- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

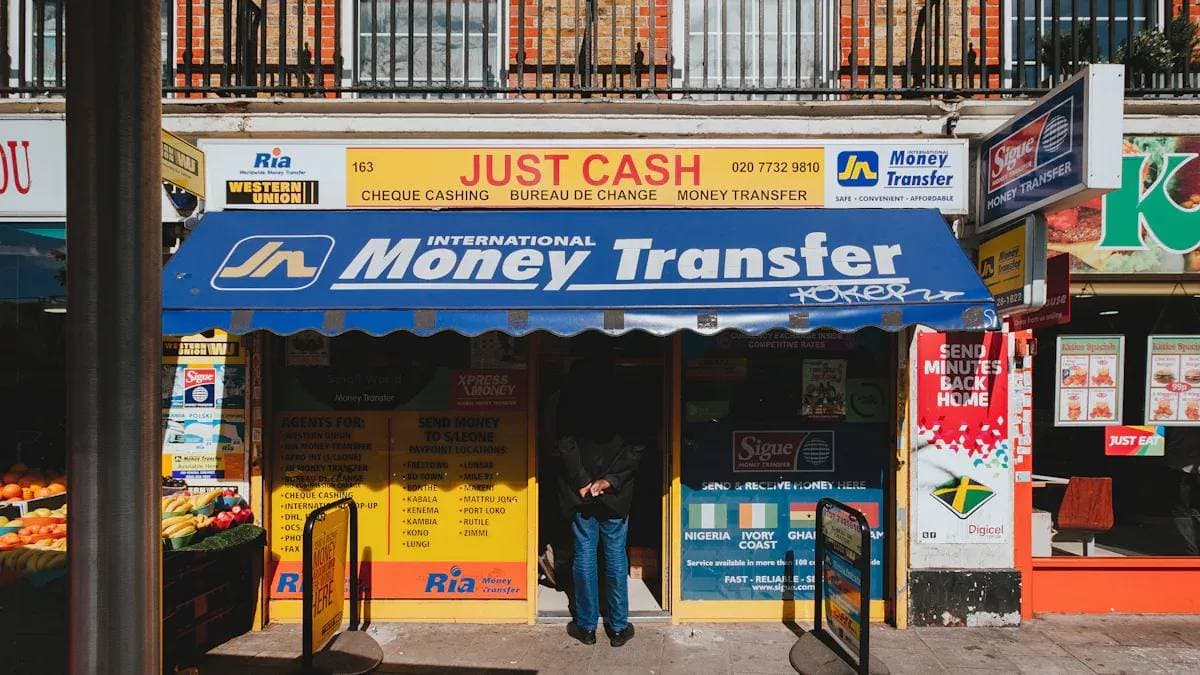

Health Savings Accounts Are Quietly Becoming Essential for More Families—You Should Know About Them!

Image Source: pexels

Have you noticed rising medical costs? More families are turning to Health Savings Accounts (HSAs) to manage healthcare expenses. You can use this tool to enjoy tax benefits and ease financial burdens. Are you clear on the practical uses of an HSA? It could become a new option for your family’s financial planning.

Key Points

- Health Savings Accounts (HSAs) offer tax advantages: contributions are tax-deductible, account growth is tax-free, and withdrawals for qualified medical expenses are also tax-free.

- HSA funds are flexible, allowing deposits or withdrawals at any time, with balances rolling over long-term, ideal for planning future medical expenses.

- Opening an HSA requires enrollment in a High-Deductible Health Plan (HDHP) and meeting specific eligibility criteria to ensure you qualify.

- HSAs allow fund investments, with tax-free growth, helping you utilize funds effectively for medical expenses.

- Regularly monitor legal and policy changes to ensure HSA compliance, staying informed about the latest qualified expense categories and investment options.

