- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What Are the Dangers of Wise Accounts Scam for People Seeking Verified Accounts

Image Source: pexels

You may think it is easier to buy verified wise accounts instead of using the official process. You should know that you can open a wise account for free. If someone tries to sell you an account, you face a wise accounts scam. People who fall for this scam often lose money or get their account closed. You risk exposing your information to more scams. Always open a wise account only through the official Wise website.

Key Takeaways

- Never buy a verified Wise account; only open accounts for free through the official Wise website.

- Scammers use fake emails, websites, and urgent messages to steal your money and personal data.

- Buying accounts risks losing access to your funds, legal trouble, and long-term financial harm.

- Watch for red flags like urgent money requests, strange links, and pressure to act fast.

- If you suspect a scam, change your passwords, contact Wise and your bank, and report the fraud immediately.

Wise Accounts Scam Explained

What Is a Wise Accounts Scam

A wise accounts scam happens when someone tries to trick you into paying for a verified Wise account or gives you false promises about account verification. Wise does not charge you to open an account, and only Wise can verify your information. If you see offers to buy verified wise accounts, you face a scam. Wise and financial security experts do not give a single definition for a wise accounts scam. Instead, they describe different scam types and warn you about common tricks.

Wise warns you to watch out for urgent requests, unexpected contacts, and offers that seem too good to be true. Scammers may ask you to pay deposits to unfreeze money, move money to a “safe” account, or download software to allow payments. Wise will never ask you to do these things.

You should know that Wise lists many scam types, such as investment scams, impersonation scams, phishing, and fake websites. These scams often use convincing stories to get your personal information or money.

How Scammers Target Verified Wise Account Seekers

Scammers use many methods to find people who want a verified wise account. They often use:

- Phishing emails that look like they come from Wise or other trusted sources. These emails try to steal your login details or personal information.

- Fake websites that copy the real Wise site. These sites may ask you to enter your account information or pay for verification.

- Social media ads or posts that promise quick and easy account verification or offer to sell you a verified account.

- Unsolicited phone calls or messages that pressure you to act fast or share sensitive details.

You may also see scammers use urgency and pressure tactics. They want you to make quick decisions without thinking. Some will promise you high returns or special deals if you act now. Wise teaches you to check all messages and never share your password or full card number. Always use Wise’s official website for any account verification.

Dangers of Buying Verified Wise Accounts

Image Source: pexels

Legal and Account Risks

When you try to buy verified wise accounts, you put yourself at serious legal risk. Wise follows strict anti-money laundering (AML) rules. If you use an account that you did not open yourself, Wise can close or freeze it without warning. This happens often because Wise must file Suspicious Activity Reports (SARs) when they see anything unusual. Law enforcement or Financial Intelligence Units (FIUs) may investigate your account. They can freeze your funds for months or even longer. Sometimes, you may never get your money back.

Wise and other financial companies in the EU often freeze or close accounts linked to flagged people or companies. You may lose access to your funds even if you did not do anything wrong, just because you are connected to someone suspicious.

Here are some common legal and account risks:

- Account closure or freezing without notice

- Loss of access to your funds for a long time

- Possible government seizure of your money, even without a trial

- Being linked to money laundering or other cyber-crimes

You should know that Wise and other banks, such as Hong Kong banks, must follow these rules to avoid legal problems themselves. If you use a verified wise account from a third party, you risk losing everything.

Financial Losses

You face real financial dangers when you try to buy a verified wise account. Scammers often use an advance fee fraud scam. They ask you to send a payment upfront, promising you a verified account. After you pay, they disappear with your money. You get nothing in return.

Even if you receive an account, Wise may freeze it soon after you log in. Your funds can stay locked for months. Sometimes, you never get your money back. Refunds are slow and rare. Many users report losing hundreds or even thousands of USD.

- You may lose your initial payment to the scammer.

- Any money you put into the account can be frozen or lost.

- You may face extra costs for legal help or recovery services.

