- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Apple's new product launch event was cold, and the stock price rose with difficulty. How big a break

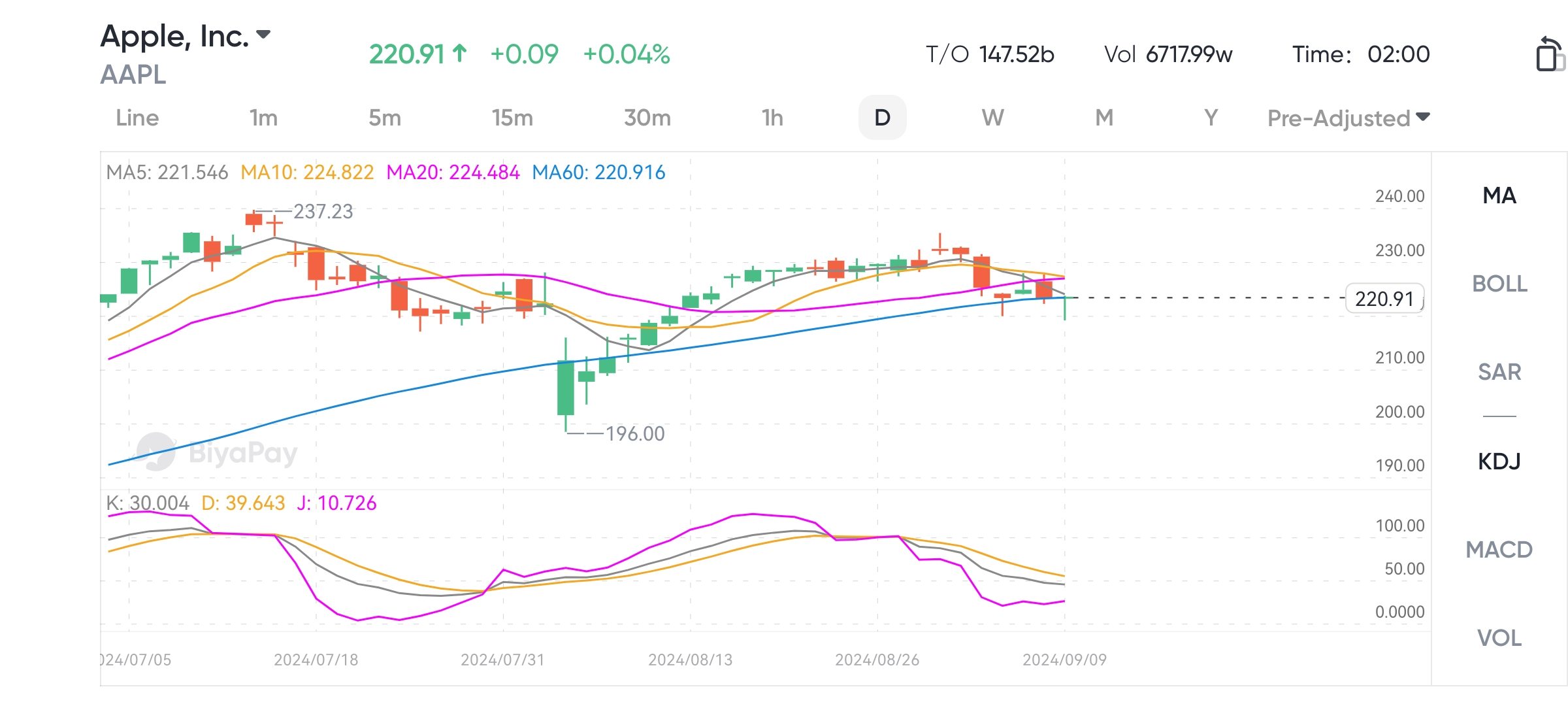

On September 10th Beijing time, Apple held the autumn new product launch event with the theme of “Highlight Moment” as scheduled, launching multiple new products including the latest iPhone. Although Apple released multiple hardware updates and new features, the event did not provoke a strong reaction from the market. When introducing the iPhone series of products and Apple Intelligence, Apple’s stock price turned from rising to falling, and the decline once expanded to more than 1%. After the event, the stock price gradually rebounded and finally barely closed up 0.04%, with the current stock price at $220.91.

The first AI iPhone a selling point, and the first batch of Apple Intelligence features will be launched next month

The most anticipated feature of this conference is the AI function carried by the iPhone 16 series. This is the first time Apple has deeply integrated AI technology into its flagship product, making it the first AI-driven iPhone, marking a new direction for Apple’s future development of smartphones. The iPhone 16 series is equipped with Apple’s latest A18 and A18 Pro chips, which have been specially optimized for AI computing and Machine Learning, improving the device’s computing power, especially in the fields of image processing, automatic speech recognition, and generative AI applications.

