Global Money Transfer: Simplifying International Payments with Easy-to-Use Apps

What is Money Transfer and why is it important?

A money transfer refers to the process of sending funds from one individual or entity to another, whether domestically or across international borders. With the rise of digital technology, this once lengthy and paper-heavy process has evolved into a swift and streamlined transaction. Today’s money transfer services enable users to send money electronically through banks, websites, or mobile apps, reducing time, cost, and physical effort.

International money transfers are significant in a globalized world where financial support, trade, and business transactions frequently cross borders. For individuals, it can mean sending money home to support family members or covering educational expenses abroad. For businesses, it facilitates smooth payments to overseas suppliers, freelancers, or employees working remotely across different countries.

The top recipient countries for remittances include India and Mexico, each receiving around $120 billion annually, followed by China with $66 billion, and the Philippines with $50 billion (World Bank, 2024). These funds significantly contribute to economic stability and development in these regions.

Digital money transfers through mobile operators have an average cost of 4.4%, much lower than traditional bank fees, which can average 12%. This cost difference means more money reaches recipients, enhancing their financial well-being.

Case example: Maria, a nurse living in the U.S., uses BiyaPay to send $500 monthly to her family in the Philippines. Thanks to BiyaPay’s flat 1% fee and real-time tracking, her family receives approximately ₱28,500 within minutes—about ₱1,700 more than what traditional banks would deliver.

Expert Insight: “Remittances are a lifeline for developing economies, reducing poverty by 23% in regions like Sub-Saharan Africa.” — IMF Report, 2023.

This demonstrates how efficient and affordable money transfer services empower families and strengthen global economic ties.

How to transfer money: A step-by-step guide

Sending money across borders has never been easier, thanks to digital platforms like BiyaPay. Follow this detailed guide to ensure fast, secure, and cost-effective transactions—and avoid common pitfalls.

Step 1: Choose a Money Transfer Platform

Select a trusted money transfer service that supports your recipient’s country. Compare fees, speed, and security features.

Practical Tips:

- Check Coverage: Ensure the platform operates in both your country and the recipient’s (e.g., BiyaPay supports 100+ countries).

- Compare Fees: Look for transparent pricing. For example, BiyaPay charges a flat 1% fee (max $10), while banks often add hidden exchange rate markups.

- Read Reviews: Trustpilot or app store ratings reveal real-user experiences.

Step 2: Create an Account

Sign up with your email/phone number and verify your identity per regulatory requirements (KYC).

Practical Tips:

- Prepare Documents: Have a government ID (passport, driver’s license) ready for instant verification.

- Enable 2FA: Use biometric authentication (Face ID/fingerprint) for added security.

Common Issues & Solutions: - Problem: Verification delays.

- Solution: Submit documents during off-peak hours (e.g., early mornings). BiyaPay’s AI-powered system approves most accounts in under 10 minutes.

Step 3: Enter Recipient Information

Input the recipient’s full name, contact details, and bank/mobile wallet information.

Practical Tips:

- Double-Check Details: A typo in the account number could delay the transfer.

- Save Recipient Profiles: Platforms like BiyaPay let you save details for future use.

Common Issues & Solutions: - Problem: Recipient’s bank rejects the transfer.

- Solution: Confirm the bank’s IBAN/SWIFT codes using their official website.

Step 4: Select the Payment Method

Choose how to fund the transfer—bank account, debit/credit card, or digital wallet.

Practical Tips:

- Bank Transfers: Cheapest option (0.5–2% fees) but slower (1–3 days).

- Debit Cards: Instant processing but may incur a 1–3% fee.

- Avoid Credit Cards: Often charge cash advance fees (up to 5%).

Common Issues & Solutions:

- Problem: Card declined due to “suspicious activity.”

- Solution: Notify your bank beforehand about the international transaction.

Step 5: Enter Transfer Amount and Currency

Specify the amount and currency. Review the exchange rate and total fees.

