Remitly fees and transfer costs made simple for users

Image Source: pexels

If you send $500 from the US to India with Remitly, you might pay a $3.99 fee for an express money transfer. However, the total cost often goes beyond Remitly fees. You face hidden fees, like exchange rate markups, which make your money transfer less valuable. Hidden fees can also show up if you use a credit card or if the recipient’s bank charges extra. Always check for hidden fees, as they can lower the amount your recipient gets.

Key Takeaways

- Remitly fees vary by country, amount, payment method, and delivery speed, so always check the exact cost before sending money.

- First-time users can save money with Remitly’s 0-fee transfer promotion and special exchange rates, but these offers have specific rules and limits.

- Exchange rate markups add hidden costs that reduce the amount your recipient gets, so compare rates carefully before transferring.

- Choosing Economy delivery saves money but takes longer, while Express delivery is faster but costs more; pick the option that fits your needs.

- Remitly shows all fees upfront and guarantees on-time delivery, refunding fees if transfers are late, giving you peace of mind.

Remitly fees overview

Image Source: pexels

Fee structure

Remitly fees depend on several factors. You will notice that the amount you pay changes based on where you send money, how much you send, your payment method, and how fast you want the delivery.

- By Country: Remitly fees are different for each country. For example, if you send $500 from the US to India, you usually pay a $3.99 fee for an express transfer. If you send money to Vietnam, the fee can range from $1.99 to $9.99, depending on the amount and speed. Sending to Haiti often uses a percentage-based fee, which means the more you send, the higher the fee.

- By Amount: Larger transfers sometimes qualify for lower or even zero fees, especially for certain countries. For example, some routes offer free transfers if you send over $1,000.

- By Payment Method: Paying with a debit card or bank account usually costs less than using a credit card. Credit card payments often come with extra charges

- By Delivery Option: Remitly offers express and economy delivery. Express is faster but costs more. Economy takes longer but has lower fees.

Here is a quick table to help you see how remitly fees can change:

| Route (From US) | Delivery Speed | Amount Sent | Fee (USD) |

|---|---|---|---|

| India | Express | $500 | $3.99 |

| Vietnam | Express | $500 | $1.99 - $9.99 |

| Haiti | Express | $500 | 2% - 3% |

| Philippines | Economy | $1,000 | $0 |

Note: The exact fee may change based on the latest Remitly pricing. Always check the fee before you send your money transfer.

You never need to worry about your recipient paying any fees. Remitly makes it clear that all costs are paid by you, the sender. The person receiving the money will not pay any extra charges, no matter which delivery method they use.

First transfer promotions

Remitly gives you a special offer when you use their service for the first time. You can enjoy a 0-fee transfer on your first successfully completed money transfer. This means you do not pay any transfer fees for your first transaction, as long as the transfer goes through and your recipient gets the money.

- Remitly calls this the “Special FX and 0-Fee on First Transfer + Discount on Second Transfer” promotion.

- The 0-fee offer only applies to your first transfer and does not include payments made with a credit card.

- You also get a special exchange rate for your first transfer, up to a certain limit.

- If you make a second transfer during the promotion period and meet the minimum spend, you can get a discount on that transfer too.

- Each person can only use this promotion once, and you cannot combine it with other offers.

- The promotion runs from February 25, 2025, to December 31, 2025, and is only available in certain regions.

- Remitly may cancel the promotion if you try to use it more than once or break their rules.

Tip: Always read the terms and conditions before using a promotion. Make sure your payment method and transfer amount qualify for the 0-fee offer.

Remitly fees can seem confusing at first, but you can save money by understanding how they work and taking advantage of first transfer promotions.

Transfer costs explained

Exchange rate markups

When you send money with Remitly, you do not get the exact mid-market exchange rate you see on financial news sites. Remitly adds a small margin to the exchange rate, which is called a markup. This markup usually ranges from 0.5% to 3.0% above the mid-market rate. For most major currency routes, you can expect a markup between 1% and 3% after your first promotional transfer. This means if the mid-market rate for USD to INR is 83.00, Remitly might offer you a rate between 80.51 and 82.17 for your transfer.

Remitly uses this markup as a main way to earn revenue, especially after your first fee-free transfer. While some services claim to use the mid-market rate, they often add fees elsewhere. Remitly aims for transparency, so you can always see the rate before you send money. However, the markup means your recipient may get less than if you used a service with no markup.

You can compare Remitly’s exchange rate markup to other services in the table below:

| Service | Exchange Rate Markup | Fee Structure Highlights |

|---|---|---|

| Remitly | 0.5% to 3.0% above mid-market | Adds markup on exchange rate plus additional fees; fees waived for transfers over $500 via bank account |

| Wise | Zero margin (mid-market rate) | Transparent fees starting around 0.43%, no exchange rate markup; profits from fixed or percentage fees |

| TransferGo | Low or no markup | Emphasizes transparency and low fees |

Note: Remitly’s markup can make transfer costs higher than services like Wise, which uses the mid-market rate and charges a separate fee.