As the first iPhone to support Apple Intelligence, the iPhone 16 series makes AI one of the core selling points of the product. Users can use AI to achieve complex task processing through simple natural language input, such as text rewriting, intelligent photo search, and deep interaction with voice assistants. This transformation makes the iPhone 16 series not just a smartphone, but a device with truly intelligent processing capabilities, which can greatly enhance the user experience. This breakthrough marks the iPhone’s further transformation from functional tools to intelligent assistants.

The launch of Apple Intelligence marks Apple’s official entry into the field of generative AI and has become the core highlight of the iPhone 16 series. Compared to the previous Siri, Apple Intelligence can handle more complex tasks and is deeply integrated into iPhone functions, bringing a truly intelligent experience. Users can not only control the device through natural language, but also use AI to automatically handle daily tasks, such as editing text, generating personalized emojis, intelligent photo search, and more humanized voice assistant interaction.

However, the global promotion of Apple Intelligence will adopt a phased strategy, initially only launching in English-speaking countries such as the US. Other language versions such as China, France, and Japanese are expected to be launched next year. Although this is a major technological breakthrough for Apple, this phased release strategy may temporarily prevent consumers in some markets from experiencing this important feature, which may have a negative impact on new product sales.

The response to the press conference was lackluster, so does the new product still have the potential to trigger a “replacement wave” and become a breakthrough point, pushing up future stock prices?

Market response to new product launches is lackluster

From the perspective of investors, this press conference did not significantly enhance market confidence. Although the iPhone 16 series has been updated in hardware and AI technology, especially the introduction of Apple Intelligence for the first time, these innovations have not brought the breakthrough expected by the market.

Consumers and investors often expect revolutionary innovation from Apple, rather than just incremental improvements in hardware. The design changes of the iPhone 16 series are extremely limited, with major hardware upgrades focused on the A18 and A18 Pro chips and camera performance optimization. These changes were not enough to spark large-scale market excitement, resulting in the stock price not seeing a significant increase during the launch event.

Compared to previous products, such as revolutionary designs like the iPhone X, the update of the iPhone 16 series appears to be more conservative. The market hopes to see more disruptive features, but Apple still continues its strategy of incremental innovation. This conservative design and feature upgrades cannot meet the market’s expectations for Apple products to lead the trend, which is also one of the main reasons for the lackluster stock price response.

Overall, the lackluster response may be attributed to the slowdown in innovation in the smartphone market in recent years, high market expectations faced by Apple, and investors paying more attention to the actual application prospects of new technologies. Although the performance improvement of the iPhone 16 series chips is commendable, the overall hardware upgrade seems to have failed to bring enough excitement to the market. In the future, Apple may rely more on AI-driven services and functions such as Apple Intelligence to enhance User Experience, thereby driving longer-term growth.

Can Apple Intelligence be the tipping point?

Apple Intelligence is the biggest highlight of the iPhone 16 series and a key step for Apple to enter the field of generative AI. Although Apple Intelligence can achieve intelligent operations such as text processing, photo search, and voice assistants, it is unclear whether these functions can become the core driving force for ordinary users to upgrade their phones.

In addition, as mentioned earlier, Apple Intelligence adopts a phased release strategy, which weakens its immediate impact as a driving force for the global replacement wave. Whether AI technology can be widely accepted and applied by users in the short term directly affects the market performance of the iPhone 16 series and also affects investors’ confidence in the rise of Apple’s stock price.

With the introduction of AI features, market concerns about privacy and data security have also increased. Although Apple emphasized its protection of user privacy at the launch event, some industry insiders still question Apple’s AI security. Consumer trust and acceptance of AI technology will directly affect the promotion effect of Apple Intelligence, thereby affecting the scale of the replacement wave.

Global smartphone market growth is slowing, and replacement demand is weak

The global smartphone market has entered a mature stage, innovation has slowed down, and consumers’ replacement cycles have generally lengthened. In recent years, the replacement cycle has gradually increased from about two years in the past to four years or even longer. This means that unless the new product has obvious appeal, consumers often choose to postpone the replacement. Although the hardware upgrades of the iPhone 16 series have improved performance, these incremental improvements are not enough to trigger a strong desire to buy in the market.

