- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Why U.S. and Hong Kong stocks are reliable - throw order demo

Every U.S. and Hong Kong stock order on BiyaPay is thrown in real-time to the stock exchange.

For elements like market data, depth, bid-ask spread, and trading volume of U.S. and Hong Kong stocks, all brokers (such as Interactive Brokers, Tiger Brokers) are the same because buy and sell trades are matched through exchanges like the Hong Kong Stock Exchange or U.S. Securities Exchange. Your orders will be displayed on the bid-ask spread, and your executed orders will be shown in the transaction details, with no market makers involved. This is similar to C2C match trading and transactions on platforms like Taobao.

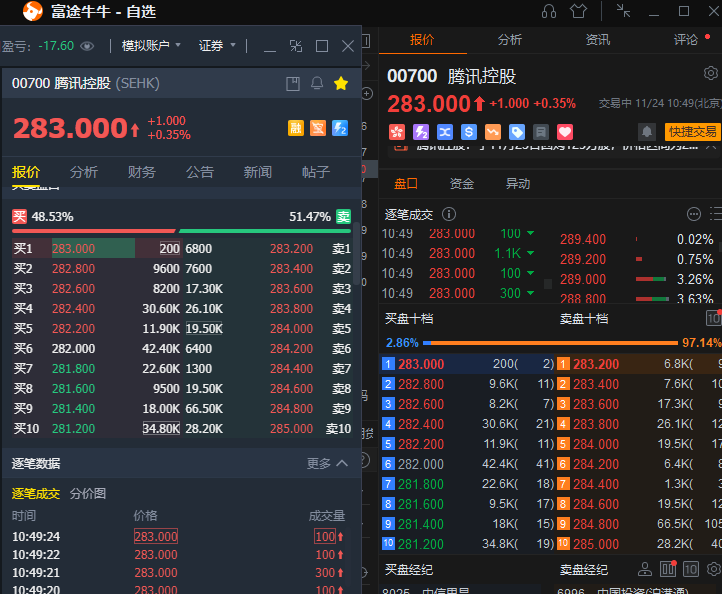

Taking Tiger Brokers and Futu Securities as examples, we search for Tencent stock, code 00700, on both platforms. We can see that despite being on two different platforms, the latest price, price change percentage, bid-ask depth, and tick-by-tick trading data are all the same.

Demonstration Begins

We’ll use this rule to test if BiyaPay can truly throw orders in real-time, one-to-one, to the stock exchange.

Preparation Work

First, register a BiyaPay account. Second, choose another familiar U.S. and Hong Kong stock platform. For this demonstration we’ll use Tiger Brokers. You can also choose others like Interactive Brokers or Futu Securities.

Step 1: Find a Suitable Stock

The first step in our operation is to find a stock with no trading volume or liquidity on Tiger Brokers.

