- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Real-Time Insights into Hong Kong Stock Market Trends and Dynamics

Image Source: unsplash

The rapidly changing Hong Kong stock market today demands that you stay on top of real-time data to make informed investment decisions. Quickly accessing accurate information can help you understand the latest market dynamics, such as the Hang Seng Index, which closed at 24,366.94 points today, up 0.84%; the H-Share Index, which climbed to 8,865.72 points, up 1.12%; and the Tech Index, which closed at 5,451.20 points, up 1.09%. Additionally, the total market turnover today reached HK$235.173 billion, indicating an active market.

Investment experts point out that quickly obtaining useful information is key to successful investing. Retail trading volume has been largely overtaken by institutional and high-frequency machine trading, accounting for over 98% of transactions. Therefore, staying informed about Hong Kong stock market trends today can give you a competitive edge in a highly contested market.

Overview of Hong Kong Stock Market Indices Today

Image Source: unsplash

Latest Performance and Trends of the Hang Seng Index (HSI)

The Hang Seng Index performed steadily today, opening 28 points higher at 24,191 points. Although the gains briefly narrowed to 16 points in the early session, the index quickly rebounded, closing up 204 points at 24,366.94 points, marking a nearly three-month high. This performance was largely driven by a consensus on the China-U.S. trade framework, significantly improving market sentiment.

Below are key data points for the Hang Seng Index’s recent performance:

| Index/Sector | Performance |

|---|---|

| Hang Seng Index | Up 0.84% to 24,366.94 points |

| Technology, Toys, Lithium Battery Stocks | Strong performance |

| Defense, Semiconductor, Film/TV Stocks | Underperformed |

| China-U.S. Trade Negotiation Progress | Impacted market sentiment |

You can see that the strong performance of technology and lithium battery stocks provided support for the HSI, while the weakness in defense and semiconductor stocks slightly dragged down the overall gains. These data help you better understand the overall trends of the Hong Kong stock market today.

Real-Time Data and Influences on the H-Share Index (HSCEI)

The H-Share Index also performed impressively today, rising 1.12%, reflecting market confidence in Chinese companies. The index’s adjustment reflects changes in constituent stocks and their weightings. For example, XPeng Inc., newly added as a constituent stock, attracted more capital inflows. Additionally, continued southbound capital inflows further demonstrated market resilience, supporting stock price increases.

Below are key factors influencing the H-Share Index:

- After constituent stock adjustments, individual stock weight caps were set to prevent large-cap stocks from overly influencing the index’s performance.

- The inclusion of new constituent stocks like XPeng Inc. increased market attention to the new energy vehicle sector.

- Southbound capital inflows reflect investor confidence in Chinese companies.

These factors not only affect the H-Share Index’s real-time performance but also provide you with important references for observing market dynamics.

Market Trends of the Hang Seng Tech Index (HSTECH)

The Hang Seng Tech Index closed at 5,451.20 points today, up 1.09%. The strong performance of technology stocks was a market highlight, particularly companies related to new energy and artificial intelligence, which attracted significant capital inflows. This trend reflects investors’ optimistic expectations for the future growth potential of the technology sector.

Below are highlights of the Tech Index’s recent performance:

- Technology stocks, especially in new energy and artificial intelligence, performed strongly overall.

- Investor confidence in the technology sector increased, with noticeable capital inflows.

- The Tech Index’s rise also boosted the performance of related industry stocks.

You can track the Tech Index’s trends to stay updated on the latest developments in the technology sector and adjust your investment strategies based on market trends.

Top-Performing and Notable Stocks in Hong Kong Today

Image Source: pexels

Stocks with the Largest Gains Today

In today’s Hong Kong stock market, the stocks with the largest gains drew significant investor attention. You can see that the new energy vehicle sector performed particularly well. For example, BYD Company Limited’s stock price rose 8.5%, closing at US$32.80 per share. This gain was primarily driven by the growth in China’s new energy vehicle sales. The market is highly confident in the sector’s future, with noticeable capital inflows.

