- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

"Black Myth: Wukong" Boosts Popularity, New Quarterly Earnings Report Becomes Market Focus—Can Nvidi

Recently, the trend of Nvidia’s stock price has become a focal point in the technology sector. Although its stock price briefly fell below the critical psychological level of $100 on August 7th, it subsequently demonstrated an impressive rebound. According to statistics, since then, Nvidia’s stock price has soared more than 30% in just a few trading days, with a market capitalization surge of $765 billion.

In terms of market performance, this rise in Nvidia’s stock price can be described as overwhelmingly strong. From August 7th to August 19th, the cumulative increase reached 31%, nearly three times the gain of the NASDAQ 100 index over the same period, marking the best eight-day winning streak since May of last year. Looking back to May of this year, Nvidia capitalized on the AI boom with a remarkable earnings report, and its stock price soared 33% in just under two weeks. This recent increase in market capitalization is the largest absolute gain in the company’s history over an eight-day trading period.

However, looking back at the previous decline in Nvidia’s stock price, the underlying reasons are quite complex. On one hand, investors’ concerns about an economic slowdown have intensified; on the other hand, the delay in the market launch of Nvidia’s next-generation Blackwell AI GPU, coupled with doubts about the revenue progress of companies purchasing its GPU chips, have triggered market concerns about a slowdown in AI spending.

The significant rise in stock prices today is not only due to the overall recovery trend in global stock markets but also supported by multiple other factors, including the popularity of current blockbuster games. Furthermore, the upcoming earnings report next week, which is highly anticipated by the market, is another significant influencing factor. Let’s delve into a detailed analysis of these elements.

The popularity of “Black Myth: Wukong” has driven demand for related products

“Black Myth: Wukong” has become a focal point across gaming, entertainment, and industry economics, with its player count on launch day soaring to the second-highest in Steam history. Behind this high-quality, highly popular game, the demand for updated gaming equipment has triggered a frenzy across the industry chain.

Since its inception in 2018, “Black Myth: Wukong” has garnered significant attention during its development phase, and its launch on August 20 catapulted it to global prominence. The game’s system requirements have led many players to upgrade their computers and purchase new peripherals, igniting a boom in the hardware sector.

Nvidia, capitalizing on this trend, released a new driver specifically for this game. On August 21, Nvidia joined the world’s largest gaming expo, Gamescom, to showcase the game’s performance at the highest graphics settings. Nvidia highlighted that to achieve the ultimate gaming experience, a player would need an RTX 40 series graphics card supporting full-ray tracing and DLSS 3 technology.

Nvidia announced that the game had been added to the GeForce Now cloud gaming service, allowing GeForce Now subscribers to play “Black Myth: Wukong” without enduring lengthy download times.

Just the day before, Nvidia had released the new Game Ready 560.94 driver, optimized for the latest games supporting DLSS 3.5 technology, including “Black Myth: Wukong.” Additionally, the official PC requirements for “Black Myth: Wukong” indicate that a minimum of a GTX 1060 graphics card is needed to play the game.

With more gamers joining the “Monkey King” craze, the demand for Nvidia’s related products has further increased, which is likely to continue boosting its stock price.

Nvidia’s new quarterly earnings are expected to exceed expectations

Nvidia is set to release its Q2 2025 earnings report on August 28, 2024, with profits expected to exceed expectations due to strong revenue growth and profits from multiple high-growth sectors. Over the past five years, the company has successfully increased its revenue from $10.9 billion in FY 2020 to $60.9 billion in FY 2024.

Looking back at the performance trajectory of the first quarter of FY 2025, Nvidia reported revenue of $26 billion and an operating profit margin of 69%. These figures highlight Nvidia’s leading position in two booming markets: artificial intelligence and data centers.

Additionally, these figures reveal other previously unnoticed trends, such as the data center revenue and a compound annual growth rate of 75% for growth, maintained at this level for the fifth consecutive year, with a $22.6 billion increase in the first quarter of 2025. The excellent earnings performance is likely driven by the dominance in the data center sector, spurred by the surge in AI demand and strategic partnerships.

Nvidia has a diversified product portfolio that supports the profit potential in numerous areas. Gaming revenue contributes a substantial portion of the revenue, having grown at a compound annual growth rate of 11% for nine consecutive years; this is considered a resilient result, proving that demand for Nvidia GPUs continues. Additionally, two other lines of business within Nvidia—professional visualization and automotive—are currently small contributors to overall revenue.

More importantly, they hold significant potential, notably as Nvidia continues to innovate, such as with autonomous driving solutions based on the Nvidia DRIVE platform and next-generation AI-driven solutions. With growth in the highest demand and cutting-edge industries like AI, gaming, and autonomous driving, Nvidia’s multiple revenue streams have prepared it well to surpass earnings expectations and continue a strong financial performance cycle.

