- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Understanding the Differences Between Bank Code, SWIFT Code, and IBAN

When handling international or cross-border transfers, and even local transfers within Hong Kong, you may come across the need to enter the recipient’s Bank Code and SWIFT Code, among other codes. These terms can be confusing, so this article aims to clarify the distinctions between Bank Code, SWIFT Code, and IBAN.

一、Bank Code

What is a Bank Code?

In Hong Kong, the bank code, also known as the bank identifier code, clearing code, or classification code, is a unique three-digit identifier assigned by the Hong Kong Monetary Authority to all banks in the region. This code helps streamline the transfer process.

The bank code is crucial, much like an ID number, as it must be used along with the branch code and account number to ensure local transfers reach the correct account. An incorrect bank code can result in the funds being returned.

How Bank Codes Work

Each registered bank in Hong Kong has a unique three-digit code.

For example, HSBC’s code is 004, while Hang Seng Bank’s code is 024.

Where Bank Codes Are Used

Bank codes are exclusively for local transfers within Hong Kong.

二、SWIFT Code

What is a SWIFT Code?

A SWIFT Code, or Bank Identifier Code (BIC), is an international bank code established by the SWIFT organization and approved by ISO. Every member bank of SWIFT has a specific code used to send payment messages during wire transfers, directing funds to the recipient bank. This code functions as a global bank identifier. Each bank applying to join SWIFT must create a SWIFT address code, which becomes effective upon SWIFT’s approval.

Structure of a SWIFT Code

A SWIFT Code is typically 8 or 11 characters long and includes:

- Bank Code: Four letters representing the bank’s name.

- Country Code: Two letters as per ISO standards.

- Location Code: Two characters (letters or numbers) indicating the city.

- Branch Code: Three characters (letters or numbers) identifying the branch.

For example, the SWIFT code for the Bank of China’s Shanghai branch is BKCHCNBJ300, which stands for: BKCH (Bank Code), CN (Country Code), BJ (Location Code), 300 (Branch Code).

Global Usage

SWIFT codes are used widely in most countries and regions.

三、IBAN

What is IBAN?

IBAN, or International Bank Account Number, is a bank account identifier formulated by the European Committee for Banking Standards (ECBS). It is used by banks in ECBS member countries and applies only within Europe.

Structure of IBAN

An IBAN includes a country code + bank code + region + account number + check code, with a maximum length of 34 characters.

IBAN vs. SWIFT Code

Unlike the SWIFT Code, which identifies a specific bank, an IBAN identifies both the bank and the account holder’s account number. SWIFT Codes do not provide account number details.

Important Tips

- IBAN is used only in Europe, and failing to use an IBAN in the Eurozone may incur additional fees.

- Chinese banks do not have IBAN numbers.

How to Find and Verify Bank Codes, SWIFT Codes, and IBANs

You can:

