Wave Accounting Review What Works and What Doesn’t

Image Source: pexels

If you run a small business or work as a freelancer, this Wave Accounting Review highlights a tool that makes accounting simple. Wave stands out because you can use its core features—like unlimited invoicing and expense tracking—completely free. The cloud platform offers a user-friendly interface and strong security, so you can manage your finances from anywhere. However, Wave Accounting does not have advanced features or many integrations. According to this Wave Accounting Review, it’s best suited for small businesses with basic needs, rather than companies seeking the best accounting software for complex tasks. Some support and payroll options come at an extra cost or are only available in the US and Canada.

Key Takeaways

- Wave Accounting offers free core features like unlimited invoicing and expense tracking, making it ideal for small businesses and freelancers on a tight budget.

- The platform is easy to use with a simple, user-friendly interface that helps beginners manage their finances without stress.

- Wave lacks advanced features such as inventory management and has limited customer support, which may not suit growing businesses with complex needs.

- Paid add-ons like payroll and live support are available but only in the US and Canada, and come with extra costs.

- Wave is best for those who want a basic, no-cost accounting solution but should consider other software if they need more features or plan to scale.

Wave Accounting Overview

Image Source: unsplash

What Is Wave Accounting

You might wonder what makes Wave Accounting stand out in the world of small business accounting. Wave is a cloud-based accounting platform that helps you manage your finances online. You can send invoices, track expenses, and see your financial reports from any device with internet access. The main appeal of Wave Accounting is that it offers these core features for free. You do not need to worry about monthly fees just to keep your books in order.

Wave focuses on making accounting easy for people who do not have a background in finance. The dashboard is simple, and you can find what you need without digging through menus. If you want to see how Wave compares to other big names in the cloud accounting space, take a look at this table:

| Company | Market Share (Est.) | Ranking |

|---|---|---|

| Wave Accounting | 0.24% | #29 |

| QuickBooks | 43.87% | N/A |

| NetSuite | 9.30% | N/A |

| Cognos | 7.18% | N/A |

You can see that Wave does not have the biggest market share, but it still serves thousands of users who want a simple, free solution.

Who Should Use Wave

Wave works best for people who want to keep things simple and affordable. If you run a small business, work as a freelancer, or manage an invoice-based business, you will likely find Wave helpful. Here are some of the main groups who use Wave:

- Small business owners with limited budgets who need to track expenses and generate reports.

- Startups looking for cost-effective financial tools.

- E-commerce businesses that use Shopify or PayPal and want to manage sales and transactions.

- Consultants who need to send invoices and track payments.

- Freelancers, independent contractors, and solo entrepreneurs who want free, cloud-based accounting.

Wave is not the best choice if you need advanced payroll, inventory management, or lots of integrations. Larger businesses with complex needs may want to look at other options. For most small businesses, Wave Accounting offers a user-friendly, cloud solution that covers the basics without extra costs.

Wave Accounting Review: Pros and Cons

Pros

When you look at a wave accounting review, you will see that many users love how much value they get for free. Here are some of the biggest advantages you will notice:

- Wave does not charge monthly fees for its core features. You can send unlimited invoices, track expenses, and manage your books without worrying about hidden costs. This makes it a top choice for freelancers and small businesses with tight budgets.

- You get a wide range of bookkeeping tools. Wave lets you create journal entries, reconcile your bank accounts, and customize your chart of accounts. You can also generate balance sheets and other financial reports.

- The platform supports unlimited income and expense tracking. You can link your bank accounts and categorize transactions in bulk, which saves you time.

- Wave offers receipt scanning and backup. You can snap a photo of a receipt and attach it to your expenses, making it easy to keep accurate records.

- Invoicing is simple and flexible. You can create and customize invoices, set up recurring billing, and send payment reminders. Wave also lets you track which clients have paid and which still owe you money.

- The reporting tools are strong for a free product. You can view income statements, cash flow reports, balance sheets, sales reports, and sales tax summaries.

- Wave is easy to use. The interface is clean and intuitive, so you do not need to be an accounting expert to get started.

- Getting started is quick. You can import your data and connect your bank accounts without hassle.

- If you need help, you can use the online knowledge base and community forums. Many users find answers to their questions there.