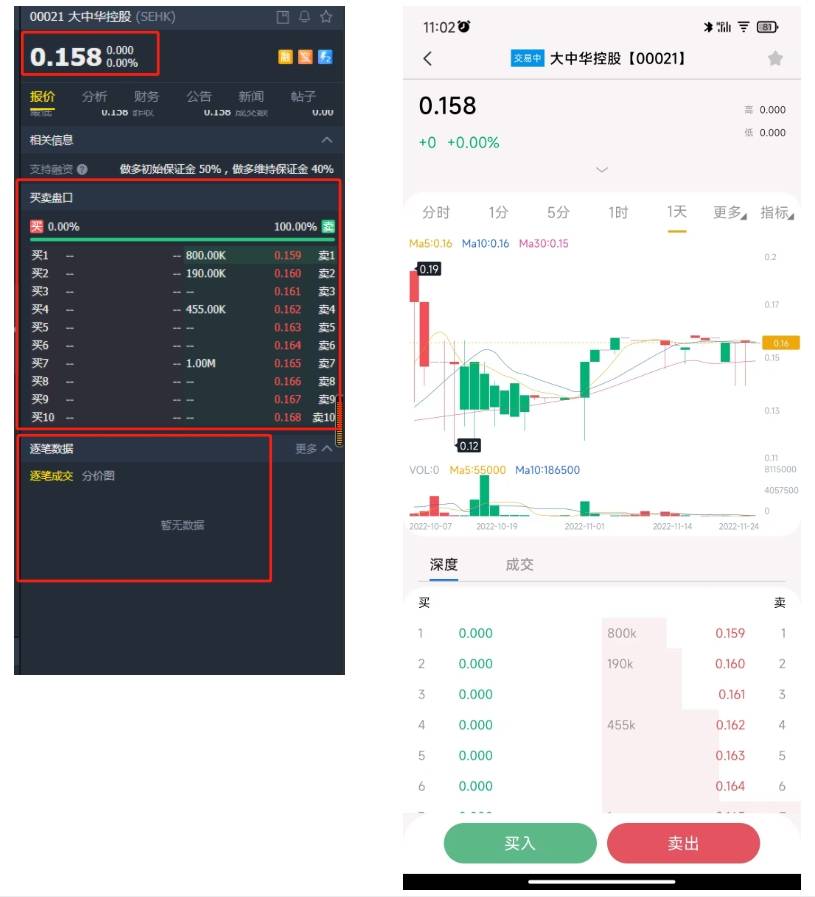

We go to the market section, select Hong Kong stocks, all stocks, and sort by trading volume in descending order. We find many stocks with no trading volume and select 00021.

We see that this stock currently has a 0% change in price, no buy depth, and no tick-by-tick trading data.

Now, we switch accounts and find this stock on the BiyaPay platform.

Comparing the two, we can see that the data on both Tiger Brokers and BiyaPay are the same.

