- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Google's AI dominance is solid, the stock price is rising but still worth it! Investors should not m

The stock market has spent the last year predicting the demise of Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL), aka Google, due to the generative AI threat from OpenAI. Google has long been a leading investor in AI technologies and despite the company fumbling some initial AI releases, the company appears back on track after the I/O developer conference. My investment thesis remains Bullish on the stock, though the recent rally above $175 doesn’t offer the deep discount anymore.

GOOG Market Trend, Chart BiyaPay App

Generative AI Search

The biggest fear for Google is generative AI technology from OpenAI and Microsoft (MSFT) supplanting their leadership position in Search. Search is by far the largest revenue and profit driver for Google and users obtaining answers from ChatGPT or CoPilot could quickly replace valuable searches on Google.

The company has turned Gemini into a Search Generative Experience to make the current search experience more natural, personal, and impactful. The hope is that the Google Search user base continues using Google and starts incorporating generative AI tools into existing searches, eliminating the need to utilize ChatGPT.

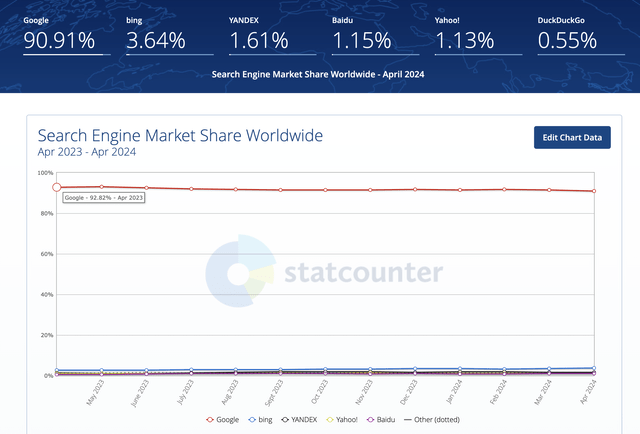

Google maintains a nearly 91% market share in global Search in April 2024, though the amount is down from nearly 93% from a year ago. Bing has reached nearly 4% of the global market with the U.S. version now claiming 8% market share.

Google generates nearly $200 billion in annual sales from the advertising business attached to Search. Data continues to show the search tool controlling over 90% of the global market, though the data isn’t clear whether it fully incorporates the market share for all searches, such as those done on OpenAI chat tools.

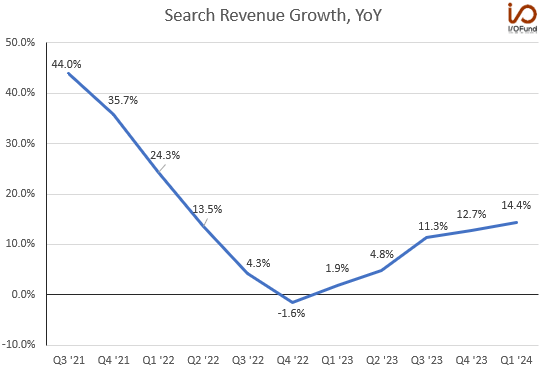

The good sign that AI is either boosting revenue, or at least not impacting the business, is that both the Search and Cloud segments are reporting accelerating growth with strong Q1’24 numbers as follows:

- Google search - $46.16B, up 14.4%

- YouTube ads - $8.09B, up 20.9%

- Google Network - $7.41B, down 1.1%

- Google subscriptions, platforms and devices - $8.74B, up 17.9%

- Google Cloud - $9.57B, up 28.4%

- Other Bets - $495M, up 71.9%

Another way of checking on the Search market impact is to view the revenue growth rates from this segment. In Q1, sales growth accelerated to 14.4% after bottoming out in Q4’22 with a slight sales decline.

Oddly, OpenAI launched ChatGPT in November 2022. The data possibly suggests the AI excitement led to growing demand for Search and Google participated as a byproduct and has now grown further due to the incorporation of generative AI tools into Search with the latest addition of Gemini to help further spurn growth.

Of course, the 2022 numbers had tough comps with the company reporting massive growth during the Covid boosts of 2021 through early 2022. As highlighted above, Q4’22 faced the tough comp of 35.7% growth back in Q4’21 on top of strong growth in Q4’20 not included in the chart.

Also, the company announced AI Agent and other AI tools. These AI products are expected to continue driving growth for Search and Cloud products with BoA analyst Justin Post maintaining a $200 price target on Google based on the successful I/O.

Gemini Advanced is now available for $19.99/month. The advanced version features new and exclusive features along with the ability to upload documents and PDFs for summaries and answers.

ChatGPT apparently has millions of subscribers to the generative AI subscription service at $20 per month. The AI company reported revenues topping a $2 billion annual run rate with plans to double the amount by 2025.

Gemini Advanced probably won’t catch up to OpenAI, but the key is making sure Google Search remains the dominant player.

Still Cheap

The stock has surged to $175, so Google isn’t the same bargain as in the past, especially in the last 2022 dip below $100. The tech giant is back into solid growth mode with analysts forecasting several years of 10%+ growth.

The consensus estimates now have Google earning $8.56 in 2025 for nearly 14% growth next year. The stock only trades at 20x these GAAP numbers but excluding massive stock-based compensation makes Google far more appealing. If investors are optimistic about this company and want to enter the market, they may want to use traditional securities such as Interactive Brokers, Schwab, and Tiger, or use the new multi-asset trading wallet BiyaPay to regularly monitor stock prices and buy or sell stocks at the appropriate time. Among them, BiyaPay can not only recharge USDT to trade US and Hong Kong stocks, but also support recharging USDT to withdraw US dollars and Hong Kong dollars to bank accounts, and then withdraw fiat currency to other securities for investment. This method can be said to be fast, unlimited, without any deposit and withdrawal troubles, and can also monitor the stock market trends at any time, which is very suitable for investors to invest in Google.

For 2023, Google spent $22.5 billion on SBC and the company remained relatively flat in Q1 at $5.3 billion. At the end of March, the employee count was down nearly 10K YoY to 181K suggesting SBC should remain at a similar level in 2024.

At a 15% tax rate and with ~12.5 billion shares outstanding, the EPS impact is ~$1.53 per share. Based on the 2025 EPS target, Google is set to earn a non-GAAP EPS of $10.09. The stock trades at about 17x these EPS estimates.

Google is already the cheapest of the large tech stocks trading at only 20x forward GAAP EPS estimates. The stock is far cheaper than the other AI play with Microsoft trading at nearly 32x forward EPS targets. Both Meta Platforms (META) and Apple (AAPL) are increasing opportunities in AI and trade at slightly higher forward PE ratios, with Apple having nowhere near the current growth opportunities of Google.

As highlighted above, Google is even cheaper than the group at only 17x the adjusted EPS targets, and the company has a net cash balance of $95 billion.

Summary

The key investor takeaway is that Google remains cheap, even at all-time highs. The tech giant is no longer the major bargain of the last several years, but the company is successfully navigating through the AI minefield to come out a winner despite initial missteps.

Google remains the best way to play generative AI due to the technology released at the I/O conference and the cheap valuation of the stock. The company should benefit on multiple fronts, with boosted Search demand from AI and Google Cloud seeing further upside demand to build on a business already heading towards $10 billion in quarterly revenues. Investors should use the current price to own Google and definitely load up on any weakness.

Finally, a reminder that all investments carry risks, so investors should consider carefully and hopefully everyone will see favorable investment returns!

Source: Seeking Alpha

Editor: BiyaPay Finance