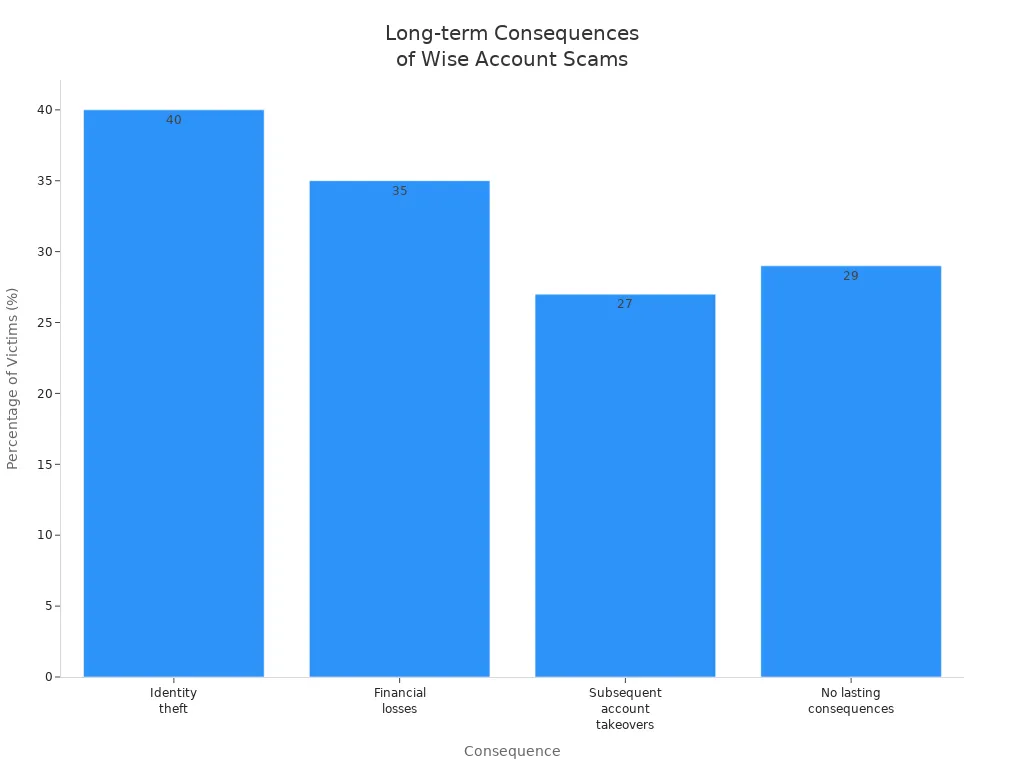

The chart below shows the long-term consequences for people who fall victim to these scams:

| Consequence | Percentage of Victims (2023) |

|---|---|

| Identity theft | 40% |

| Financial losses | 35% |

| Subsequent account takeovers | 27% |

| No lasting consequences | 29% |

You can see that financial loss is common. Some people lose as much as $85,000 USD. The risk is real and growing each year.

Data and Security Threats

When you try to buy a verified wise account, you also risk your personal data. Scammers use phishing emails and fake websites to steal your information. If you enter your details on a fake site, they can take your card details and identity information. This puts you at risk for more cyber-crimes in the future.

- Scammers may steal your card details, identity documents, and login information.

- Your data can be sold or used for more scams.

- You may become a target for future account takeovers or fraud.

You may also suffer emotional harm. Many scam victims feel helpless, anxious, or even depressed. You may lose trust in online banking and payment systems. Some people have trouble sleeping or feel paranoid about using the internet. These feelings can last a long time.

Many victims blame themselves for falling for a scam. This can make you feel even worse and less likely to trust others or yourself in the future.

The long-term effects go beyond money. You may face identity theft, reputation damage, and ongoing attacks on your digital life. Even if you recover your account, the risk of future harm stays high.

Spotting Wise Accounts Scam

Red Flags and Warning Signs

You can protect yourself from a wise accounts scam by learning to spot the warning signs. Many people fall for these tricks because scammers use common tactics. The table below lists some of the most reported red flags. If you notice any of these, you should stop and check before you act.

| Red Flag | Explanation |

|---|---|

| Unexpected or urgent money requests | Someone asks you for money quickly, often with a story that does not make sense |

| Requests for confirmation codes or MTCN | You get asked for codes that are not needed for your payment or transfer |

| Fake check scams | You receive a check and are told to send money back, but the check later bounces |

| International wire transfer requests | You get sudden requests to send money abroad, often with urgent stories |

| Spelling and grammar errors | Messages have many mistakes, which can show the sender is not professional |

| Refusal to communicate face-to-face | The person avoids phone or video calls before you send money |

| Pressure to make quick decisions | You feel rushed to act without time to think |

| Romance scam indicators | Someone you meet online refuses to meet in person and asks for PIN codes or cryptocurrency |

If you see any of these red flags, you should pause and check the details. Scammers often use pressure and confusion to trick you.

