- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Exploring the Mystique and Limitless Potential of CrowdStrike (CRWD)

CrowdStrike’s Q1 earnings report this week demonstrates robust growth, with increased market share and higher customer spending, driving continuous cash flow growth. Over the next 12 months, we are likely to witness CrowdStrike’s market value surpassing $100 billion. It is projected that within the next 4-5 years, the market value will double.

We will understand why CrowdStrike can reach a market value of $100 billion in the future from the following three aspects.

The Path to $10 Billion Orders

1. Stable Growth in Endpoint Security

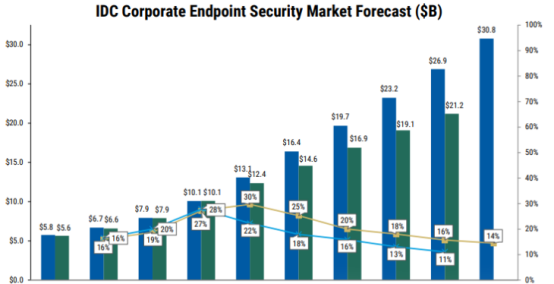

Currently, the overall endpoint security market size is $16 billion, with 70% of companies still using third-generation endpoint security solutions, while new-generation solutions account for only 30%.

This is significant for achieving stable growth in endpoint security profits in the future. As time progresses, more companies will transition to new-generation solutions, presenting a massive potential customer market.

The overall endpoint security market is expected to achieve double-digit high-speed growth annually, with the total market size surpassing $30 billion by 2028. The main driving factors include:

(1) Upgrading Endpoint Security Solutions

Older Solutions:

- AV (Antivirus): Primarily relies on signature databases to detect computer viruses, with antivirus capabilities entirely dependent on the update frequency of these databases.

- NGAV (Next Generation Antivirus): Offers more advanced features to compensate for the shortcomings of traditional antivirus software, such as more frequent signature updates and the introduction of machine learning and AI to identify malware.

- EPP (Endpoint Protection Platform): Provides protection not only for computers but also for a broad range of endpoints, including smartphones and tablets, against network threats.

New Generation Solutions:

- EDR (Endpoint Detection and Response): A cybersecurity solution focused on monitoring, detecting, and responding to potential threats and malicious activities on computer endpoints (such as desktops, laptops, servers, etc.). EDR systems collect and analyze endpoint data to identify abnormal behaviors, potential attacks, and exploitations.

- NGEP (Next Generation Endpoint Protection): A combination of EPP and EDR, referred to by Gartner as EPP with EDR. This new generation endpoint security protection platform integrates prevention, defense, detection, and response.

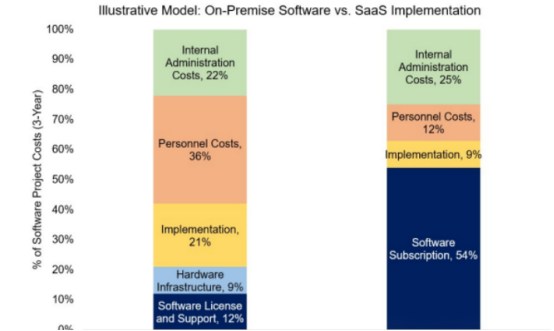

(2) The Shift from On-Premise Security to SaaS Delivery Significantly Boosts Average Selling Prices

The transition from traditional on-premise solutions to SaaS increases the average price by 2-3 times due to outsourced hosting costs and infrastructure spending to SaaS providers, as well as the incremental EDR functionalities driving higher average prices.

By adding additional security functional modules (Cloud Workloads, Identity, SIEM, VM) to existing antivirus solutions, customers can integrate various security functions into one platform, improving efficiency and reducing complexity. This can result in prices exceeding those of traditional antivirus solutions (AV) by more than five times.

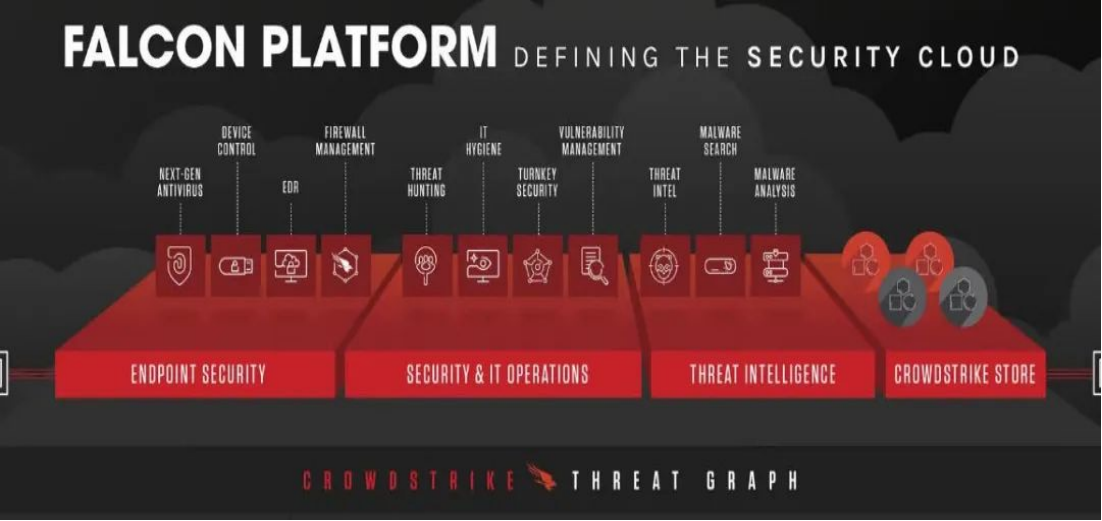

CrowdStrike’s Falcon EDR (Endpoint Detection and Response) solution has a strong competitive advantage in the endpoint security market. It has been rated as a market leader and took the top position from Microsoft in 2023.

