear pricing, Wise and Revolut are strong picks. For business or high-value money transfers, OFX stands out.

Choosing the Best Alternative

Personal Transfers

When you want to send money to friends or family, you need to think about more than just the price. You want a provider that makes things easy and safe. Here are some things you should look at:

- Check all fees, including sending, transfer, and receiving fees.

- Compare exchange rates. Even a small difference can change the total cost.

- Look at transfer speed. Fast transfers cost more, but sometimes you need the money to arrive quickly.

- Make sure your recipient can get the money easily. Some services offer bank deposits, cash pickup, or mobile wallets.

- Choose a provider with strong security, like two-factor authentication and encryption.

- Make sure the provider is regulated and has a good reputation.

- Review customer support and how easy it is to use the app or website.

- Keep your confirmation numbers and check the status of your transfer.

If you want a fast and affordable way to send money, experts say Instarem is a top choice for personal remittances, especially for countries like India and the Philippines. Remitly is also popular for its flexible delivery options and speed.

Tip: Always use a rate comparison tool before you make a transfer. This helps you find the best deal and avoid hidden fees.

Business Needs

If you run a business, you need more than just low fees. You want payment solutions that help you manage money across borders and pay teams or suppliers. Here are some key things to consider:

- Look for transparent pricing and low exchange rate margins to protect your profits.

- Choose a provider that offers mass payouts, batch payments, and multi-currency accounts.

- Make sure the service works with your accounting software and other business tools.

- Check for strong security and compliance with local rules.

- Find out if you get a dedicated account manager or special business support.

- Review transfer speed and reliability to keep your cash flow steady.

- Think about features like rate alerts, forward contracts, and automation.

Providers like OFX and Revolut Business stand out for their business features. OFX gives you dedicated account managers and great rates for large transfers. Revolut Business offers real-time exchange rates, company cards, and easy integration with accounting software. Wise also supports batch payments and multi-currency accounts, but has some limits on transfer size and business support.

Note: The best provider depends on your needs. If you make lots of small payments, Revolut or Wise may work best. For high-value transfers or advanced features, OFX is a strong choice.

You have many choices for sending money abroad. Wise offers low fees and transparent rates, but other providers stand out for speed, business tools, or coverage. Check out this quick table to compare the main differences:

| Platform | Fees | Speed | Coverage & Features |

|---|---|---|---|

| Wise | Low | Moderate | Multi-currency, simple interface |

| Revolut | Varies | Fast | App-based, multi-currency wallet |

| PayPal | Higher | Fast | Global reach, easy to use |

| OFX | No fee (large transfers) | 1–4 days | High limits, business tools |

| Remitly | Flexible | Minutes–days | Cash pickup, mobile wallet |

Always compare fees, exchange rates, and speed before you send money. Use trusted resources like InternationalMoneyTransfer.com to check real-time rates. Think about your needs—speed, cost, payout options, and support—so you can pick the best provider for your next transfer.

FAQ

What is the cheapest way to send money internationally?

You usually find the lowest fees with OFX for large transfers and Revolut for smaller amounts. Wise also offers transparent pricing. Always compare both the transfer fee and the exchange rate before you send money. Check the latest USD exchange rates here.

How fast can I send money with these Wise alternatives?

Transfer speed depends on the provider and method. Here’s a quick look:

| Provider | Fastest Transfer Time |

|---|---|

| PayPal | Minutes |

| Remitly | Minutes (Express) |

| Revolut | Minutes |

| OFX | 1 day |

| Xe | 1 day |

Some transfers may take longer, especially to certain countries.

Are these money transfer services safe to use?

Yes, all these providers use strong security. You get encryption, two-factor authentication, and regulation by financial authorities. Always double-check the website address and never share your password with anyone.

Can I use these services for business payments?

Yes, you can. OFX and Revolut offer special business features like bulk payments and multi-currency accounts. Wise also supports business transfers but has some limits on transfer size and business support. Always review the business tools before you choose a provider.

After exploring Wise alternatives, BiyaPay can help you manage cross-border payments more efficiently. With real-time exchange rate queries and conversions, supporting over 30 fiat currencies and 200+ digital currencies, remittance fees as low as 0.5%, and coverage across over 200 countries and regions with same-day remittance delivery, BiyaPay offers a flexible payment solution. Additionally, BiyaPay’s Easy Card supports convenient payments on eBay, Amazon, PayPal, and more, simplifying your transactions. Experience these benefits now to enhance your financial management! BiyaPay makes your cross-border payments smoother.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.