- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Withdraw Money from Cash App? A Withdrawal Guide for Mexican Users

Cash App is a popular mobile payment and remittance platform that supports multiple currencies such as the Mexican peso (MXN), US dollar (USD), and euro (EUR). In Mexico, users can withdraw funds from Cash App to bank accounts such as Santander, Bancomer and Banorte, or they can directly withdraw cash at ATMs.This article will provide a detailed introduction on how to withdraw money from Cash App in Mexico, as well as how to reduce remittance costs and ensure transaction security.

Can Mexican bank accounts be linked to Cash App?

In Mexico, users cannot directly link their local bank accounts to Cash App because this application is mainly targeted at the US market and currently only supports US bank accounts and debit cards. Although Cash App supports transactions between the US dollar (USD) and the Mexican peso (MXN), its international remittance function is still limited. Major Mexican banks such as Santander, Bancomer, and Banorte are not on the official list of banks supported by Cash App.

How to check if Cash App supports linking a Mexican bank account?

If users want to add a Mexican bank account to Cash App, they can try the following methods to verify:

- Enter Cash App, find the “Bank Accounts” option, and select to add a bank.

- Enter the account information of the Mexican bank. If Cash App does not support this bank, the system will prompt an error message.

- Contact Cash App customer service to confirm the latest international account linking policy.

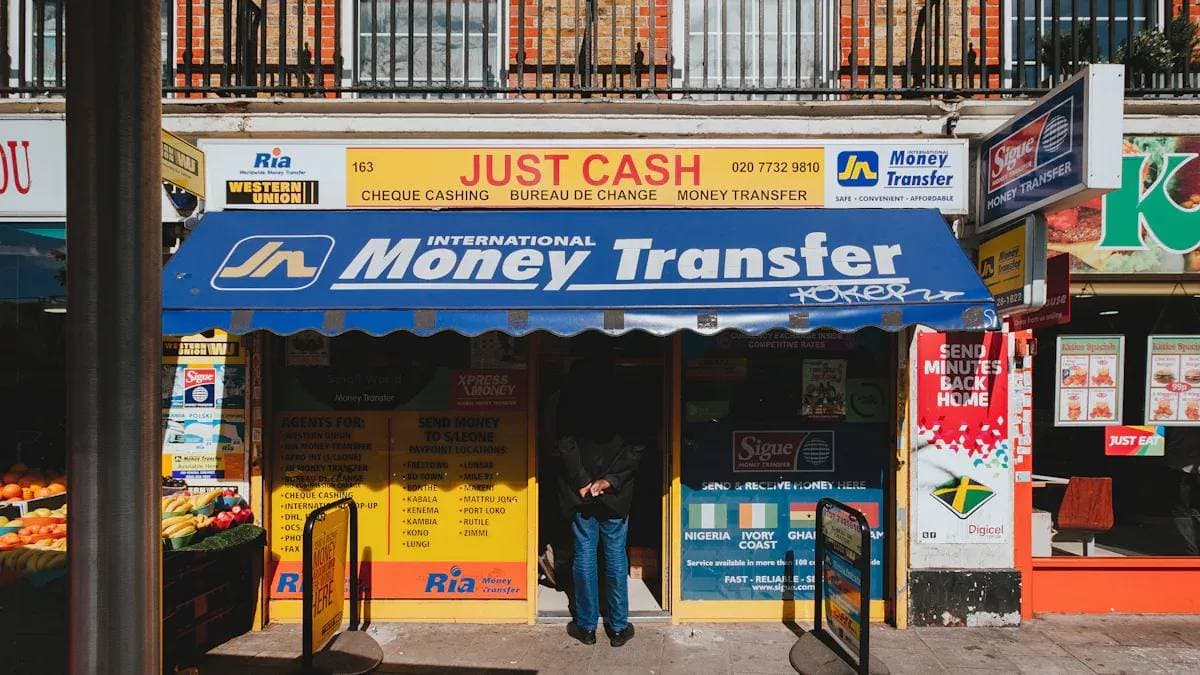

Since Cash App has not officially entered the Mexican market, even if users successfully add a Mexican bank card, they may still encounter problems such as transfer failures and withdrawal restrictions. Therefore, it is recommended that users use alternative options such as PayPal, Wise, or Western Union, which are more suitable for cross-border fund management and transfers.