Online Scams and Phishing Tactics

Online scams use many tricks to steal your information. Phishing is one of the most common methods. Scammers pretend to be trusted companies, like Wise, and try to get your personal details. You may get emails or texts that look real, but they are fake.

- Scammers send emails or texts that look like they come from Wise or other payment services.

- They claim there is a problem with your account or say there is suspicious activity.

- Messages ask you to click a link to update your payment details or confirm your information.

- These emails often use company logos and familiar language to appear real.

- The messages may use generic greetings and have suspicious links or requests for personal data.

- Scammers create a sense of urgency or fear to make you act fast.

- If you click the link, you may go to a fake website that looks like Wise, but it is designed to steal your login details.

You should always check the sender’s email address and never click on links from messages you do not trust. Wise will never ask you to update payment information through an email link. By staying alert, you can avoid falling for online scams and keep your account safe.

Safe Account Verification and Protection

Image Source: pexels

Legitimate Account Verification Steps

You should always use the official Wise website for wise account verification. Never trust third parties or anyone who offers to sell you a verified account. Wise makes the account verification process clear and secure. This protects your money and your identity.

To complete account verification, Wise asks you to follow these steps:

- Choose a valid photo ID, such as a passport or national ID card. Make sure your document is not expired and matches your Wise account details.

- Take clear photos of your ID. If your document has two sides, upload both.

- Sometimes, Wise may ask for extra documents, like proof of address or a selfie holding your ID.

- Submit your documents through the Wise website or app. Wise will review your information, which usually takes about two working days.

- Wait for an email from Wise confirming your verification. If there is a problem, Wise will give you tips to fix it.

- Wise keeps your information safe by using strong encryption.

Tip: Only trust emails from addresses ending in @wise.com. If you get a message with urgent language or strange links, do not click. This is important scam avoidance advice.

What to Do If You Suspect a Scam

If you think you have interacted with a scammer, act quickly to protect your account and personal information. Here are the steps you should take:

- Contact your bank or financial institution right away. Ask them to check for any suspicious activity and help you secure your account.

- Change all your passwords, including your Wise account and email.

- Report the scam to Wise using their official support channels.

- Block and stop all contact with the scammer. Keep records of your communication.

- If you lost money, report the incident to the police or your local fraud authority. You may be able to claim compensation.

Staying alert and following these steps can help you avoid further harm. Always use the official Wise process for account verification and never share your details with anyone else.

Wise account scams put your money and personal data at risk. Phishing emails and fake websites can trick you into sharing sensitive information, leading to account takeovers and financial theft. Always use Wise’s official verification process. You can protect yourself by following these steps:

- Learn to spot phishing attempts and suspicious messages.

- Use multi-factor authentication and update your passwords often.

- Share what you know about scams to help others stay safe.

Staying alert and informed helps you and your community avoid online scams.

FAQ

Can you recover money lost to a Wise account scam?

You may recover your money if you act fast. Contact Wise and your bank right away. Report the scam to your local police. Quick action gives you the best chance to get your funds back.

Is it safe to buy a verified Wise account from someone online?

No, it is never safe. Only Wise can verify accounts. Buying from others puts your money and personal data at risk. You may lose your funds and face legal trouble.

What should you do if you gave your ID to a scammer?

Change your Wise password and contact Wise support. Watch your accounts for strange activity. Report the scam to your local police. You should also consider a credit freeze to protect your identity.

How can you tell if a Wise website is real?

Check the website address. The real Wise site uses https://wise.com. Look for the lock symbol in your browser. Never click on links from emails or messages you do not trust.

While Wise account scams like phishing emails and fake websites threaten your financial security, BiyaPay offers a safe, transparent alternative for global payments. With same-day international transfers and remittance fees as low as 0.5%, BiyaPay supports 30+ fiat and 200+ digital currencies with real-time exchange rates, ensuring no hidden costs. Pay globally with Biya EasyCard in 190+ countries, supporting Amazon, eBay, and PayPal, all with no annual fee. Whether you’re an expat in Malaysia paying rent or shopping on Amazon, or a traveler needing secure payments abroad, BiyaPay protects you from scams and high fees. Complement your travel insurance or cost-conscious lifestyle in Malaysia—register in minutes at BiyaPay for secure, low-cost transactions.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.