In this market environment, Apple needs to impress consumers with more radical innovation. However, the iPhone 16 series did not bring enough innovative elements, especially limited changes in appearance and core functions, which led to users not having enough motivation to replace existing devices. This also made investors doubt whether the iPhone 16 series could drive Apple’s revenue growth, further suppressing the upward momentum of the stock price.

High valuation pressure increases, and stock prices are difficult to boost in the short term

Apple’s current Price-To-Earnings Ratio is already higher than the long-term average, which means the market has high expectations for its future growth. However, the gradual innovation of the iPhone 16 series and the uncertainty of the global economic environment make investors cautious about its future growth prospects. If the new product fails to bring the expected sales growth, Apple’s high valuation will face adjustment risks, and the upward space of the stock price will also be suppressed.

Currently iPhone sales remain Apple’s most important source of revenue. If the iPhone 16 series does not trigger a strong replacement wave, the upward potential of Apple’s stock price will be greatly reduced. In addition, pressure from competitors such as Huawei and Samsung is also intensifying, making Apple’s performance in this key market challenging.

Can new products become a breakthrough and push up stock prices?

Despite the lackluster market response and short-term stock price performance after the release of the iPhone 16 series, it does not mean that Apple has lost the potential to drive up the stock price. Although Apple Intelligence, as the core selling point, may not fully play a role in the short term, with the advancement of global promotion plans, especially after its launch in the Chinese market, AI functionality may gradually become a key factor driving demand for replacement phones. If Apple can allow more users to experience the powerful functions of AI through marketing activities and software updates in the coming months, the iPhone 16 series is still expected to trigger a relatively long-lasting replacement wave, thereby boosting Apple’s revenue and stock price.

The growth of service revenue and Apple’s future growth potential

Apple’s financial performance in recent years shows that the service business is becoming an important pillar of its revenue growth. Unlike the cyclical fluctuations of hardware sales, the revenue of the service business is more stable and predictable, and the profit margin is significantly higher than that of hardware products. With the introduction of Apple Intelligence and the continuous expansion of the global user base, the growth of service revenue will provide new impetus for Apple’s future.

The importance of service business is increasing

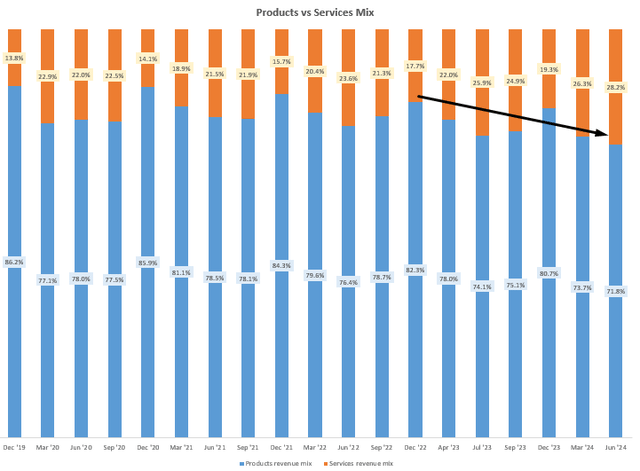

Apple’s services business includes various products and services such as Apple Music, iCloud, App Store, Apple TV +, Apple Arcade, etc. The revenue from these services is gradually becoming an important part of Apple’s overall revenue. According to the latest financial report data, the proportion of revenue from Apple’s services business to total revenue has increased from 18% seven quarters ago to 28%. With the global popularity of devices such as iPhone, iPad, and Mac, the ecosystem services provided by Apple through these devices are becoming increasingly important.

The gross profit margin of the service business is much higher than that of the hardware product, reaching about 70%, while the gross profit margin of the hardware product is generally around 30%. With the increase in the proportion of service revenue, Apple’s overall profit margin is also improving, which has a positive impact on the company’s long-term profitability and shareowner returns. The stability and high profit margin of the service business provide Apple with a buffer against the fluctuations in the hardware market, especially in the context of slowing iPhone sales growth.

Apple Intelligence drives the expansion of the service ecosystem

Apple Intelligence is not only an important selling point of the iPhone 16 series, but it will also become an important driving force for the expansion of Apple’s service business. With the introduction of AI technology, Apple’s various services will become more intelligent and personalized. For example, Apple Music can accurately recommend music that users like through AI, iCloud can more efficiently manage users’ photos and files, and the App Store can make more accurate application recommendations based on user behavior.

