- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

After Alibaba's financial report was released, the stock price fell but still improved. What is the

Summary

- Alibaba beat top-line estimates and showed positive results in its domestic e-Commerce business for the March quarter.

- The e-Commerce company generated a significant amount of free cash flow again, which is undervalued by the market and supports a higher valuation for Alibaba’s shares.

- Despite concerns about investments, Alibaba’s focus on returning cash flow to shareholders makes it an attractive investment option.

Shares of Alibaba (NYSE:BABA)(OTCPK:BABAF) slumped yet again after the e-Commerce company submitted its earnings sheet for the March quarter that unfortunately showed a 96% decline in profitability. However, Alibaba beat on the top line and saw encouraging results from its e-Commerce business.

Given the considerable free cash flow generated by its e-commerce business, the editor believes that Alibaba’s stock should have a higher valuation multiple, especially now that the company has announced a special dividend of $0.66 per share. Considering that the stock price has fallen after the financial report was released, the editor believes that investors face another opportunity to participate! If investors have investment intentions, they can choose a more credible securities firm for investment. For example, Jiaxin Wealth Management is a globally renowned investment securities firm. By opening an account with Jiaxin Wealth Management, they can get a bank account with the same name. They can deposit digital currency (USDT) into the multi-asset wallet BiyaPay, and then withdraw fiat currency to Jiaxin Securities for investment. Of course, investors can also search for the BABA stock code on the platform first, monitor the stock price regularly according to their investment strategy, and choose the appropriate time to buy stocks.

BABA Market Trend, Chart BiyaPay App

Alibaba beat top line estimates

E-commerce company Alibaba surpassed Wall Street’s average forecast in terms of total revenue, but its adjusted earnings were significantly lower than expected due to a significant drop in annual earnings reported by the company (which is related to changes in the valuation of equity stake investments). Alibaba announced adjusted earnings per share of $1.40, which was lower than the market consensus of $0.02. The reported revenue was $30.73 billion, which was $310 million higher than expected.

Alibaba’s e-Commerce business is on an upswing

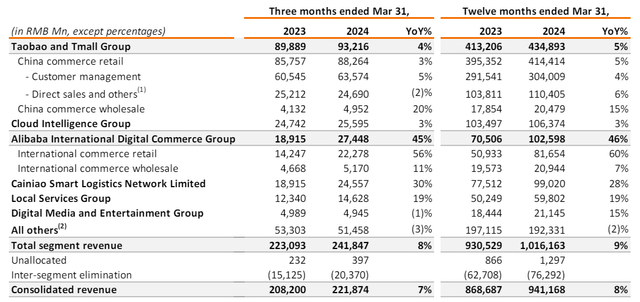

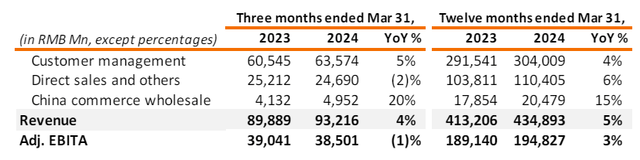

Compared to the previous quarter, Alibaba’s top line growth in its e-Commerce division (Taobao and Tmall Group) doubled from 2% to 4% . The segment reported total revenues of $12.9 billion with growth driven by online search results and purchase recommendations.

Alibaba’s total revenue for the quarter was $30.70 billion, an increase of 7% year-on-year. Compared to the previous quarter, Alibaba’s revenue growth accelerated by 2 percentage points.

In the short term, the editor expects Alibaba to maintain this momentum in its largest and most important revenue source department (Taobao and Tmall Group account for 39% of all revenue), with Alibaba Quarter 1 economic growth of 5.3%, exceeding market expectations.

Alibaba’s Taobao and Tmall Group’s results were driven by growth in customer management, specifically growth in online gross merchandise value/GMV. GMV measures the amount of dollars that flows through an e-Commerce platform and is often regarded as an important KPI. Total segment revenue growth was 4% Y/Y, showing 2 percentage points increase compared to the December quarter.

Alibaba’s key value is its free cash flow

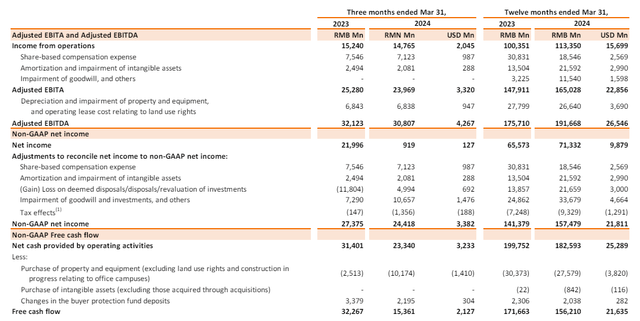

Alibaba’s free cash flow in the March quarter was $2.1 billion. In the full financial year, Alibaba generated $21.6 billion in free cash flow, which calculates to a quarterly average FCF of a massive $5.4 billion. This implies positive free cash flow of $1.8 billion per month!

