- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

A Guide to U.S. Treasury Bonds Investment for Beginners: Annual Yields Over 5%

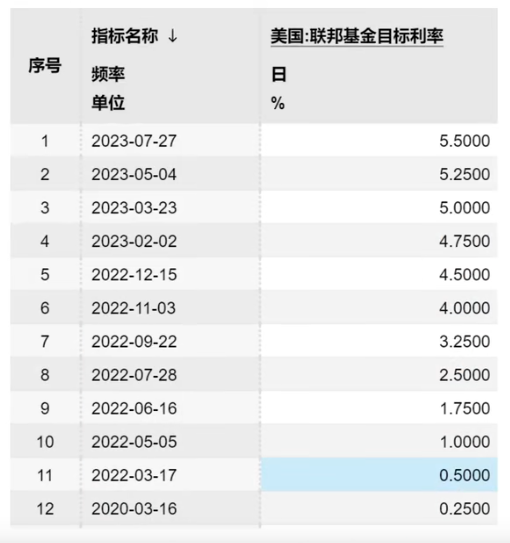

Since March 2020, the United States has raised interest rates 11 times, increasing the federal funds rate from 0.25% to 5.5%. With limited room for further rate hikes, the market expects a rate cut before the end of 2024. Against this backdrop, U.S. Treasury bonds have garnered significant attention from investors. So, what is the correct approach for mainland investors to invest in U.S. Treasury bonds?

Classification of U.S. Treasury Bonds

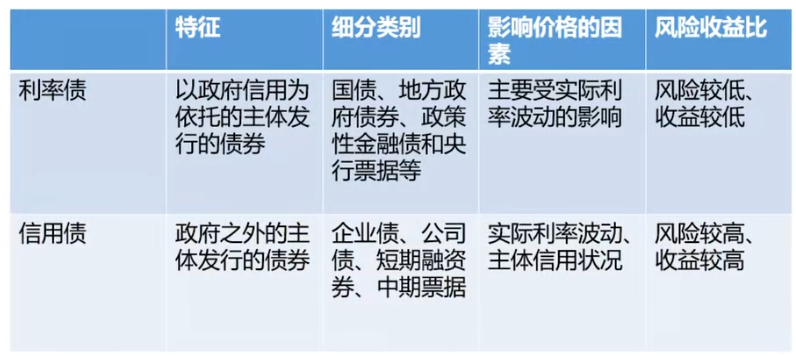

The term “U.S. Treasury bonds” is broad and, like domestic bonds, includes both credit bonds and interest rate bonds. Interest rate bonds are those without credit risk, meaning they are very safe and guaranteed to pay principal and interest. Their market performance is only affected by interest rates, hence the name “interest rate bonds.” Typical examples of interest rate bonds are Treasury bonds and local government bonds.

On the other hand, credit bonds carry credit risk, meaning there is a possibility of default on principal and interest payments. A typical example of a credit bond is corporate bonds. Due to the potential risk of corporate default, the yields on credit bonds are generally higher than those on interest rate bonds. Overall, because the quality of credit bond issuers varies greatly, they are more suitable for high-risk-tolerant and highly professional investors. Therefore, we will focus on interest rate bonds, which are more suitable for most investors.

How to Invest in Interest Rate Bonds?

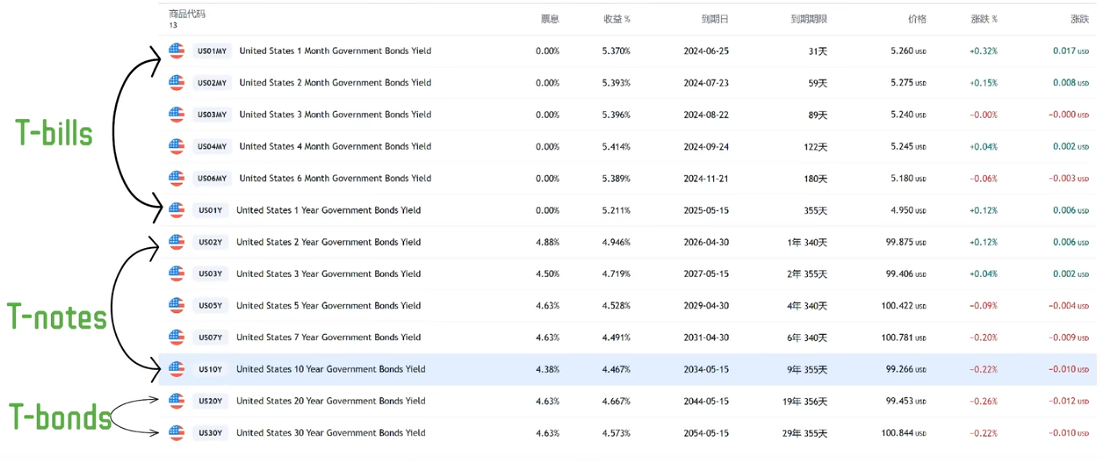

Using U.S. Treasury bonds as an example, they can be categorized into three types based on their maturities. Those with maturities of one year or less are called short-term Treasury bonds, or Treasury Bills (T-Bills). Those with maturities greater than one year but not exceeding ten years are called medium-term Treasury bonds, or Treasury Notes (T-Notes). Finally, those with maturities exceeding ten years are called long-term Treasury bonds, or Treasury Bonds (T-Bonds).

