- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

China Concepts Stock Market Volatility? Leading Strategies Teach You How to Stably Invest in US and

Hong Kong stocks opened low and continued to decline. The Hang Seng Index fell more than 2,000 points at one point during the day, and the Science and Technology Index fell more than 14% at one point. As of the close, the Hang Seng Index in Hong Kong fell by 9.41%, and the Hang Seng Technology Index fell by 12.82%. Chinese brokerage stocks, real estate stocks, semiconductors and other sectors fell sharply. Rongxin China fell by more than 43%, Agile Group fell by more than 41%, Kaisa Group fell by more than 38%, Sunac China fell by more than 37%; China Merchants Securities fell by more than 36%, Shenwan Hongyuan Group fell by more than 35%, and CICC fell by more than 33%; Huahong Semiconductor fell by more than 23%, and SMIC fell by more than 18%.

What is the reason for the callback?

Analysts believe there are mainly two reasons:

One is that the expectation of the Federal Reserve’s interest rate cut has significantly weakened. Recently, the US dollar index and US bond yields have risen across the board. Yesterday, the 10-year US bond yield reached over 4%. However, today, non-US currencies rebounded across the board, especially the rebound of the yen, which led to a sell-off in the Asia-Pacific market.

Secondly, there has been a huge increase in Chinese assets recently. Whether it is the Hong Kong stock market, the FTSE A50 futures index, or the China asset ETF listed on the periphery, all have high returns. Yesterday, the A50 holdings reached a historical high. This often means increased volatility.

Analysts also believe that the Fed’s interest rate direction may also be an important reason for the plunge.

US Federal Reserve Bank of St. Louis President Musalem expressed support for a 50 basis point rate cut at the September FOMC Monetary Policy meeting. Continuing to gradually cut interest rates over time will be appropriate. Employment and inflation are both in “good shape”, and the risks faced by these two goals are balanced. The FOMC’s policy path is “slightly above” the median. It is expected that PCE inflation will converge towards 2% in the coming quarters. The cost of easing too quickly and too aggressively is higher than the cost of slow action.

For investors with a large position, a leading strategy can be considered to protect the position.

What is the leading strategy?

The lead strategy is similar to the covered bullish strategy, but it usually takes longer to be effective. In addition to the two positioning of covered bullish (long position of the underlying asset + short position of bullish), a third positioning is needed, which is to buy put options to protect against losses caused by falling stock prices. Therefore, the three legs of this strategy are:

- Purchase the target (stock) to profit from future price increases

- Purchase put options to protect against falling stock prices and provide insurance

- Sell bullish options to provide financing for the above insurance

The combination of these three positions results in limited losses and profits. Limited losses result from holding long positions in put options, while limited profits result from holding short positions in bullish options. The insurance effect of put options depends on the exercise price and option premium of the put option. Profit depends on the (higher) exercise price and the option premium charged from selling the option. Creating a good lead strategy requires skill. Generally speaking, an increase in market volatility will help this strategy, especially during a bull market when the demand for bullish options increases, resulting in higher pricing compared to put options with the same expiration date and exercise price.

Due to holding short positions on Bullish options, investors cannot expect high returns when considering leading strategies. Leading strategies take longer to produce results, so it is difficult to achieve high annualized returns, such as exceeding 20%. Of course, in terms of the expenditure on the underlying stock, the risk of this strategy is still relatively low. This is where the value of leading strategies lies for investors.

When investors do not want to lose too much in the underlying stock trading, but at the same time hope to profit from the stock market rise over a longer period of time, they can consider a leading strategy. The simpler way is to hold this strategy and not worry about it until the expiration date or very close to the expiration date before position squaring and exiting. Of course, holding for a long time is also a disadvantage of the leading strategy, which requires investors to wait until the expiration date is approaching before fully enjoying the benefits of this strategy. However, considering the low risk of the leading strategy, the long term is also a cost worth paying for many investors.

