- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Amazon AWS and the Pentagon Bet Big! Intel Goes All-In on the 18A Node – Will This Be Their Comeback

Recently, Intel has caught the industry’s attention again due to major partnerships and technological breakthroughs. Intel has secured a long-term collaboration deal with Amazon AWS and a $3.5 billion semiconductor manufacturing contract with the Pentagon, making headlines in the tech world. At the same time, Intel has announced its full commitment to its 18A node technology, bypassing the intermediate 20A node. This move signals the company’s determination to compete head-on with TSMC.

These positive developments have reignited market expectations for Intel’s future. Consequently, Intel’s stock surged, closing 6.4% higher on Monday and gaining another 3.7% at Tuesday’s opening.

Despite these promising developments, Intel still faces several challenges. From financial struggles to layoffs and shrinking market share, whether Intel can truly turn the tide remains an open question.

Intel’s Struggles

In recent years, Intel has faced a series of severe financial and market challenges, threatening its position in the global semiconductor industry.

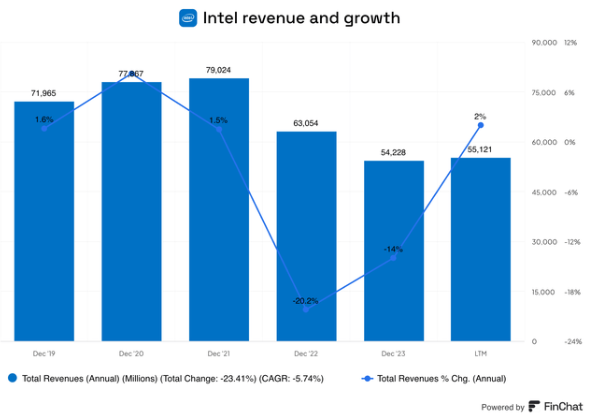

From a financial perspective, Intel’s free cash flow has been negative for several years, primarily due to massive capital expenditures over the past few years, while revenue growth has remained sluggish.

Intel’s growth stagnation has been a long-standing issue. The primary question for investors is, when can Intel regain stable growth? After announcing its second-quarter earnings, Intel rolled out a major cost-cutting plan, aiming to slash $10 billion by 2025, including a proposed layoff of 15,000 employees—15% of its total workforce. It’s hard to imagine Intel reigniting growth predictably with such significant cuts.

From 2021 to 2023, Intel’s capital expenditures reached $20.03 billion, $25.05 billion, and $25.75 billion, respectively. However, these investments have failed to drive revenue growth, instead worsening the company’s financial pressure.

At the same time, Intel’s gross margin has plummeted from 61.7% in 2018 to a projected 41.4% in 2024. Meanwhile, competitors like AMD and NVIDIA have steadily gained market share. AMD’s gross margin jumped from 37.8% in 2018 to 51.4% in 2024, and NVIDIA’s surged from 61.2% in 2019 to 76% during the same period. This shift in the competitive landscape has directly impacted Intel’s position in the high-performance chip market, causing it to lose its technological edge.

Moreover, Intel’s much-delayed 10nm process has severely hindered its competitiveness, while TSMC and Samsung have successfully moved into mass production of 5nm and 3nm technologies. Intel’s delays have cost it market opportunities, further weakening its overall revenue performance.

These technological delays have cast doubt on whether Intel can deliver its 18A node technology on time, despite its recent restructuring efforts and strategic partnerships aimed at reversing its fortunes. Intel is also transitioning towards AI as part of its business transformation, trying to address its worsening financial situation. Notably, Intel had to suspend its quarterly dividend last month due to declining profits and negative free cash flow.

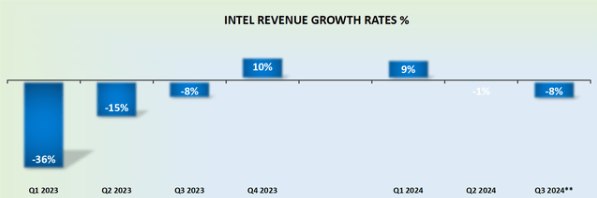

For the second quarter of 2024, Intel reported a larger-than-expected loss, with revenue down 1% year-over-year to $12.8 billion. Over the past five years, Intel’s profitability has deteriorated sharply, with net income falling from $21.05 billion in 2019 to just $1.67 billion in 2023.

Today, financial pressures and fierce market competition are the largest obstacles to Intel’s recovery.