Let’s start with short-term Treasury bonds, T-Bills. T-Bills can have maturities as short as one month and up to one year. As of now, the annualized yield on T-Bills exceeds 5%, with one-month T-Bills offering an annualized yield of 5.37%, which is quite attractive. After all, the annualized yield of the S&P 500 is around 8%, and it comes with significantly higher risks.

After discussing the advantages of T-Bills, let’s talk about their drawbacks. One major disadvantage is the reinvestment risk associated with T-Bills. For example, if you invest in one-month T-Bills today, you will receive your funds back in a month. If you then wish to reinvest in T-Bills but find that the Federal Reserve has lowered interest rates, the yield on your new T-Bills will also be lower. This is known as reinvestment risk.

It is recommended to use ETFs to invest in T-Bills, such as through the TPU ETF, because buying individual bonds requires a high capital threshold and reinvestment at maturity, which can be cumbersome. ETFs are more convenient, requiring only a small management fee. A relevant ETF is SGOV, which has a one-year yield of 5.43% and a management fee of 0.07%.

Next, let’s talk about medium- and long-term Treasury bonds, T-Notes and T-Bonds. If you invest in T-Bonds, then the more the Federal Reserve raises interest rates, the better for you because your yield will also increase. In other words, T-Bills, due to their shorter terms, do not have significant interest rate risk. However, this is not the case for medium- and long-term Treasury bonds, as they are more sensitive to interest rate changes.

What’s the logic behind this? Let’s explain further. Suppose the U.S. government issues a 10-year Treasury bond with a face value of $100 and a coupon rate of 5%, meaning it pays $5 in interest at the end of each year and returns the principal at the end of the 10th year. This bond provides the following cash flow to investors. If the market interest rate is currently 6%, then this bond, which only pays 5% interest annually, is not worth buying at its face value of $100. You would value this bond at the current market rate of 6%, discounting the bond’s cash flow to a present value of $92.64. If the market interest rate then drops from 6% to 4%, this bond with a 5% coupon rate becomes highly attractive and valuable.

Using the same calculation method, the bond’s value would rise to $108.11, an increase of $15.47 or 16.7%, even higher than its face value by $8. Therefore, changes in interest rates directly affect the price of the bonds you hold: the lower the interest rate, the higher the bond price, and vice versa. This is known as interest rate risk. Additionally, you’ll find that the longer the bond’s term, the higher the interest rate risk, meaning the longer the bond’s term, the greater the price fluctuation caused by the same interest rate change. For example, during the interest rate hike cycle in the U.S. starting in March 2020, where the federal funds rate was rapidly increased from 0.25% to 5.5%, ETFs of bonds with maturities over 10 years were cut in half, a drop comparable to that of stocks. Therefore, for medium- and long-term U.S. Treasury bonds, unless you hold them to maturity, the risk is not low. Even if you do hold them to maturity, you need to endure significant price volatility during the holding period, especially during an interest rate hike cycle. Fortunately, the Fed’s rate hikes are almost at their end, and the market is beginning to expect rate cuts. From this perspective, whether you adopt a strategy of holding to maturity to earn interest or wait for the rate cut cycle to profit from price differences, medium- and long-term U.S. Treasury bonds are indeed worth paying attention to now.

So, how should you invest in medium- and long-term U.S. Treasury bonds? Similar to short-term bonds, although some brokers allow the purchase of medium- and long-term U.S. Treasury bonds, I do not recommend this approach. The convenience and complexity of purchasing these bonds can be very unfriendly, especially in terms of liquidity, and you could easily make mistakes. In contrast, buying U.S. Treasury bond ETFs is a much better option.

If you have an account for trading Hong Kong and U.S. stocks, you can search for and purchase bonds using their codes, just like buying stocks. It’s very convenient. If you don’t have an account yet, you can open one in Hong Kong and fund it through Interactive Brokers or Charles Schwab to start investing. If opening a Hong Kong bank account is inconvenient, you can use the new trading platform BiyaPay for direct trading of U.S. and Hong Kong stocks, or use it as a funding tool for your Charles Schwab account.