- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Market V-Shaped Rebound! Nvidia CEO Jensen Huang Unveils Blackwell Chip, Triggering a $250 Billion S

On Wednesday, September 11th, during the midday trading session of U.S. stocks, Nvidia CEO Jensen Huang participated in a technology conference organized by Goldman Sachs, where he had a conversation with Goldman Sachs CEO Solomon. Huang’s speech at the Goldman Sachs conference has garnered widespread market attention. His discussion not only covered the market demand for Nvidia’s latest generation of AI chips, Blackwell, but also hinted at the company’s strategy to potentially reduce its reliance on TSMC. This strategy immediately triggered a chain reaction in the market. Nvidia’s stock price subsequently soared, leading to a rebound across the entire technology sector.

Reports indicate that during the U.S. stock market midday trading, Huang’s comments on the “enormous demand for AI chips” leading to “strained relationships between Nvidia and its customers” ignited the U.S. stock market, causing major indices to completely erase intraday losses and turn positive with a V-shaped rebound, particularly in technology and chip stocks.

The company’s stock rebounded from a low of $107, with the highest increase reaching 8.4%, breaking through $117 at one point, and ultimately closing up 8%, marking the largest single-day gain in six weeks, adding $250 billion to its market value. This surge not only reflects the market’s confidence in Nvidia’s future growth potential but also demonstrates the significant influence of Huang’s remarks on market sentiment.

Why did Huang’s speech have such a tremendous impact? Behind this lies Nvidia’s leading position in the AI chip market and the company’s proactive attitude towards future technological development. His remarks are of great significance not only for Nvidia’s own development but also have a profound impact on the entire technology industry.

Goldman Sachs Conference Speech

On September 11, 2024, at the Goldman Sachs conference, Nvidia CEO Jensen Huang delivered a key speech amid fluctuations in the company’s stock price. Huang’s speech focused on the market demand for AI chips and supply chain challenges, attracting widespread attention from investors and the tech industry.

Huang candidly discussed the current shortage of AI chips, which has led to tense relationships between Nvidia and its customers. He pointed out that Nvidia’s AI chips, especially the highly anticipated Blackwell series, have become hot items in the market.

“Everyone is counting on us… The demand for our products is so great that everyone wants to be the first to get them, to get the largest share. We may have more emotional customers today, which is understandable. Relationships are tense, but we are doing our best,” said Huang.

Huang’s words reveal the intense desire of customers for Nvidia’s products and their urgent need for the latest technology in the fierce market competition.

Huang further emphasized the importance of Nvidia’s products to customers’ businesses, stating: “The delivery of our components, technology, and infrastructure directly affects our customers’ revenue and competitiveness.” This indicates that AI chips are not just tech products but are also key factors in driving business growth and maintaining market competitiveness.

Despite supply chain challenges, Huang remains optimistic about Nvidia’s future. He revealed that the company is accelerating production to meet the urgent market demand for Blackwell chips and expects to achieve mass shipments in the coming quarters. This positive outlook not only alleviates market concerns about supply shortages but also demonstrates Nvidia’s leadership in the AI field and its commitment to future technological development.

Huang’s speech is not only a response to the current market situation but also an affirmation of Nvidia’s strategy. Against the backdrop of the rapid development of global AI technology, Nvidia’s chips play an indispensable role in driving industry progress.

Market Reaction

The impact of Huang’s speech on Nvidia’s stock price was immediate.

After the U.S. stock market opened on September 11th, Nvidia’s stock price fell to near $107, a low point during the day. However, as Huang’s speech at the Goldman Sachs conference continued, market sentiment began to shift rapidly, and investors regained confidence in Nvidia’s future demand growth, causing the stock price to climb significantly. During the midday session, Nvidia’s stock price continued to rise, eventually reaching $117 at the end of the day, with an intraday increase of up to 8.4%, and a swing close to 9% from low to high.