Note: Compared to paid platforms like QuickBooks Online or FreshBooks, Wave gives you many of the same bookkeeping and reporting features at no cost. This can save you hundreds of dollars each year.

Here is a quick look at how Wave stacks up against other platforms on price and features:

| Platform | Pricing Model | Key Features Included |

|---|---|---|

| Wave Accounting | Completely free, no monthly fees | Unlimited invoicing, items, contacts; payroll and bookkeeping paid add-ons |

| Bonsai | $19/month (Plus), $29/month (Premium) | Invoicing, project management, time tracking, white-labeling, subcontracting |

| FreshBooks | $7.50/month (Lite), $12.50/month (Plus), $25/month (Premium) | Basic invoicing, expense tracking, double-entry accounting, recurring invoices, project profitability tracking |

| QuickBooks Online | Starting at $25/month (Simple Start) | Invoicing, estimates, expense management, inventory management, extensive integrations |

You can see that Wave offers a lot for free, while other platforms charge monthly fees for similar features.

Cons

No wave accounting review would be complete without looking at the downsides. While Wave works well for many small businesses, you may run into some limits as your needs grow. Here are the main drawbacks you should know:

- Wave only offers one plan. If your business grows and you need more advanced features, you cannot upgrade within Wave. This limits scalability.

- The platform does not support inventory management, budgeting, or project accounting. If you sell products or need to track inventory, you will need to use workarounds or switch to another tool.

- Customer support is limited for free users. You can only get help by email, and response times can be slow. There is no live chat or phone support unless you pay for premium services.

- Some users report problems with bank account syncing. This can make it hard to manage your transactions and keep your books accurate.

- The mobile app has issues. Users say it does not always work well for accounting or receipt scanning, which can slow you down if you work on the go.

- Setting up recurring invoices for installment payments can be tricky. You may need to create separate invoices as a workaround.

- Importing and categorizing bank and credit card statements can be confusing. Some users find duplicate transactions or unclear categories.

- Integrations with third-party apps are limited and sometimes difficult to set up. If you rely on other cloud tools, this could be a problem.

- There are some unresolved bugs that affect the user experience.

Here is a table showing how some of these limits can impact growing companies:

| Limitation | Impact on Growing Companies |

|---|---|

| No sub-accounts | Makes it hard to track detailed expenses, which you need for budgeting and project costing. |

| COGS accounts not separated from operating expenses | Hurts your ability to analyze product costs and set prices. |

| Poor inventory support | Forces you to use manual workarounds, which adds complexity and risk of errors. |

| No inventory tracking reports | You have to track inventory outside of Wave, which is less efficient. |

| Single plan with limited scalability | You cannot add more features as your business grows. |

| Email-only customer support | Delays in getting help can slow down your business. |

Tip: If you expect your business to grow or need advanced accounting features, you may want to look at paid platforms like QuickBooks Online or Xero. These offer more robust tools and better support, but at a higher cost.

When you weigh the wave accounting pros and cons, you will see that Wave is a great fit for freelancers and small businesses who want a free, easy-to-use cloud solution. However, if you need advanced features or plan to scale up, you may find these limits frustrating. Many users share these views in their wave bookkeeping review and other feedback online.

Key Features of Wave Accounting

Invoicing

You can create and send unlimited invoices with Wave. The platform lets you make customizable invoices by adding your logo and choosing colors. You can set up recurring billing for clients who pay you on a regular schedule. Wave also sends payment reminders, so you do not have to chase clients. While you get basic invoice customization, you will not find advanced options like retainer invoices or approval workflows. If you want to accept online payments, Wave Payments lets your clients pay by credit card or bank transfer. Deposits may take a bit longer than with some competitors, but the process is simple and secure.

Expense Tracking

Wave makes income and expense tracking easy. You can snap photos of receipts and attach them to expenses. The system helps you categorize transactions, so you always know where your money goes. You can track both income and expense tracking for multiple businesses in one account. This feature works well for freelancers and small business owners who want to keep things organized without extra effort.

Bank Connections

Wave connects to your bank accounts and imports transactions automatically. The platform uses 256-bit SSL encryption, which is the same level of security as major banks in Hong Kong and the United States. You can reconcile your accounts and spot errors quickly. Wave’s bank connections are reliable, but some users report occasional syncing issues. The platform holds PCI Level-1 certification, so your data stays safe.