Additionally, Xiaomi Corporation in the technology sector also performed strongly, with its stock price rising 6.2% to US$15.40 per share. Xiaomi’s recently launched new smartphone model received positive market feedback, with sales data exceeding expectations. These factors prompted investors to have higher expectations for Xiaomi’s future growth potential.

Below are the data for the stocks with the largest gains today:

| Stock Name | Gain (%) | Closing Price (USD) |

|---|---|---|

| BYD Company Limited | 8.5 | 32.80 |

| Xiaomi Corporation | 6.2 | 15.40 |

| Tencent Holdings | 5.8 | 42.50 |

Stocks with the Most Significant Declines

In today’s Hong Kong stock market, some stocks’ declines caught market attention. You should note that the tourism and aviation sectors were affected by pandemic-related news, resulting in weak performance. For example, Cathay Pacific Airways’ stock price fell 7.3%, closing at US$8.90 per share. The recent resurgence of the pandemic has reduced travel demand, directly impacting the aviation industry’s profit expectations.

Another stock with a significant decline was Haidilao International Holding Ltd., whose stock price dropped 6.8% to US$5.60 per share. Market concerns about rising costs in the catering industry and weakening consumer demand dragged down its stock performance.

Below are the data for the stocks with the most significant declines today:

| Stock Name | Decline (%) | Closing Price (USD) |

|---|---|---|

| Cathay Pacific Airways | 7.3 | 8.90 |

| Haidilao International Holding Ltd. | 6.8 | 5.60 |

| China Petroleum & Chemical Corporation | 5.5 | 4.20 |

Stocks with the Highest Trading Volume and Their Reasons

Stocks with the highest trading volume typically reflect market activity levels. Today, Alibaba Group Holding Limited recorded a trading volume of 120 million shares, making it the most traded stock. You can see that Alibaba recently announced a new e-commerce platform upgrade plan, which attracted significant investor attention. This news fueled market optimism about its future profitability.

Another high-trading-volume stock was China Construction Bank, with a trading volume of 95 million shares. China Construction Bank recently released its quarterly financial report, showing profit growth exceeding market expectations. This positive news attracted more capital inflows, boosting trading volume.

Below are the data for the stocks with the highest trading volume today:

| Stock Name | Trading Volume (Shares) | Closing Price (USD) |

|---|---|---|

| Alibaba Group Holding Limited | 120 million | 25.30 |

| China Construction Bank | 95 million | 6.80 |

| Tencent Holdings | 82 million | 42.50 |

Tip: Observing the stocks with the highest trading volume can help you understand market capital flows and identify potential investment opportunities.