By the close, Nvidia’s stock was up 8%, marking the largest single-day gain in six weeks. This increase not only allowed Nvidia to recover part of the losses since August 30th but also added about $250 billion to its market value.

This strong rebound not only boosted Nvidia’s stock performance but also had a cascading effect on tech stocks and the overall U.S. stock market.

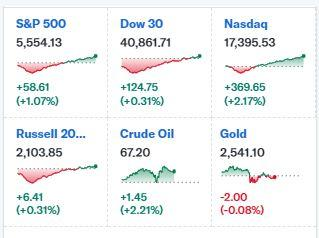

Nvidia’s stock surge led to a general strengthening in the technology sector, with the S&P 500 index reversing from a 1.6% morning drop to a gain of over 1%; the Dow Jones Industrial Average rebounded from a 744-point decline to a 0.3% increase, closing above the psychological threshold of 40,000 points; the Nasdaq Composite Index rose from a 1.4% midday drop to a gain of over 2%, with a swing of more than 630 points or 3.8%; the Nasdaq 100 Index’s swing reached 3.8%. In addition, the chip industry performed particularly well, with the Philadelphia Semiconductor Index surging nearly 5%, leading the market that day.

Analysts believe that for the first time since October 2022, both the S&P 500 and the Nasdaq 100 successfully offset intraday losses of more than 1.5%. In other words, Huang’s strong “high demand” signal conveyed in his speech at the Goldman Sachs conference alone was enough to offset the negative impact of the inflation data released earlier that day on market sentiment.

The financial blog Zerohedge also commented on this, stating that against the backdrop of U.S. stocks falling due to inflation and economic data, Huang’s single sentence turned the situation around: “No matter what, all the market heard was ‘strong demand’.”

Nvidia’s Chip Business

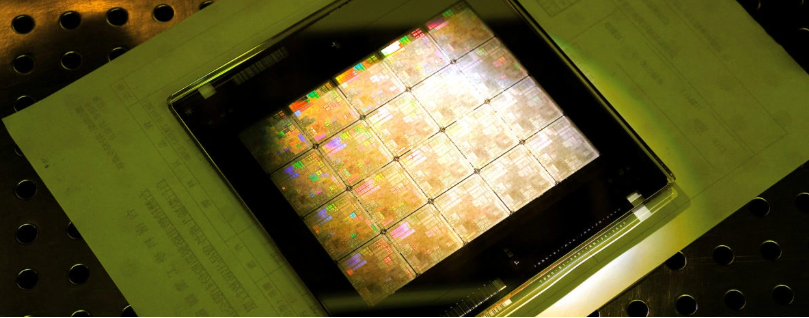

Nvidia has held a dominant position in the high-performance computing and graphics processing unit (GPU) market for many years, especially with its strong performance in the fields of artificial intelligence (AI) and data centers, making it a leader in the global chip industry. The company’s technological innovations and market expansion in several key markets have ensured its competitive edge in the fiercely competitive semiconductor industry.