To return to growth, Intel must take bold actions, such as pursuing new technology nodes and collaborating with major clients to regain market share. Fortunately, these efforts are beginning to pay off. Intel recently secured a $3.5 billion contract to manufacture semiconductors for the Pentagon and reached a long-term partnership with Amazon to produce custom AI chips, strengthening its ties with major clients.

Intel’s $3.5 Billion Pentagon Contract

Intel’s $3.5 billion contract with the U.S. Department of Defense (Pentagon) is one of its most strategically significant moves in recent years.

The contract is part of the “Secure Enclave” program, which aims to produce advanced semiconductors domestically for high-security applications in military and intelligence operations. This not only provides Intel with a stable revenue stream but also enhances its strategic position within U.S. government projects, easing some of its financial burdens.

Financial Impact

This $3.5 billion contract follows Intel’s $8.5 billion funding and $11 billion loan support from the CHIPS and Science Act. Winning such high-value contracts allows Intel to showcase its capabilities in advanced manufacturing and secure chip production. These contracts also alleviate Intel’s financial pressure, stemming from its massive capital expenditures, by providing much-needed cash flow to help the company meet its 2025 target of positive free cash flow.

Long-Term Impact

Beyond immediate financial relief, this contract strengthens Intel’s political and market position.

In the broader context of global semiconductor supply chain restructuring, Intel’s involvement in such high-end projects aligns with the U.S. government’s focus on supply chain security. As geopolitical uncertainties grow, Western countries are increasingly prioritizing self-sufficiency in high-tech sectors, reducing dependence on external sources. Intel is well-positioned to benefit from this trend.

This contract not only ensures stable revenue for the next few years but also secures Intel’s place at the heart of U.S. industrial policy. Moreover, the technological breakthroughs from the Secure Enclave project could lay the groundwork for Intel’s entry into commercial markets with high-security requirements, such as finance, healthcare, and energy.

Intel’s success in replicating its defense sector success in these industries could unlock more high-margin, high-barrier orders, further consolidating its market position.

Intel’s Partnership with Amazon AWS

Intel’s collaboration with Amazon AWS is another significant move that cannot be overlooked.

This multi-year, multi-billion-dollar partnership underscores the scale and stability of their collaboration. The deal not only has the potential to drive Intel’s future revenue growth but also signals AWS’s strong confidence in Intel’s 18A node technology.

Intel will use its cutting-edge 18A node to produce custom AI chips for AWS and design and manufacture Xeon processors based on its Intel 3 node. This collaboration highlights AWS’s trust in Intel’s technical capabilities and provides Intel with a competitive advantage in the high-performance computing and AI chip markets.

Strategically, AWS’s decision to partner with Intel signals that Intel still holds its ground in the next generation of AI and high-performance computing chips. With AI and cloud computing markets continuing to grow, this partnership could provide Intel with sustained long-term growth.

Perhaps even more crucially, partnering with AWS, one of the world’s leading cloud computing platforms, will enhance Intel’s influence in this sector and potentially attract more clients like Google Cloud and Microsoft Azure.

Technology and Market Position

On the technical front, Intel is betting heavily on its 18A node manufacturing process, which is central to the company’s future competitiveness.

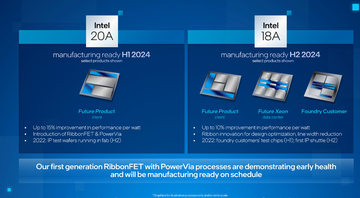

The 18A node technology is Intel’s core strategic development for the future, and its success is pivotal for the company. To understand Intel’s decision to bypass the 20A node, it’s essential to grasp the relationship and technological differences between these two nodes.

A node in semiconductor manufacturing refers to a key measure, typically in nanometers (nm), indicating transistor size. Smaller nodes typically mean higher transistor density, lower power consumption, and improved chip performance. Each node shrink represents a technological leap.

Intel initially planned the 20A node as a transitional technology before the 18A node, gradually advancing the company’s manufacturing process into sub-10-angstrom territory. However, due to its financial crisis and the need to accelerate its R&D process, Intel has decided to skip the 20A node and focus all its resources on the 18A node.

The 18A node retains key technologies like RibbonFET and PowerVia while optimizing performance, power consumption, and transistor density further. This decision reflects Intel’s confidence in the 18A node and its urgency in closing the technology gap with TSMC and other competitors.

In short, Intel’s decision to bypass the 20A node and concentrate on the 18A node underscores the company’s high confidence in this technology. The success or failure of the 18A node will not only determine Intel’s technological leadership but also its ability to reclaim lost market share and reestablish itself as a major global player.

