- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Microsoft's Q4 earnings are out. Azure underperformed, leading to a stock price decline. How should

Introduction

Although Microsoft Corporation (NASDAQ: MSFT) reported better-than-expected results in the fourth quarter of fiscal year 2024, its stock price immediately fell after the financial report was released.

Prior to the release of the report, Microsoft’s stock price had already fallen by 10% from its high point, so we are now in the process of adjustment. In this article, we will investigate Microsoft’s report for the fourth quarter of the 2024 fiscal year and re-evaluate its long-term risks and returns to make wise investment decisions.

Brief Review of Microsoft’s Q4 FY2024 Report

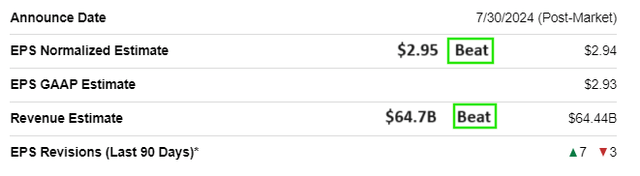

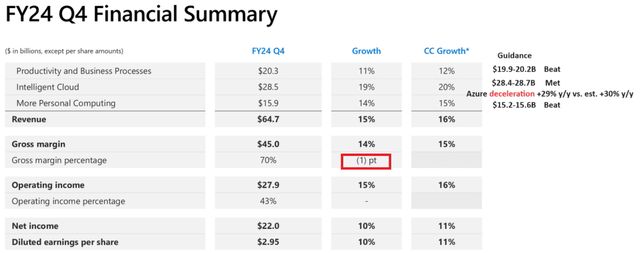

For Q4 FY2024, Microsoft reported a double beat, with total revenues of $64.7B (+15% y/y, vs. est. $64.4B) and diluted EPS of $2.95 (+10% y/y, vs. est. $2.94); however, the quantum of the beat was minuscule.

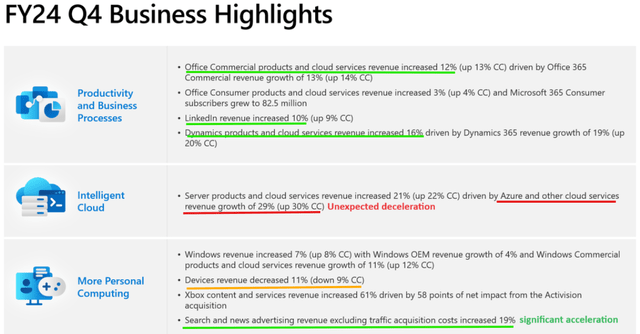

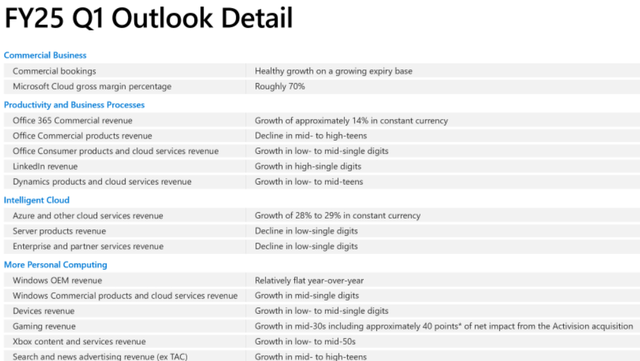

As you can see above, Microsoft’s Productivity & Business Processes [$19.6B, +12% y/y] and More Personal Computing [$15.6B, +17% y/y] segments exceeded management’s guidance range, the Intelligent Cloud business [$28.5B, +21% y/y] was closer to the lower end of management’s guided range of $28.4-28.7B, with deceleration in Azure Cloud growth rate from 31% y/y in Q3 to 29% y/y in Q4. Last week, Alphabet reported an acceleration in Google Cloud Platform revenues (from 28% y/y to 29% y/y); hence, the deceleration in Microsoft Azure is a real negative surprise!

While Azure numbers look disappointing, Microsoft’s Search and News Advertising revenues jumped +19% y/y, a significant acceleration from last quarter’s 12% y/y growth. Finally, AI-powered Bing showing some progress!