Introduction to Health Savings Accounts

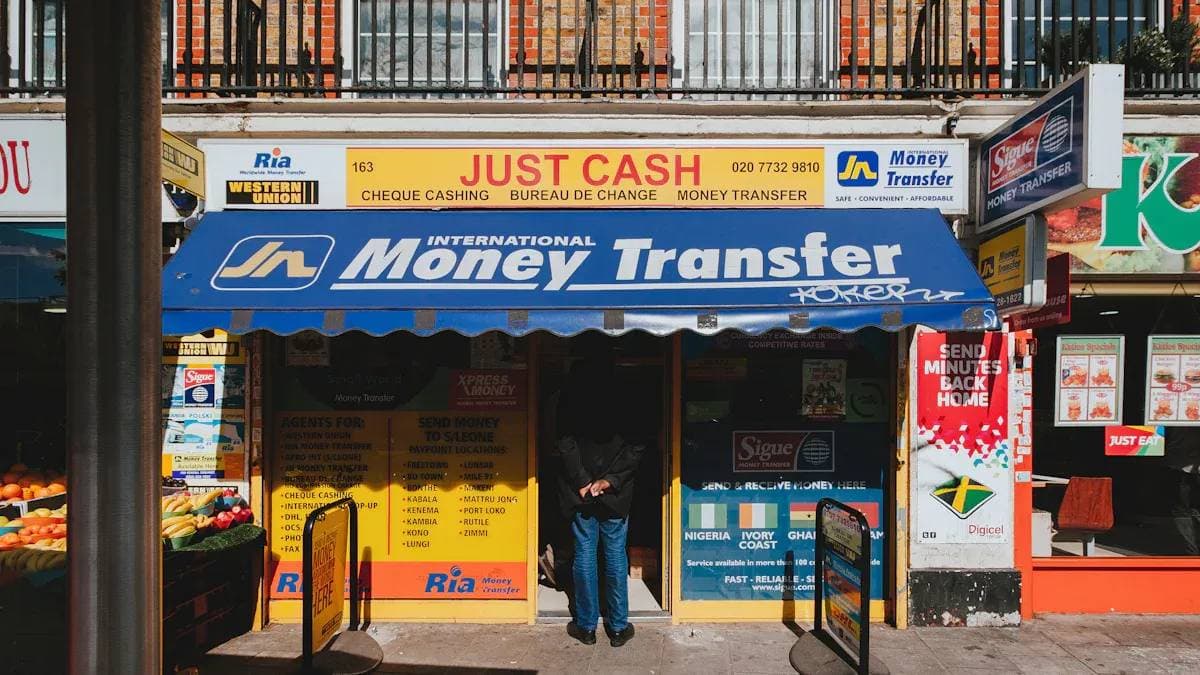

Image Source: unsplash

Definition and Core Features

You may have heard of Health Savings Accounts but aren’t clear on their specifics. According to the U.S. Internal Revenue Service (IRS), an HSA is a tax-exempt trust or custodial account. You can set up this account with a qualified trustee to pay or reimburse certain medical expenses you incur. Establishing an HSA doesn’t require IRS approval, and you can work with a trustee different from your health plan provider. Only eligible individuals can contribute to the account.

You can use an HSA to prepare for future medical expenses. The funds can cover qualified medical costs, including doctor visits, dental, vision exams, and prescription drugs. Your annual contributions are tax-deductible, and the account balance can accumulate and be invested until you need to withdraw it.

The table below summarizes the main features and characteristics of HSAs:

| Feature/Characteristic | Description |

|---|---|

| Tax Advantages | Contributions are tax-deductible, account growth is tax-free, and withdrawals for qualified medical expenses are tax-free. |

| Fund Flexibility | You don’t need to withdraw by a specific date; balances can be saved and invested for future medical expenses. |

| Eligibility Requirements | Must be enrolled in a qualified High-Deductible Health Plan (HDHP) and not claimed as a dependent by others. |

| Expense Scope | Can be used for various medical expenses, including medical, dental, vision copays, and prescriptions. |

| Retirement Use | After age 65, funds can be used for Medicare premiums; non-medical withdrawals only incur standard income tax. |

You can see that HSAs not only help with daily medical expenses but also support retirement healthcare planning.