Blackwell Chip: The New Generation of AI Core

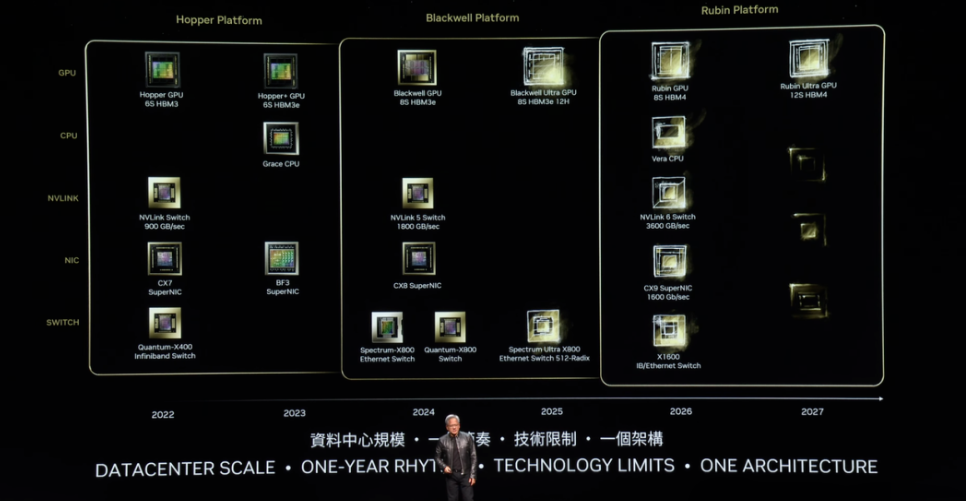

At the Goldman Sachs conference, Huang highlighted the upcoming Blackwell chip, which represents the next generation of Nvidia’s products in the fields of AI and data center technology. The Blackwell chip will provide more powerful computing capabilities and higher energy efficiency for AI workloads, meeting the growing demand for AI computing from hyperscale cloud service providers and tech enterprises. With the global explosion in demand for generative AI and AI model training, the Blackwell chip is expected to become the growth engine for Nvidia in the coming years.

Huang admitted that the market demand for the Blackwell chip has far exceeded the current supply, leading to fierce competition among customers. He further emphasized that Nvidia is working hard to solve this supply shortage problem and plans to accelerate production to meet market demand.

Through this move, Nvidia is trying to alleviate the emotional tension of customers while ensuring that the Blackwell chip can quickly capture the market.

The Importance of Increasing Blackwell Chip Production

The company reported that data center revenue for the second fiscal quarter was $26.3 billion. Although this figure indicates a year-over-year increase of more than 150% driven by substantial investments in AI infrastructure, it also represents a slowdown compared to the first quarter’s year-over-year growth of 427%. Therefore, although the optimistic outlook from leading hyperscale and cloud service providers is expected to continue supporting the growth momentum of the Hopper architecture, Nvidia is facing the impact of the “law of large numbers.”

In other words, Nvidia’s investors may need the Blackwell chip to quickly gain market share during the transition period. Although there is a cautious sentiment in the short term, the management emphasizes that customer demand for the Hopper architecture remains strong while preparing to adopt the Blackwell. Therefore, investors can rest assured that the management expects a significant increase in Hopper shipments in the second half of fiscal 2025.

Although the Hopper architecture has performed well, Nvidia must prove that it can effectively improve the production yield of the Blackwell chip. The company anticipates that the Blackwell will begin to ramp up in the fourth quarter of fiscal 2024, indicating that a more robust growth momentum should be expected from fiscal 2026.

The management optimistically stated that “demand for the Blackwell platform far exceeds supply,” which aligns with recent market comments. Nvidia’s full-stack AI infrastructure not only has a competitive advantage in AI training but also performs well in inference tasks. Now, Nvidia’s AI clusters have become a standard for leading AI companies and tech giants.

Therefore, the company’s confidence in the Blackwell chip is justified, indicating that potential AI infrastructure investments will be more active.

In addition, it is estimated that the growth in sovereign AI demand is still in its early stages, with the management raising its revenue forecast for sovereign AI to “reach several billion dollars this year.” As the AI arms race intensifies globally, countries will use their exclusive data domains to gain an advantage.

At the same time, as “AI factories” become mainstream, the AI technology adoption rate among enterprise users is expected to increase. The management revealed that they are currently working with most of the Fortune 100 companies to promote AI projects across industries and regions, which will further strengthen market confidence in the monetization of AI technology.

Data Center and AI Chip Applications

Nvidia’s AI chips have become a significant growth driver for the company, particularly in data center applications. In the second quarter of 2024, Nvidia’s data center business revenue reached $26 billion, marking a year-over-year increase of over 150%. This figure not only reflects the booming development of AI infrastructure but also demonstrates the high dependency of global tech companies on Nvidia’s chips. The existing Hopper architecture has been widely adopted in numerous hyperscale data centers, and the upcoming Blackwell chip is set to further solidify the company’s leadership in this domain.

