- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Sixth

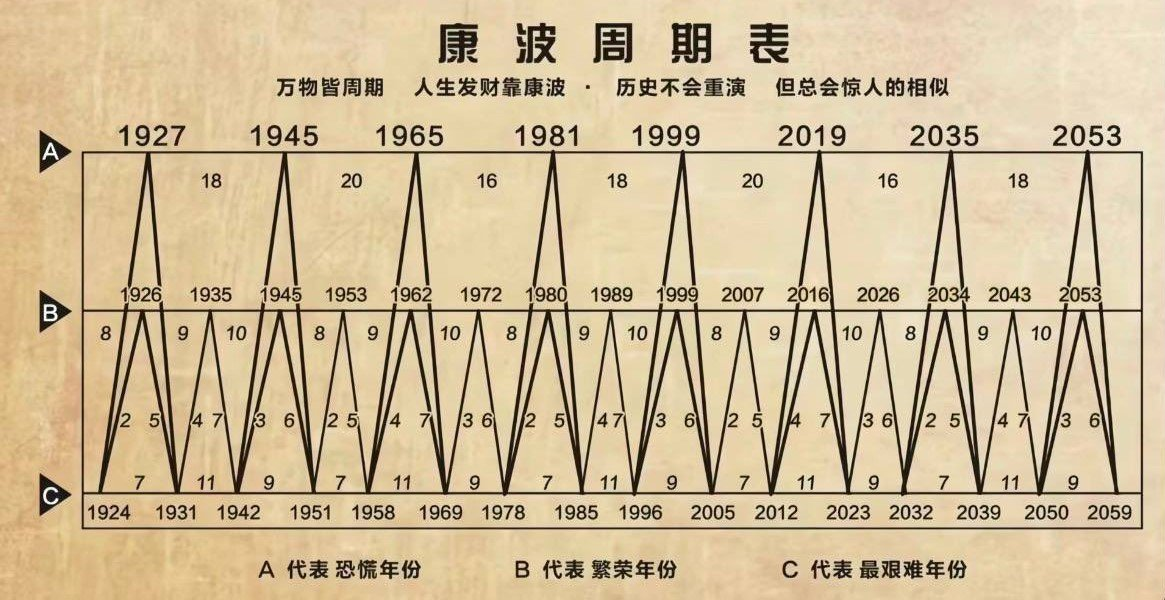

Is Now a Good Time to Invest in U.S. Stocks? Seizing the Kondratieff Cycle to Gain an Edge

In recent years, the U.S. stock market has garnered the attention of global investors. Over the past few decades, the U.S. stock market has shown remarkable growth potential, becoming a cornerstone of the global capital markets. For investors, the central question often boils down to: “Is now a good time to invest in U.S. stocks?” The answer is not solely dependent on short-term market fluctuations; it requires an understanding of long-term economic cycles, particularly the Kondratieff Cycle, which holds profound implications for predicting market trends.

The Kondratieff Cycle: A Key to Understanding Economic Fluctuations

The Kondratieff Cycle, also known as the long wave cycle, is an economic theory first proposed by Russian economist Nikolai Kondratieff in the 1920s. Kondratieff discovered that the capitalist economic system experiences cycles of fluctuations lasting 45 to 60 years, affecting the overall functioning of the economy. His research suggested that the economy is not perpetually in a state of growth or decline, but rather goes through four distinct stages: boom, recession, depression, and recovery.

- Boom: Innovation and technology drive rapid economic growth, market confidence soars, and investor enthusiasm is high.

- Recession: Economic growth slows, market volatility increases, and investors become cautious.

- Depression: The economy stagnates, markets shrink, capital returns diminish, and companies either downsize or collapse.

- Recovery: New technologies and innovations emerge, the economy gradually recovers, and market confidence returns.

These four stages of the Kondratieff Cycle have a significant impact on financial markets, especially stock markets. The cyclical nature of bull and bear markets in the U.S. often aligns with the global long wave economic cycle. Therefore, understanding the current phase of the U.S. stock market in relation to this cycle can help determine whether it is a good time to invest.

The U.S. Stock Market’s Historical Performance and the Kondratieff Cycle

The U.S. stock market has experienced numerous fluctuations and cycles over the past 100 years. Major events such as the Great Depression, the dot-com bubble, the subprime mortgage crisis, and the COVID-19 pandemic-induced market volatility are concrete manifestations of different stages of the Kondratieff Cycle. A historical view shows how these significant events are closely tied to this long wave economic theory.

The Great Depression and the Kondratieff “Depression Stage”

The Great Depression of 1929 was one of the most severe financial crises in U.S. and global economic history. At the time, the Kondratieff Cycle was at its “depression” stage, market confidence collapsed, and stock prices plummeted. However, in the decades that followed, the U.S. stock market gradually recovered and soared once again, entering a new phase of recovery and boom.

The Dot-Com Bubble and the Kondratieff “Boom Stage”

The dot-com bubble of the late 1990s exemplified an overheated U.S. stock market and irrational investor exuberance. At that time, the U.S. market was in the “boom” stage of the Kondratieff Cycle, with emerging technology companies rapidly rising and the stock market soaring. However, due to excessive expansion of the bubble economy, the market crashed in early 2000, leading to a brief “recession stage.”