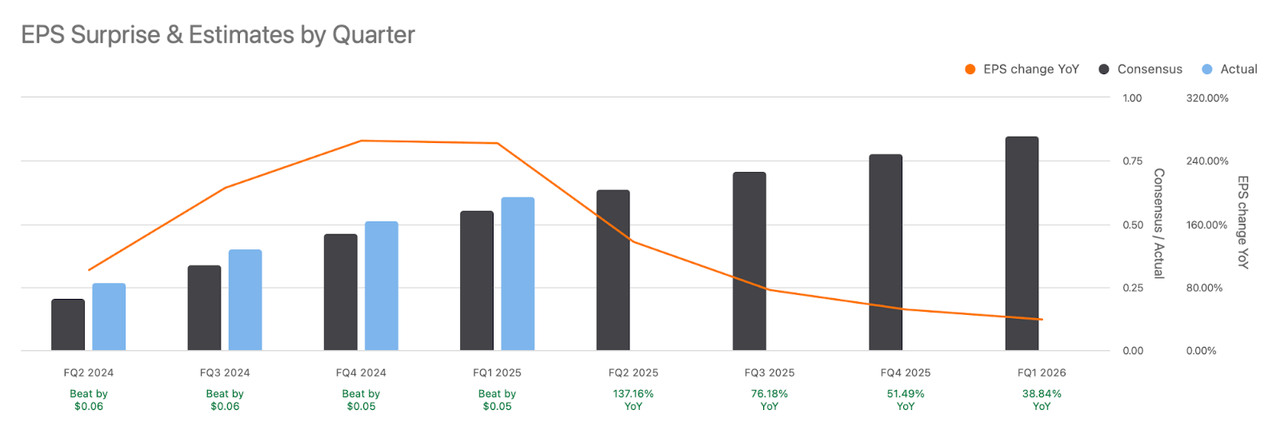

Lastly, Nvidia’s earnings have consistently exceeded expectations over the past few quarters, and thus far, EPS for FY 2024 and FY 2025 has been slightly but steadily above expectations. The upcoming earnings for Q2 2025 look promising, with an expected year-over-year EPS growth of 137.16%, thanks to Nvidia’s leadership in the AI and data center markets. Although the EPS growth rate may decline in the coming quarters, Nvidia’s earnings momentum appears strong, indicating a high likelihood of continued excellent performance with a positive outlook.

If you are attracted by these earnings expectations and considering an investment, you can use BiyaPay to monitor market trends before and after Nvidia’s earnings release to find the right time to buy. Additionally, if you encounter any difficulties with deposits or withdrawals, you can use BiyaPay as a professional tool for managing funds in U.S. and Hong Kong stocks. It allows for the conversion of cryptocurrencies into USD or HKD, and facilitates withdrawals to bank accounts and deposits to other brokerage accounts for stock purchases. BiyaPay offers fast transaction processing and no limits on transaction amounts, ensuring you don’t miss out on investment opportunities.

Nvidia’s AI monopoly is unstoppable

Nvidia holds a dominant position in the AI chip market, with an estimated market share of 80%. Much of this dominance stems from its leading GPUs, which have become the de facto standard for training and deploying AI models in data centers. Nvidia’s CUDA software platform is used extensively by AI developers, further cementing its monopolistic position.

Competitors like Advanced Micro Devices (AMD) and Intel (INTC) have challenged Nvidia. AMD launched the Instinct MI300X, and Intel introduced the Gaudi 3 AI accelerator. However, these companies mainly compete in specialized niche markets rather than the broader general training market, which remains Nvidia’s core strength and main focus.

Moreover, deep integration with major cloud service providers like Amazon (AMZN), Microsoft (MSFT), and Google (GOOG) also solidifies Nvidia’s leadership. These providers rely on Nvidia GPUs to support their AI infrastructures. This quarter, over 40% of Nvidia’s revenue came from its top customers.

While these companies have chips in development, they still heavily rely on Nvidia and its high-performance GPUs. For instance, despite Amazon’s in-house chips like Inferentia and Tranium for AI tasks, it continues to tout the efficiencies achievable by customers using Nvidia GPUs. Google deploys TPUs internally but also offers access to Nvidia chips through its cloud services. This scenario means that these massive clients continue to use Nvidia’s premium hardware, further solidifying the company’s position as a core participant in the AI infrastructure market.

Finally

In conclusion, Nvidia’s recent significant price increase has been fueled by various positive factors, and the stock may continue to rise. However, whether this trend can be sustained largely depends on the earnings report due next week.

While recognizing these positive aspects, it’s also crucial to focus on risk analysis. First, due to the lack of new product launches, the company’s revenue may experience a consecutive slowdown in the new quarter. Second, the upcoming release status of the Blackwell products deserves close attention. Additionally, although Nvidia still holds a monopolistic position in AI, its competitors should not be underestimated. Lastly, everyone can look forward to the new earnings report.