- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

US Department of Justice intervenes! Supermicro plummets 12% and Dell's opportunity emerges. How can

According to relevant news, the US Department of Justice has launched an investigation into Supermicro Computer (SMCI), after short-selling firm Hindenburg questioned the company’s finances. The US Department of Justice has contacted a former employee of SMCI and will obtain any information and evidence of financial violations. The employee had previously sued the company and was willing to be a whistleblower.

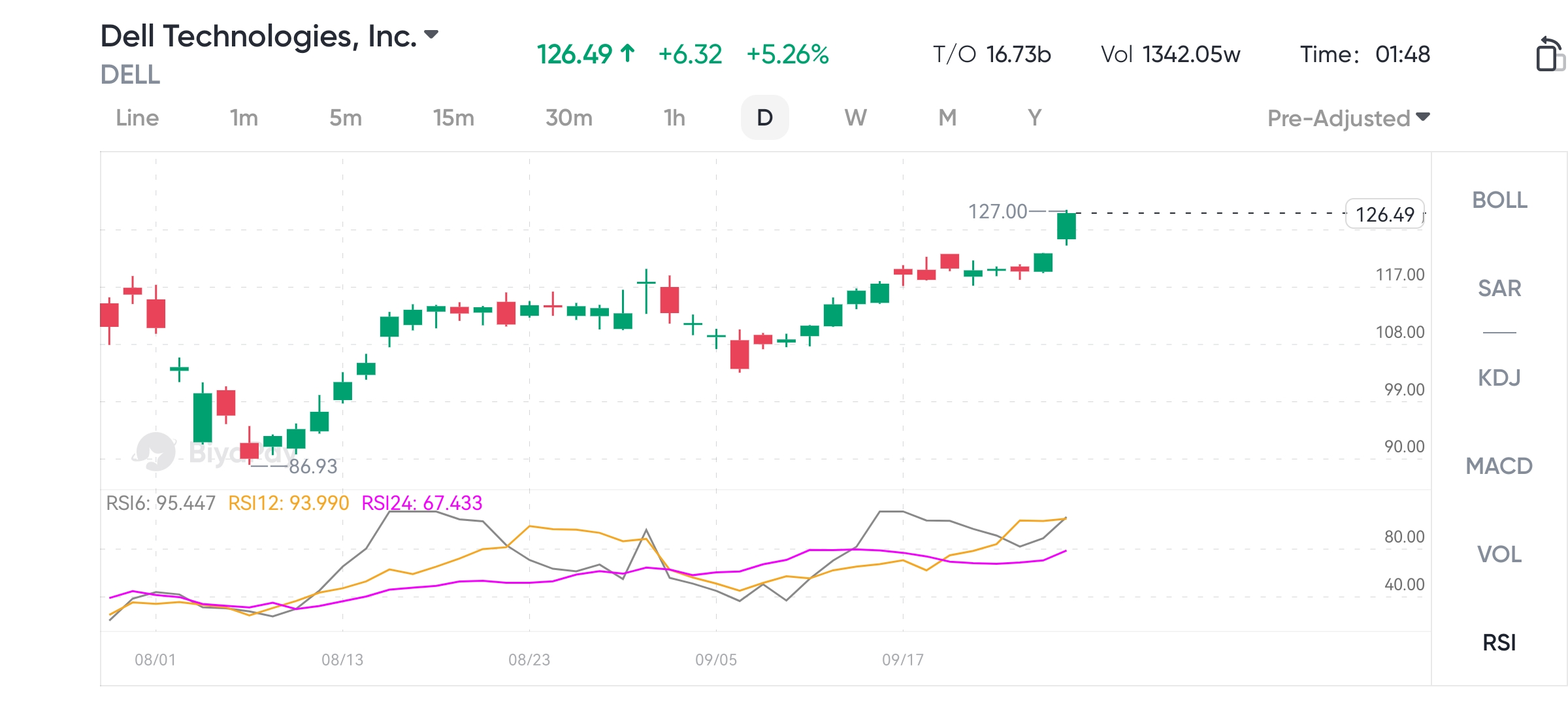

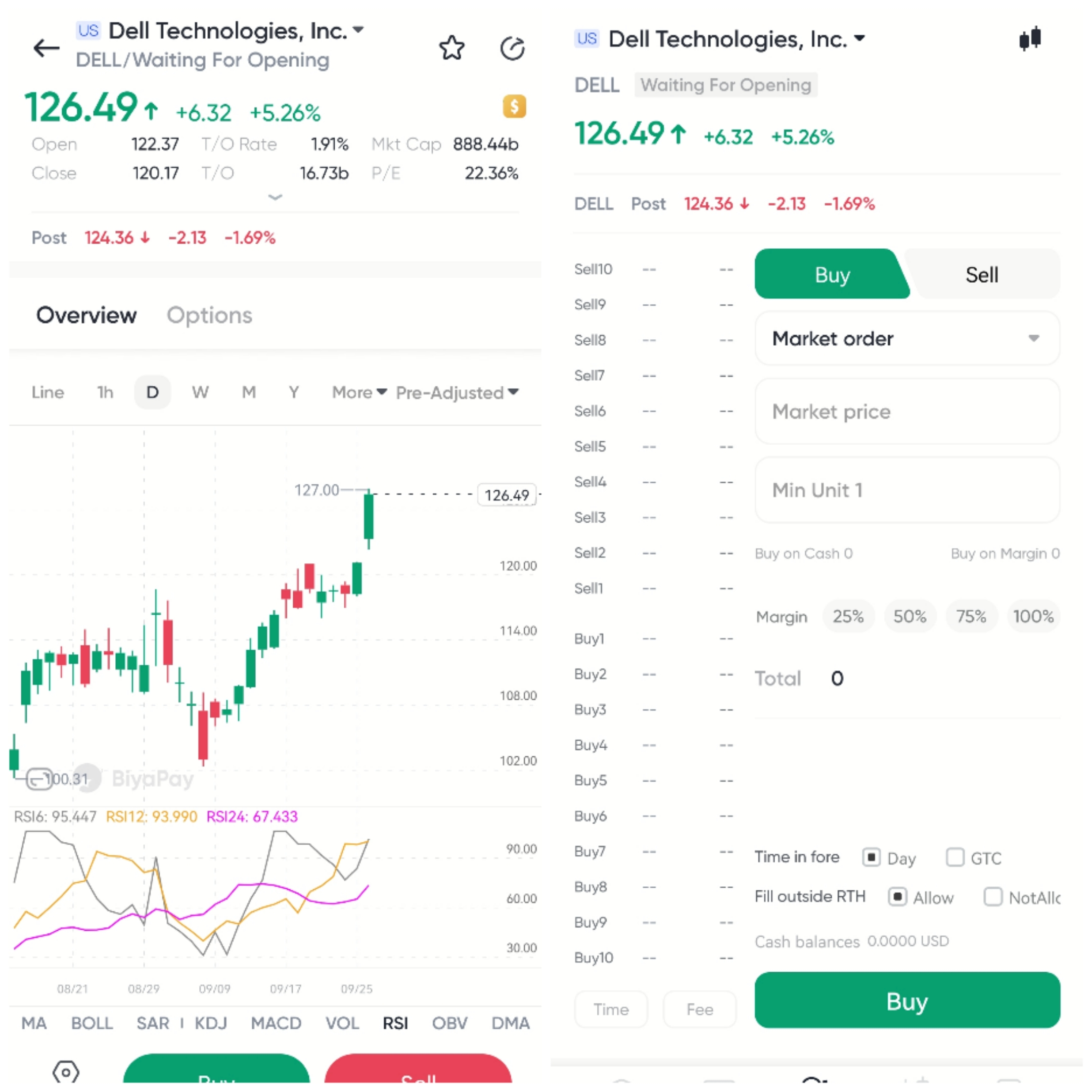

Due to this news, on Thursday, the stock price of Ultra Microcomputer plummeted by 17% to $382.29, delisting several times due to the large decline, and finally fell by 12.17%, setting the largest decline in nearly a month. This week, Dell was re-listed as a constituent stock in the S & P 500 Index, bringing positive factors. Compared with the decline of Ultra Microcomputer, Dell showed a sharp contrast. On the same day, the stock price of Dell Technologies rose rapidly, and finally closed up 5.26%.

Supermicro computers are in deep trouble, and the stock price has plummeted one after another

Recently, Supermicro has become the focus of an investigation by the US Department of Justice, which directly triggered a sharp fluctuation in its stock price. The rumors of this judicial investigation follow the shocking report released by Hindenburg Research in late August, which directly pointed out that Supermicro has new evidence of accounting manipulation.