Market Trends and Expert Opinions

Analysis of Current Market Trends

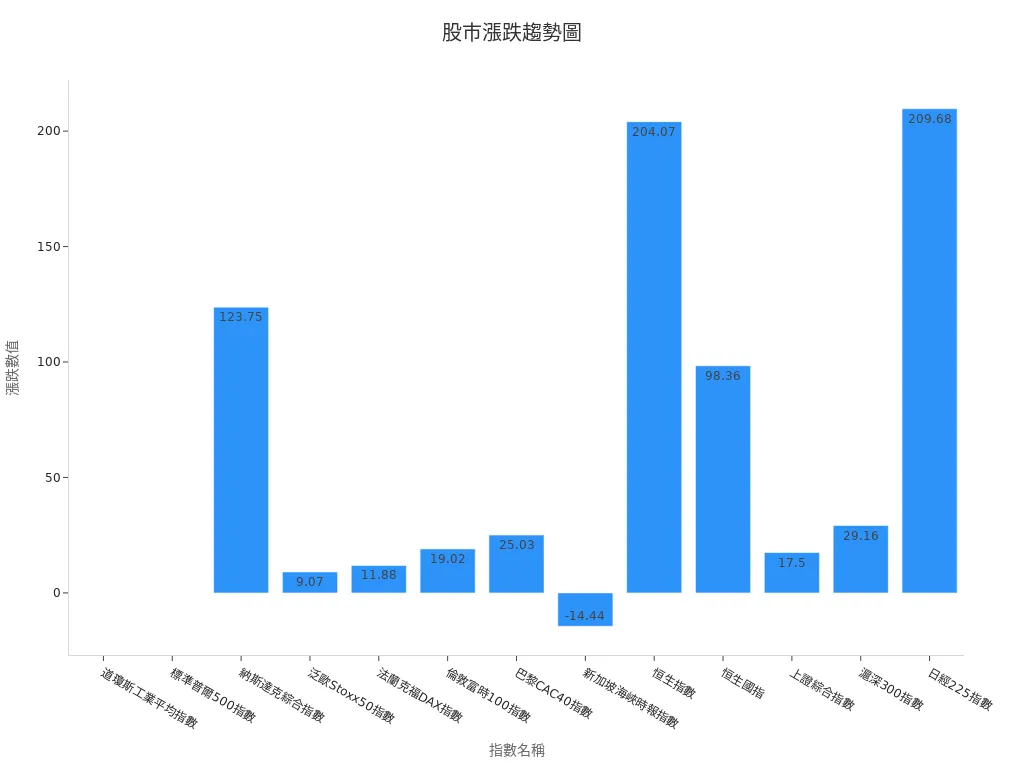

Recently, global stock markets have shown a steady upward trend, and the Hong Kong stock market today is no exception. The Hang Seng Index rose 0.84%, and the H-Share Index gained 1.12%, reflecting optimistic market sentiment. Below are real-time performance data for major stock indices:

| Name | Index | Gain/Loss | Percentage |

|---|---|---|---|

| Hang Seng Index | 24,366.94 | 204.07 | 0.84% |

| H-Share Index | 8,865.72 | 98.36 | 1.12% |

| Shanghai Composite Index | 3,402.32 | 17.50 | 0.52% |

| Nasdaq Composite Index | 19,714.99 | 123.75 | 0.63% |

| Nikkei 225 Index | 38,421.19 | 209.68 | 0.55% |

You can see that the strong performance of technology and new energy-related industries drove gains in multiple market indices. This reflects investor confidence in innovative sectors. Meanwhile, continued southbound capital inflows provided stable support for the Hong Kong market.

Expert Predictions on the Future of the Hong Kong Stock Market

Experts believe that the Hong Kong stock market may face volatility in the future but remains optimistic in the long term. Historical data shows that after rising in the first half of the year, the Hong Kong market maintained gains in the second half only 40% of the time, with an average decline of 0.79%. This suggests the market may experience short-term adjustments but will not alter the long-term growth trend.

Additionally, experts point out that the technology and new energy sectors will continue to be market growth engines. With increasing policy support from China, the profitability of related companies is expected to improve further. You can focus on leading companies in these sectors to capture potential investment opportunities.

Risks and Opportunities Investors Should Note

In the current market environment, you need to pay attention to the following risks and opportunities:

- Risks:

- Global economic uncertainty may impact market sentiment.

- Rising interest rates may pressure high-valuation stocks.

- Geopolitical risks may lead to market volatility.

- Opportunities:

- Policy support for technology and new energy sectors provides growth potential.

- Southbound capital inflows reflect international investor confidence in the Hong Kong market.

- Undervalued high-quality stocks may offer long-term investment opportunities.

Tip: Diversification and risk management are key strategies for dealing with market volatility. You can consider allocating capital to different industries and asset classes to reduce risk.

Impact of Global Markets on Hong Kong Stocks Today

Immediate Impact of U.S. Stocks on Hong Kong Stocks

U.S. stock market fluctuations have a significant impact on the Hong Kong stock market, especially during major events. Historical data shows that on October 19, 1987, during the “Black Monday” crash, U.S. stocks plummeted 22.62%, directly causing a 33.33% drop in the Hong Kong stock market. This linkage effect reflects the high correlation between the two markets.

| Event | U.S. Stock Decline | Hong Kong Stock Decline |

|---|---|---|

| 1973-1974 | N/A | 91.5% |

| October 19, 1987 | 22.62% | 33.33% |

You can observe that U.S. stock performance often serves as a key reference for Hong Kong stock market trends. When U.S. stocks experience significant fluctuations, Hong Kong stock market investors should closely monitor and adjust their strategies promptly.

