- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

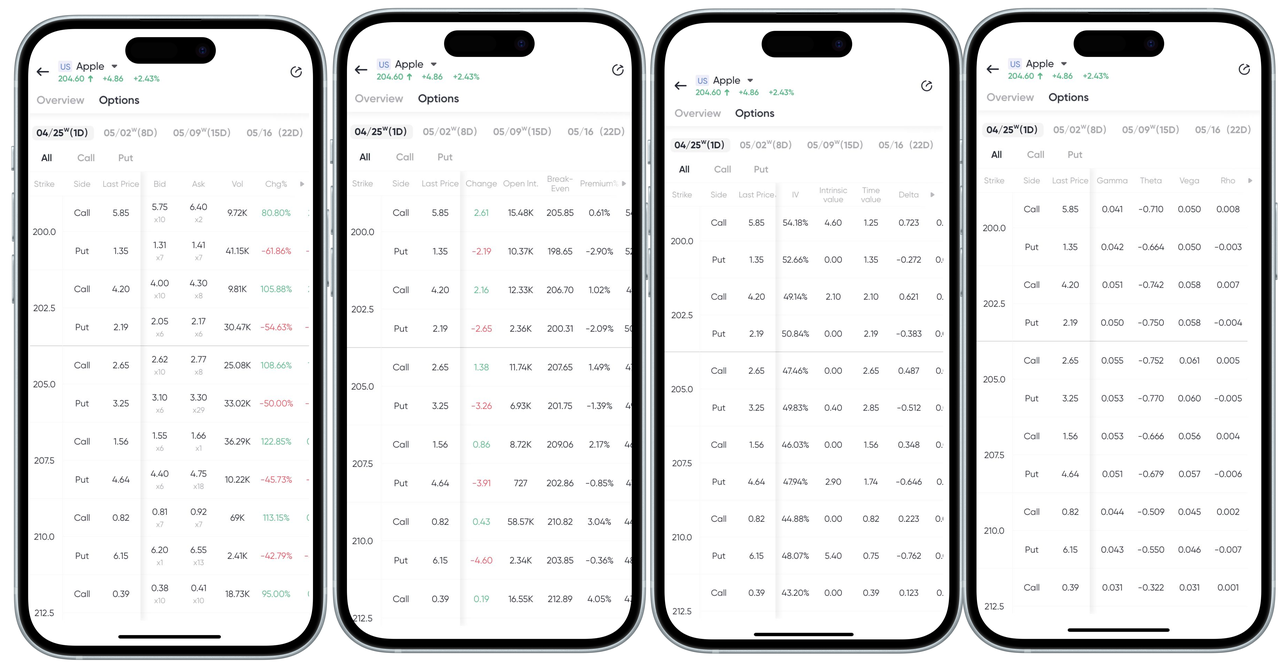

A detailed breakdown of the Option Chain page and its key concepts?

BiyaPay

Published on 2025-05-26 Updated on

2025-06-19

The following is a popular description of the data on the options trading page to help you quickly understand the option quotation table and understand the composition and fluctuation principle of option prices.

- Option Type

- Call: The buyer has the right to buy the underlying asset at a fixed price at a certain time in the future. Suitable for bullish markets.

- Put: The buyer has the right to sell the underlying asset at a fixed price at a certain time in the future. Suitable for bearish markets.

- Strike Price

The exercise price is the price at which the option agrees to buy or sell the underlying asset in the future. For example:

- 200.0 means exercising the right at $200.0 per share.

- 212.5 indicates an exercise of rights at $212.5 per share.

- Latest Price

The price at which the option is trading in the current market. For example:

- The last price of 200.0 Call is $5.85, which means that you would pay $5.85 to buy one option.

- Bid and Ask

- Bid: The highest price that a buyer is willing to offer in the market. As:

- The bid price of 200.0 Call is $5.75 and the quantity is x10, which means that there are 10 buy orders waiting to be filled.

- Ask: The lowest price that a seller is willing to accept in the market. As:

- The sell price is $6.40 and the quantity is x7, indicating that there are 7 sell orders pending.