It is worth noting that this is not the first time that Supermicro has been involved in accounting controversies. It has previously paid a huge fine of up to $17.50 million to the US Securities and Exchange Commission (SEC) for being accused of prematurely recognizing revenue and underestimating expenses. Now, Hindenburg’s further accusations not only deepen the market’s concerns about Supermicro’s accounting practices, but also reveal significant challenges faced by its core business, including a lack of significant competitive advantages. This series of negative news undoubtedly dealt a considerable blow to Supermicro’s stock price.

After the short-selling company Hindenburg released its report, Supermicro Computer immediately stated that it would not be able to submit its annual report for the current fiscal year to the US Securities and Exchange Commission on time. The market’s confidence in Supermicro Computer plummeted sharply, and the stock price once plummeted nearly 20%, which has been difficult to recover since then.

Now, with the intervention of the US Department of Justice, market concerns have further escalated, and its stock price has plummeted by another 12%. The Department of Justice’s review of Supermicro computers may lead to stricter regulatory consequences, including possible fines and corrective measures. This uncertainty adds complexity to the future of Supermicro computers and may continue to affect their market performance for some time to come.

Dell is expected to benefit, why?

Dell Technologies stands to gain when Supermicro is in trouble due to a US Department of Justice investigation and a negative report from Hindenburg Research.

Firstly, Supermicro is facing a serious credibility crisis due to the negative report from Hindenburg Research and the investigation by the US Department of Justice. This uncertainty may prompt Supermicro’s customers to seek more stable and trustworthy alternative suppliers. Against this backdrop, Dell has become the first choice for these customers with its stable financial situation, strict compliance operations, and extensive product services. Especially in the AI server market, Dell has established a good reputation, and Supermicro’s difficulties undoubtedly further strengthen Dell’s competitive advantage.

Secondly, Dell’s business strategy positioning is precise, especially when targeting stable customer groups such as enterprise end point markets and government entities, which can effectively avoid the adverse effects brought by market fluctuations. However, Ultra Microcomputer currently relies mainly on price competition, which will be difficult to maintain in the current financial crisis, thereby weakening its market competitiveness.

For investors, the uncertainty of Supermicro computers makes Dell a more attractive investment choice. Markets often seek safe havens during turbulent times, and Dell is expected to attract more investors’ attention with its strong profitability and stable operating prospects. In addition, Dell’s return to the S & P 500 Index further enhances its market reputation and capital inflow expectations.

Dell’s continued expansion in the AI field has enabled it to quickly absorb the market share that may be lost by ultracomputers. By continuously increasing the deployment of AI servers and launching technologically advanced DLC solutions, Dell can meet the market’s demand for high-performance computing and energy-saving servers, further strengthening its industry leadership position. These factors together have created an excellent opportunity for Dell to stand out in the current market turmoil.

Finally, Dell can consolidate and enhance its brand value by shaping its image as a solid and reliable technology leader in the market. By strengthening Client Server and active marketing activities when competitors face financial and legal challenges, it can more effectively highlight its position as an industry leader.

What other growth potential does Dell have?

Dell Technologies is not just a personal computer and server manufacturer; it is also an active player in the emerging technology field. Driven by artificial intelligence (AI), the demand for high-performance computing continues to grow. Dell has taken multiple strategic measures in this field to ensure its leadership in the market.

Strategic Expansion in the AI Server Market

Dell is expanding its influence in the AI server market, especially by adopting Nvidia’s latest Blackwell system. These systems are designed to handle complex AI algorithms and large-scale Data Analysis, and can provide necessary computing power. In 2022, Dell’s AI servers equipped with Nvidia GPUs have received high praise in the market for their excellent processing power and energy efficiency. With the advancement of technology and the increase of AI applications, Dell expects its market share in the AI server field to grow significantly.

Leading the way in direct liquid cooling technology

Dell is an industry leader in Direct Liquid Cooling (DLC) technology, which is key to optimizing data center operations. DLC technology significantly improves energy efficiency and equipment performance by directly cooling hot components in servers. Given the growing global demand for energy conservation and emission reduction, this technology provides a clear competitive advantage. Dell’s PowerEdge XE9680L liquid-cooled server is a typical example, which not only improves the operational efficiency of data centers, but also meets increasingly stringent environmental standards.