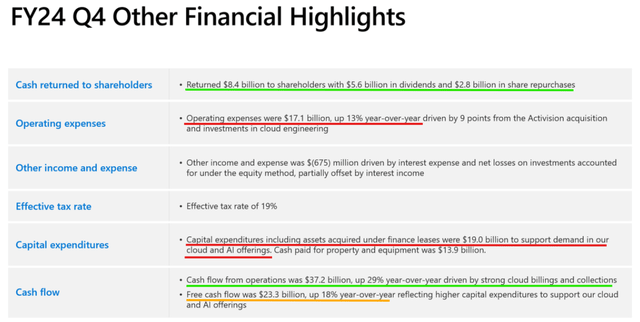

Now, during Q4 FY2024, Microsoft’s operating expenses grew by +13% y/y while the revenue growth rate moderated to +15% y/y. Consequently, Microsoft generated $37.2B in cash flow from operations (+29% y/y) and $23.3B in quarterly free cash flow (+18% y/y) in Q4. From these free cash flows, Microsoft returned $8.4B to its shareholders in the form of share repurchases ($2.8B) and dividends ($5.6B).

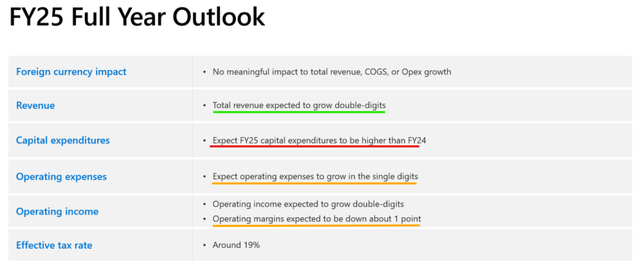

Microsoft is still a giant cash printing machine; however, with the gap in its revenue and operating expenses growth rates narrowing in recent quarters, concerns about Microsoft’s operating leverage (margin expansion) story hitting a snag have been rising. However, Microsoft’s FY2025 outlook calls for double-digit revenue growth and single-digit operating expenses growth:

Hence, I am no longer worried about Microsoft’s operating leverage.

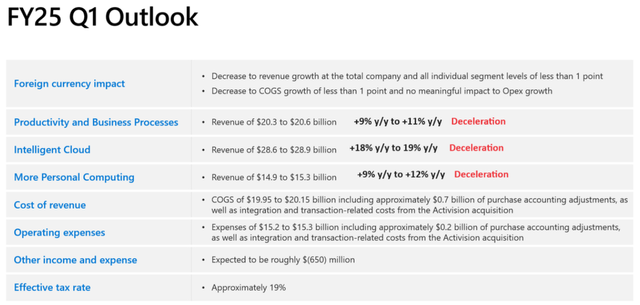

For Q1 FY2025, Microsoft’s management guided for deceleration across the business, with total revenues expected to come in at $64.3B at the midpoint of the guidance range, a figure that fell short of pre-Q4 consensus street estimates for Q1-FY2025 revenue of $65.45B.

Furthermore, Microsoft’s leadership guided for increased CAPEX spending in FY2025, with Q1 FY2025 CAPEX set to rise sequentially from the $19B Microsoft spent in Q4 FY2025. With roughly half of this CAPEX spend going into real estate and infrastructure, Microsoft’s management sees this spending as a long-term asset that will be monetized over 15 years! Also, Microsoft’s leaders - Satya Nadella and Amy Hood - expressed a belief that Microsoft’s increased CAPEX spend is a sign of higher AI demand; however, while doing so, they mentioned architectural consistency between cloud and AI infrastructure, i.e., if Microsoft ends up overbuilding AI capacity, they will monetize the GPUs via cloud computing demand. This sort of language was utilized by Alphabet’s leadership, too. Unfortunately, both Nadella and Pichai failed to provide a real answer on the ROI (quantum and timeframe) of the ongoing AI infrastructure spending. Yes, it might be too early to make an assessment; however, with elevated CAPEX spending about to apply pressure on FCF generation, stock prices could get hurt in the near term if the return on investment remains uncertain.

Overall, Microsoft’s Q3 FY2024 report is mixed. While the company beat top and bottom-line estimates, it failed to meet lofty investor expectations. Despite increasing its AI CAPEX spending, Microsoft’s Azure Cloud revenue unexpectedly decelerated in Q4. This raises question marks over the future ROI on the ongoing CAPEX spending cycle and, in my view, puts a richly valued MSFT stock in the penalty box for the next quarter at the very least.