These personalized services will enhance users’ dependence on Apple’s ecosystem, improve service stickiness and User Experience. Once users enter Apple’s service ecosystem, it is difficult for them to easily switch to other platforms, especially when Apple Intelligence provides them with a personalized experience different from other platforms. This can not only increase the Retention Rate of existing users, but also attract more new users to join Apple’s ecosystem, thereby further driving the growth of service revenue.

The potential of the global market and the continued growth of service revenue

With the continuous expansion of Apple’s device installation base in the global market, especially in Emerging Markets, the growth potential of the service business is huge. The smartphone penetration rate in Emerging Markets such as India is rapidly increasing, and the penetration rate of Apple devices in these markets is gradually increasing. Every new iPhone user is a potential service subscriber. This means that Apple’s future service revenue growth will not only rely on the contribution of existing users, but also benefit from the continuous expansion of the global device base.

Space for pricing growth and sustainability of high profits

Apple has a high brand loyalty, and its user stickiness gives the company greater flexibility in pricing. In the past few years, Apple has slightly increased subscription prices on some services (such as Apple Music and iCloud), but the User Churn rate remains low. With the widespread application of Apple Intelligence and the improvement of service experience, Apple may further increase subscription fees for services, thereby driving revenue growth.

Compared to the hardware business, the cash flow of the service business is more stable and predictable. Service revenue is not strongly affected by macroeconomic cycles, especially in the context of increasing global economic uncertainty. Apple can rely on its service business to provide a more stable source of profit. The profit margin of the service business will also continue to remain high, which is of great significance to the company’s overall financial health.

The role of service business in supporting stock prices

With the increase in the proportion of service revenue, Apple’s business model is gradually shifting from hardware-driven to service-oriented. Investors’ valuation model for Apple is also changing, with more and more analysts seeing Apple as a technology platform company rather than just a hardware manufacturer. This change in perception helps to improve Apple’s Price-To-Earnings Ratio, as the market usually gives platform companies higher valuation multiples.

The growth of the service business will provide long-term support for Apple’s stock price. Although iPhone sales growth may be limited in the short term, the stable growth and high profit margin of the service business will ensure that Apple continues to maintain profitable growth in the coming years. In addition, with the comprehensive promotion of Apple Intelligence, Apple’s service ecosystem will further expand, which will provide additional momentum for future stock price increases.

How should investors layout?

Although the market response to Apple’s release of the iPhone 16 series has been muted, Apple’s long-term potential is still worth watching from an investment perspective.

In the short term, the sales performance of the iPhone 16 will be an important factor in determining stock price fluctuations, and its sales will directly affect Apple’s quarterly performance. At the same time, the launch of Apple Intelligence will also enhance the growth potential of the service business, and the continuous expansion of service revenue provides strong support for Apple’s stable growth.

In addition, Apple’s service ecosystem will continue to expand, especially in Emerging Markets, where the growth of service revenue will further consolidate its profit sources. Apple Intelligence’s personalized services will enhance user stickiness, driving more subscriptions and service consumption. As the proportion of service businesses in total revenue increases, Apple will be able to maintain profit growth in the context of hardware sales fluctuations, providing investors with a relatively stable return opportunity.

In the long run, Apple’s technological innovation remains a key driver of its growth. Foldable screen phones, augmented reality (AR) and mixed reality (MR) devices, as well as the highly anticipated Apple car project, are all growth engines for Apple’s future. Once these new technologies and product lines are successfully launched, they will open up new markets for Apple and further drive up the company’s stock price. Although the monetization of these projects may take time, they are expected to become important support for Apple’s next growth cycle.

Therefore, friends who want to invest in Apple can go to BiyaPay to buy, or monitor the subsequent market trends to find a suitable buying opportunity. In addition, if you have difficulties with deposits and withdrawals, you can also use it as a professional tool for depositing and withdrawing funds from US and Hong Kong stocks. Recharge digital currency to exchange for US dollars or Hong Kong dollars, withdraw to your bank account, and then deposit funds to other securities firms to buy stocks. The arrival speed is fast, and there is no limit, so you will not miss investment opportunities.

However, as investors, we should also recognize the risks and be vigilant against the unfavorable factors brought by the global macroeconomic environment and competitive pressures. Inflation, rising interest rates, and global economic slowdown may affect consumers’ demand for high-end products, and competition from manufacturers such as Huawei and Samsung cannot be ignored, which will bring fluctuations to Apple’s stock price.

Overall, Apple’s new product line, especially Apple Intelligence, is expected to further release its development potential in the future. Friends who are interested in investing should flexibly respond to market changes, actively capture Apple’s future growth opportunities, and do a good job in threat and risk assessment.