- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Apple Finally Joins The AI Era

Summary

- WWDC 2024 was amazing, as Apple finally made its long-overdue leap into AI by introducing Apple Intelligence.

- The new features are more user-friendly and also conducive to further enhancing Apple’s attractiveness.

- Combined with my DCF analysis, which indicates that Apple’s stock is accurately priced, I am assigning a “Hold” rating to the stock.

Introduction

There is a lot to say about Apple (NASDAQ: AAPL ) (NEOE: AAPL: CA ). Once the largest company in the world, it was initially successfully challenged by Microsoft ( MSFT ) and is now facing competition from Nvidia ( NVDA ) for second place.

While big tech companies have ventured into artificial intelligence to explore its potential applications, Apple has remained silent until now.

On June 10th, Apple held its annual Worldwide Developers Conference. During the event, the company finally met users’ long-standing expectations by launching Apple Intelligence and making significant improvements in User Experience.

The market’s response to this innovation was extremely positive, and Apple’s stock price rose significantly in the trading days after the launch event. Investors generally expect that Apple Intelligence will drive the company’s sales growth, thereby supporting its market performance and stock price in the long term.

In addition, my valuation model shows that the stock is priced accurately, and investors are worth holding the company’s stock. If you have a positive attitude towards Apple’s future and want to buy stocks, you can go to BiyaPay, search for the APPL stock code on the platform, and trade in real-time online. Of course, if you have problems with deposits and withdrawals, you can also use this platform as a professional tool for depositing and depositing US and Hong Kong stocks. Recharge digital currency to exchange for US dollars or Hong Kong dollars, withdraw to your bank account, and then deposit to other securities firms to buy this stock. Compared with other platforms, this has a faster arrival speed and no limit.

APPL Market Trend,Chart By BiyaPay App

I will start with a brief review of the business and discuss what has been going on in the past decade. We’ll talk about the WWDC Event right after.

Business Description

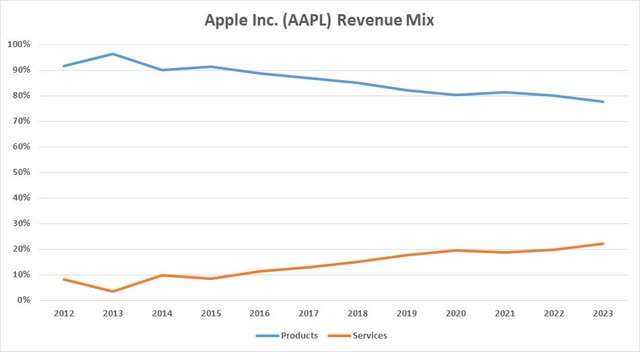

In fiscal year 2023, more than half of Apple’s total revenue came from iPhone sales. Around 26% of its earnings came from other products such as Mac, iPad, wearables, and home and accessories. The remaining 22% was services, including the Apple Store, Apple TV, and Apple Pay.

Interestingly, over time, Apple has been becoming more of a service company than a product-based company. While services accounted for less than 10% of revenue in 2012, they generated 22% of revenue in 2023.

Apple Inc. FY2023 10K

The gross margin of services provided is significantly higher than that of products. Thanks to this shift in revenue mix and pricing increases, the company managed to keep its earnings margin high.

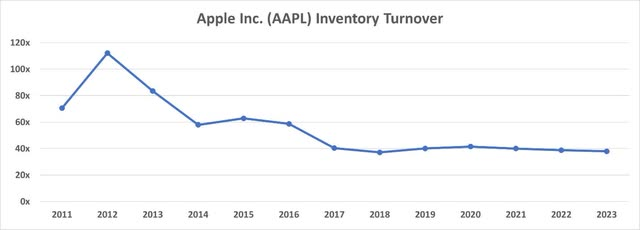

However, as Apple grew, it started producing more products than it could sell. That’s why both inventory turnover and adjusted return on assets show a sharp decline over the last decade.

S&P Capital IQ

S&P Capital IQ & Author

This is partly caused by increasing competition in smartphones and computers. When the first iPhone was introduced back in 2007, it completely changed the way we perceived phones. However, over the years, Apple has not been pioneering technology to the same significant degree.

The company seems to be aware of this, as evidenced by announcements at this year’s Worldwide Developers Conference. Now, it is Apple’s time to put pressure on its competitors.

Without further ado, let’s analyze the news everyone has been waiting for and its implications for the future of Apple.

WWDC Event Highlights

Apple has finally found something to do with its huge cash position and delivered everything its users wanted at this year’s Worldwide Developers Conference. That was among other things, artificial intelligence.

First of all, Apple did really show why it’s the best in user experience. The first half of the presentation was dedicated to IOS 18 and how it makes the lives of Apple customers easier. The iPad got a calculator app, there were design improvements, Apple Pay online and “Tap to Cash” were introduced, and there were improvements made to the connectivity of devices, such as using the iPhone on a Mac.

