- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

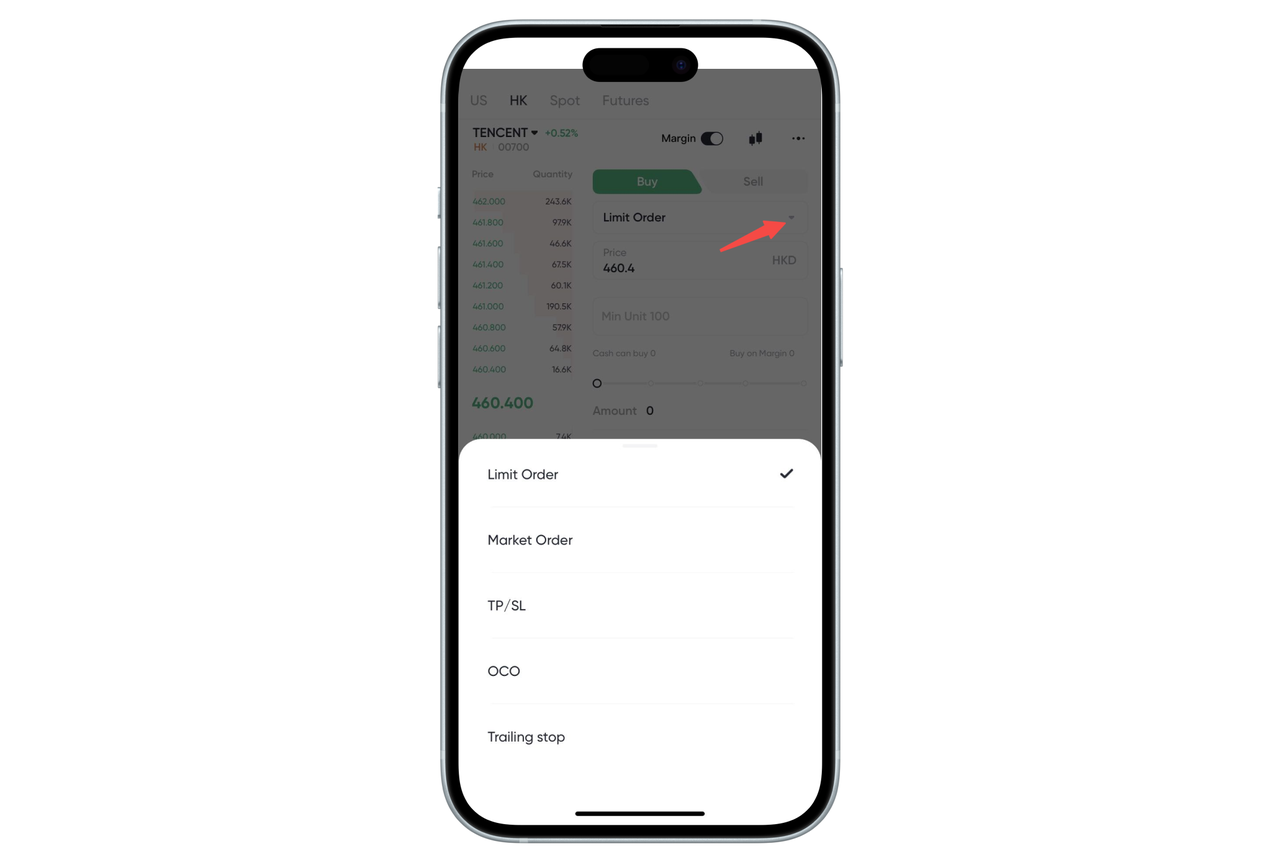

What order types are supported for trading Hong Kong stocks on BiyaPay?

There are five types of orders for trading Hong Kong stocks on BiyaPay: Limit Order, Market Order, Take-Profit and Stop-Loss, Two-way Take-Profit and Stop-Loss, and Moving Take-Profit and Stop-Loss.

The rules for these five types of orders are described below:

1. Limit Order

A limit order is an order to be executed after a certain price or better has been reached.

