- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Frequently Asked Questions about US and Hong Kong Stocks

1. Does BiyaPay have a brokerage license?

We are a financial technology service provider. The securities firms we connect to are Tiger or Interactive Brokers. Currently, we are positioned as channel securities firms and hold RIA licenses under the US Securities Supervision Commission (SEC) and New Zealand FSP securities licenses!

2. Why can’t I sell my position?

The biggest reason may be that your BiyaPay US and Hong Kong stock fund account balance is not enough for transaction fees. Please take the following two measures to sell stocks.

A. Reduce the number of traded stocks

Recharge funds to BiyaPay US and Hong Kong stock fund account

3. How can I verify whether my US and Hong Kong stock orders on BiyaPay are really traded on Tiger Interactive Brokers?

If you want to test whether your order on BiyaPay is really in the liquid market, you can choose to place an order on stocks with relatively low liquidity (such as those with a market value of less than 100 million US dollars). You can see if you are on the tiger! Because the global depth of US and Hong Kong stocks is transparent and consistent, you can see whether they have entered the liquid market through placing an order.

BiyaPay US Hong Kong Stock Selling Demo Link: https://www.biyagl.com/NewsDetail.html?id=807

4. Why is the cost price much higher than the purchase price after I buy stocks?

Explanation of the minimum handling fee for US and Hong Kong stocks

For investors who are just starting to get in touch with US and Hong Kong stocks, they may not be very familiar with the transaction fees of US and Hong Kong stocks. Below, we will introduce some related issues about US and Hong Kong stock transaction fees. Interested friends can continue reading.

How is the handling fee for US stocks calculated?

On BiyaPay The transaction fee for buying and selling US stocks is not calculated based on the ratio of “transaction amount”, but on the basis of “number of traded stocks”, as shown in the figure. The The minimum transaction fee is $2.98, which is currently among the lowest among US stock brokers.

US stock trading fees include trading commissions, platform fees, external agency fees, trading activity fees, and CSRC fees (only charged when selling orders). The specific charging standards are as follows:

[1] Trading Commission: $0.0039 per share, minimum $0.99 per order , up to 0.5% of the total transaction amount, charged by the securities company.

[2] Platform Fee: $0.004 per share, with a minimum charge of $1 per order and a maximum charge of 0.5% of the total transaction amount, collected by the securities company.

[3] External agency fees and transaction activity fees: $0.00396 per share, minimum $0.99 per order , up to 1% of the total transaction amount, charged by external agencies.

[4] CSRC fee (charged only when selling orders): 0.0000229% of the transaction amount, minimum charge of 0.01 US dollars per transaction , charged by the US Securities Supervision Commission.

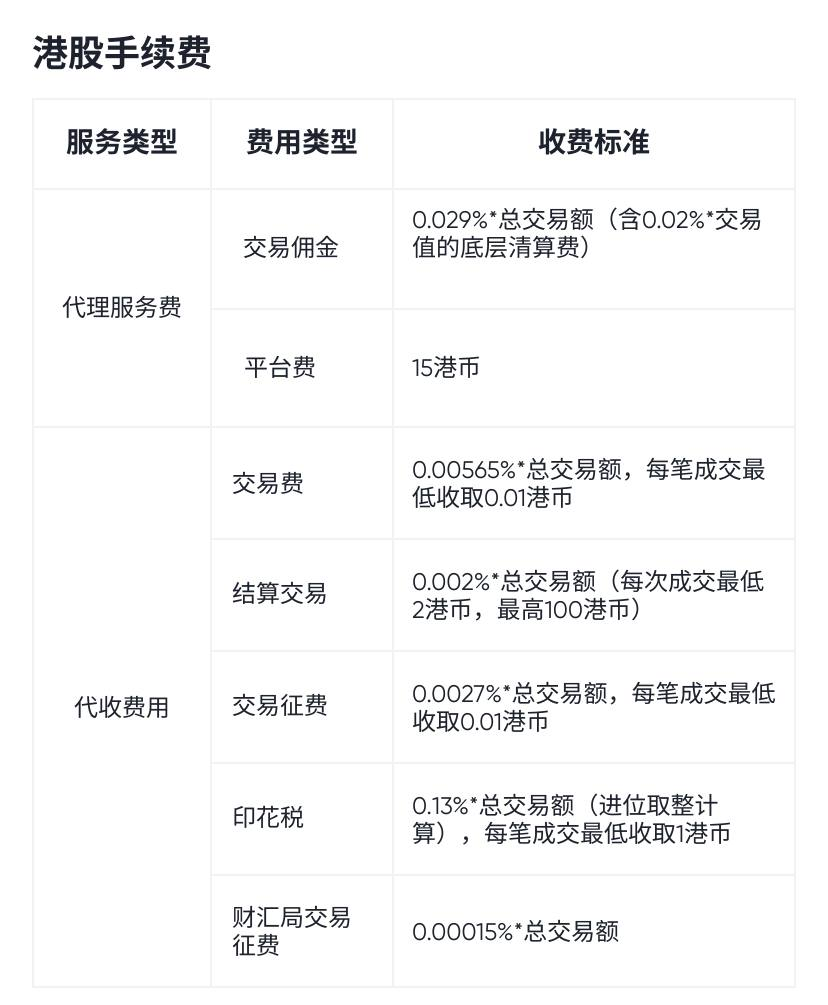

How is the handling fee for Hong Kong stocks calculated?

In BiyaPay , the transaction fee for buying and selling Hong Kong stocks, in addition to the fixed platform fee, other fees are calculated at the rate of “transaction amount”, as shown in the figure, the minimum transaction fee per transaction is HK $18.02.

Hong Kong stock trading fees include trading commission, platform fee, transaction fee, settlement fee, transaction levy, stamp duty, and finance bureau transaction levy. The specific charging standards are as follows:

[1] Transaction commission: 0.029% of the transaction amount, charged by the securities company.

[2] Platform fee: A fixed HK $15 per transaction , collected by the securities company.

[3] Transaction fee: 0.00565% of the transaction amount, minimum charge of 0.01 HKD per transaction , collected by HKEx.

[4] Settlement fee: 0.002% of the transaction amount, minimum fee 2 HKD , maximum 100 HKD, collected by Hong Kong Clearing House.

[5] Transaction Levy: 0.0027% of the transaction amount, minimum charge of 0.01 Hong Kong dollars per transaction , collected by the Hong Kong Securities Supervision Commission.

[6] Stamp Duty: 0.13% of the transaction amount, minimum charge of HKD 1 , less than HKD 1 is calculated as HKD 1, collected by the Hong Kong government.

[7] Finance Bureau Transaction Levy: 0.00015% of the transaction amount, collected by the Hong Kong FRC.

Investors in US and Hong Kong stocks are particularly concerned about transaction fees. Taking the US stock market as an example, the minimum transaction fee for any transaction is $2.98. If you buy a small number of US stocks and the transaction price is low, plus the minimum transaction fee of $2.98, the cost price of your transaction will be particularly high. For example, if you buy one share of Santander Bank stock priced at $4.64 and add the minimum transaction fee of $2.98, your cost price per share will be $7.62. Therefore, it is recommended that you trade stocks with a quantity and transaction price higher than a certain value, so that the transaction cost will decrease relatively significantly.