- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Ultimate Solution—USDT to USD Conversion Tool, Helping You Cash Out from the Crypto World without Fr

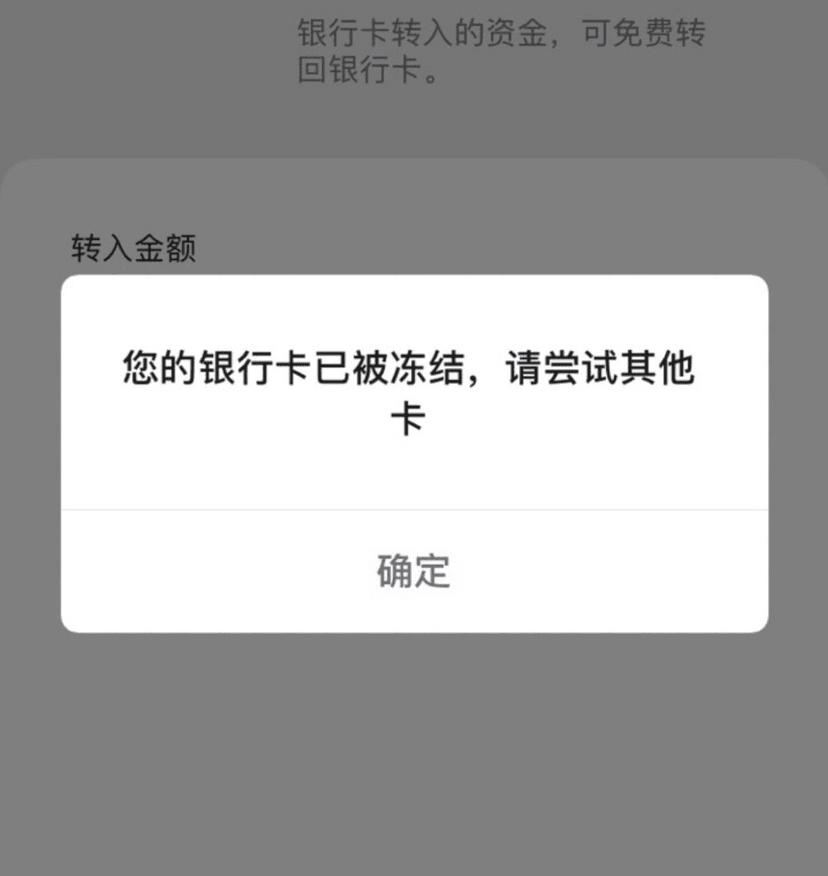

In the wave of cryptocurrency trading, the safe flow of funds has become a focal point for investors. However, frequent occurrences of bank card freezing events have brought considerable trouble to investors. Imagine you meticulously operate in the cryptocurrency market and earn a large profit, but when you try to cash out, you encounter the embarrassment of having your bank card frozen three times out of four transactions; even when switching to Alipay, the system determines the transaction as abnormal and freezes your account. Amid Bitcoin’s record-high prices, investors cannot convert their profits into real wealth due to bank card freezes.

This article will delve into how to solve this tricky problem by using the B2C model and converting USDT to USD.

The Emergence of the Need for Non-Frozen Card Cash Outs in the Crypto World

Investors who frequently invest in cryptocurrencies have more or less encountered the situation of frozen cards when cashing out. This is because cryptocurrencies are not yet explicitly recognized by authorities, and with increasing regulation of cryptocurrencies by relevant institutions, some unclear arrival records will attract the attention of banks. To ensure the safety of users’ assets, banks will immediately freeze the bank card, but this does not happen every time, although the probability is relatively high. Some novice investors may encounter frozen cards on their first cash-out attempt.

How does unclear funding come about?

If the buying price in the C2C trading market is lower than the selling price.

Theoretically, you can buy 1000 USDT at a price of 7.34 and then sell 1000 USDT at a price of 7.38, making a net profit of 0.04*1000=40 USD=280 RMB. You can keep arbitraging this way.

But the market is not foolish, and the arbitrage has long been smoothed out.

The reason for this is that merchants using fiat currency to buy USDT (i.e., offering 7.38) have unclear funds, so they are willing to buy USDT at a cost higher than the market price to dispose of their unclear funds, and you become an accomplice in laundering the unclear funds.

In 2018 and before, the C2C market was relatively normal. Later, various unclear funds from telecom fraud and other sources started flowing through the C2C market in the crypto world. Law enforcement tracking unclear funds is now stricter on this area, and cards through which unclear funds flow will be frozen for investigation.

Characteristics of unclear funds

Very much like an infectious disease. Highly contagious and latent, not visible on the surface. Hence, it has two characteristics:

- As long as this card receives unclear funds, it will be infected and may be frozen. Any transfer from this card to any other card will also infect the new card.

- Before freezing, you do not know which card or money is problematic; only when it is frozen do you find out, so it is somewhat unpredictable.

So how to prevent the problem of frozen cards when cashing out?

What are the current ways to cash out in the market?

- C2C cash-out

Choose the C2C mode of platforms like Binance, OKX, etc., and trade cryptocurrencies with merchants through the platform. Security depends on the merchant’s reputation, transaction volume, security awareness, etc.

- Offline cash-out

Find a long-term offline partner to trade cryptocurrencies face-to-face. Security depends on mutual trust and the other party’s moral standards. If it is a familiar person, the safety is relatively high, but if it is a stranger with bad intentions, not only your property might be at risk, but even your personal safety might be jeopardized.

- Online private organizations’ communities

Some people establish related communities in WeChat groups or Telegram groups to trade cryptocurrencies and fiat currencies. The security is very poor, with the risk of absconding anytime, and you cannot find the person, easily scammed, and cannot guarantee the funds’ cleanliness.

All the above belong to C2C, which is a person-to-person transaction mode, and the security is hard to guarantee.

Introducing a new method to cash out without freezing cards and the advantages of this method:

Using USDT directly for cash-out has a high probability of encountering unclear funds. The truly safe way to cash out is B2C, which is platform-to-person. For example, you can deposit USDT into a remittance platform and then exchange it for USD on the platform, finally converting USD into fiat currency.

The platform’s advantages are:

- The platform has a remittance license and is regulated by financial institutions in multiple countries.

- The platform monitors the source and destination of funds, ensuring that received and remitted funds are absolutely clean and safe.

- The platform has long-term operations with good reputation and brand trust.

Due to some drawbacks of C2C cash-out and some advantages of the B2C model, it can be judged that with the industry’s growing maturity, B2C will definitely become the mainstream method for cashing out in the crypto world.

BiyaPay is such a platform that can perform B2C cash-outs and is a magic tool for converting USDT to USD for cashing out. Founded in 2019, BiyaPay is a global multi-asset trading wallet headquartered in Singapore, with subsidiaries and expanded business coverage in the US, Canada, Hong Kong, Singapore, and other places. It has 509,000 registered users covering countries and regions around the world. Additionally, it has obtained related licenses from the US, Canada, and New Zealand, with high security.

So how to use BiyaPay for zero-frozen card cash-outs?

- Register with BiyaPay and complete real-name authentication.

- Get an overseas bank account.

Here are a few recommended banks: East West Bank, OCBC, DBS, Standard Chartered, ZA Bank, etc.

- Bind your overseas bank account to BiyaPay.

- Deposit cryptocurrency into BiyaPay, convert it to fiat currency, and withdraw it to your overseas bank account.

- Keep your funds overseas, and if needed, you can settle the exchange through Alipay or Wise.

From now on, completely solve the problem of frozen cards when cashing out.