- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Western Union Remittance Guide: Limits, Processes, Fees, and More

Western Union, founded in 1851, is a leading international remittance company with the world’s largest and most advanced electronic fund transfer network. Western Union has agent locations in nearly 200 countries and regions worldwide. As of December 2023, Western Union has partnered with 81 agent banks in China, including the Postal Savings Bank of China and China Construction Bank, with over 27,000 service outlets nationwide.

Western Union’s operation of a large number of self-operated and cooperative physical outlets also brings considerable costs. It should be noted that Western Union profits from both exchange rates and fees. The exchange rate calculation does not follow a set pattern and can change without notice. However, Western Union is not the only option for international remittances. In recent years, several emerging international remittance platforms have appeared, such as BiyaPay. These platforms offer simple operation processes, lower fees, unlimited remittance amounts, and support full blockchain tracking of the remittance process, making it transparent.

Western Union Fees

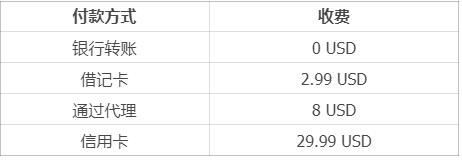

Western Union charges different transfer fees depending on factors such as the destination of the remittance, the amount sent, the payment method, and whether the transfer is made online or through an agent. The transfer fee is charged per transaction, and can be relatively high for small amounts, with cash pickups being more expensive than direct bank transfers.

When paying for a transfer, the cost is higher with debit or credit card payments, but these methods are faster than bank transfers. For example, the table below shows the fees for different payment methods when sending money from the United States to a bank account in China:

Western Union Transfer Time

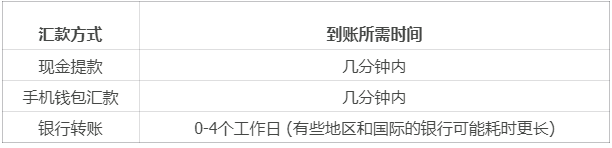

The time it takes for a transfer via Western Union can range from a few minutes to several days, depending on the following factors:

The method of payment—using a debit or credit card typically results in faster transfers compared to bank payments. However, the destination of the remittance also affects the time it takes for the funds to arrive.

Is Using Western Union Safe?

Western Union has been in the remittance business for over 160 years, establishing a reputation as a reliable international remittance service in over 200 countries.

Using Western Union for remittances can be done through local branches, online platforms, or mobile apps. You simply need to provide the recipient’s information, destination country, amount, and chosen payment method. You can track the transfer status online with a tracking number, and the recipient can easily collect the funds at a Western Union branch.

A unique feature of Western Union is that you can send funds to a bank account or have the recipient pick up the funds in cash. Although millions of people worldwide trust Western Union to transfer their funds safely and quickly, this does not mean there are no security risks. However, Western Union understands the responsibilities and risks associated with international remittances and strives to manage these risks as effectively as possible.

In most countries where Western Union is available, the service is regulated and protected by government agencies. These financial regulatory agencies closely monitor the company’s fund flows and business practices to protect customers’ funds.

The specific regulation of Western Union varies by country; for example, in the UK, the Financial Conduct Authority (FCA) regulates Western Union’s activities, while in Germany, the Federal Financial Supervisory Authority is responsible.

These agencies are just some of the regulatory bodies overseeing the company’s fund flows. In short, you usually do not need to worry about the safety of your remittance. However, there are some alternative options to Western Union that are also worth considering.

A Safer and More Convenient Solution - BiyaPay

BiyaPay is an international wallet that provides global users with multi-asset trading, including global payments and international remittances, as well as major investment services such as U.S. stocks, Hong Kong stocks, options, and digital currencies. Its most notable feature is the support for real-time exchange rate inquiries and conversions for over 20 fiat currencies and more than 200 digital currencies, allowing for large remittances anytime, anywhere in most countries or regions worldwide, with fast transfer speeds, low fees, and no limits on the amount.

BiyaPay’s global remittances are all completed online, supporting full-chain tracking, transparent remittance processes, and multiple compliance qualifications. It has obtained financial licenses from the United States, Canada, the U.S. SEC, and New Zealand, making your digital-to-fiat currency exchange safer and more legal, eliminating the risk of account freezes in off-exchange transactions. Additionally, it has comprehensive KYC certification and professional, legal offshore accounts, treating every remittance with care, ensuring users can remit every penny with peace of mind.

Moreover, if you frequently travel overseas or engage in overseas investments and need to exchange and transfer money across different currencies, you may often encounter various fund transfer issues, such as exchange limits, wire transfer limits, lack of Hong Kong cards/accounts or offshore accounts, difficulties in cross-border transfers, returning funds to your home country, slow brokerage fund transfers leading to missed opportunities or severe losses. To address these issues, you can use BiyaPay as a professional fund transfer tool.

Western Union Remittance Process

Western Union Online Remittance Process

Steps for Online Remittance:

- Log in to the Western Union official website

- Register a personal account

- Enter your detailed information and remittance details, including the recipient, destination, amount, and payment or collection method

- Review the remittance instructions and fees After completing these steps, you can track the progress of the remittance using the remittance number on the Western Union form.

Western Union Agent Location Remittance Process

- Visit a nearby Western Union agent location

- Present your ID or other identification and fill out the remittance form provided

- Pay the amount to be remitted along with the corresponding service fee to the Western Union agent

- After confirming that the information on the receipt is correct, you need to sign the receipt The receipt contains your Money Transfer Control Number (MTCN), which you can use to track the status of your remittance online.

Western Union Transfer Limits

The specific transfer limits for Western Union remittances vary depending on factors such as transaction history, recipient location, payment or collection method, agent, and country-specific receiving restrictions. For example, when sending money from the United States to China, the online transfer limit is $7,000, but the limit may vary if processed through an agent. Please refer to the sending agent for specific details. Additionally, note that Chinese citizens can receive no more than $50,000 per person per year from abroad.

Conclusion

The above content introduces the limits, remittance processes, and transfer times of Western Union, helping you better understand how to use Western Union for international remittances. By understanding this information, you can choose the most suitable remittance method according to your needs, ensuring that funds reach the recipient quickly and safely.