- Ask bank staff directly

- Call for information

- Check the bank’s official website

- Look for your bank’s SWIFT/BIC code on bank statements

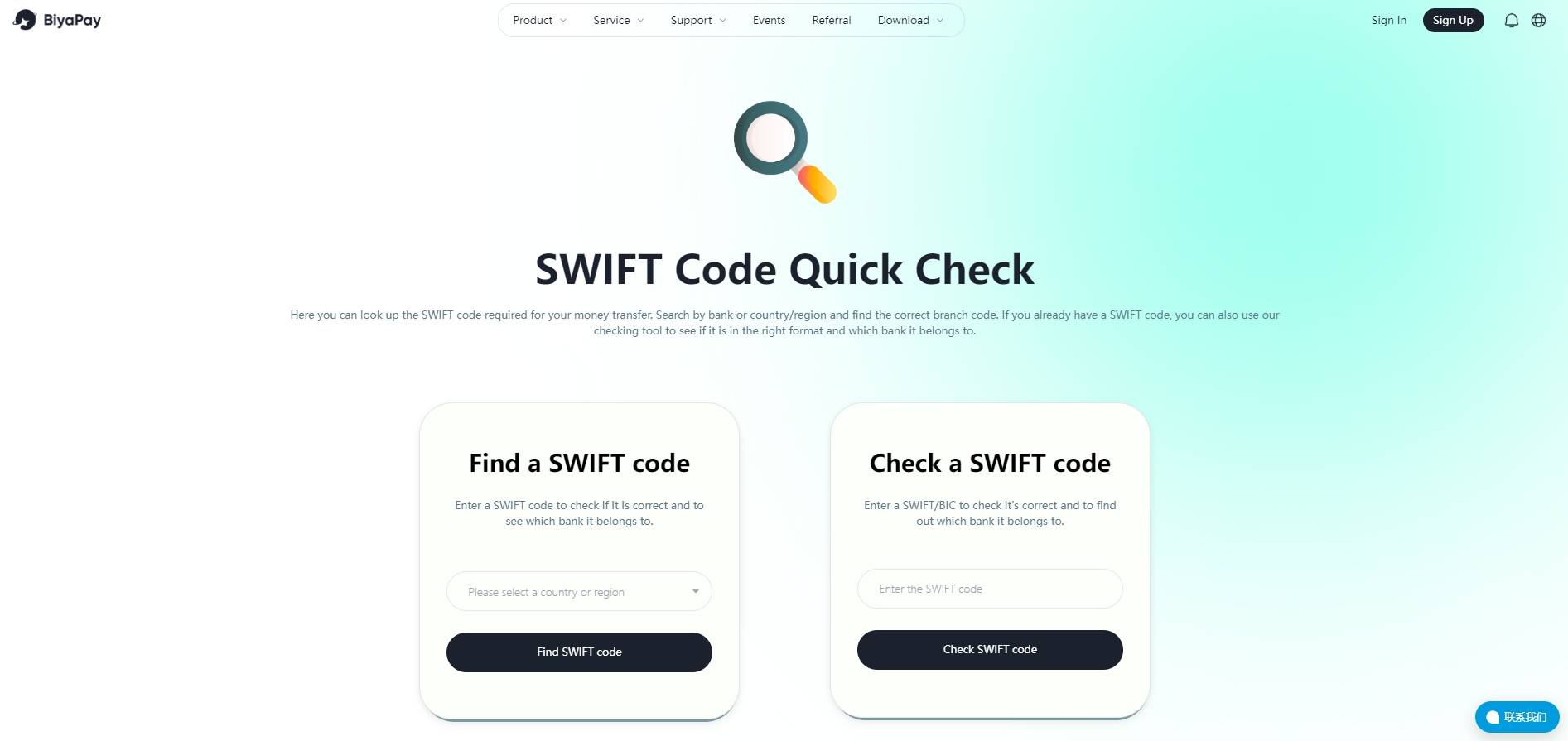

You can also search by bank or country/region on Wise and BiyaPay websites to find the correct SWIFT Code and bank code, or use their checker if you already have the international bank code.

Bank codes are for local transfers within Hong Kong. For international transfers, apart from needing the SWIFT code or IBAN, choosing the right remittance tool is crucial to simplify the process and ensure transaction security. BiyaPay offers a cost-effective and fast solution for international remittances.

BiyaPay is a global multi-asset trading wallet that includes global payments and international remittances, along with major investment services such as US stocks, Hong Kong stocks, options, and digital currencies. Its standout feature is the support for real-time exchange rates and conversions for over 20 fiat currencies and more than 200 digital currencies, enabling large transfers in most countries worldwide quickly and with low fees.

BiyaPay also boasts a user-friendly interface and streamlined operations, ensuring transaction security to protect user information and funds. It offers competitive exchange rates to reduce remittance costs, low handling fees with no hidden charges, and holds financial licenses in the USA, Canada, US SEC, and New Zealand, ensuring safe and legal currency exchanges and avoiding account freeze risks from off-exchange transactions. With comprehensive KYC certification and professional legal offshore accounts, every remittance is handled with care, providing users peace of mind. This enhances the efficiency and security of international transfers, facilitating smoother cross-border capital flows.