Service and payment method fees

Remitly charges different service fees based on how you pay and how fast you want the money delivered. You can choose between Express and Economy delivery. Express transfers arrive within minutes, but you pay a higher fee. Economy transfers take 3 to 5 business days, but the fee is lower.

Here is a table to show how delivery speed and payment method affect your fees:

| Delivery Option | Speed | Funding Method | Typical Fees (USD) | Additional Charges |

|---|---|---|---|---|

| Express | Minutes | Credit/Debit Card | $1.99 - $9.99 | Up to 3% credit card fee |

| Economy | 3-5 business days | Bank Transfer | As low as $0.99 | Possible bank transfer fees |

Remitly’s service fees can start as low as $0.99 for some routes when you use a bank transfer. This is much less than what you pay at most banks. For example, a traditional Hong Kong bank might charge $20 to $40 for an international wire transfer. Remitly also offers promotional discounts, which can lower your fees even more.

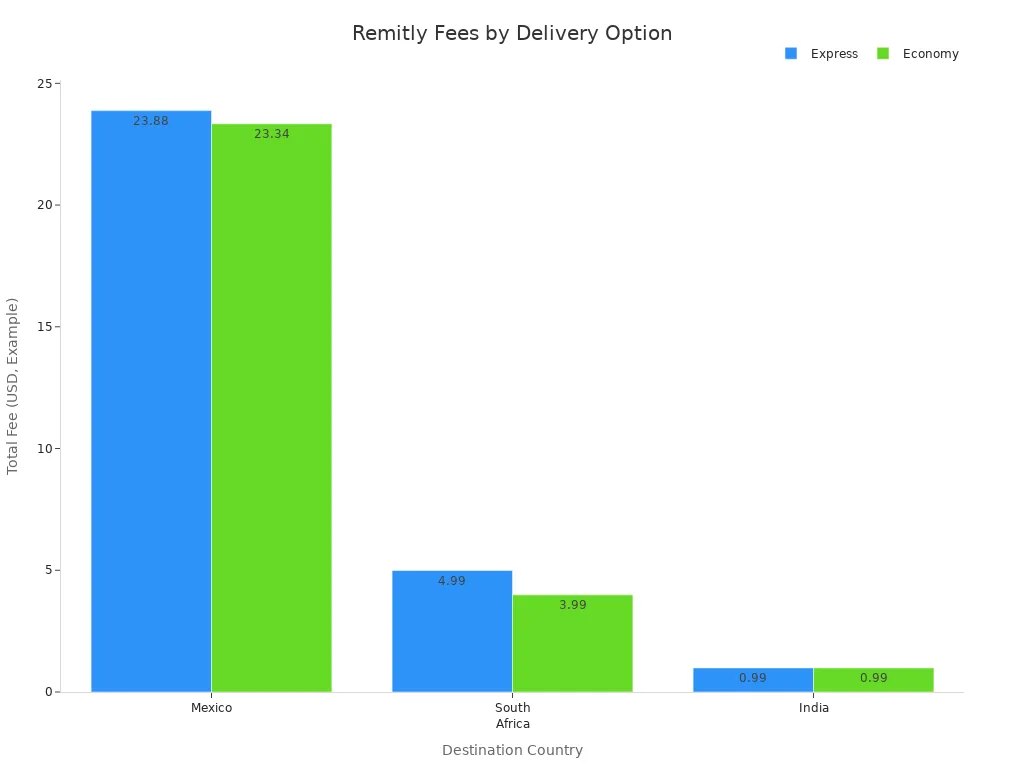

You can see how Express and Economy fees compare for different countries in the chart below:

Tip: Always check the total fee and exchange rate before you send money. Express is best for urgent transfers, but Economy saves you money if you can wait.

Remitly’s transparent pricing and lower service fees make it a strong choice for international money transfers. You can often save compared to traditional banks, especially when you use bank transfers and take advantage of promotions. By understanding how exchange rate markups and service fees work, you can better manage your transfer costs and make sure your recipient gets the most money possible.

Remitly fees by country and method

Image Source: unsplash

Express vs economy

You can choose between Express and Economy delivery when you use Remitly for international money transfers. Express transfers move your money quickly, often within minutes. However, you pay higher Remitly fees for this speed. Economy transfers take longer, usually three to five business days, but the fees are lower. If you need your money transfer to arrive fast, Express is the best choice. If you want to save money, Economy works well for non-urgent transfers.

- Express delivery costs more because it uses faster payment networks.

- Economy delivery uses slower networks, so Remitly fees are lower.