At the same time, we predict that CrowdStrike will maintain its current market share, with annual order volume increasing at an annualized rate of 12%. By 2029, the total endpoint security order volume is expected to reach $4.5 billion (up from $2.1 billion in 2023).

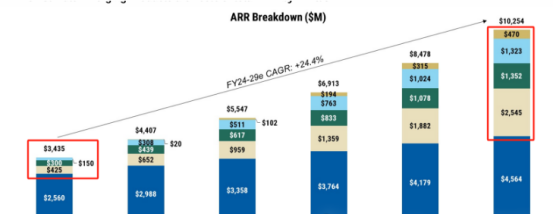

2. Explosive Growth in Other Business Areas

The dual increase in market size and brand penetration drives the revenue growth of emerging cybersecurity solutions (mainly including Falcon Cloud Security, Falcon Identity Protection, Falcon LogScale, and Charlotte AI). By 2024, the annual order volume is expected to reach $875 million, with a future annual growth rate exceeding 125%, reaching $56.9 billion by 2029.

Valuation Section

Based on current operations, CrowdStrike’s gross retention rate (GRR) and net retention rate (NRR) are as high as 98% and 120%, respectively, placing them at top levels. This means that CrowdStrike’s customer base is not only stable but also increasing in value.

The calculation of the gross retention rate considers the difference between the MRR (Monthly Recurring Revenue) at the end of the period and the start of the period, deducting only the revenue losses due to customer churn and not accounting for revenue changes from customer upgrades or downgrades. Additionally, a high gross retention rate indicates that the company has successfully retained most customers and possibly gained some new revenue.

From the perspective of operational efficiency:

(1)Economies of Scale from Personnel Growth

“We expect a certain level of operational leverage after a 40-50% increase in personnel over the next two years.”

As the number of employees increases, the productivity of each employee will improve, reducing the proportion of fixed costs in total revenue and enhancing the company’s operational efficiency.

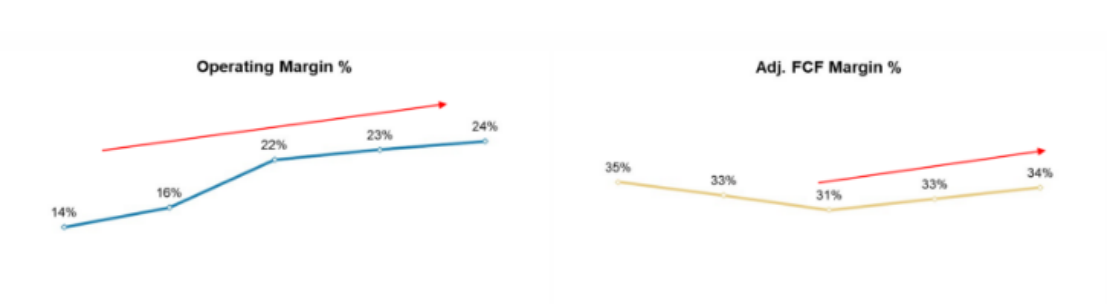

(2)Stable Improvement in Operating Rate

The company plans to enhance operating profit margins by reducing hosting costs, increasing product or service upselling, and leveraging AI technology to improve customer support efficiency.

It is expected that the profit margin will increase from 27.6% to 34% over the next two years.

(3)Operating Profit Margin Drives Free Cash Flow Growth

Stable growth in operating profit margin should maintain a free cash flow (FCF) profit margin above 30%.

Based on the company’s continuous improvement and growth in cash flow, we use EV/FCF/Growth for valuation.

The EV/FCF/Growth multiples for large SaaS companies and leading cybersecurity companies are around 1.5 times. Based on our previous estimates of CrowdStrike’s annual order volume and cash flow profit margin (FCF margin), we deduce an estimated market value of approximately $100 billion. Given the current number of shares, the fair value per share is estimated to be around $422.

Summary

In summary, CrowdStrike (CRWD), with its innovation and leadership in the cybersecurity field, combined with solid financial performance and broad market prospects, demonstrates strong growth potential and limitless possibilities, poised to become a trillion-dollar company.

The editor suggests that interested investors closely follow the company and make investment decisions considering their personal investment goals and risk tolerance. You can trade U.S. and Hong Kong stocks through traditional brokers or opt for new multi-asset trading brokers like BiyaPay for investment transactions. The biggest advantage of BiyaPay is that you don’t need an overseas bank account; you can trade U.S. and Hong Kong stocks in real-time by simply topping up digital currencies (such as USDT). If you already have other brokerage accounts, this platform also supports exchanging digital currencies for USD or HKD and withdrawing to your overseas bank account, and then depositing to other brokers. It’s fast, without limits, and can solve the problem of fund deposits and withdrawals in one go.