By skipping the 20A node, Intel can advance to a more sophisticated manufacturing process faster, aiming for high-volume production of the 18A node by 2025. This could allow Intel to catch up with or even surpass TSMC’s N2 node, capturing market share in the process. This leapfrog approach shortens Intel’s technology development cycle and enhances its global competitiveness in the semiconductor market.

As AI and cloud computing markets continue to expand, other tech giants (such as Microsoft and Google) may consider forging similar partnerships with Intel, further boosting its market share. AWS’s decision to partner with Intel sends a strong message to the market: even in the face of fierce competition from TSMC and Samsung, Intel remains a formidable player with advanced manufacturing capabilities and technological solutions. This partnership strengthens Intel’s position as a global semiconductor leader and enhances its voice in high-performance computing and AI markets.

While the 18A node is seen as Intel’s key to future success, some uncertainties remain.

Technically, yield and production stability may pose significant challenges. Intel’s history shows that the company has faced repeated production delays and technical issues with previous nodes, such as the delay of the 10nm process. Whether Intel can deliver high-volume production of the 18A node on time will be a major factor in determining the success of its comeback. Additionally, competitors like TSMC and Samsung are aggressively advancing their latest processes, with TSMC’s N2 node expected to launch around the same time, making the industry keenly interested in the performance comparison between the two.

Intel’s ability to gain a competitive edge in the market will depend on its technological stability, production yield, and customer satisfaction.

Boost to Financials and Stock Prices

This partnership with AWS not only showcases Intel’s technical capabilities but also has immediate positive effects on its financials.

Following the announcement of this collaboration, Intel’s stock price surged by nearly 8%, reflecting the market’s optimism toward the partnership. Investors bullish on Intel’s future can monitor stock prices through multi-asset wallets like BiyaPay, seeking ideal trading opportunities. If dealing with funding issues, BiyaPay can also serve as a reliable tool for depositing and withdrawing funds into U.S. or Hong Kong stock accounts, allowing for swift transactions without limits.

Given AWS’s position as a major driver in the global cloud computing and AI space, this long-term partnership will provide Intel with a steady revenue stream. This is crucial for Intel, especially as the company faces financial pressures and negative free cash flow. Such large-scale collaborations offer long-term funding that could improve Intel’s financial health.

Moreover, this partnership could trigger a series of positive chain reactions.

Other top tech companies, such as Microsoft Azure and Google Cloud, might consider similar partnerships with Intel, broadening its opportunities for market expansion in high-growth fields like AI and cloud computing.

In summary, Intel’s collaboration with Amazon AWS carries significant strategic weight. Not only does it provide a powerful platform to showcase Intel’s technology, but it also lays the foundation for financial stability and market expansion in the future. As the 18A node rolls out successfully, Intel may secure more high-value partnerships like this, gradually rebuilding market confidence and regaining its competitive edge in the global semiconductor market.

Foundry Business Spin-off

One of Intel’s key moves recently is the spin-off of its foundry business into an independent subsidiary.

For the past two years, Intel’s chip manufacturing unit has been losing money, consuming $25 billion of the company’s funds in two years, while Intel lagged behind in the AI race. This situation has prompted the former chip giant to rethink its future development model.

The independent foundry business will have its own management team and financial structure, allowing it to raise funds independently. This provides Intel with more financial flexibility, enabling it to expand the foundry business without relying on Intel’s overall financial performance.

The 18A node will be the cornerstone of Intel’s foundry business post-spin-off.

It not only represents Intel’s most advanced manufacturing process but also marks the shift of Intel’s foundry services from serving internal needs to providing global client services. The 18A node has the potential to compete with the world’s top foundry companies, such as TSMC and Samsung, with its new RibbonFET transistor architecture and PowerVia power delivery technology, greatly enhancing chip performance and energy efficiency.

Furthermore, an independent foundry business will make it easier for Intel to partner with other semiconductor design firms.

In the past, external clients were hesitant to choose Intel due to the close ties between its foundry business and its chip design unit. By operating independently, Intel can remove this concern and attract more design firms to use its manufacturing services.

This presents Intel with opportunities to further expand its market share, especially as the global semiconductor supply chain continues to localize. Intel’s foundry business could become a preferred choice for global clients.

Risks

While Intel shows strong signs of recovery, several uncertainties remain.

First, execution risks persist, particularly regarding the production timeline for the 18A node. Given Intel’s history of delays, the market remains cautiously optimistic about its ability to deliver on time. Second, competitive pressure is intense. With TSMC and Samsung continuing to lead, Intel must accelerate its technological progress.