From the perspective of positioning, the leading strategy structure is:

Stock long + bearish long + bullish short = leading strategy

Pros and cons analysis

Advantages:

- It can provide investors with maximum protection when facing a decline in the target stock price.

- When the stock price of the target fluctuates violently, the risk of this strategy is very low, and it can even produce risk-free transactions.

- From the perspective of balancing risk and return, this strategy can achieve a higher risk-reward ratio.

Cons:

- This strategy will have better results in the long run, so its effectiveness needs time to wait.

- Maximum profit is possible only at the expiration date.

- In terms of the investment, only a low return can be obtained.

Transaction steps

- Buy or hold stocks (targets).

- Buy at-the-money (or out-of-the-money) put options, which are put options with exercise prices close to but lower than the current stock price

- Sell out-of-the-money bullish options, which are bullish options with a strike price higher than the current stock price.

The closer the exercise price of a put option is to the price of the underlying stock, the better insurance investors can get when the stock price falls. Of course, the higher the insurance level, the higher the cost investors need to pay.

Entry (position establishment)

- Try to ensure that the underlying stock’s future trend is upward , and confirm that there is a clear price support area as much as possible.

Position squaring

- On the expiration date, investors will hope that the bullish options they hold will be called-over, thus maximizing their profits.

- If the underlying stock price remains below the exercise price of the bullish option but above the stop-loss point of the underlying, then let the bullish option be held until expiration in a non-call-over manner, thus obtaining the full option premium.

- The essence of the lead strategy is to set the exercise price of the put option at a position no less than the stop loss point, so as to minimize the risk. In this case, investors can safely hold the entire positioning until the expiration date.

- If investors use margin for trading, then when there is an urgent need for margin, they need to close this strategy. Therefore, this strategy is not very suitable for situations where cash is needed before the expiration date.

- Experienced investors will increase and build positions on three “legs” respectively according to the fluctuation of the target stock price, so that investors can obtain additional profits before the expiration date.

