- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Can AMD's Stock Price Break Through the Bottleneck Following a $4.9 Billion Acquisition of ZT System

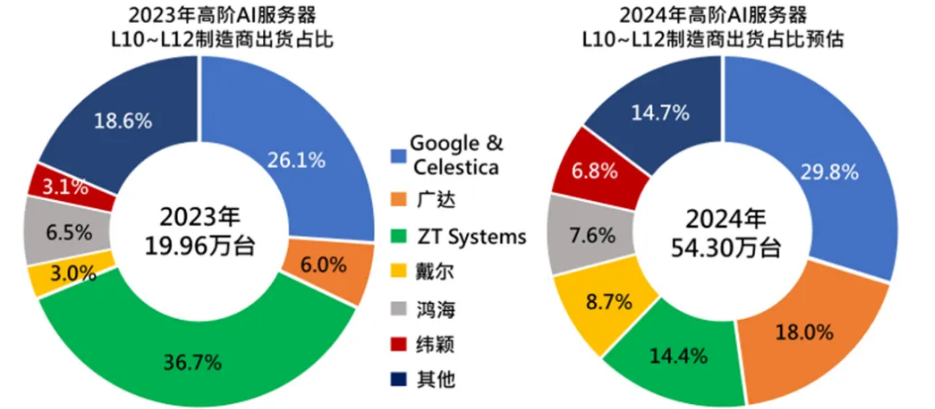

On the evening of August 19th, Beijing time, U.S. chip giant AMD announced it would acquire ZT Systems for $4.9 billion. ZT Systems is a leading provider of AI and AI infrastructure for some of the world’s largest hyperscale computing companies, holding one of the top three market shares in the high-end AI server market. This transaction, valued at a whopping $4.9 billion, is a significant move in AMD’s long-term AI strategy, aiming to significantly expand its capabilities in data center AI systems to address a market opportunity expected to reach $400 billion by 2027.

The acquisition has been unanimously approved by AMD’s board of directors. The deal is expected to close in the first half of 2025, pending certain regulatory approvals and the satisfaction of other customary closing conditions. Upon completion, ZT Systems will become part of AMD’s Data Center Solutions business unit.

This acquisition is AMD’s second major transaction in recent times. Recently, AMD completed the acquisition of Europe’s largest private AI lab, Silo AI, for approximately $665 million. Pre-market on August 19th, AMD’s stock rose more than 2%. Analysts remain optimistic about AMD’s long-term market prospects, believing that this strategic acquisition will further solidify its market position and support its stock price growth in the medium to long term.

Motivation for the Acquisition

As a leading global semiconductor company, AMD has been actively seeking to strengthen its market position in the field of artificial intelligence (AI). Although AMD has performed well in traditional semiconductor and GPU (Graphics Processing Unit) markets, it still lags behind its competitor Nvidia in the high-performance chip sector dedicated to AI computing in data centers.

Nvidia has long held a leading position in the AI chip market, especially in data center and machine learning applications. Its GPUs are widely used in various AI tasks, ranging from autonomous driving to advanced data analytics. In contrast, while AMD has strong performance in graphics and gaming markets, it has been slower to enter the market for chips specifically designed for AI.

Therefore, this acquisition may be driven by several considerations:

Closing the Gap and Increasing Competitiveness:

In the fields of high-performance computing and AI, server design is a key element that directly affects computing performance, energy efficiency, and the ability to meet customer customization needs. Before this acquisition, although AMD had strong chip design capabilities, it had not made significant strides in server design, particularly in customized design.

The lack of server design capabilities placed AMD at a disadvantage against competitors like Nvidia, which not only has advanced GPUs but also offers fully optimized server systems. Nvidia’s DGX series servers provide deeply optimized solutions, featuring high performance, low latency, and high bandwidth, meeting the demands of enterprise-level AI tasks. Mastery of server design is a crucial factor in Nvidia’s leadership in the AI and data center markets.

Thus, AMD’s acquisition of ZT Systems can be seen as a strategic move to fill this gap. ZT Systems specializes in providing high-performance cloud computing solutions for data centers, including the development of customized hardware. These technologies and experiences will help AMD design and optimize high-performance chips and systems for AI computing, particularly in processing large amounts of data and performing complex computations with high energy efficiency.