Enhanced services and software solutions

Dell continues to expand its range of services in the fields of Cloud Service and cyber security. As enterprises move towards digital transformation, the demand for cloud infrastructure and cyber security has increased dramatically. Dell’s cloud solutions and Cybersecurity services help enterprises effectively manage their IT environments by providing integrated security management, which not only enhances customer loyalty but also brings stable revenue streams to Dell.

Strategic Expansion in Global Markets

Dell is increasing its investment in Emerging Markets, especially in regions such as Asia and Africa. By working with local partners, Dell can not only better adapt to local market demand, but also effectively avoid the risks of global economic fluctuations. This geographic diversification strategy has begun to pay off, such as the sustained growth in the Indian and Chinese markets, which has brought new growth momentum to Dell.

What is Dell’s current valuation status?

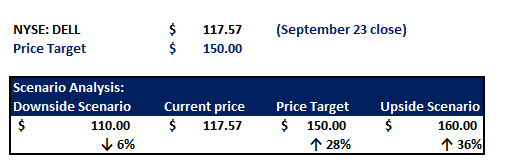

Based on in-depth financial analysis and market evaluation, Dell’s stock target price has been set at $150 per share.

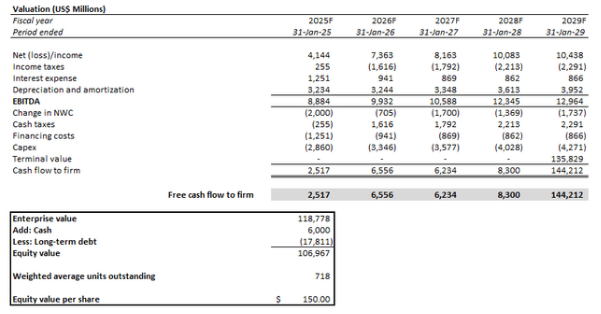

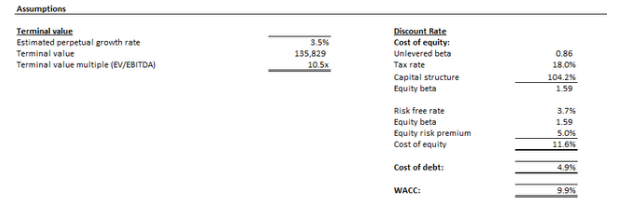

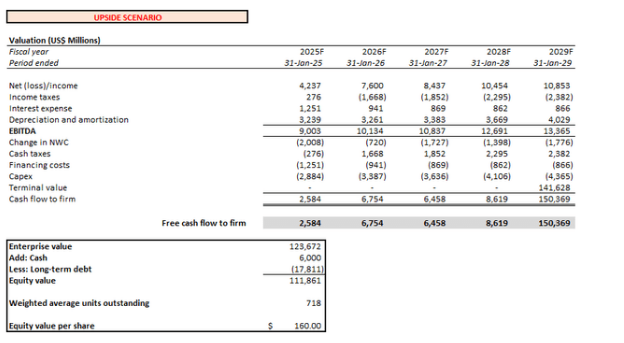

This valuation is primarily based on the discounted cash flow (DCF) method, which estimates a company’s future free cash flows and discounts them to their current value to estimate the company’s intrinsic value. In the DCF model, Dell’s future cash flows are discounted back to present value using a Universal Discount Rates of 9.9% Weighted Average Cost of Capital (WACC). This ratio reflects Dell’s capital structure and related risks. The analysis also assumes an implied permanent growth rate of 3.5%, which is consistent with Dell’s expected economic expansion in core operating areas and aims to reflect Dell’s competitive advantages and growth potential in the AI market and other technology areas.

In the optimistic upmarket scenario, Dell’s share in the AI server market is expected to achieve significant growth, especially due to its investment in direct liquid cooling (DLC) solutions and other AI optimization technologies. In addition, if AMC and other competitors encounter difficulties in the market, Dell may seize the opportunity to fill these gaps and further expand its market share. In this case, enhanced operational leverage and scale effects may lead to Dell’s profits exceeding market expectations.

Based on these analyses, the estimated intrinsic value of Dell’s stock in an uptrend scenario is $160 per share. This price is significantly higher than the current trading price, indicating that under ideal conditions, Dell’s stock has significant upward potential.