Let us now re-evaluate MSFT stock in light of these Q4 FY2024 numbers.

Microsoft Fair Value And Expected Returns

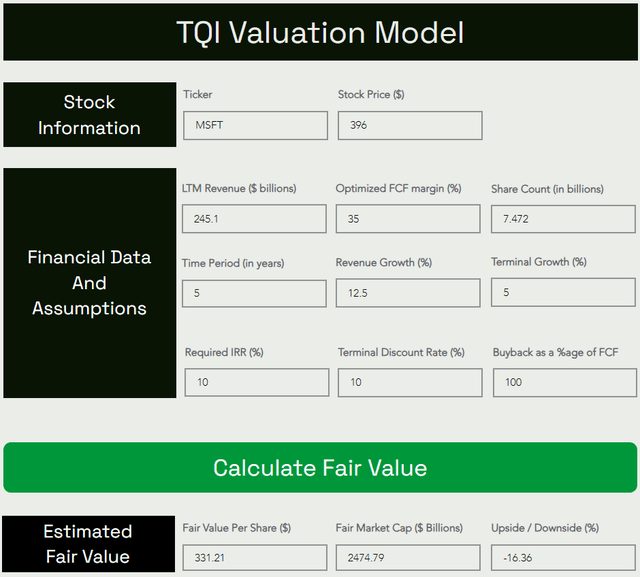

In Microsoft: Bubble, Bubble Toil, And Trouble, I shared detailed reasoning behind our model assumptions for Microsoft. For today’s evaluation, we’re sticking to all of our past assumptions, with the only change coming in the form of the model’s revenue base - TTM revenue now stands at $245.3B

Now, despite using aggressive assumptions for long-term growth and steady-state margins, Microsoft continues to look overvalued, albeit the gap to fair value has narrowed to ~15% in light of the ongoing correction in MSFT stock:

According to our valuation model, Microsoft’s fair value estimate is ~$331 per share (or ~$2.5T). With the stock trading at ~$396 per share, I now see a downside of -16% to fair value in MSFT stock.

Predicting where a stock will trade in the short term is impossible; however, over the long run, a stock will track its business fundamentals and obey the immutable laws of money. If the interest rates were to return to artificially low levels (i.e., ZIRP), higher equity multiples would be justifiable. However, I work with the assumption that interest rates will eventually track the long-term average of ~5%. Inverting this number, we get a trading multiple of ~20x (P/FCF).

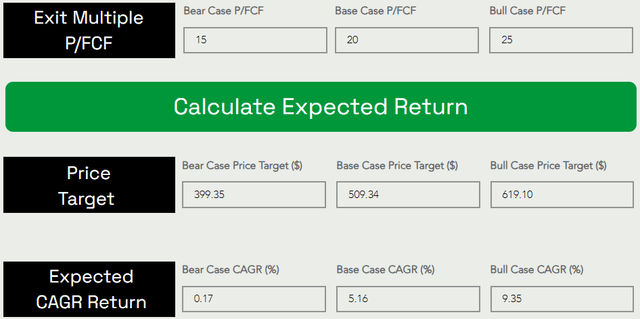

Assuming a base case exit multiple of 20x P/FCF, I see Microsoft stock rising from ~$396 to ~$509 per share in the next five years at a CAGR of 5.16%.

Overall, Microsoft’s five-year expected return is better than the national bond yield (about 4-5%), worth holding, and the current stock price is low, worth paying attention to. It is recommended to go to BiyaPay to monitor Microsoft’s market trends and choose a suitable entry point. Of course, it can also be used as a professional tool for depositing and depositing US and Hong Kong stocks. Recharge digital currency to exchange for US dollars or Hong Kong dollars, withdraw to a bank account, and then deposit to other securities firms to buy stocks. The arrival speed is fast, there is no limit, and it will not delay the market.

Should you buy, sell, or hold Microsoft stock now?

As of the fourth quarter of fiscal year 2024, despite a slight slowdown in Azure, Microsoft’s performance has been outstanding. Despite the recent stock price decline, it is still an amazing company. Moreover, Microsoft’s five-year expected compound annual growth rate (CAGR) has now exceeded the risk-free government bond yield, which may be a good choice for investors who tend to hold for the long term. Its recent stock price correction is worth paying attention to. If you have investment tendencies, you can choose the appropriate entry point and buy the stock according to your own situation.