The broad application of Nvidia’s AI chips extends beyond AI model training and inference, also propelling the digital transformation of enterprises. The company’s technological edge in generative AI, deep learning, and efficient data processing has earned its products widespread recognition across various industries. Especially against the backdrop of the current global AI demand surge, Nvidia’s chips are accelerating AI deployment for businesses and governments.

Market Position and Competitive Advantage

Nvidia maintains a leading position in the AI chip market through technological innovation and product diversification. Its main competitors include AMD and Google’s TPU, but Nvidia’s advantage is not only reflected in hardware performance but also in its robust ecosystem integration capabilities. By seamlessly integrating hardware, software, and AI infrastructure, Nvidia provides comprehensive solutions for its customers, going far beyond merely supplying hardware.

At the Goldman Sachs conference, Jensen Huang emphasized this advantage, stating that Nvidia leads not only in AI hardware but also across the entire AI technology stack. “We bear the burden of many, and everyone is counting on us. The demand is so great that the delivery of our components, technology, infrastructure, and software is really an exciting/emotive matter for people,” he said. This all-encompassing market competitiveness allows Nvidia to keep growing even in the face of strong competition.

In summary, Nvidia’s chip business is widely recognized for its dominant position in the AI and data center markets. By continuously innovating and launching the next generation of Blackwell chips, Nvidia is expected to continue leading the development trend of AI infrastructure in the coming years, ensuring its global market share in the semiconductor industry continues to expand.

Expansion Plans of Major Tech Customers

Expansion plans of tech giants like Meta and xAI have further intensified the demand for Nvidia’s AI chips. According to Barron’s, the strong financial report of software giant Oracle this week serves as a reminder that demand for Nvidia’s AI-related chips should remain robust, a trend confirmed by Jensen Huang today.

Elon Musk’s startup xAI is using a large number of Nvidia GPUs to build its Colossus AI training infrastructure, and Meta has already planned to purchase billions of dollars’ worth of Nvidia H1 chips by the end of this year. These large tech clients with expansion plans are enough to make Nvidia dominate the AI chip market.

Supply Chain and TSMC

At the Goldman Sachs conference, Jensen Huang emphasized that Nvidia heavily relies on TSMC for chip production, mainly because TSMC is at the forefront of semiconductor manufacturing technology, especially in the production of high-end AI chips and data center chips. He pointed out: “TSMC’s agility and their ability to respond to our needs are truly incredible.” This cooperative relationship ensures that Nvidia can meet the massive market demand for AI chips in a timely manner.

However, Jensen Huang also indicated that Nvidia has prepared for contingencies, stating that if necessary, Nvidia could turn to other suppliers, such as Samsung or other foundries. He mentioned: “If needed, we can switch to other suppliers because we have developed most of the key technologies in-house.” This shows that Nvidia has made preparations for potential supply chain disruptions and can flexibly adjust suppliers when necessary.

Nevertheless, Jensen Huang also pointed out that switching to other suppliers might affect the quality of Nvidia’s chips. He said: “Although we have the capability to change suppliers, such adjustments could lead to a decline in chip quality.” Therefore, despite having alternative plans, TSMC, with its excellent technology capabilities and response speed, will continue to play a significant role for some time to come, especially in the production of Nvidia’s core AI chips.

Jensen Huang’s speech at the Goldman Sachs conference demonstrated that while Nvidia is striving to address supply chain risks, it will still rely on TSMC’s advanced technology and production capabilities. However, Nvidia has prepared measures to deal with potential supply chain disruptions and can flexibly adjust suppliers when necessary.

Investor Perspective and Major Investment Bank Analysis

Recently, there has been a divergence in views among major investment banks regarding Nvidia’s investment prospects. While Goldman Sachs remains optimistic, other banks such as Citigroup and Barclays call for caution regarding Nvidia’s growth.