- Some countries offer free transfers for amounts over $1,000, especially with Economy.

Payment options

Remitly supports several payment methods for international transfers. You can pay with a bank account, debit card, credit card, or even Apple Pay in some regions. Each method affects the total cost of your international money transfers.

- Bank transfers and debit cards usually have the lowest fees.

- Credit card payments often cost more because of extra processing charges or cash advance fees.

- Cash pickup and mobile wallet transfers are available in many countries, but fees may vary.

- New customers can get promotional rates and fee waivers for their first money transfer, sometimes up to $2,000.

Tip: Always check the payment method details before sending. Some banks, like Hong Kong banks, may charge extra for receiving international transfers.

Sample fee table

Here is a quick look at Remitly fees for popular international money transfers from the US. Fees change based on the amount, delivery speed, and payment method.

| Route (From US) | Amount Sent | Delivery Speed | Payment Method | Fee (USD) |

|---|---|---|---|---|

| India | $500 | Express | Debit Card | $3.99 |

| Vietnam | $500 | Express | Credit Card | $7.99 |

| Haiti | $1,000 | Economy | Bank Transfer | $0 |

| France | $1,200 | Economy | Bank Transfer | $0 |

| Philippines | $1,000 | Express | Debit Card | $2.99 |

You see that transfers over $1,000 may have no fees, especially with bank transfers and Economy delivery. Remitly guarantees no hidden fees, so you know the total cost before you send your money transfer.

Exchange rates and total transfer costs

Promotional vs regular rates

When you send money with Remitly, you may see two types of exchange rates: promotional and regular. Promotional rates are special offers for new customers. For example, if you send money from the United States to France, Remitly may give you a promotional rate of 0.8519 EUR for every 1 USD. This rate only applies to your first $1,500 sent and is available one time per customer. You get this rate as a benefit for your first transfer, and it is usually better than the regular rate.

- Promotional rates are for new customers only.

- The offer applies to a limited amount, such as the first $1,500.

- You pay no fees on transfers to France during this promotion.

- These rates can change at any time, so always check before you send.

Regular rates apply after you use your promotional offer. These rates may be lower than the promotional rate, so your recipient could get less money for the same amount sent. Remitly updates both promotional and regular rates many times each day. The company watches the market closely to make sure you get a competitive rate for your international transfers.

Note: Promotional rates are limited-time offers and come with specific terms and conditions. You must be a new customer to qualify.

Impact on recipient amount

Exchange rates play a big role in how much your recipient gets from international transfers. Even a small change in the rate can make a big difference. Remitly updates its rates often because of changes in the global economy and market demand. When you send money, you see the real-time rate, so you can choose the best moment to transfer.

For example, if the exchange rate drops, your recipient will receive less money in their local currency. If the rate goes up, they get more. Remitly shows you the exact amount your recipient will get before you confirm the transfer. This helps you plan and make sure your international transfers are as effective as possible.

Tip: Always check the current exchange rate before sending money. Timing your transfer can help your recipient get the most value.

Remitly vs Wise: fees and transparency

Total recipient amount

When you send money to India or Vietnam, you want your recipient to get as much as possible. Wise and Remitly use different ways to calculate the final amount your recipient receives. Wise uses the mid-market exchange rate and charges a clear, low fee. Remitly often adds a markup to the exchange rate and may charge a fee, depending on the amount and delivery speed.

Here is a comparison for transfers over $1,000 from the United States to India:

| Feature | Remitly (>$1,000) | Wise (>$1,000) |

|---|---|---|

| Transaction Fee | No fee | Transparent fee starting at 0.48% |

| Exchange Rate | Markup between 0.4% and 1.4% (hidden cost) | Mid-market rate, no markup |

| Transfer Speed | Economy: up to 5 days; Express: instant | Over 60% instant, 95% within 24 hours |

| Transfer Limit | Up to $30,000 | Up to $1,000,000 |

With Wise, your recipient usually gets more because there is no exchange rate markup. Remitly may give you more payout options, such as cash pickup or instant delivery, but the total amount received can be lower due to the hidden markup. For Vietnam, Wise also tends to offer a higher recipient amount for the same reasons, although exact numbers may vary.

Note: Always check the final amount your recipient will get before you confirm your transfer. Small differences in exchange rates can make a big impact.

Cost transparency

You need to know exactly what you pay when sending money. Wise shows you every fee up front and uses the real exchange rate you see online. You can see the total cost and the exact amount your recipient will get before you send. Remitly also shows you the fees and the exchange rate, but the rate includes a hidden markup. This markup is not always clear unless you compare it to the mid-market rate.

Remitly does offer a special guarantee. If your transfer does not arrive on time, Remitly will refund your transfer fee. This promise gives you extra peace of mind, especially if you need your money to arrive by a certain date. Wise does not offer a similar refund policy for delays, but it does deliver most transfers quickly and reliably.