By integrating ZT Systems’ technology, AMD will be better positioned to compete with companies like Nvidia, enhancing its product competitiveness in the AI data center market. Through these technological advancements, AMD can better serve enterprises and research institutions that require large-scale machine learning and data analytics, thereby capturing a larger market share in the future AI field.

Market Expansion and Enhanced Customer Base:

The acquisition of ZT Systems allows AMD to leverage ZT’s existing customer relationships and market channels, which is crucial for AMD’s expansion in the data center market. ZT Systems’ strengths in providing customized cloud computing solutions, especially in handling large-scale data and high-performance computing needs, will directly complement AMD’s products and services.

This integration not only enhances AMD’s technological capabilities but also significantly expands its potential customer base and market coverage.

Furthermore, ZT Systems’ enterprise solutions are already in use across various industries such as financial services, healthcare, and telecommunications, providing AMD with opportunities to further penetrate these vertical markets.

Long-Term AI Market Strategy:

AMD’s acquisition of ZT Systems strategically positions the company to more effectively address the rapidly evolving industry trends in AI technology and big data analytics.

As the core of modern technological infrastructure, data centers have a growing demand for high-performance computing. AI applications, from cloud computing to deep learning algorithms, require vast amounts of computing power, which in turn drives the demand for advanced data centers equipped with high-performance computing systems.

ZT Systems’ expertise in data center design and operation enables AMD to offer more efficient solutions to meet increasingly complex computing needs. This capability is crucial for AMD, as the rapid advancements in AI and machine learning demand continuous technological innovation and hardware support.

Through this strategic acquisition, AMD demonstrates its commitment and ability to maintain a leading position in the global technology market, ensuring sustained growth and successful transformation in the coming years.

Future Outlook After the Acquisition

After acquiring ZT Systems, the technological and market strategy impacts on AMD will gradually become evident, making the future outlook even more promising.

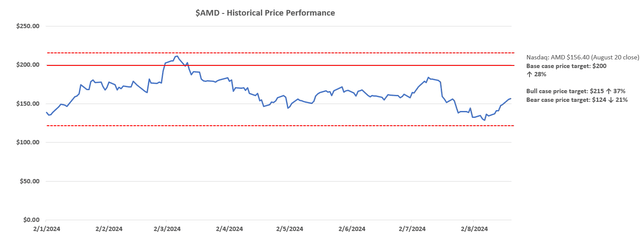

Although AMD’s stock price is no longer overvalued, the company still faces challenges in competing with Nvidia in the AI GPU market. Nvidia recently released its flagship GPUs, the H100 and H200, continuing its dominance. Recently, AMD’s stock price has dropped nearly 10%, underperforming the broader market, although it has remained flat year-to-date.

Despite AMD reporting a solid second-quarter earnings report a few weeks ago, showing a 9% year-over-year increase in revenue to $5.84 billion, exceeding expectations by $120 million, this has not been enough to reignite its stock price. However, the company still has several catalysts driving its development, at least helping it continue to exceed expectations in the future.

First, AMD’s flagship MI300 series chips generated over $1 billion in revenue for the first time in the second quarter, indicating strong demand for its products. Additionally, during the recent earnings call, AMD’s management noted that Microsoft (MSFT) is currently using the company’s MI300X AI GPU to support its generative AI tools and platforms, which is another positive development.

More importantly, AMD now expects its data center revenue to exceed $4.5 billion this fiscal year, up from the previous forecast of $4 billion.

Moreover, AMD’s customer business also performed impressively in the second quarter. As the company prepares to ramp up production of its recently released Zen 5 CPUs in the third quarter, it is likely to maintain this momentum in the coming quarters.

All these factors suggest that AMD’s growth story is far from over. With the demand for AI GPUs and CPUs expected to continue growing, the company recently raised its third-quarter revenue forecast to $6.7 billion, higher than the market’s general expectation of $6.61 billion.

Furthermore, AMD continues to effectively utilize integration strategies to enhance its competitive advantage and technological capabilities. Through its recent series of acquisitions, AMD has achieved incremental growth and cost synergies, placing itself in a more advantageous position in the increasingly competitive market. The effectiveness of this strategy is evident.