Reporting

You get a basic set of reports with Wave. These include profit and loss statements, cash flow summaries, and sales tax reports. The reports help you see how your business is doing, but you will not find advanced analytics or custom report templates. If you need more detailed insights, you may want to look at other accounting software. Still, for most small businesses, the reporting tools in Wave cover the essentials.

Payroll

Wave offers payroll as a paid add-on. You can run payroll for employees and contractors, set up direct deposit, and handle tax calculations. In 14 U.S. states, Wave files payroll taxes automatically. In other states, you must file taxes yourself. Payroll costs start at $20 USD per month plus $6 USD per employee. Wave payroll only works in the United States and Canada. You will not find advanced HR features or employee benefits in this tool.

Note: The wave accounting features list covers the basics well, but you will not find inventory management, time tracking, or deep integrations. If you need more advanced money management features, you may want to consider other platforms.

Wave Accounting Pricing

Free Plan

You might wonder what you get with the completely free plan from Wave. The answer is: a lot. Wave gives you access to all the core accounting tools without charging you a monthly fee. You can send unlimited invoices, track your expenses, and connect your bank accounts. You also get basic financial reports and can manage multiple businesses under one login. These free features make Wave a great choice if you want to keep your costs low.

Here’s a quick look at what you get for free:

- Unlimited invoicing and expense tracking

- Basic financial reports

- Bank account connections

- Receipt scanning (with some limits)

- Multiple business management

You do not need to enter a credit card to start using Wave. The free plan covers most needs for freelancers and small businesses. If you want to try out Wave accounting pricing, you can sign up and use the platform right away.

Paid Add-Ons

Wave plan pricing stays simple, but you can add extra services if you need them. These paid add-ons help you handle more complex tasks. Here’s what you can get for an extra cost:

- Payroll: You can run payroll for employees and contractors in the US and Canada. Payroll pricing starts at $20 per month plus $6 per employee. You get a 30-day free trial, so you can test it before you pay. Payroll automates tax filings, creates W2 and 1099 forms, and lets you pay by direct deposit. You can pause or stop payroll anytime.

- Live Support: If you want live chat or email support, you can pay for this add-on. Support is available Monday to Friday during business hours.

- Unlimited Receipt Capture: You can pay for more receipt scanning if you need it.

- Bookkeeping Services: Wave offers bookkeeping help for a monthly fee. You can cancel anytime.

These add-ons save you time and help you avoid mistakes. Payroll, for example, keeps your records up-to-date and helps you avoid tax penalties. All paid services have clear pricing, so you know the cost before you buy.

Note: Wave plan pricing is easy to understand. You only pay for what you use. If you just need the basics, you can stick with the free plan. If your business grows, you can add more features as needed.

Usability and Support

User Experience

When you first try wave, you will notice its user-friendly design. The dashboard looks clean and simple. You can find what you need without searching through lots of menus. Many users say wave makes accounting less stressful, even if you do not have a background in finance. The setup process is quick. You can connect your bank accounts, import transactions, and start sending invoices in just a few minutes.

Here is a quick comparison of wave and another popular platform:

| Aspect | Wave Accounting | FreeAgent |

|---|---|---|

| Interface Design | Simple, straightforward, intuitive; ideal for users with limited accounting knowledge | More advanced and customizable; suited for experienced users needing detailed features |

| Usability | Easy to navigate; quick setup; suitable for small businesses, startups, freelancers | Offers extensive customization; appeals to users requiring detailed functionality |

| Mobile App | Available, but less feature-rich compared to desktop | More comprehensive app mirroring desktop features |

You will find that wave’s mobile app lets you send invoices and accept payments, but it does not offer all the features of the desktop version. Some users wish the app included bill management and more reporting tools. Others mention that glitches can happen when importing bank transactions or reconnecting accounts. If you want to save and return to a bank reconciliation later, wave does not support this yet. Still, most users praise wave for its ease of use and flexibility.

Note: Wave’s interface stands out for its user-friendly design. You can get a clear overview of your business with the dashboard, even if you are new to accounting.