Eligible Users

Do you qualify to open an HSA? Currently, nearly 39 million Americans are eligible due to enrollment in HDHPs. You need to meet these requirements:

- Enrolled in a High-Deductible Health Plan (HDHP)

- Not enrolled in Medicare or other health plans

- Not claimed as a dependent on someone else’s federal tax return

If you work or live in mainland China, you cannot directly open a U.S. HSA, but you can learn from U.S. practices to understand how to manage family healthcare finances with similar tools. HSAs in the U.S. primarily target those with high-deductible health insurance, who often aim to reduce medical costs through tax benefits and fund accumulation.

You can assess whether an HSA suits you based on your health insurance type and family medical expense needs. If eligible, you can enjoy the account’s multiple benefits.

Advantages of Health Savings Accounts

Image Source: pexels

Tax Benefits

When managing family medical expenses, tax benefits are one of the most attractive features of HSAs. You can enjoy triple tax advantages, making your funds more effective for healthcare. The table below summarizes these three key tax benefits:

| Tax Advantage | Description |

|---|---|

| Tax-Deductible Contributions | Contributions to your HSA are pre-tax, reducing your taxable income. |

| Tax-Free Growth | Funds in the account can be invested, with growth exempt from federal taxes when used for qualified medical expenses. |

| Tax-Free Withdrawals | Withdrawals for qualified medical expenses are not subject to taxes. |

Your annual contributions not only reduce taxable income but also grow tax-free within the account. As long as funds are used for qualified medical expenses, withdrawals are tax-free. This tax structure maximizes fund efficiency, easing the financial burden of medical costs.

Fund Flexibility

When using an HSA, you’ll find fund management highly flexible. You can deposit or withdraw funds at any time, provided the use complies with regulations. Compared to Flexible Spending Accounts (FSAs), HSAs have clear advantages. The table below highlights key differences:

| FSA | HSA | |

|---|---|---|

| Can funds roll over yearly? | Usually not (some plans allow limited rollovers) | Yes |

| Portable after job change? | No | Yes |

You can keep HSA balances indefinitely without worrying about year-end forfeiture. Even if you change jobs or retire, the funds remain yours. This flexibility allows long-term medical expense planning, avoiding fund waste.

You can use HSA funds for various medical expenses, including:

- Co-insurance: Percentage you pay for services

- Copays: Fixed amounts you pay for services

- Annual deductibles: Costs you cover before insurance kicks in

- Qualified medical expenses, including some dental, prescription, and vision costs

You can flexibly allocate funds based on family needs, enhancing healthcare efficiency.

Accumulation and Growth

When using an HSA long-term, you can achieve continuous fund accumulation and growth. The account has no expiration, and funds roll over yearly. You can invest the balance for additional returns. HSAs not only help with current medical expenses but also provide financial support for future and retirement healthcare needs.

The table below shows how HSAs help families manage rising medical costs:

| Feature | Description |

|---|---|

| Tax Benefits | Enjoy pre-tax contributions, tax-free growth, and tax-free withdrawals, reducing tax burdens. |

| Portability | The account is yours, usable even after job changes or retirement. |

| Employer Contributions | Employers and family members can contribute, increasing fund accumulation. |

| Annual Contribution Limits | 2025 limits: $4,300 for individuals, $8,550 for families. |

| HDHP Requirement | Requires enrollment in an HDHP with 2025 minimum deductibles of $1,650 for individuals, $3,300 for families. |

| Eligible Medical Expenses | Funds can cover unreimbursed qualified medical costs like deductibles, copays, and prescriptions. |

You can accumulate funds through HSAs, invest for growth, and flexibly address rising medical costs. You can also adjust annual contribution limits based on family needs to ensure adequate healthcare coverage. HSAs provide a long-term, stable financial tool for healthcare, helping you face uncertain future medical expenses with confidence.