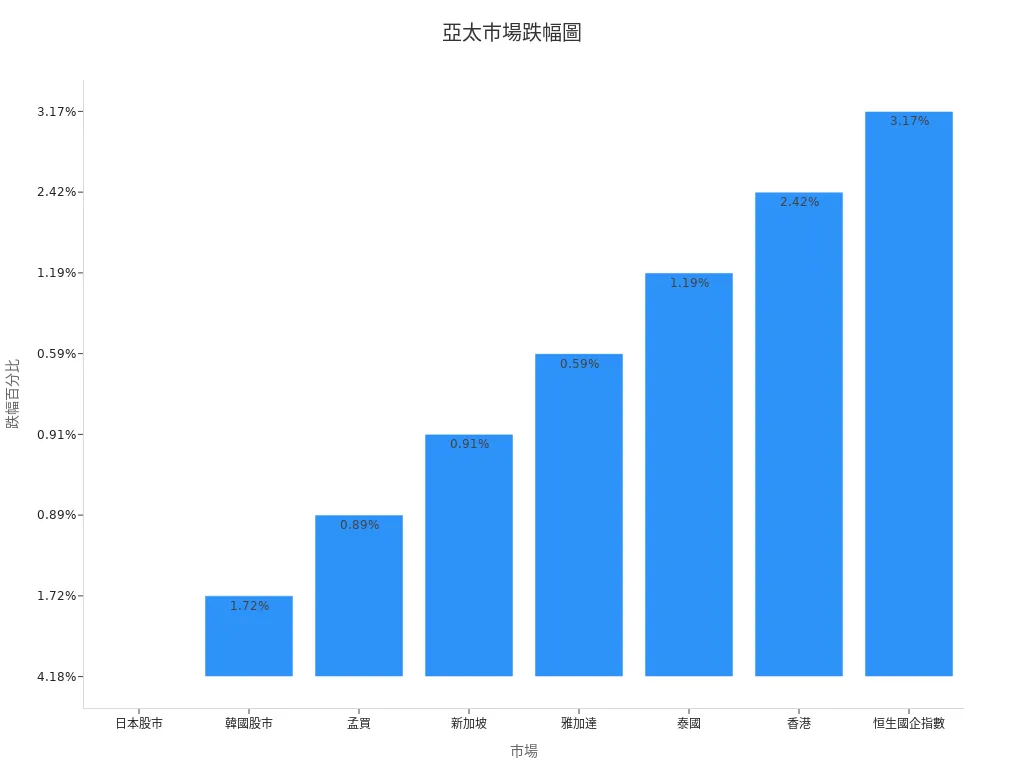

Linkage Effects of A-Shares and Other Asia-Pacific Markets

The linkage effects of A-shares and other Asia-Pacific markets also impact the Hong Kong stock market. Recent data shows that when A-shares fluctuate, other Asia-Pacific market indices often follow suit. For example, the Nikkei 225 Index fell 4.18%, while the Hang Seng Index dropped 2.42%. This linkage effect reflects the close relationship between regional markets.

| Market | Index | Decline |

|---|---|---|

| Japan Stock Market | Nikkei 225 Index | 4.18% |

| South Korea Stock Market | Composite Index | 1.72% |

| Hong Kong | Hang Seng Index | 2.42% |

| H-Share Index | 3.17% |

You can use these data to understand the linkage effects between A-shares and Asia-Pacific markets, enabling a more comprehensive assessment of potential risks and opportunities in the Hong Kong stock market.

