- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Learning Investment from the Vice President - Analysis of Vice President Wang's Vice President Vance

Ohio Senator J.D. Vance was nominated as Trump’s 2024 running mate last week. As a US political figure, the deputy’s financial asset holdings also need to be made public. So how can we use public information to query the assets of US political figures?

- Office of Government Ethics (OGE https://www.oge.gov/ )

OGE provides financial disclosure reports for senior federal government officials. These reports detail their assets, liabilities, and income. You can search and view Kamala Harris’ financial disclosure reports on OGE’s website.

- OGE financial disclosure

- Congressional Financial Disclosure System ( https://disclosures-clerk.house.gov/ )

Members of the US Congress are required to disclose their financial status and holdings as required. Her financial disclosure report can be found at the following website:

- US House Financial Disclosure System

- US Senate Financial Disclosure System

- News and public databases

Some news organizations and public databases also organize and publish financial information of political figures. For example:

- OpenSecrets ( https://www.opensecrets.org ) provides a lot of information about the finances of political figures, but due to the limitations of its website, it is recommended to visit its website directly to search for financial information about Kamala Harris.

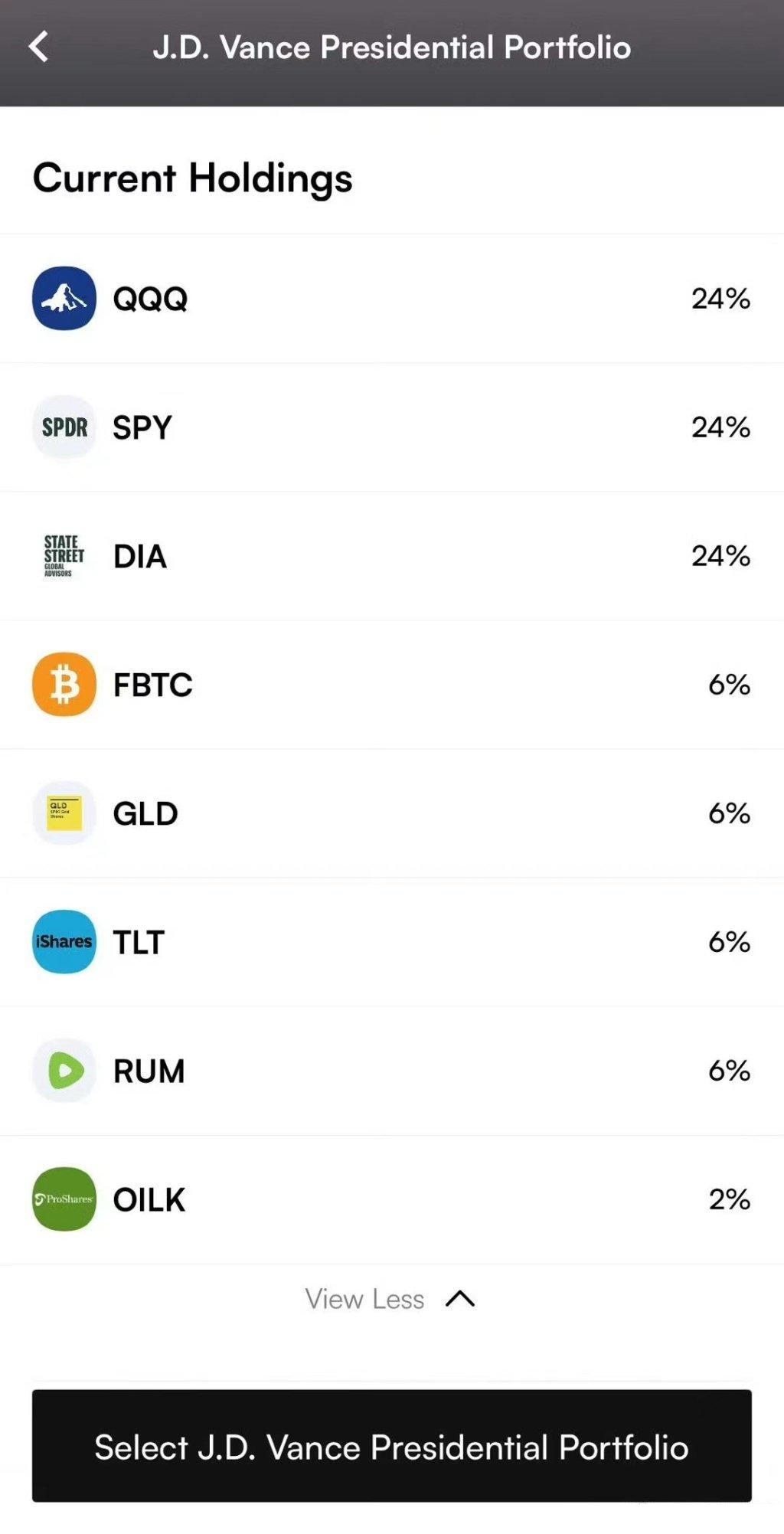

From the above data sources, we can query that J.D. Vance holds the following financial assets.

From the chart, it can be seen that Vance mainly invests in US stocks through ETFs. The top three holdings are all broad-based ETFs. From the perspective of holdings, the three major indices account for 72% of the positioning, firmly beating 99.9% of fund managers. These three ETFs have risen by 20.25%, 17.03%, and 6.74% respectively this year.