Tip: Compare both the fees and the exchange rates before you send money. Look at the total recipient amount, not just the advertised fee. This helps you choose the best service for your needs.

Transfer speed and limits

Delivery times

When you send money with Remitly, you choose between Express and Economy transfers. Your choice affects both the speed and the cost of your transfer. Express transfers deliver funds within minutes. You pay higher fees for this speed. Economy transfers take three to five business days. These transfers cost less, but your recipient waits longer.

Here is a table to help you compare the two options:

| Aspect | Express Transfer | Economy Transfer |

|---|---|---|

| Transfer Speed | Minutes | 3-5 business days |

| Fees | Higher | Lower |

| Payment Method Impact | Credit card costs more | Bank transfer costs less |

| Exchange Rate Margin | Higher markup | Lower markup |

| User Preference | Best for urgent needs | Best for saving money |

Tip: If you need to send money quickly, choose Express. If you want to save on fees, pick Economy. Always check the total cost before you send.

Sending limits

Remitly sets limits on how much you can send in one transaction and over certain time periods. These limits depend on the country you send from, the country you send to, and the payment method you use. For most countries, you can send up to $10,000 USD per transaction. Some routes, like India, allow much higher limits—up to $1,000,000 USD. Mexico has a lower limit, often $2,500 USD per transfer.

Remitly also uses daily and monthly limits. For example, Express transfers may allow up to $2,999 USD per day and $7,999 USD per 30 days. Economy transfers can go up to $5,000 USD per day and $40,000 USD per 30 days. If you use a credit card, your limit may be lower than if you use a bank account.

Remitly asks for more identification if you want to send larger amounts. You can increase your limits by verifying your identity and explaining your transfer purpose. Local laws and regulations may also affect your limits. Always check your current limits in your Remitly account before sending a large transfer.

Note: Sending limits help keep your money safe and follow local rules. If you need to send more, complete your verification early to avoid delays.

You should always look at both the transfer fee and the exchange rate before sending money with Remitly. Some services, like Wise, show all costs up front and use the mid-market rate, which helps you avoid hidden fees. When you compare Remitly with other providers, you can find the best deal for your needs.

- Watch for hidden fees that can lower the amount your recipient gets.

- Use first transfer promotions and check current rates to save money.

- Choose the right transfer type and timing for the best value.

FAQ

How do you check Remitly’s current fees before sending money?

You can visit Remitly’s website or app. Enter your sending country, receiving country, and amount. Remitly will show you the exact fee, exchange rate, and the amount your recipient will get before you confirm your transfer.

Does Remitly charge hidden fees?

Remitly shows all fees up front. However, you should watch for exchange rate markups. These markups can lower the amount your recipient receives. Always compare the offered rate with the mid-market rate for full transparency.

Can your recipient in China or other countries pay any fees?

Your recipient never pays fees to Remitly. You cover all costs as the sender. However, some banks, such as Hong Kong banks, may charge a fee for receiving international transfers. Always check with the recipient’s bank for possible extra charges.

What happens if your Remitly transfer is delayed?

Remitly guarantees on-time delivery. If your transfer arrives late, Remitly will refund your transfer fee. You can contact customer support for help if you experience a delay.

Is there a limit to how much you can send with Remitly?

Remitly sets sending limits based on your country, the destination, and your payment method. For most routes, you can send up to $10,000 USD per transaction. You can increase your limit by verifying your identity and providing more information.

While Remitly offers transparent fees and fast transfers, its exchange rate markups (0.5%-3.0%) can reduce the amount your recipient gets, especially for frequent transfers to India or beyond. For a cost-effective alternative, try BiyaPay. BiyaPay provides transfer fees as low as 0.5%, significantly less than traditional bank wire transfers ($20-$50) or Remitly’s markup-heavy rates. With real-time exchange rate transparency, you can convert over 30 fiat currencies or 200+ cryptocurrencies, ideal for travel, remittances, or online purchases. Covering 100+ countries with same-day transfers, BiyaPay ensures speed without sacrificing value. Registration takes minutes with simple identity verification, making it perfect for urgent payments. Secured by U.S. and New Zealand financial licenses, BiyaPay guarantees safe transactions. Whether sending money to family in India or paying for a U.S. trip, BiyaPay maximizes your recipient’s funds. Join BiyaPay today for low-cost, secure, and efficient global payments!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

2025 Taiwan Stock Market Year-End Review and 2026 Outlook: Can the AI Boom Continue?

Say Goodbye to Bank Queues: Latest 2025 Bank of China App Guide for Converting Cash to Exchange

After Over 100 Billion in Buybacks, Has Tencent's Long-Term Investment Logic Changed?

Say Goodbye to Panic: Master the Winning Rules for Stock Investing in a Bear Market

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.