The Subprime Mortgage Crisis and the Kondratieff “Recession Stage”

The 2008 global subprime mortgage crisis reflected the “recession stage” of the Kondratieff Cycle. Many financial institutions went bankrupt, the global economy fell into recession, and the U.S. stock market took a significant hit. Nevertheless, after this crisis, U.S. stocks rebounded from their lows, driven by new technological innovations such as social media and smartphones, entering a new boom phase.

The Current Phase of the U.S. Stock Market in the Kondratieff Cycle

Understanding the Kondratieff Cycle is crucial for investors, as it provides macroeconomic guidance. So, where does the U.S. stock market currently stand in the Kondratieff Cycle?

A Continuation of the Boom or the Beginning of a Turning Point?

Since the end of the 2009 global financial crisis, U.S. stocks have enjoyed more than a decade-long bull market, driven in particular by the strength of technology stocks. Both the S&P 500 and the NASDAQ have continuously set new records. Although the COVID-19 pandemic led to a sharp decline in early 2020, the market quickly rebounded, thanks to large-scale economic stimulus programs implemented by governments around the world, and stocks continued their upward trajectory.

However, after more than a decade of booming markets, certain uncertainties have begun to surface. Rising inflation, geopolitical tensions, supply chain disruptions, and the tightening of global central bank monetary policies all suggest that the market may soon enter the “recession stage” of the Kondratieff Cycle.

Recession Signals

Despite differing views in the market, some analysts believe that the U.S. stock market is nearing the end of the Kondratieff Cycle and could face recession risks. Here are a few possible signals pointing to a market downturn:

- High Inflation Pressure: Rising inflation globally, particularly in the U.S., may prompt the Federal Reserve to accelerate interest rate hikes, which could dampen economic growth.

- Tightening Monetary Policies: Central banks around the world are gradually reducing quantitative easing, and the resulting liquidity contraction could put pressure on stock markets.

- Geopolitical Uncertainty: Global political tensions, especially trade wars and energy crises, could undermine market confidence.

- Slowing Corporate Earnings Growth: As costs rise and consumer demand slows, many companies are experiencing reduced earnings growth, which could signal the beginning of an economic downturn.

Investment Strategies for U.S. Stocks: Seizing Opportunities in the Kondratieff Cycle

Although the market faces potential recession risks, this does not mean there are no opportunities in U.S. stocks. In fact, the volatility of the Kondratieff Cycle provides diverse strategies and opportunities for investors.

- Long-Term Investors: Strategic Positioning

For long-term investors, short-term market fluctuations should not be the only factor determining whether to enter the market. Instead, the key to long-term investing lies in finding high-quality companies and strategically positioning during downturns to achieve long-term returns. For example, those who invested in U.S. stocks at the low point following the 2008 financial crisis have reaped substantial rewards.

The “recession stage” of the Kondratieff Cycle is typically accompanied by market corrections and declines, but it also presents an opportunity for long-term investors to acquire quality assets at lower prices. History has shown that each market trough lays the foundation for the subsequent boom. Therefore, for patient investors, short-term market volatility may be the best entry point.

- Short-Term Investors: Capitalizing on Volatility

For short-term investors, the Kondratieff Cycle’s volatility offers numerous trading opportunities. During the “recession stage” or periods of heightened volatility, short-term investors can capitalize on market swings by trading volatile stocks or indices. Options, ETFs, and leveraged trading tools can help short-term investors generate returns in a turbulent market.

- Diversified Investment: Risk Mitigation

Regardless of the Kondratieff Cycle’s phase, diversification remains a key strategy for reducing risk. By allocating assets across different industries, regions, and asset classes, investors can effectively mitigate the risks posed by a single market downturn. For example, in addition to U.S. stocks, investors can consider diversifying into assets such as Bitcoin, commodities, real estate, and global stock markets to build a more robust portfolio.

Through the BiyaPay platform, investors can easily invest in U.S. and Hong Kong stocks and participate in digital currencies such as Bitcoin. BiyaPay’s diverse investment channels offer users more choices, helping to create a balanced portfolio that maximizes returns while diversifying risk. Additionally, through BiyaPay, you can deposit digital currencies like USDT and remit multiple currencies such as USD, EUR, and HKD to your personal bank account for further investments in global assets like commodities and real estate, optimizing your global asset allocation strategy.

Conclusion: Seize the Kondratieff Cycle and Invest in U.S. Stocks with Confidence

In summary, the Kondratieff Cycle provides a framework for understanding long-term fluctuations in the U.S. stock market. While the current market is filled with uncertainty, a deep analysis of the Kondratieff Cycle allows investors to better assess market direction and formulate appropriate investment strategies.

For long-term investors, short-term market fluctuations will not alter their investment logic and may even present an opportunity to buy on dips. Meanwhile, short-term investors can take advantage of market volatility to achieve quick profits. Regardless of the strategy, the key is to seize the opportunities presented by the Kondratieff Cycle and make rational decisions in order to gain an edge in the U.S. stock market.