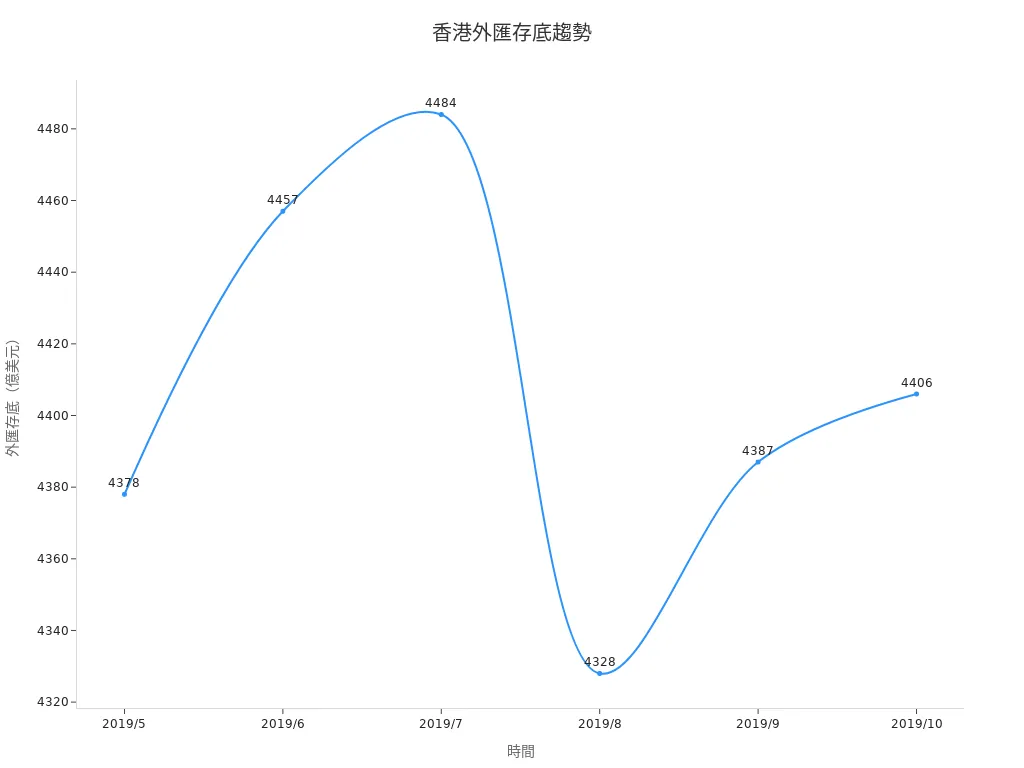

Impact of International Economic Events on the Market

International economic events have a significant impact on the Hong Kong stock market. Despite political unrest, Hong Kong’s foreign exchange reserves not only did not decrease but continued to grow during the protests, reflecting market confidence in Hong Kong’s economy.

| Time | Foreign Exchange Reserves (USD Billion) | Notes |

|---|---|---|

| May 2019 | 4,378 | |

| June 2019 | 4,457 | |

| July 2019 | 4,484 | |

| August 2019 | 4,328 | |

| September 2019 | 4,387 | |

| October 2019 | 4,406 | Increased for two consecutive months |

Additionally, the resilience of Hong Kong stocks is noteworthy. For example, from June to November 2019, the Hang Seng Index’s closing levels remained relatively stable, demonstrating market resilience. You can infer that while international economic events may cause short-term fluctuations, their long-term impact often depends on market fundamentals.

Real-Time News and Events

Major News Impacting the Hong Kong Stock Market Today

Today, the Hong Kong stock market was influenced by several major news events. You should note that the Chinese government announced a new economic stimulus plan aimed at supporting the development of small and medium-sized enterprises. This news boosted market confidence, particularly for stocks related to small and medium-sized enterprises, which performed strongly. For example, certain technology and manufacturing stocks rose by more than 5%. Additionally, in international markets, the U.S. Federal Reserve hinted at possibly delaying interest rate hikes, which also positively impacted the Hong Kong stock market.

You can see that these news events directly influenced investor sentiment and capital flows. Understanding these dynamics can help you better grasp the trends of the Hong Kong stock market today and make more informed investment decisions.

Impact of Policy Changes or Economic Data

Policy changes and fluctuations in economic data significantly impact the Hong Kong stock market. Below are several key factors:

- Policy changes may affect companies’ borrowing costs, thereby impacting stock index performance.