Optimistic Outlook from Goldman Sachs

After the Goldman Sachs conference, Goldman Sachs analyst Toshiya Hari maintained a “Buy” rating on Nvidia. He believes that the market’s sell-off of Nvidia’s stock was excessive, citing that the demand for AI chips remains strong, especially from large cloud service providers like Amazon, Google, and Microsoft, known as hyperscalers. Hari pointed out: “The demand for accelerated computing remains very strong, particularly as the demand from hyperscalers is expanding to other enterprises and even sovereign nations.”

Furthermore, Goldman Sachs believes that despite Nvidia’s recent earnings report not fully meeting Wall Street’s extremely high expectations, the company still dominates in the commercial silicon sector, especially in terms of innovation speed, even compared to custom silicon.

Goldman Sachs estimates that generative AI will begin to make a substantial contribution to industry growth from the second half of 2025, driving Nvidia’s long-term profitability.

Cautious Stance from Citigroup

In contrast to Goldman Sachs’ optimism, Citigroup’s view is more cautious. U.S. stock strategist Scott Chronert warned that Nvidia might be gradually transitioning from an “exciting AI darling” in the market to a “steady, large-cap tech stock.” He noted that Nvidia’s future growth may no longer have a profound impact on the overall market, “Simply looking at the deceleration of the performance and guidance growth rates, it is evident that Nvidia’s most impressive performance and fundamental influence on the market trend may have passed.”

Citigroup also pointed out that as the Federal Reserve’s interest rate cut expectations approach, capital is flowing out of the once dominant tech leaders, and although Nvidia’s profit growth remains strong, it will no longer continue to be a significant driver of the S&P market returns. The sell-off after its “solid but not outstanding” earnings report indicates that this semiconductor giant’s status as a major AI favorite in the market is fading, and compared to Nvidia, Apple has replaced Nvidia as Citigroup’s preferred AI stock.

Cool-headed Analysis from Barclays

Barclays has a more cautious attitude towards Nvidia’s future growth. After analyzing the AI capital expenditure of hyperscale cloud providers, the analysts believe that although the demand for AI products is strong, the future may not hold 12,000 AI projects of a scale similar to ChatGPT.

Barclays pointed out that while Silicon Valley is indeed discussing how AI will change the world, and many new services will reveal some bullish cases, it is unlikely that there will be as many as 12,000.

Investor Advice

Considering the views of major investment banks, although Nvidia’s stock has corrected in the near term, this may be an opportunity for long-term investors to increase their positions. Investors can monitor stock prices regularly and trade stocks at the right time.

Nvidia’s leadership in the AI field is undisputed, especially in the fields of generative AI and accelerated computing, and there is still a broad development prospect in the future. As the demand for AI technology in various industries continues to grow, Nvidia’s innovation capabilities and technological advantages will continue to drive its long-term growth.

In the short term, market sentiment fluctuations provide investors with a more attractive entry point. Although supply chain issues and competitive pressures exist, Nvidia is well prepared to deal with these challenges. Investors should focus on Nvidia’s long-term strategy, especially its continuous expansion in the AI field. This long-term perspective helps to maximize returns and withstand the impact of short-term fluctuations.

Jensen Huang’s speech at the Goldman Sachs conference clearly demonstrated Nvidia’s market leadership in the AI chip field and its firm confidence in future growth. Although Nvidia faces stock price fluctuations due to not fully meeting Wall Street’s extremely high expectations in the short term, the company still has strong market competitiveness, especially driven by the demand for generative AI and accelerated computing, with huge potential for future growth.

Although major investment banks have different views on Nvidia’s short-term prospects, institutions such as Goldman Sachs remain optimistic about its long-term development, especially in terms of continuous innovation in commercial silicon and AI technology, Nvidia is still in a leading position in the industry.