Determining Suitability

Needs Assessment

When considering whether to open an HSA, first analyze your healthcare and financial needs. You can evaluate from these perspectives:

- Do you have a High-Deductible Health Plan (HDHP)? Only this type of insurance allows HSA eligibility.

- Do you want to reduce medical expenses through tax benefits? HSAs help save taxes and improve fund efficiency.

- Do you have high medical expenses or want to prepare for future costs? HSA funds cover various medical expenses, addressing unexpected needs.

- Do you want account funds to grow through investments? HSAs allow tax-free investment returns.

- Do you want funds to roll over long-term without expiration? HSA funds remain available indefinitely.

The table below lists common reasons people choose HSAs:

| No. | Reason Description |

|---|---|

| 1 | Save on taxes, reduce taxable income |

| 2 | Earn tax-free interest |

| 3 | Portable funds, valid long-term |

| 4 | Covers various medical and non-medical expenses |

| 5 | Acts as an investment tool for higher returns |

| 6 | Pays future Medicare premiums |

| 7 | Usable for non-medical expenses after age 65 |

| 8 | Addresses unexpected medical costs |

You can assess whether an HSA suits your family based on your specific circumstances.

Eligibility Check

To determine if you qualify for an HSA, use this checklist:

- You must have an HDHP and meet minimum deductible requirements.

- Your insurance plan must have maximum out-of-pocket limits for individuals and families.

- You cannot have other non-qualifying health coverage, such as Medicare, TRICARE, or TRICARE For Life.

- If you’ve used VA medical benefits in the last three months, you may be ineligible unless you have a service-related disability or only received preventive services.

- You cannot be claimed as a dependent on someone else’s tax return.

- You cannot participate in non-qualifying medical savings accounts like FSAs or HRAs, unless they cover only dental or vision expenses.

Use this checklist to quickly determine HSA eligibility. If you meet all criteria, explore the opening process and account management further.

Opening and Using an HSA

Opening Steps

You can open an HSA through three methods:

- Open an account through your employer. Many companies offer HSAs as part of benefits, often paired with HDHPs.

- Contact a licensed Hong Kong bank or investment brokerage to inquire about HSA services.

- Use an online financial platform for convenient account setup and management.

To open an account, prepare these materials:

- Social Security Number

- Driver’s license or state ID

- Contact information (including email address)

- Employer information

- At least one beneficiary’s details (legal name, date of birth, Social Security Number)

After submitting materials, the bank or financial institution will assist in setting up the account. Once established, you can contribute funds based on your needs.

Account Management

You can manage HSA funds in various ways. You can use account tracking tools to record medical expenses and reimbursements. Spreadsheets offer flexible management of past medical expenses. Budgeting software can automatically tag and categorize qualified medical purchases. Keep digital and paper receipts for future reimbursements or tax audits.

When withdrawing funds, ensure they’re used for qualified medical expenses. Even if you’re no longer enrolled in an HDHP, you can use funds for qualified expenses. Refer to IRS Publication 502 for the scope of qualified medical expenses.

Considerations

When using an HSA, avoid these common pitfalls:

- Not contributing the maximum allowed amount, missing tax benefits and growth opportunities

- Using funds for non-qualified expenses, incurring penalties and taxes

- Failing to keep medical expense receipts, risking issues during tax audits

- Missing tax filing deadlines, losing pre-tax deduction opportunities

- Not utilizing investment options, missing account balance growth

- Not designating a beneficiary, complicating fund transfers

- Ignoring state tax impacts, potentially causing additional tax burdens

Ensure all funds are used for qualified medical expenses, such as prescription glasses, pain relievers, or hearing aids. Let funds roll over to prepare for significant future medical expenses. Adjust contribution amounts based on your situation to avoid penalties for non-medical withdrawals.