- Unemployment and employment rate data directly affect investor confidence.

- Fluctuations in price indices and inflation rates alter market capital flows.

- Political factors and government economic policies may trigger short-term market volatility.

For example, recently released unemployment rate data in Hong Kong showed a decline to 3.2%, boosting market sentiment, particularly for stocks in the retail and service sectors. You can use these data to analyze potential risks and opportunities in the market.

Company Announcements and Industry Trends

Company announcements and industry trends provide crucial market insights. For example, a tech company recently released its quarterly sales data, showing a 15% year-on-year increase in smart device sales. This reflects growing market demand and has attracted more investor attention.

Below are common data analysis methods used in company announcements:

- Year-on-year sales comparisons reveal changes in market demand.

- Such comparisons help businesses allocate resources and identify growth areas or customer segments.

- When sales show negative growth, companies can promptly adjust strategies to mitigate market volatility.

By analyzing these announcements, you can identify potential investment opportunities and better understand the latest industry developments.

Today’s performance of the Hong Kong stock market reflects multiple factors, including shifts in inflation data, policy adjustments, and geopolitical uncertainties. You should monitor these trends closely, as although inflation shows signs of cooling, a tight labor market may continue to impact future market movements. When formulating strategies, investors should consider the importance of diversification. Data shows that diversified stock-bond portfolios have achieved an average annual return of 3.9% over the past decade, with lower volatility than pure equity portfolios. Staying flexible and tracking market dynamics will help you find stable investment opportunities amid fluctuations.

FAQ

1. How to access real-time updates on the Hong Kong stock market?

You can use professional financial platforms like Bloomberg or Reuters. Additionally, the Hong Kong Exchange (HKEX) website provides real-time data. Mobile apps such as “AAstocks” or “Investing.com” also offer quick access to market trends.

Tip: Choose reliable sources to avoid delayed or inaccurate data.

2. What risks should investors be aware of in the Hong Kong stock market?

Investors should watch for market volatility, policy changes, and global economic events. For instance, rising interest rates may pressure high-valuation stocks. Diversification can effectively reduce risks.

Suggestion: Regularly review your portfolio to ensure balanced asset allocation.

3. How to analyze the potential value of popular stocks?

Consider the following aspects:

- Financial data: Check metrics like P/E ratios and earnings growth.

- Industry trends: Assess the sector’s growth potential.

- Company announcements: Monitor quarterly reports and major news.

Example: BYD’s recent profit growth reflects strong demand for new energy vehicles.

4. How does southbound capital affect the Hong Kong stock market?

Inflows of southbound capital indicate international investors’ confidence in Hong Kong’s market. These funds typically focus on large-cap blue-chip and tech stocks, positively impacting market liquidity and share prices.

Data shows: In 2023, southbound capital inflows hit a record high, driving the Hang Seng Index upward.

5. How to navigate market volatility?

Staying calm during volatility is key. Strategies include:

- Diversification: Reduce exposure to single-asset risks.

- Long-term holding: Avoid short-term emotional decisions.

- Regular reviews: Adjust strategies based on market changes.

Tip: Set stop-loss points to limit potential losses.

In 2025, Hong Kong’s stock market is dynamic, with the Hang Seng Index soaring to 24,366.94 points, the China Enterprises Index up 1.12%, and the Tech Index rising 1.09%, but market volatility and cumbersome traditional bank cross-border processes can hinder investment efficiency—how can you stay ahead and boost returns? BiyaPay offers an all-in-one digital financial platform, enabling seamless trading of Hong Kong and US stocks without offshore accounts, helping you swiftly respond to market trends and seize opportunities.

Supporting USD, HKD, and 30+ fiat and digital currencies, real-time exchange rate tracking ensures transaction transparency, while global remittances to 190+ countries feature fees as low as 0.5%, with rapid delivery to meet digital investment needs. A 5.48% annualized yield savings product, with no lock-in period, balances liquidity and steady returns. Sign up for BiyaPay today to pair Hong Kong market insights with BiyaPay’s global financial solutions, creating an efficient, low-cost investment experience!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.