Practical Tips:

- Compare Rates: Check the mid-market rate on Google or other authentic websites. BiyaPay offers zero exchange rate markups.

- Use Rate Alerts: Some apps notify you when rates improve.

Common Issues & Solutions: - Problem: Hidden fees in the exchange rate.

- Solution: Choose platforms like BiyaPay that display the real rate upfront.

Step 6: Review and Confirm the Transfer

Double-check all details and authorize the transaction.

Practical Tips:

- Save Receipts: Screenshot the confirmation screen for disputes.

- Track in Real Time: BiyaPay sends SMS/app notifications (e.g., “Funds sent to Japan”).

Common Issues & Solutions: - Problem: Sent to the wrong account.

- Solution: Cancel immediately—BiyaPay allows reversals within 15 minutes if funds aren’t claimed.

Types of Money Transfer Services

There are three main ways to send money across borders: bank transfers, wire transfers, and online money transfer services. Each differs in terms of speed, fees, and ease of use. Understanding them can help you choose the right option.

Bank transfers

Bank transfers move money directly between accounts, making them one of the oldest and most secure forms of international money transfer. They’re ideal for large transactions but typically come with delays and higher costs. While trusted and widely accepted, bank transfers often take several days to process and may lack transparency in fees or exchange rates.

Pros:

- High Security: Regulated by financial authorities, ideal for large transactions (e.g., corporate trade, real estate).

- Global Reach: Supports nearly all countries and currencies, including emerging markets (e.g., Africa, Southeast Asia).

Cons: - High Costs: Fees include transfer charges (0.1%–1%), intermediary bank fees, and unfavorable exchange rates (often 1%–3% below market rates).

- Slow Speed: International transfers take 1–5 business days, delayed by holidays and time zones.

User Cases:

- Corporate Example: A Chinese exporter uses Bank of China to wire €100,000 to a German client. Total fees: ~€300 (1% fee + intermediary charges). Processing time: 3 days.

- Student Feedback: “Bank wires feel safe, but the fees are steep. My parents have to initiate tuition payments a week in advance to avoid delays.”

Cryptocurrency Transfers (e.g., USDT, USDC, XRP)

Cryptocurrency transfers leverage blockchain technology to enable fast, low-cost cross-border transactions using digital assets like USDT, USDC, or XRP. These decentralized solutions bypass traditional banking systems, offering near-instant settlements and fees as low as $0.01 per transfer. While stablecoins like USDC minimize volatility risks, users must navigate evolving regulations and technical complexities to ensure secure, compliant transactions.

Pros:

- Ultra-Low Fees: Blockchain transfers cost as little as $0.01 (e.g., XRP transactions).

- Instant Settlement: Completed in minutes, 24/7 operation.

- Stability: Stablecoins (e.g., USDC) avoid crypto volatility by pegging to fiat currencies like the USD.

Cons:

- Regulatory Risks: Banned or restricted in some regions (e.g., EU’s MiCA framework limits non-compliant stablecoins).

- Technical Barriers: Requires managing private keys and wallets, posing risks for non-tech users.

User Cases:

- Corporate Example: A Singaporean tech firm pays a Mexican supplier in USDC, saving 1.2% in fees and reducing settlement time from 3 days to 5 minutes.

- Student Feedback: “I sent USDT to my family in minutes, but they worried about legality, so we switched back to banks.”

Online money transfer services (e.g., Wise, PayPal, BiyaPay)

Online services and money transfer apps like PayPal, Western Union, and BiyaPay offer the most modern and convenient solution for fast and flexible transfers. These platforms let you send money using your phone, card, or digital wallet, often with lower fees and real-time tracking. With features like 24/7 accessibility and instant delivery, platforms like BiyaPay are transforming the landscape of global money transfer anywhere.

Pros:

- Low Fees: Charges typically 0.5%–1.5% with near mid-market exchange rates (e.g., Wise offers real-time rates).