- NASDAQ ETF QQQ (24%)

- S & P ETF SPY (24%)

- Dow Jones ETF DIA (24%)

The so-called broad-based ETF is an exchange-traded fund (ETF) designed to track a wide range of market indices. These ETFs usually cover a large number of stocks or bonds in a country, region, or globally to reflect the overall market performance. The characteristics of broad-based ETFs are high diversification and relatively low risk, suitable for long-term investors and investors who want Risk Diversification, and very suitable for novice investors. In summary, the characteristics of broad-based ETFs are:

Diversification : Broad-based ETFs typically hold a large number of different stocks or bonds, thereby reducing the risk of individual companies or industries. For example, an ETF tracking the S & P 500 index would include stocks of 500 large US companies.

Low cost : Broad-based ETFs typically have lower management fees and transaction costs because they passively track market indices and do not require active management.

Strong liquidity : Due to their wide coverage and high popularity, broad-based ETFs typically have high liquidity, easy trading, and small bid-ask spreads.

High transparency : Broad-based ETFs typically disclose their holdings on a daily basis, giving investors a clear picture of their portfolios.

In addition, Vance also holds,

- Bitcoin ETF FBTC

-

Vance is consistent with Trump’s support for cryptocurrency. The presidential candidate will speak at the Bitcoin conference in Nashville, Tennessee from the 25th to the 27th of this month. Vance himself holds Bitcoin and held 250,000 US dollars in Bitcoin in 2022.

-

Bitcoin continues to be optimistic, and now it has firmly stood at the 60,000 mark. In addition, the Ethereum ETF will be officially listed in the US on July 23 this month. I don’t know if this wave can reach 4K. If it rises and falls back, you can continue to invest regularly.

-

- Gold ETF GLD

- Treasury ETF TLT

- Conservative video internet company Rumble (RUM)

- After Trump nominated J.D. Vance as his vice presidential candidate, Rumble’s stock price soared 28% and eventually closed up 20%

- Crude Oil ETF OILK

It can be seen that Vance’s holdings include stock ETFs (NASDAQ 100 Index accounts for 24%, S & P 500 Index accounts for 24%, Dow Jones Industrial Average accounts for 24%), digital currencies (Bitcoin 6%), and commodity ETFs. Gold ETFs (GLD) and crude oil ETFs (such as OILK) account for 6% and 2% of its investment portfolio, respectively. US long-term government bonds (TLT) account for 6%. Among them, RUM is a Cloud Computing Platform technology company, accounting for about 6%. The overall portfolio allocation is relatively balanced and diverse. The stock holdings account for more than 80%, and the commodity holdings account for nearly 10%. This reflects its overall stable allocation and preference for commodity allocation.

This allocation also reflects the emphasis on traditional safe-haven assets and energy markets. As a safe-haven asset, gold can provide protection during economic uncertainty and inflation. As a key indicator of economic activity, the price fluctuations of crude oil have a profound impact on the global economy.

Policy expectations and market impact after Trump takes office

J.D. Vance’s selection as Trump’s campaign deputy can reveal some key tendencies in Trump’s economic policy. Although J.D. Vance is mainly known for his book “The Countryman’s Elegy”, his stance on political economy and possible economic tendencies are also worth paying attention to.

- Focus on the working class and rural areas

J.D. Vance described the plight of working-class and rural communities in the Midwest and Appalachia regions of the US in “The Elegy of the Countryman”, emphasizing the economic challenges faced by these regions. Choosing Vance as his deputy indicates that Trump may continue to focus on economic issues in these regions and promote policies to support the development of working-class and rural communities.

- Protectionism and economic nationalism

Trump has implemented multiple protectionist policies during his presidency, including tariffs against China and other countries. J.D. Vance is also critical of the impact of globalization on US workers and businesses, supporting stronger trade protection measures. This indicates that the Trump administration may continue to implement protectionist policies to protect domestic industries and employment.

- Deregulation

The Trump administration has been committed to reducing regulation of businesses to promote economic growth. Choosing Vance as his deputy may mean that Trump will continue to promote policies to relax regulation, reduce the burden on businesses, stimulate investment and innovation.

- Support the energy industry

J.D. Vance is from Ohio, an important energy-producing state, especially in the shale gas and oil industries. Choosing Vance as his deputy indicates that Trump may continue to support the traditional energy industry and promote policies to promote the development and production of oil and gas.

- Tax reduction policy

Trump implemented a large-scale tax cut policy during his presidency, aiming to stimulate economic growth and increase employment. Vance’s role as deputy may mean that Trump will continue to push for tax cuts to further reduce the tax burden on businesses and individuals.

- Infrastructure investment

Although Vance did not explicitly express a strong stance on infrastructure investment, Trump has expressed support for large-scale infrastructure investment plans. Choosing Vance may mean that the Trump administration will continue to seek to promote economic growth and create job opportunities through infrastructure investment.

- Health and social services

Vance is very concerned about the opioid crisis and health issues. Choosing him as his deputy indicates that the Trump administration may take more action in the field of health and social services, especially in responding to the opioid crisis and improving medical services.

Some experts predict that Trump will win the US election. Against the backdrop of global economic turmoil and intensified market volatility, investors’ attention to the US stock market has unprecedentedly increased. As a barometer of global Financial Marekt, the trend of the US stock market not only affects the US economy, but also affects the asset allocation and wealth management strategies of global investors. At the same time, with the rapid development of digital financial technology, Interactive Brokers, Schwab Securities, and multi-asset wallet BiyaPay have gradually become ideal tools for investors to manage multiple assets, providing new solutions for dealing with complex and changing market environments, providing investors with a new way of asset management, and helping them achieve stable wealth appreciation in volatile markets.