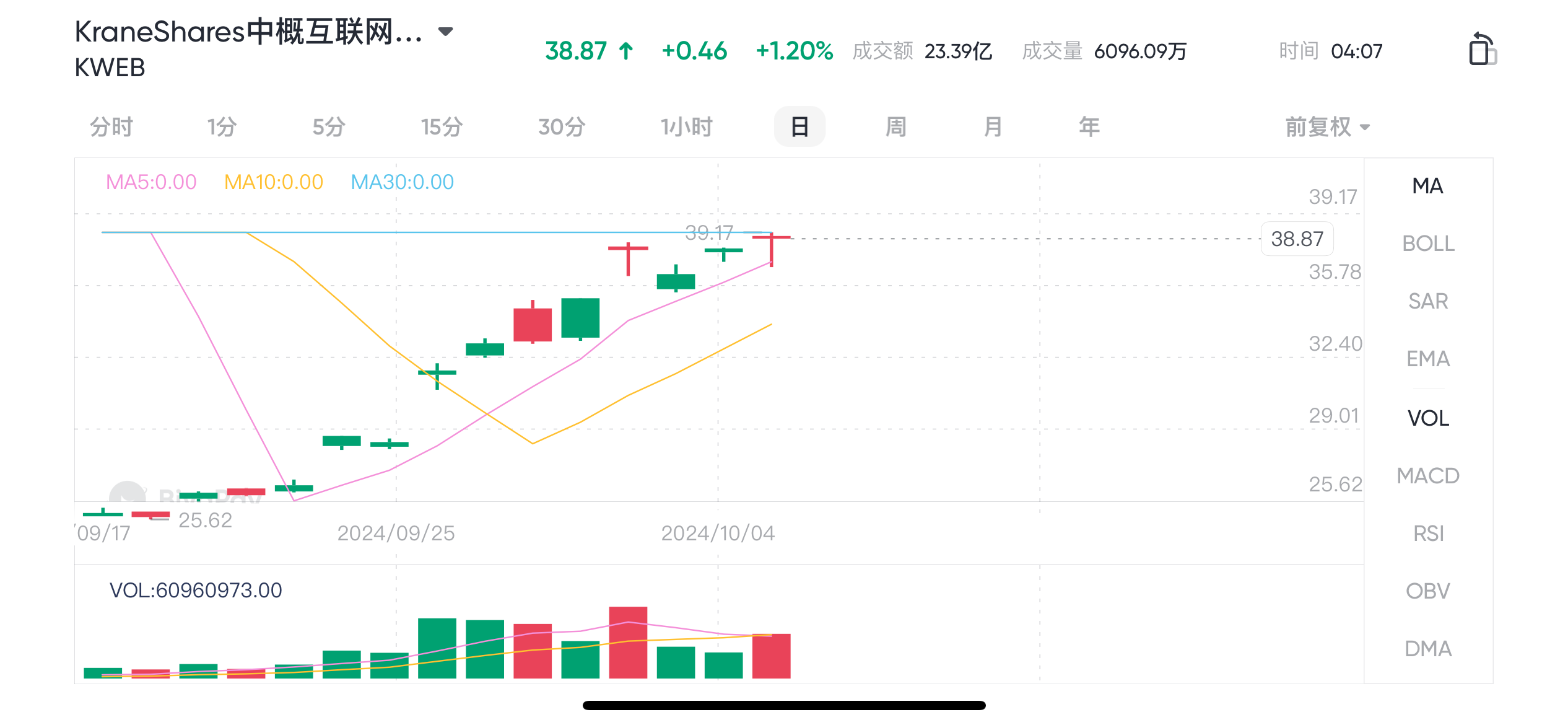

Taking KWEB stock as an example, its lead option strategy is as follows:

Assuming an investor holds 100 shares of the China Overseas Internet ETF-KraneShares (KWEB) currently priced at $38.87, when the investor is unsure about how the price will change in the near future and wants to buy insurance for their position. The collar strategy can be used.

In addition, US stock options trading is an important financial tool for investors, which can provide leverage and risk management possibilities. Choosing a suitable US stock options trading platform is crucial. Firstly, the platform should have advanced security performance and good regulatory records, which ensures the safety of transactions and the protection of funds. Secondly, the User Interface should be intuitive and easy to use, supporting fast execution of trades, while providing comprehensive market data and analysis tools to help investors make wise decisions.

TD Ameritrade, E * TRADE, and Interactive Brokers are several well-known options in the market that offer competitive price structures, extensive market access, and powerful tool suites. In addition to these traditional stock trading platforms, investors can also choose platforms like BiyaPay that support both trading digital currencies and trading US and Hong Kong stocks. You can recharge USDT for trading, and deposits and withdrawals are convenient and fast, which is very suitable for investors who pursue speed and diversified fund allocation.

Now I will use the operation on the BiyaPay platform as an example to demonstrate:

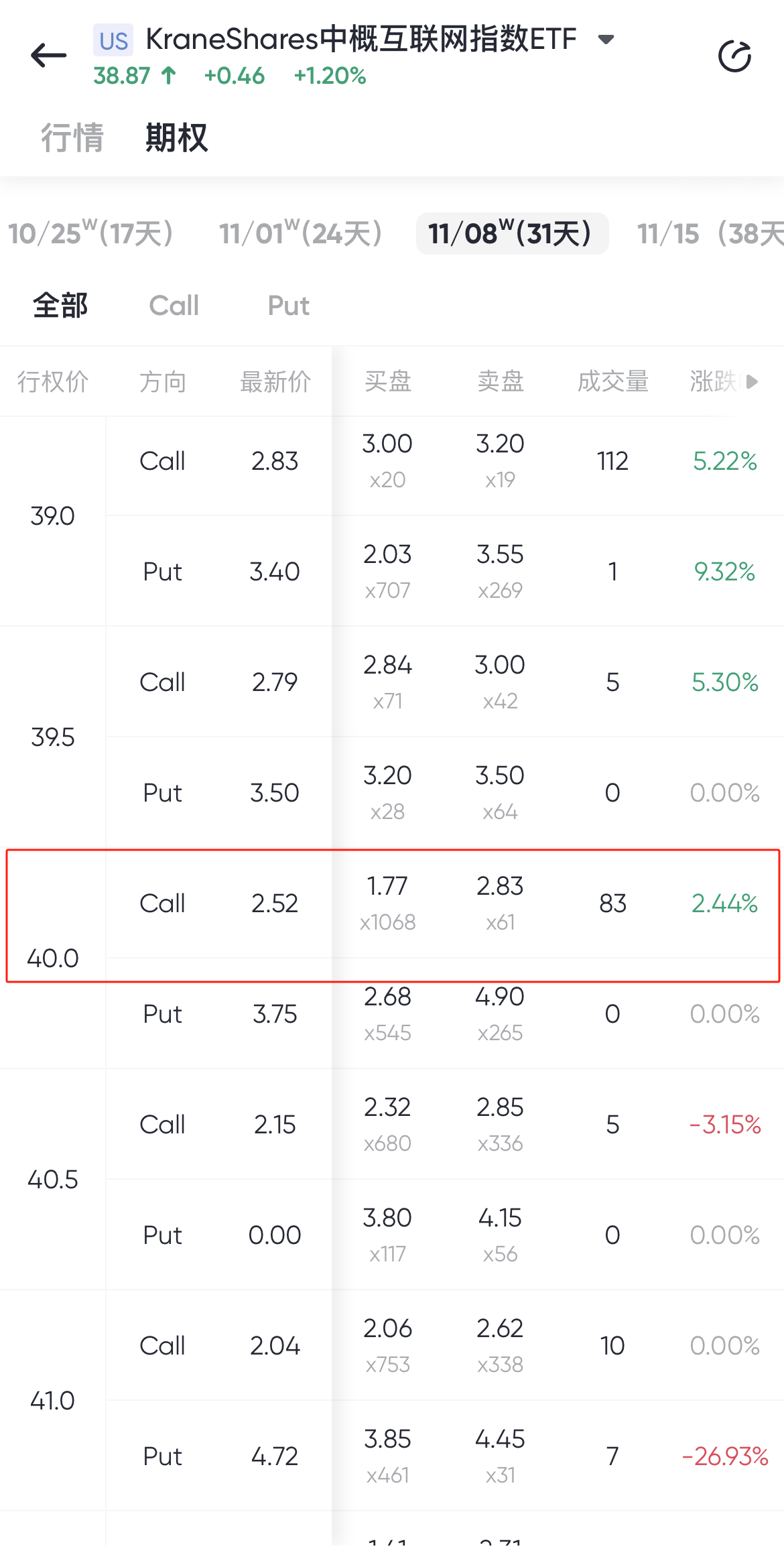

In the first step, investors can sell bullish options with an exercise price of $40 and an expiration date of November 8th at a price of $2.52, earning $252.

The income and expenses of the two options mostly offset each other, with a total cost of 0 and an income of $19. According to this plan, investors have established a protective strategy at low cost.

In the second step, you can also buy a put option with an exercise price of $37.5 and an expiration date of November 8th at a price of $2.33, costing $233.

The ultimate protective effect of the strategy is that if KWEB falls beyond the call-over price of the put option at 37.5, no matter how low the price falls, the loss will be locked in.

The maximum loss is equal to the call-over price of the put option - the underlying purchase price + the premium for selling the bullish option - the premium for buying the put option, which is $156. Regardless of how much KWEB falls before the option contract expires, even if it falls to $1, the maximum loss for investors will only be $156.

In addition to locking in the maximum loss, the lead strategy also maintains the ability of the investment portfolio to generate returns. When the underlying price rises to the call-over price of $40 for selling bullish options, the portfolio achieves maximum returns.

From the case, it can be clearly felt that the leading strategy gives investors the ability to protect the “fruits of victory” and prevent risks in KWEB. After the short-term volatility ends, investors can also unwind the leading strategy and continue in bullish or bearish directions.