- Speed: Instant or 1–3 days delivery (e.g., Western Union for cash pickups).

Cons:

- Transfer Limits: Lower caps for single/monthly transactions (e.g., Alipay caps cross-border transfers at $50,000).

- Geographic Gaps: Limited support for niche currencies or countries (e.g., TransferWise excludes Iran).

User Cases:

- Freelancer Example: A Filipino designer receives 1,000 via Wise from a U.S. Client with 50% less exchange rate loss.

- SME Feedback: “BiyaPay cuts our cross-border payment costs by 30%, but occasional delays require careful cash flow planning.”

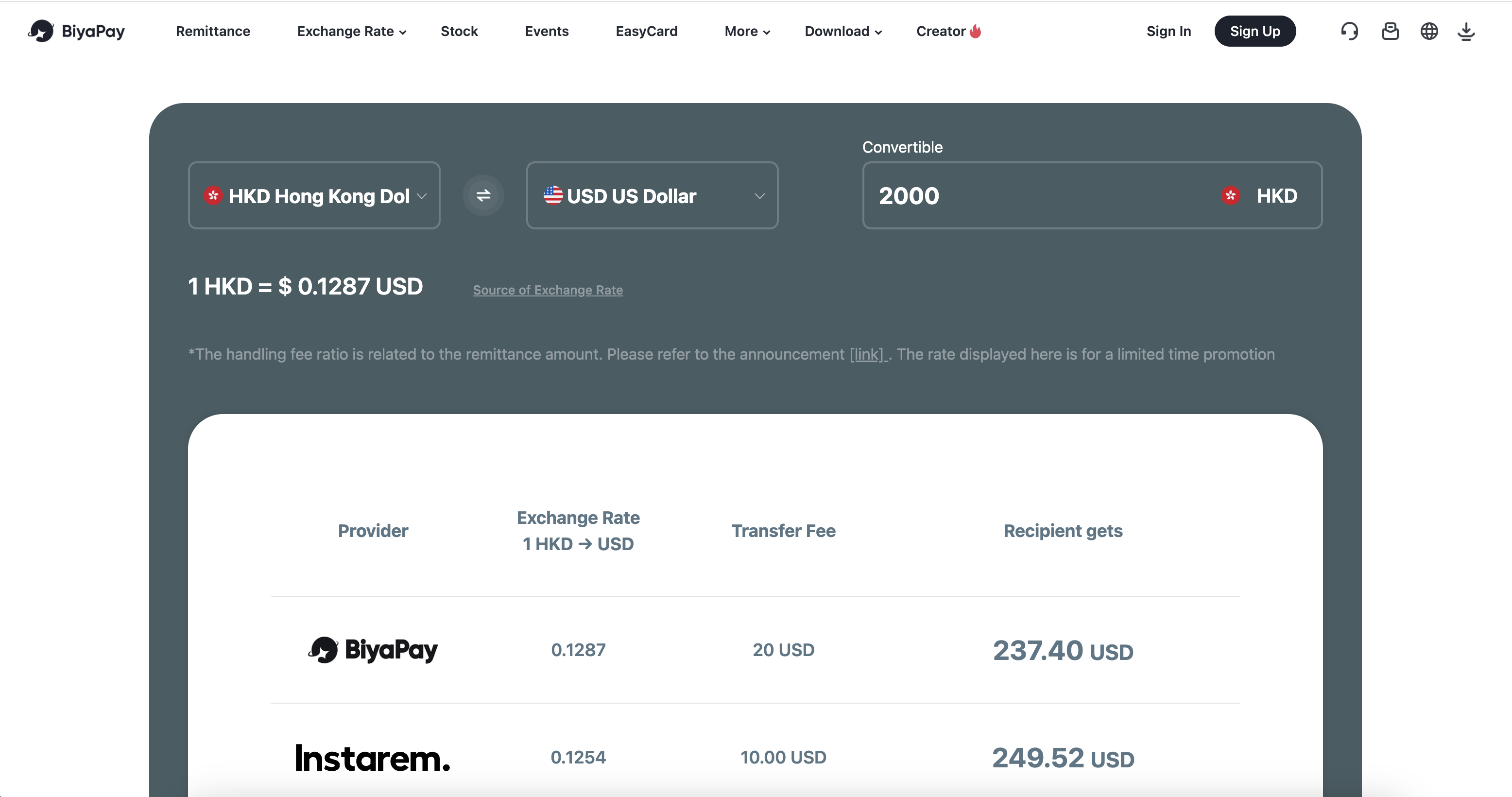

Comparison of global money transfer services

When it comes to choosing a global money transfer service, it’s essential to compare platforms based on factors like transaction speed, fees, ease of use, and geographical coverage. Here’s a quick comparison of three popular services: PayPal, Western Union, and BiyaPay.

PayPal

A widely used online money transfer service that connects to your bank or card, allowing transfers worldwide through email or mobile numbers.

- Speed: Transfers are instant between PayPal accounts; however, bank withdrawals may take 1–3 days.

- Cost: Fees vary depending on currency conversion, funding source, and destination, often higher for international transfers.

- Convenience: Effortless to use, with a clean interface and widespread acceptance across e-commerce platforms.

- Limitations: High fees for international use and limited availability in some regions without PayPal coverage.

Western Union

A longstanding name in international money transfer, known for cash pickups and global accessibility, even in remote areas.western union money transfer app

- Speed: Offers instant cash pickups in many countries; bank transfers may take longer.

- Cost: Typically higher fees, especially for cash pickups or when paying with credit/debit cards.

- Convenience: Excellent for users without bank accounts—available at physical agent locations.

- Limitations: Fees and exchange rates can be opaque; the process may require in-person steps in some areas.