What are the fees of Cash App in Mexico?

The remittance and withdrawal fees of Cash App in Mexico vary depending on the transaction type and payment method.

Firstly, standard bank deposits usually do not incur additional fees, but if users choose expedited fund arrival, there may be a handling fee of 1.5% - 3%. It is recommended that users plan their fund usage in advance to avoid unnecessary expenses.

Secondly, when transferring money from Mexico to the United States, Cash App charges an international remittance handling fee of 4%. Although this fee is lower than that of some traditional banks, users can still find more cost-effective options by comparing different remittance methods. For example, using MoneyGram or Wise may offer more favorable exchange rates and handling fees.

In addition, users may be charged additional fees when using a credit card or debit card for cash withdrawals. Therefore, before making a withdrawal, it is recommended that users consult their bank or payment provider to understand the possible costs involved in order to choose the most economical withdrawal method.

What are the withdrawal methods of Cash App in Mexico?

Cash App offers a variety of withdrawal methods. Users can flexibly choose the most suitable one for themselves, such as local bank transfer, MoneyGram cash withdrawal, or ATM cash withdrawal.

When choosing a withdrawal method, users should consider the arrival time of funds, fees, and security. Bank transfer is usually the safest method, but it may take 1-3 working days; MoneyGram cash withdrawal is faster, and the funds usually arrive within a few minutes, but it may involve additional handling fees; ATM withdrawal is convenient and direct, but users need to ensure that they use a debit card that supports Cash App cash withdrawal.

To avoid additional expenses, it is recommended that users use the free withdrawal services provided by local banks or choose the low-fee withdrawal options of Cash App. In addition, users can also set transaction notifications in Cash App to ensure that every transaction can be monitored, thereby reducing the risk of unauthorized transactions.

Before making a withdrawal, users should check their account balance, confirm the receiving method, and pay attention to whether there are handling fees or exchange rate conversion fees. By reasonably choosing the withdrawal method, users can reduce costs, increase the speed of fund arrival, and ensure the security of funds.

How to withdraw Cash App funds using an ATM?

In Mexico, users can directly withdraw funds from their Cash App accounts through an ATM, but they need to ensure that their Cash App account is connected to a local debit card. After linking the debit card, users can use it to withdraw cash at an ATM. The specific steps are as follows:

- Open Cash App, go to the “Withdraw” option, and select “Link Debit Card.”

- Enter the information of the debit card issued by a local Mexican bank and complete the verification.

- After a successful link, insert the debit card into a supported ATM.

- Select “Withdraw” and enter the desired amount, and confirm to complete the transaction.

Some ATMs may charge additional cash withdrawal handling fees. When choosing an ATM, users can give priority to using the ATMs of banks that support free withdrawals to reduce additional costs. In addition, Cash App allows users to set transaction notifications. After each withdrawal, users will receive SMS or email reminders to ensure the security of funds.

How to recharge the Cash App account from Mexico? What are the recharge methods?

In Mexico, users can recharge their Cash App accounts for cross-border transfers, bill payments, or depositing US dollars. The main recharge methods include bank transfer, credit card payment, and MoneyGram cash recharge.

Users can select the “Recharge” option within Cash App, then enter the transfer amount, choose the payment method, and confirm the transaction. If using bank transfer, the recharge amount usually arrives within 1-3 working days; when using MoneyGram for recharge, the funds usually arrive instantly, but there may be a certain handling fee.

During the recharge process, users need to provide valid identity information to ensure that the transaction complies with security standards. Some banks may require users to provide additional transaction confirmations to ensure the legality of the source of funds. Therefore, it is recommended that users confirm the specific requirements of their bank or remittance service provider before recharging.

Conclusion:

In Mexico, users can safely withdraw Cash App funds to local accounts or as cash through methods such as bank account transfer, MoneyGram cash withdrawal, and ATM withdrawal. The handling fees and arrival times of different withdrawal methods vary. Users should choose the least costly and most convenient method according to their own needs and withdrawal amounts.

If you want to break through the remittance limit and enjoy remittance services covering most regions of the world, you can consider BiyaPay. It adopts the local remittance method to ensure that the funds reach the payee’s account safely in the shortest time, while avoiding high handling fees and cumbersome international transfer processes. For users with frequent remittance needs, this is a high-quality option that saves time and money.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.