Customer Support

Customer support is an important part of any accounting tool. With wave, you get access to a help center and community forums for free. If you want live chat or email support, you need to pay for it as an add-on. Some users feel frustrated by the lack of live phone support and 24/7 help. You may have to wait for answers if you use the free plan.

Here are some common challenges users report:

- No live phone support or round-the-clock assistance from wave accounting support.

- No formal training or guided onboarding for new users.

- Limited dashboard customization and reporting options.

- The mobile app does not support all features, such as bill management or time tracking.

Many users say customer service is friendly and helpful when you reach them. However, a few users have shared complaints about slow response times or unresolved issues. If you need fast answers, you might find wave accounting support less reliable than some paid competitors.

Tip: If you run a small business and want free accounting, wave gives you good value. Just remember that customer support is limited unless you pay for extra help.

Wave vs Competitors

QuickBooks Online

When you compare wave to QuickBooks Online, you notice some big differences. Wave gives you core accounting features like invoicing, expense tracking, and bank reconciliation for free. QuickBooks Online offers more advanced tools, such as inventory management, time tracking, and detailed sales tax reports. If your business is growing or needs more complex features, QuickBooks Online might fit better.

Here’s a quick table to help you see the differences:

| Aspect | Wave Accounting | QuickBooks Online |

|---|---|---|

| Features | Core accounting: invoicing, bank reconciliation, expense tracking; limited advanced features | Extensive features: inventory management, time tracking, sales tax management, advanced reporting |

| Pricing | Free plan available; Wave Pro at $16/month; payroll starting at $20/month | Multiple tiers: $30 to $200/month; additional costs for payroll and premium features |

| Scalability | Suitable for small businesses and freelancers; Wave Pro adds moderate scalability with unlimited users | Supports business growth with multiple plans and advanced features; easy upgrades as business expands |

| Integrations | Limited integrations, mainly banking and payment processors; Zapier for some third-party apps | Integrates with over 650 third-party apps including PayPal, Shopify, Square |

| Customer Support | Email and chat only; no phone support; limited support channels | Phone, live chat, community forums, extensive help resources |

| Mobile Apps | Basic mobile app; lacks employee payroll app and time clock | Feature-rich mobile app including mileage tracking and receipt capture |

| Payroll | Payroll costs $20/month (self-service) + $6/payee; limited to 14 states; syncs only with Wave Accounting | Payroll costs $45/month + $6/payee; integrates with multiple payroll providers |

QuickBooks Online stands out for its advanced features and scalability. Wave is easier to use and much more affordable, especially if you want to avoid monthly fees. Many small businesses start with wave and move to QuickBooks Online as they grow.

FreshBooks

FreshBooks is another popular choice if you are looking for accounting alternatives. It offers more customer support options than wave, including phone, email, and chat. FreshBooks also connects with over 200 apps directly and more than 1,500 through Zapier. This makes it a good pick if you need lots of integrations.

Here’s a quick list to help you compare:

-

- Free core accounting and invoicing features.

- Intuitive and easy-to-navigate interface.

- Tools for professional invoicing and payment processing.

-

Wave Cons:

- Limited customer support (chatbot and email only).

- Lacks advanced features like double-entry accounting and receipt scanning.

-

FreshBooks Pros:

- Customizable invoices, time tracking, and project management.

- Strong customer support via phone, email, and chat.

- More third-party integrations and a polished user interface.

-

FreshBooks Cons:

- Paid service starting at $8.50/month, more expensive than wave.

- May lack some advanced inventory features.

If you want a free solution, wave is hard to beat. If you need more support and integrations, FreshBooks could be a better fit.

Xero

Xero is a strong option if you want advanced accounting features and plan to grow your business. Xero offers inventory management, project tracking, and purchase orders. Wave does not have these features. Xero also supports more integrations and works well for businesses outside the US and Canada.