Given the potential for an increase, everyone can go to BiyaPay to seize the opportunity and buy Dell. In addition, if you encounter difficulties in depositing and withdrawing funds, BiyaPay can also serve as a professional tool for depositing and withdrawing funds from US and Hong Kong stocks. You can exchange digital currency for US dollars or Hong Kong dollars, quickly withdraw it to your bank account, and then transfer the funds to other brokerage accounts to buy stocks. The platform has a fast and unlimited deposit speed, which will not let you miss investment opportunities.

Dell’s risk factors

Despite Dell Technologies demonstrating strong growth potential and market adaptability in multiple areas, its business operations still face a series of risks. These risks may not only affect Dell’s short-term performance, but also have a profound impact on its long-term strategy.

Impact of global economic fluctuations

Dell’s business is greatly affected by the global economic environment, especially in its key markets such as North America and Europe. Global economic uncertainties, such as changes in trade policies, currency fluctuations, and macroeconomic slowdowns, may affect Dell’s sales and profits. Although Dell has adopted a diversification strategy to mitigate these risks, an economic recession may still lead to reduced spending by businesses and consumers, affecting Dell’s overall performance.

Technological change and market adaptability

The rapid changes in the technology industry require Dell to constantly innovate to maintain the relevance of its products and services. A major risk of this rapid evolution is that Dell may invest in technologies that are ultimately not accepted by the market. For example, if Dell invests in a new data storage technology that is ultimately considered inefficient or outdated by the market, this investment may result in financial losses. In addition, Dell needs to constantly evaluate its R & D spending to ensure that its investment can bring corresponding market returns.

Competitive pressure

Dell faces fierce competition from companies such as HP, Lenovo, Apple, and Supermicro in the personal computer and server markets. Especially for Supermicro, although it is currently troubled by legal investigations, its technological innovation and cost-effectiveness in high-performance computing and server solutions are still competitive. These factors keep Supermicro under direct competitive pressure on Dell in the market.

The problems with ultracomputers may cause fluctuations in their market share in the short term, but in the long run, if ultracomputers can solve their current problems and continue to drive product innovation, Dell will need to adjust its market and product strategies accordingly to remain competitive. In addition, Dell must also deal with competition in the global market, especially in the Asian and European markets, where Lenovo and HP have a greater influence.

To maintain its leading position, Dell needs to continuously focus on technological innovation, market positioning adjustments, and global supply chain optimization.

Compliance and Legal Risk

As a global enterprise, Dell must comply with laws and regulations in various markets, including data protection regulations (such as GDPR), environmental regulations, and import and export controls. Failure to comply with these regulations may result in heavy penalties, litigation, or loss of operating licenses. For example, if Dell’s products fail to comply with European Union environmental standards, they may be banned from selling in this important market, which will have a serious impact on sales and brand reputation.

How do investors layout?

In the current market environment, considering the uncertainty faced by supercomputers and the lack of obvious short-term positive factors, investors may seek more stable investment choices.

In this case, Dell Technologies, with its stable position in the global personal computer and server market, as well as its continuous investment in cloud solutions and artificial intelligence, provides investors with a reliable investment harbor. The diversification and global distribution of its business have built a defense line that can effectively resist the impact of industry fluctuations and market uncertainties. Therefore, for investors seeking stable returns and lower volatility, Dell is a preferred investment target worth considering.

For investors who want to avoid current market fluctuations, including Dell in their investment portfolio can effectively diversify the risks associated with a single technology stock. Dell’s extensive market coverage and innovation capabilities enable it to stably respond to rapid industry changes while providing sustained growth momentum.

Especially in today’s rapidly developing Cloud Services and AI technology, Dell’s deep layout in these areas indicates that it will continue to benefit from industry growth. However, investors should also pay attention to the risks mentioned earlier.

Meanwhile, despite the current legal and financial challenges facing Supermicro computers, which increase its short-term market uncertainty, its long-term potential in high-performance computing and server technology may not be affected by this. If investors are willing to take high risks in pursuit of corresponding high returns, they can pay attention to the development trends of Supermicro computers, go to BiyaPay to monitor the stock market trend, adjust investment strategies in a timely manner, and seize possible market recovery opportunities.

Overall, Dell’s solid and innovative capabilities, combined with the uncertainty of ultramicrocomputers, provide Dell with a unique market opportunity, enabling it to stay ahead of the competition in the technology field. Investors should closely monitor the dynamics of these two companies in order to make wise investment decisions and optimize the performance of their investment portfolios.