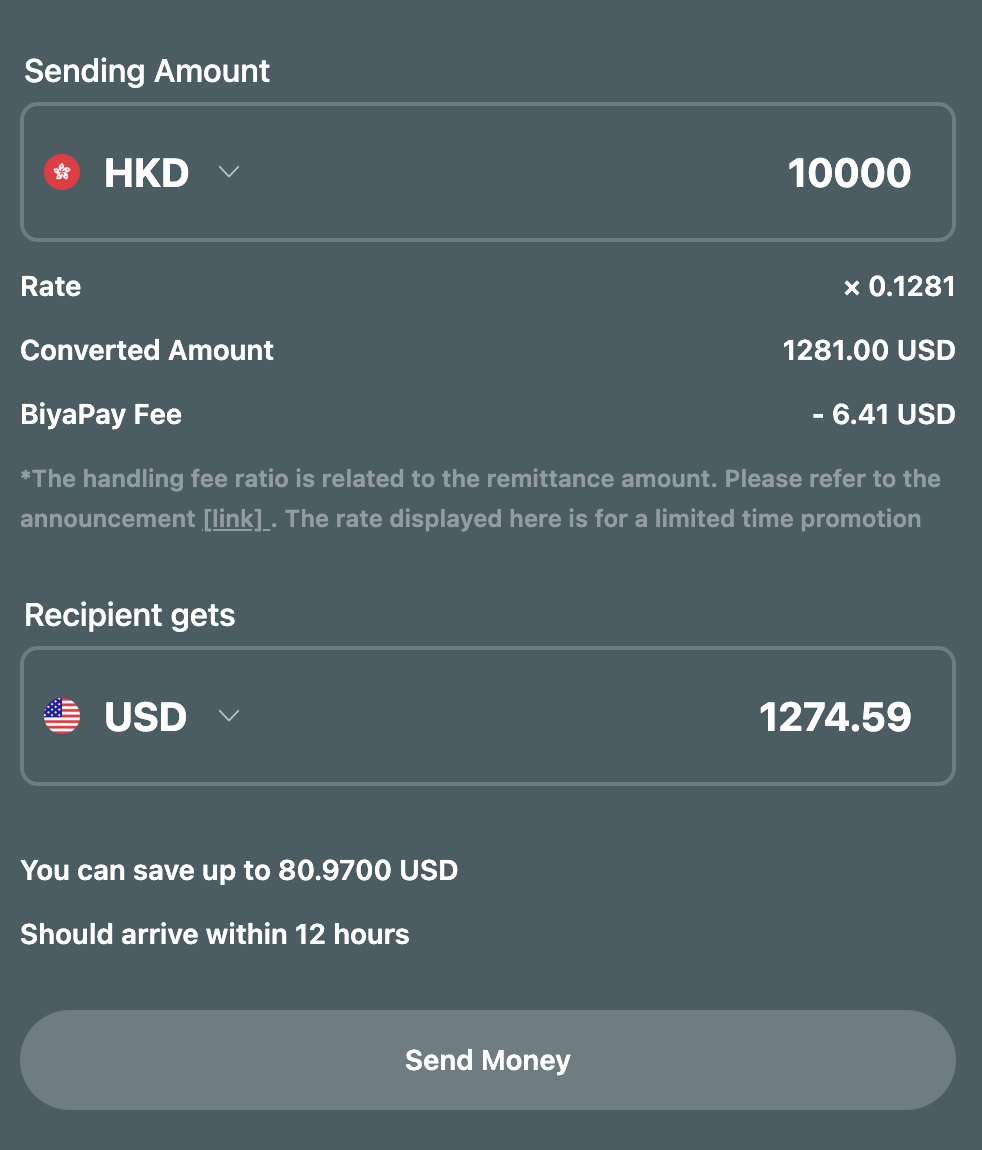

BiyaPay

A rising, modern money transfer app focused on fast, secure, and affordable global transfers, especially beneficial for frequent senders.

- Speed: Enables near-instant transfers using just your phone—ideal for urgent or recurring payments.

- Cost: Offers highly competitive rates with transparent fees and real-time currency conversion.

- Convenience: 100% digital experience with real-time tracking and 24/7 customer support.

- Limitations: Being newer, it may not yet be as widely recognized as legacy services, but rapidly expanding.

How to Use BiyaPay money transfer app

Step 1: Download the BiyaPay App

Head to the BiyaPay money transfer app and download it to your device.

Step 2: Register and Verify Your Account

Open the app and sign up with your email. Complete the identity verification process by adding your bank card and entering the required personal details.

Step 3: Deposit USDT

From the homepage, click on the Deposit option, choose the on-chain deposit method, and transfer USDT into your BiyaPay account.

Step 4: Send Fiat Currency

Navigate to the Transfer page, select USDT for the remittance (which will be converted to USD for the transfer), choose the recipient’s account, and enter the email verification code or Biya Authenticator code to finalize the transaction.

BiyaPay: Your trusted partner for instant and secure global money transfers

BiyaPay has emerged as a leading platform for cross-border financial services, combining speed, affordability, and robust security. Below, we explore its unique features, user success stories, and advanced safety protocols to demonstrate why it stands out in the crowded fintech market.

Unique Features and Competitive Advantages

- Multi-Asset Integration: BiyaPay allows users to manage digital currencies (e.g., USDT, BTC), traditional stocks, and forex within a single platform. This eliminates the need to juggle multiple accounts, making it ideal for diversified investors.

- USDT-to-Fiat Conversions: Users can instantly convert USDT to USD, EUR, or HKD at a 1:1 rate, bypassing traditional banking hurdles. This feature is particularly valuable for traders needing quick access to global markets.

- No Offshore Account Required: Unlike traditional brokers, BiyaPay lets users trade U.S. or Hong Kong stocks using crypto or fiat without needing a foreign bank account.