Check out this table for a side-by-side comparison:

| Feature Category | Wave Accounting | Xero |

|---|---|---|

| Pricing | Free plan with unlimited invoicing; paid plan at $16/month | Starts at $20/month with three scalable plans |

| Invoicing | Unlimited invoices on free plan; basic invoicing features | Limited to 20 invoices on cheapest plan; advanced invoicing features like credit memos, payment reminders, billing unbilled labor and expenses |

| Inventory Management | Not available | Included in all plans |

| Purchase Orders | Not supported | Supported |

| Reporting | Basic reports: profit & loss, balance sheet, cash flow | Extensive customizable reports including cash-flow forecasting |

| Third-party Integrations | Only via Zapier (less seamless) | Over 1,000 native integrations |

| Payroll Integration | Only Wave Payroll | Integrates with multiple payroll providers (Gusto, Deel, Oyster) supporting global payroll needs |

| User Collaboration | Unlimited users only on paid plan | Supports multiple users across all plans |

| Customer Support | Email and chat only on paid plan; no phone support | 24/7 online support; no phone support |

Wave is best for freelancers and very small businesses who want simple accounting at no cost. Xero works better for small to midsize companies that need more features and plan to scale. If you want global support and advanced tools, Xero is one of the top alternatives to wave.

User Feedback on Wave Accounting

Image Source: pexels

Positive Reviews

When you look at user reviews for wave, you see a lot of happy customers. Many people say wave makes accounting easy, even if you do not have much experience. Here are some things users like most:

- The platform is free and does not hide fees. You can send unlimited invoices and track your income without worrying about surprise charges.

- Users love the invoicing tools. You can customize invoices, send them quickly, and even accept payments online. One user said, “Wave’s invoicing is unbeatable. We haven’t had a single unpaid invoice in eight years, thanks to how easy it is to create, send, and follow up.”

- The mobile app helps you send invoices and manage your books from anywhere. This saves you time and keeps your business moving.

- Many reviews mention that wave is perfect for small businesses, freelancers, and anyone with simple accounting needs.

- People appreciate the time-saving automation, like automatic bank reconciliation and payment reminders.

You will notice that most reviews highlight the value you get from the free plan. Even with some limits, users say the ease of use and core features make wave a top choice for basic accounting.

Common Complaints

Not all reviews are positive. Some users run into problems that can slow down your work. Here are the most common complaints you will find in wave reviews:

- Bank connections sometimes break or disappear. This means you may need to reconnect your accounts, which can be frustrating.

- Customer support is limited, especially if you use the free plan. Many reviews mention slow responses or trouble getting help when you need it most.

- Some users see duplicate transactions after importing bank data. This creates confusion and extra work.

- The platform does not offer advanced reporting or inventory management. If your business grows, you may outgrow wave.

- Frequent software updates can make it hard to find features you use often.

- You cannot set up auto-renewing bills, so you have to enter them manually each time.

- Auto-reminder messages sometimes feel too strict or unfriendly to clients.

You will see these issues come up in many reviews, especially from users with more complex needs. The table below shows what makes users recommend or avoid wave:

| Factor Category | Positive Factors | Negative Factors |

|---|---|---|

| Cost | Free plan, unlimited invoicing, no hidden fees | Extra fees for payroll and bookkeeping |

| Usability | Simple setup, mobile app, easy to use | Limited support for free users, live help only with add-ons |

| Features | Double-entry accounting, automated reconciliation, customizable taxes | No inventory management, no audit trails |

| Payment Processing | Fast payments, unlimited bank accounts | Payment fees vary, limited payroll and currency support |

| Scalability | Great for small businesses and freelancers | Not scalable for growing businesses, only in US and Canada |

If you want a simple, free tool, wave gets strong reviews. If you need more advanced features or fast support, you may want to look at other options.

If you run a small business or work as a freelancer, wave gives you free, easy accounting tools. You get unlimited invoicing, simple reports, and a user-friendly dashboard. Check this table to see if wave fits your needs:

| Criteria / Factor | Details / Considerations |

|---|---|

| Business Size and Type | Best for micro-businesses, freelancers, or sole traders |