Risks and Limitations

Legal and Policy Considerations

When using an HSA, stay aware of legal and policy changes. The U.S. has recently adjusted HSA usage scopes. You can now use HSA funds to pay Direct Primary Care (DPC) membership fees, increasing flexibility in choosing medical services. Telemedicine services are also included as qualified expenses, enhancing accessibility and affordability of modern healthcare. The table below summarizes these changes and their impacts:

| Change Content | Impact |

|---|---|

| HSA funds can pay Direct Primary Care (DPC) fees | Makes DPC a qualified medical expense, increasing HSA flexibility |

| Telemedicine services qualify for HSA funds | Enhances accessibility and affordability of modern healthcare |

Regularly monitor policy updates to ensure compliance. If living in mainland China, you cannot directly open a U.S. HSA, but you can learn from these policy changes to understand global trends in healthcare financial tools.

Investment Risks

When managing an HSA, you can choose various investment options, including stocks, mutual funds, and ETFs. Based on your risk tolerance, select simplified brokerage experiences, recommended fund lists, or investment services managed by registered advisors. Typically, when your HSA cash balance exceeds $1,000, you can open an investment account, with all investment gains tax-free. You can trade and invest online anytime.

- Choose diversified investment products to enhance growth potential.

- Enjoy tax-free investment gains, increasing long-term account value.

However, investments carry risks. The average deductible for HDHPs is $4,070, far higher than $679 for PPO plans. You may face higher out-of-pocket medical costs. Data shows HDHP users with HSAs are 2.5 times more likely to pay over 5% of their income on medical expenses compared to comprehensive insurance users. Low-income families face greater financial strain due to limited disposable income, potentially affecting health outcomes.

Before investing, assess your risk tolerance and plan fund allocation carefully to avoid financial strain from market volatility or high medical costs.

You can enhance family financial security through HSAs:

- Funds roll over long-term, usable in retirement.

- Tax benefits reduce medical cost burdens, improving financial efficiency.

- Flexibly plan medical expenses based on your situation.

Research shows high-income families benefit more, with limited help for low-income households. Actively learn about policies and processes to make informed choices.

FAQ

What’s the difference between an HSA and an FSA?

You can roll over HSA funds yearly, while FSAs typically reset at year-end. HSAs are personally owned and portable after job changes.

Can I open an HSA through a licensed Hong Kong bank?

You can inquire whether licensed Hong Kong banks offer HSA services. Prepare identification and relevant documents. Refer to the bank’s official guidelines for specifics.

What products can HSA funds be invested in?

You can invest in stocks, mutual funds, or ETFs, with tax-free gains. Allocate funds based on your risk tolerance.

What happens if I use HSA funds for non-medical expenses?

You’ll face penalties and taxes for non-medical withdrawals. Ensure all withdrawals are for qualified medical expenses and keep receipts for tax compliance.

Are there minimum opening amounts or fees for HSAs?

Check with banks or financial institutions for minimum opening amounts and fees, typically in USD. Consult the institution for specific details.

With rising medical costs, a Health Savings Account (HSA) offers a flexible and tax-efficient way to manage your family’s healthcare expenses. However, challenges like high remittance fees, opaque exchange rates, and complex platforms can hinder effective financial planning, especially for cross-border transactions.

BiyaPay simplifies these issues with a comprehensive financial platform. Access real-time exchange rate queries to stay informed on fiat and digital currency conversions, supporting a wide range of currencies with full transparency. With remittance fees as low as 0.5%, covering most countries globally and offering same-day transfers, BiyaPay ensures efficiency and reliability. Plus, you can invest in US and Hong Kong stocks via our stocks feature without needing an overseas account, creating new opportunities to grow your healthcare funds. Sign up with BiyaPay today to streamline your medical financial planning and secure your family’s future!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.