- Real-Time Global Transfers: BiyaPay processes cross-border remittances in minutes, with fees as low as 0.5%—far cheaper than banks (3–5%) or services like Wise (1.5%).

- Zero Hidden Costs: The platform offers mid-market exchange rates with no markup, ensuring transparency. For instance, converting USDT to USD incurs no spread losses, unlike traditional brokers.

User Success Stories

- Cross-Business Payments:

- Example: A Chinese exporter, Ms. Wang, saved 80% in fees by using BiyaPay to send $500,000 to Southeast Asian suppliers. Traditional banks charged 3–5% and took 3–5 days, while BiyaPay completed the transfer in 1 hour with a 1% fee.

- Retail Investors:

- Example: A 25-year-old investor, Xiao Zhang, bypassed China’s capital controls by using USDT to buy Tesla shares on BiyaPay. He completed account setup in 5 minutes and traded with zero commission.

- Students and Expats:

- Example: A student in the UK used BiyaPay’s “flash exchange” to convert GBP to USDT, then to EUR for tuition payments, reducing fees by 66% compared to banks.

Whether you’re a parent funding a child’s studies abroad or a business owner managing overseas payroll, BiyaPay’s global reach and clarity give you complete control over international transfers. For instance, if you want to send money to Japan to pay a supplier or help a relative, you can initiate the transfer from your phone, track its journey instantly, and receive confirmation as soon as it’s delivered, usually within minutes.

With BiyaPay, international money transfers are no longer stressful or uncertain; they’re simplified, monitored, and delivered with confidence.

Security and Compliance

- Regulatory Licenses: BiyaPay holds licenses from U.S. MSB, Canadian MSB, New Zealand FSP, and SEC’s RIA, ensuring compliance in major markets.

- Advanced Protection:

- AES-256 Encryption: All transactions and user data are secured with military-grade encryption.

- Two-Factor Authentication (2FA): Combines biometric scans (Face ID/fingerprint) and SMS verification to prevent unauthorized access.

- Segregated Accounts: User funds are stored in regulated bank accounts, separate from corporate assets.

- Fraud Prevention: Real-time AI monitoring flags suspicious activity, such as sudden large transfers or login attempts from unrecognized locations.

Conclusion

In conclusion, selecting an exemplary money transfer service is essential for ensuring efficient, secure, and cost-effective international transactions. Whether you’re sending money for personal reasons or managing business payments, exemplary service can make a significant difference in convenience and reliability. Explore BiyaPay for your next global money transfer and experience fast, secure, and low-cost transfers with transparent fees and real-time tracking. Trust BiyaPay to simplify your international transactions and deliver peace of mind with every transfer.

FAQs

- What is the best app for international money transfers?

The best app for international money transfers online depends on your needs, but BiyaPay is a top choice for its fast, secure, and affordable global transfers. It supports sending money to over 100 countries with real-time tracking.

- How do I transfer money internationally using an app?

To transfer money internationally, download a reliable money transfer app like BiyaPay, create an account, and select your recipient and payment method. Once the details are confirmed, the money is sent instantly or within a few minutes.

- Are money transfer services safe to use?

Yes, most services are safe, with BiyaPay implementing advanced encryption and secure protocols to ensure the safety of your transactions. Rest assured, your data and funds are protected from unauthorized access.

- How long does it take for an international money transfer to go through?

Transfer times vary, but BiyaPay offers near-instant transfers, typically completing transactions within minutes, depending on the payment method and destination country. You can track the status in real-time.

- What are the fees associated with global money transfers?

Global money transfer fees differ by service, but BiyaPay is known for its transparent, low-fee structure. There are no hidden charges, and the platform ensures you get the best value for your transfer.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Zelle Wire Transfer or ACH? Clearing Up the Confusion

Why Is Canada's Country Code 1

What Are the Daily Limits for Chase Accounts?

Tap and Go A Beginner's Guide to Cardless ATM Withdrawals

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.