| Budget | Free core features; great for tight budgets |

| Ease of Use | Simple interface for beginners |

| Core Features | Invoicing, receipt scanning, expense tracking, reports |

| Limitations | Fewer features, limited support, not for rapid growth |

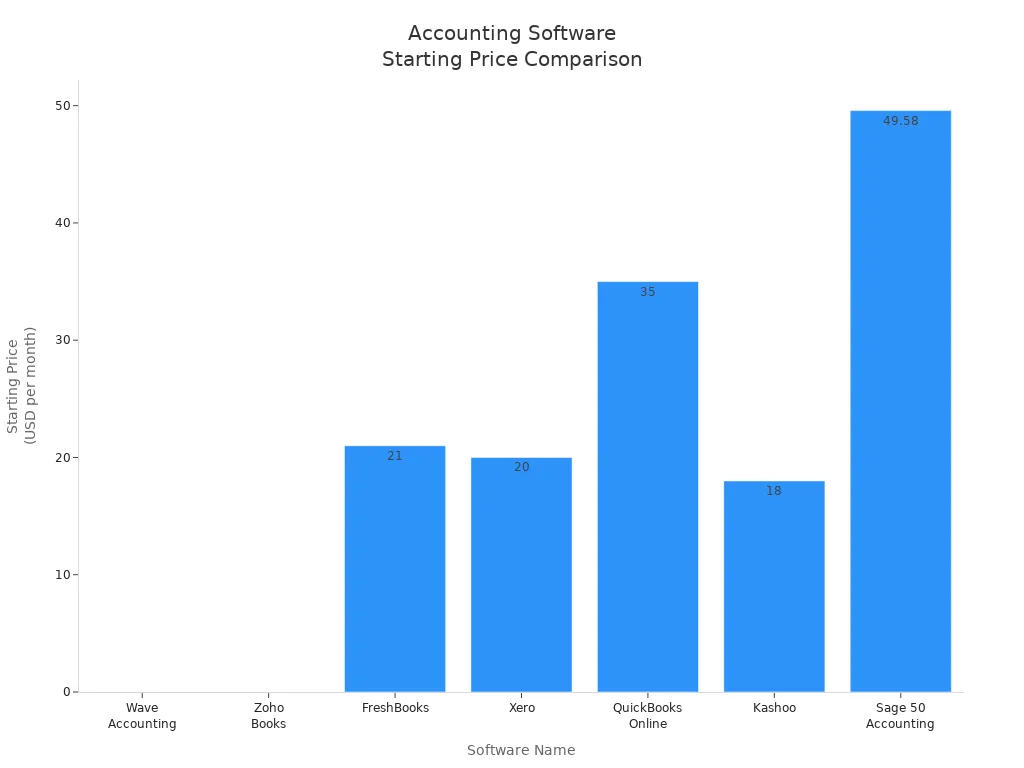

Some businesses outgrow wave as they need more features or better support. If you want to compare, look at this chart of starting prices for top platforms:

Try wave’s free plan first. If you need inventory, advanced analytics, or more support, explore alternatives that match your business growth.

FAQ

Is Wave Accounting really free?

Yes, you can use Wave’s core features without paying anything. You get unlimited invoicing, expense tracking, and basic reports. If you want payroll, live support, or extra receipt scanning, you pay for those add-ons. All prices appear in USD.

Can I connect Wave to other business apps?

Wave offers limited integrations. You can connect your bank accounts and payment processors. For more connections, you use Zapier. If you need deep integration with e-commerce or inventory tools, you may want to look at other platforms.

Is my financial data safe with Wave?

Wave uses 256-bit SSL encryption and PCI Level-1 certification. Your data stays protected, just like with major Hong Kong banks. You control your account access. Wave does not share your information without your permission.

Will Wave work for my growing business?

Wave works best for freelancers and small businesses. If your business grows and you need inventory, advanced reporting, or more integrations, you may outgrow Wave. You might want to switch to a platform like QuickBooks Online or Xero as your needs change.

For small businesses and freelancers, Wave Accounting offers free core features like unlimited invoicing and expense tracking, while BiyaPay can further enhance your cross-border financial management. With real-time exchange rate queries and conversions, supporting over 30 fiat currencies and 200+ digital currencies, remittance fees as low as 0.5%, and coverage across over 200 countries and regions with same-day remittance delivery, BiyaPay adds flexibility to your operations. Whether you opt for Wave or other tools, BiyaPay helps boost efficiency, especially for international payment needs.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Tap and Go A Beginner's Guide to Cardless ATM Withdrawals

Why Is Canada's Country Code 1

What Are the Daily Limits for Chase Accounts?

How Safe Is Your Money With Ally Bank in 2026?

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.