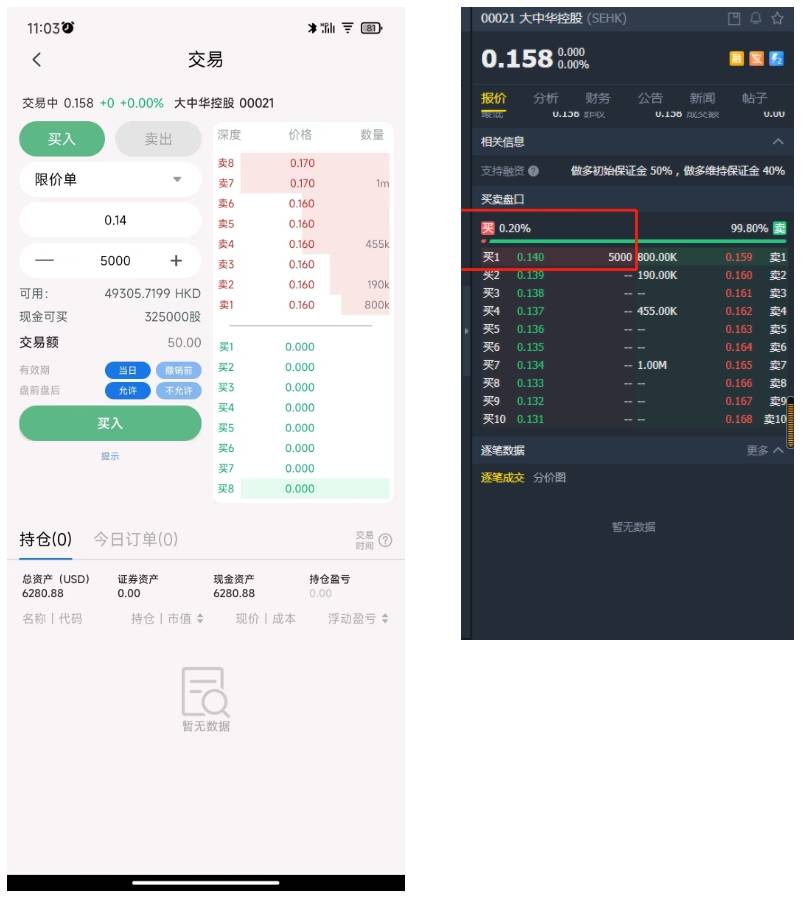

Step 2: Start Placing Orders to Test Synchronization

We place an order on BiyaPay with a limit price of 0.14 for 5000 shares. Switching to the Tiger platform, we can immediately see that the previously empty buy order now shows a Buy 1 order, with the order data exactly matching what was placed on BiyaPay. The time difference between the two platforms is only about 1 second, leaving no time for reaction.

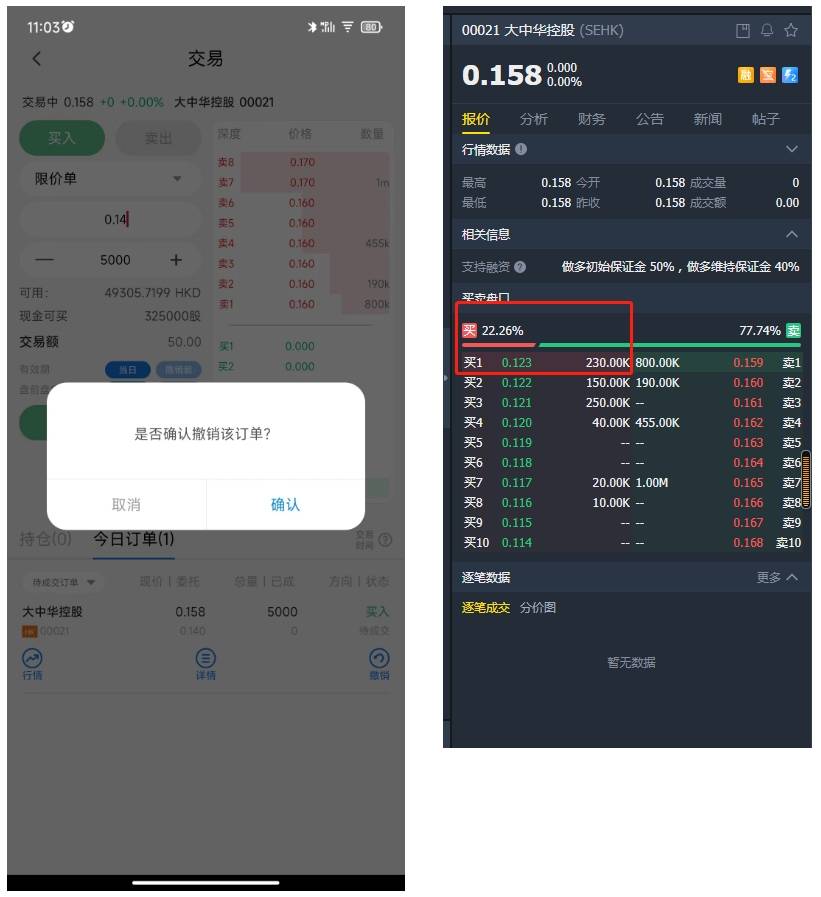

Step 3: Cancel the Order to See if It’s Truly Synchronized

We see that after canceling the order on BiyaPay, the Buy 1 price on the Tiger platform changes instantly from 0.14 to 0.123. This indicates that our order on BiyaPay indeed reached the exchange and the synchronization time is very short, essentially real-time order throwing.

Conclusion

After the demonstration, BiyaPay can indeed throw orders in real-time to the stock exchange, as personally tested and confirmed. The entire process can be experimented by yourself. You can choose any stock that meets the criteria for testing, but if you choose popular stocks like Apple or Tesla, it might be difficult to discern our order due to the large trading volume on the bid-ask spread. We chose a stock with no trading volume to more clearly verify this.