Therefore, it is certain that AMD will continue to grow at a respectable pace in the future. At the current price, AMD seems to be a better investment. Interested individuals can monitor the market trends on multi-asset wallets like BiyaPay and wait for the right opportunity to buy.

If you have concerns about deposits and withdrawals, BiyaPay can also serve as a professional U.S. and Hong Kong stock deposit and withdrawal tool. You can recharge digital currency, convert it into U.S. dollars or Hong Kong dollars, withdraw it to a bank account, and then deposit it into other brokerage accounts to buy stocks. The transaction speed is fast, there are no limits, and it won’t miss market opportunities.

Potential Risks, Stock Valuation, and Investor Strategies

Although AMD appears to be an attractive investment, especially at the current price, the company still faces challenges that may hinder its stock price from appreciating quickly in the foreseeable future.

First, the company’s flagship AI GPU seems to underperform compared to Nvidia’s chips. As a result, AMD struggles to capture market share from Nvidia, which already holds 90% of the AI processor market. Despite AMD’s GPUs being cheaper, they have not established a strong position. AMD expects its data center revenue to exceed $4.5 billion this year, while Nvidia has exceeded $20 billion in a single quarter and has done so for several consecutive quarters.

Second, technological integration poses a significant challenge post-acquisition, particularly in merging the technological platforms, product lines, and R&D processes of the two companies. Therefore, the acquisition of ZT Systems carries downside risks, such as integration costs and the low profitability of ZT Systems’ manufacturing business, which may initially dilute profit margins. Currently, server companies are trading at low valuations, with AMD’s acquisition price being about 0.5 times sales.

However, in the long run, the transaction will fundamentally add value to AMD. AMD’s management hopes to achieve non-GAAP accretion by the end of 2025 and plans to sell the manufacturing unit after the transaction, retaining about 1,000 engineers to enhance its system design expertise.

This transaction will have a net accretive effect on AMD’s AI strategy by incorporating system design into its AI capabilities, driving the adoption of data center processors, improving its competitive position against Nvidia, and strengthening the long-term growth trajectory of high-margin data center sales, thereby enhancing cash flow to support valuation prospects.

Therefore, considering the current risks and future growth and profit opportunities, we firmly believe that AMD still represents a favorable risk-reward combination at the current level. We maintain a base target price of $200 per share.

The target price is derived using the discounted cash flow (DCF) method, considering the cash flow projections from the fundamental analysis discussed above. A weighted average cost of capital (WACC) of 9.2%, consistent with AMD’s risk profile and capital structure, was applied. The analysis also assumes a perpetual growth rate of 6.0% applied to the expected 2028 EBITDA to determine AMD’s terminal value. The premium valuation assumption aligns with a 3.5% perpetual growth rate applied to the expected 2033 EBITDA, when AMD’s growth is expected to align with the upper range of anticipated economic expansion.

Despite the challenges AMD faces in competing with Nvidia and the potential short-term volatility due to technological integration, in the long term, AMD’s market expansion strategy and deep investment in AI technology suggest potential growth opportunities.

For investors optimistic about AMD’s future development, consider holding shares long-term, buying on dips, and closely monitoring the company’s market dynamics and technological developments to benefit when AMD’s stock valuation and industry position strengthen. However, despite its potential in certain areas, it faces fierce market competition and uncertainties in technological changes. Therefore, it is not advisable to heavily invest in AMD alone. Consider diversifying some funds into other technology companies, traditional industries, bonds, funds, and other investment products to reduce the risk associated with a single stock.

It is undeniable that AMD still lags behind Nvidia in terms of its share of the AI opportunity and the resulting revenue. However, AMD continues to make efforts to enhance its end-to-end ecosystem capabilities and demonstrates the company’s commitment to closing the competitive gap with the industry leader.

AMD also continues to showcase an effective integration strategy, a cost-effective approach to optimizing capital expenditure deployment relative to its expected growth and margin expansion trajectory. This, in turn, alleviates investor concerns about potential risks associated with excessive AI spending during the latest earnings season.

In summary, we believe that AMD’s current market valuation still represents a conservative fundamental outlook, underestimating the added growth and margin accretion factors before the sustained execution of the underlying AI strategy.