Intel’s heavy capital expenditures in recent years (over $7.5 billion in the past three years) have resulted in negative free cash flow. The company does not expect to return to positive free cash flow until 2025, meaning it faces significant financial pressure in the short term.

However, Intel’s long-term partnerships with AWS and the Pentagon provide stable revenue and have generated positive market feedback. These collaborations not only offer cash flow support but also strengthen Intel’s foundation in the highly competitive semiconductor market. Market confidence is being restored, and if Intel can manage short-term risks effectively, it is poised to reclaim its global market position and drive technology breakthroughs and stock price growth.

Is Now the Time to Buy?

When investing in a company on the path to recovery, valuation must be attractive enough to offer a compelling risk-return profile.

Valuation is the one factor that makes me somewhat optimistic about Intel stock. Currently, Intel’s book value per share (BVPS) stands at $26.95, based on $115.23 billion in equity and 4.276 billion shares outstanding. This is 19.35% higher than its after-hours stock price of $22.58, providing a solid foundation for potential upside.

The key question, however, is whether this book value is stable or projected to decline, avoiding a value trap.

It’s worth noting that Intel’s BVPS has been growing steadily over the years. Since 2014, this figure has risen annually, including a remarkable 11.7% increase from Q2 2023 to Q2 2024.

I expect this trend to continue, especially considering Intel CFO David Zinsner’s remarks during Intel’s Q2 2024 earnings call:

“By 2025, our operating expenses will be approximately $17.5 billion, with net capital expenditures between $12 billion and $14 billion, and we expect positive adjusted free cash flow.”

Suspending dividends, capitalizing on Altera, and achieving positive free cash flow will significantly improve our liquidity in 2025, allowing us to start aggressively deleveraging."

Intel’s price-to-sales ratio (P/S) is currently just 1.8, compared to NVIDIA’s 23.35 and AMD’s 9.39, suggesting that the market has punished Intel for its past financial difficulties.

As a result, any improvement in financial performance from now on could attract generous market rewards, favoring today’s long-term investors.

DCF Model Assumptions

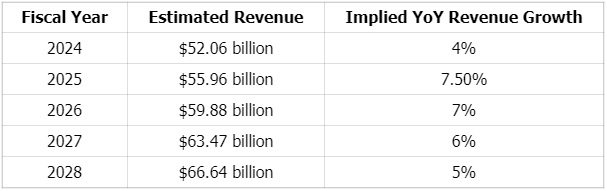

I’ve updated Intel’s DCF (Discounted Cash Flow) model to evaluate whether there’s a margin of safety for investing in Intel.

Please note that this time I’ve used very conservative growth assumptions to ensure the model captures anticipated fluctuations in revenue as Intel works through its restructuring strategy.

Here are the revenue growth assumptions used in the model:

Additionally, here are some other key assumptions used in the model:

- Capital expenditures will average about 33% of revenue over the next five years.

- The effective tax rate is 17%.

- The cost of capital is 9.5%.

- The terminal growth rate is 3%.

Based on these assumptions, Intel’s fair value is estimated at $30.30 per share, which implies nearly a 60% upside from the current market price.

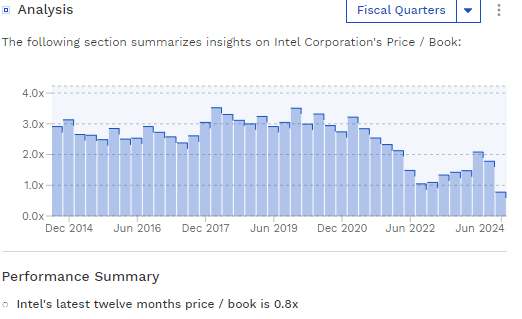

Not only that, but as shown in the chart below, Intel’s price-to-book ratio is the lowest it has been in at least a decade. This doesn’t guarantee it will return to a 2.0x or 3.0x level, but a move above 1.0x is likely, especially considering the factors mentioned earlier.

In conclusion, Intel has demonstrated strong recovery potential through a series of strategic partnerships and technological breakthroughs.

Long-term collaborations with AWS and the Pentagon not only provide stable revenue but also boost confidence in Intel’s 18A node technology. Despite execution risks and competitive pressure, Intel’s outlook remains promising, especially with government support and future financial improvements on the horizon. For investors, Intel’s technological advancements and potential market share gains make it a compelling long-term investment opportunity.