2. Market Order

A limit order is an order to buy or sell an asset immediately at the current market price.

3. Take profit and stop loss

When the latest price reaches the trigger price, the order will be placed at the pre-set order price, which can be a market order or a limit order. You can take profit and stop loss separately, or take profit + stop loss.

- Take profit and stop loss to buy. You can choose to close with the amount or with the quantity

Assets are frozen after the order is placed. If the order price is the market price and the transaction is made with the quantity, the amount of the trigger price * quantity will be frozen, if the order price is the limit price and the amount of the quantity will be frozen, the frozen amount will be sold after the buy is triggered at the take-profit trigger price or the buy at the stop-loss trigger price. If the available balance is insufficient at the end of the take-profit and stop-loss period, you cannot buy. - Take profit and stop loss sell. Only the quantity can be filled

After the order is placed, the lost amount of assets will be frozen. Sell at the take-profit trigger price or sell at the stop-loss trigger price, whichever price reaches first, which order will be triggered first. After triggering, sell the order. If the available balance is insufficient at the end of the take-profit and stop-loss, you cannot sell.

4, two-way take-profit and stop-loss

- Two-way take-profit and stop-loss buying. You can choose to close with the amount or with the quantity

The take-profit trigger price needs to be lower than the market price, and the stop-loss trigger price needs to be higher than the market price, and the assets will be frozen after placing an order. If the order price is the market price and the transaction is made with the quantity, the trigger price of the high price is taken as the standard, and the amount of the trigger price * quantity is frozen, if the order price is the limit price and the quantity is traded, the order price with the high price is the standard, and the amount of the order price is frozen if the order price is the market price and the amount is traded, then the frozen amount is reached first at the take-profit trigger price or at the stop-loss trigger price, which price is reached first, and which order is triggered first. After triggering, sell the order. If the available balance is insufficient at the end of the take-profit and stop-loss period, you cannot buy. - Two-way take-profit and stop-loss selling. Only the quantity can be filled

The take-profit trigger price needs to be higher than the market price, and the stop-loss trigger price needs to be lower than the market price, and the lost amount of assets will be frozen after the order is placed. Sell at the take-profit trigger price or sell at the stop-loss trigger price, whichever price reaches first, which order will be triggered first. After triggering, sell the order. If the available balance is insufficient at the end of the take-profit and stop-loss, you cannot sell.

5. Move take profit and stop loss

Trailing TP/SL is a kind of take-profit and stop-loss that tracks the market price, sets the price distance or ratio in advance, and automatically executes the market order when the market price reaches a preset point.

Moving take-profit and stop-loss can only be market-ordered, only take-profit or stop-loss, not take-profit + stop-loss.

You can choose to activate the price or not, and if you don’t select the activation price, the order will be activated after you place it. Select the activation price, and the order will be activated when the market price reaches or exceeds the activation price. In the case of inactivity, there is no trigger price.

activation

If the set activation price = the last transaction price at the time of placing the order, it will be activated immediately when the order is placed

If the activation price > the last traded price at the time the order was placed, the order will be activated when the new latest traded price >=activation price

If the activation price < the last traded price at the time the order was placed, the order will be activated when the new last traded price <=activation price

trigger

Buy: The last price ≥ the trigger price

Sell: The last price ≤ the trigger price where the trigger price is calculated

Buy: lowest price + callback price distance; Lowest Price* (1 + Pullback)

Sell: Highest price - retracement price distance; Maximum Price* (1 - Pullback Amplitude)

Moving TP/SL can only buy the amount, sell can only be the quantity. Buying and selling do not freeze assets.

After the order is placed, the trigger price changes with the price.

Buy trigger price = all-time low price - pullback magnitude

Sell trigger price = all-time high price - pullback magnitude

If the quantity and amount of buying and selling are sufficient, the order will be carried out according to the order quantity, and if the assets sold are insufficient, all will be sold. If the purchase amount is insufficient, buy all of them.