The big news came in the second part. That was not the AI everyone expected, but it was “Apple Intelligence”. The company seems to be taking big steps to be able to compete with other big technology companies. Let’s break down the three main developments from this announcement:

- Apple will provide personalized artificial intelligence solutions on the phone. Users’ data will not leave the device unless necessary and approved by the user. Thanks to its powerful M4 chip, the device will be able to process the data locally. This is incredibly important and presents a solution to one of the worries with Open AI’s ChatGPT. Apple users will not have to worry about their data being stored in a random data center on the other side of the world.

- Siri gets a big update and becomes the voice assistant everyone has wanted for years. Users can talk to or type to Siri about pretty much anything, and it will deliver. An example given was a user asking if they can make it to a lunch reservation after picking up their mom. Siri will be able to gather information from different applications, identify the reservation details, when mom needs to be picked up, and how long it will take to drive to the restaurant.

- Finally, Apple revealed a partnership with OpenAI. ChatGPT is integrated into the Apple ecosystem. Once Siri determines that ChatGPT might provide a better answer, it asks the user for permission to send the data to OpenAI. If approved, it will directly connect to ChatGPT. This announcement has been expected for a long time.

Overall, the event gave users everything they wanted from user experience improvements to artificial intelligence, or more accurately, Apple Intelligence.

2024 WWDC Event

Valuation

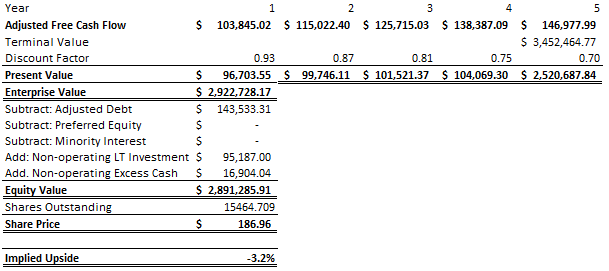

I will be using a Discounted Cash Flow model for valuation. I am basing my future earnings expectations based on revenue growth and earnings margin.

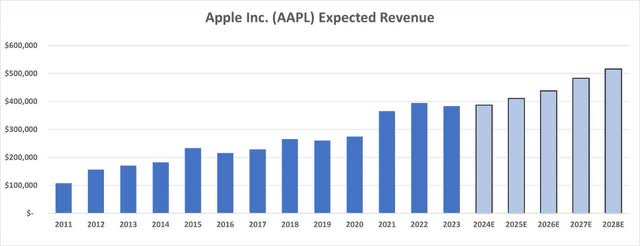

I do believe Apple can keep growing at a sustainable rate thanks to its loyal user base and pricing updates to battle inflation and increase margins. Below is a chart showing Apple’s revenue since 2011, with my estimates for the next 5 years. Based on the current macroeconomic outlook and analysts’ expectations, my 2024 estimate is only slightly higher than 2023.

S&P Capital IQ & Author

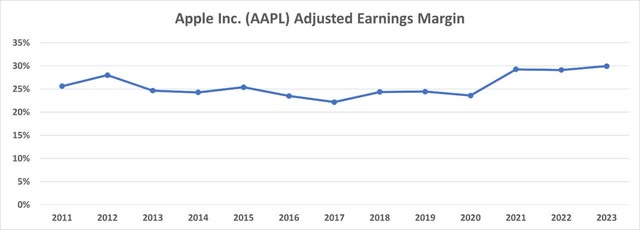

The second variable is earnings margin. Apple was able to sustain an adjusted earnings margin of around 25% for the last decade. 2021 was a great year both for the top and bottom lines. The adjusted earnings margin seems to be flat at 30%. I am positive that Apple will be able to sustain this level of adjusted earnings margin, at least for the next 5 years.

S&P Capital IQ

Adjusting earnings for CAPEX and other non-cash expenses and profits, I calculate the cash earnings.

I am using 3% as the terminal growth rate. This is slightly higher than the long-term inflation target of 2%, as I believe Apple can sustain its growth for longer. Using a long-term risk-free rate of 2%, a market risk premium of 5.7%, the stock’s 5-year equity beta of 1.25, and 4.5% as the cost of debt gives me a discount rate of around 7%.

I also may be using a different cash number in my equity value calculation. I calculate the excess cash, as I believe that’s what the investors have a claim on, not the operating cash that is going to be used next year for expenses like salaries.

Using these numbers, I find an equity value of $2.89 trillion, which means a target share price of $186.96 when I include the diluted common shares. This is a 3.2% downside over the current share price at the time of this article’s writing.

Conclusion

Overall, the launch of Apple Intelligence marks that Apple is actively innovating. It is not just a new product, but may also become a key factor driving technological development in the coming years, opening up new growth points for Apple and further enhancing its influence in the global market. This forward-looking strategic layout also further unleashes Apple’s attractiveness to investors, and the company’s stock price still has room to rise in the future.

In addition, my discounted cash flow analysis shows that Apple’s stock price is accurate, and the stock is worth holding. Interested investors can continue to pay attention to how the company uses new products to promote further development.