From a free cash flow perspective, Alibaba is enormously profitable with a free cash flow margin of 17%, and it explains why the company earlier this year announced a $25 billion stock buyback. To further the appeal of Alibaba’s shares to investors, the e-Commerce company announced a special, one-time dividend of $0.66 per-share on Tuesday . This one-time dividend is a big deal for investors as Alibaba is gradually moving towards becoming a serious dividend stock: at a current price of $80, shares of Alibaba are set to yield approximately 2.1%.

Alibaba’s valuation

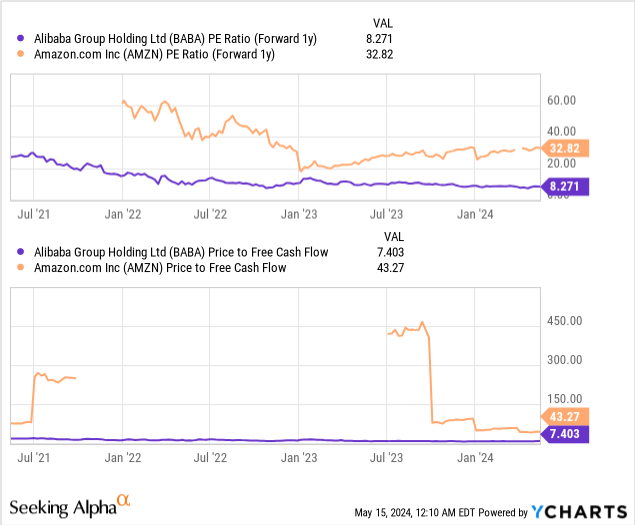

Alibaba is cheap based off of earnings and free cash flow. But I believe Alibaba’s focus on reorganizing its business into six different parts (last year’s reorganization plan) and returning much more of its free cash flow to shareholders are reasons why investors should take an investment in Alibaba seriously.

Currently, Alibaba’s Price-To-Earnings Ratio is 8.3 times, far below the company’s three-year average Price-To-Earnings Ratio of 13.0 times (a discount of 36%). In contrast, Amazon’s Price-To-Earnings Ratio is 32.8 times. The reason why Amazon’s valuation is higher is because its AWS cloud business has considerable prospects for free cash flow growth.

Amazon is also expected to grow its EPS faster than Alibaba in the near term (56% Y/Y growth for Amazon vs. 8% Y/Y for Alibaba in FY 2024). However, the extremely low valuation does not seem right to me, considering that Alibaba is enormously FCF-profitable and is now also paying special dividends. Given this backdrop, I believe Alibaba could trade at its 3-year average P/E ratio of 13X, which implies a fair value of ~$125.

Risks with Alibaba

Nowadays, the development of e-commerce is booming, and the competition among several major e-commerce platforms is becoming increasingly fierce. The development of Pinduoduo and Douyin e-commerce has also brought corresponding impacts to Alibaba’s Taobao, especially the content-based e-commerce Competitive Edge formed by Douyin e-commerce, which has always been an insurmountable gap for Taobao. Judging from Ma Yun’s previous statement, Alibaba also realizes that the opportunity of content-based e-commerce has been missed, but he stated that the company will actively take corresponding measures and vigorously develop AI e-commerce to enhance competitiveness in the future.

Under the trend of cross-border e-commerce, Alibaba International continues to grow strongly. This quarter, Alibaba International not only surpassed Alibaba Cloud Ali Cloud Aliyun in revenue scale for the first time, but also achieved a growth rate of 45%, undoubtedly becoming Alibaba’s second largest source of revenue. This is a milestone, but under the pressure of strong competitors such as Temu, Shein, and TikTok of Pinduoduo, Alibaba International will continue to increase investment to exchange for market space and enhance competitiveness.

How to make investment choices?

Although Alibaba’s stock price fell after the financial report was released, the company’s performance for the quarter was not so bad. Thanks to its focus on low-cost products in the e-commerce business, the e-commerce company’s revenue momentum doubled compared to the previous quarter. Alibaba continues to generate a large amount of free cash flow, which will be returned to shareholders as part of its generous capital return plan (now including special dividends). From the perspective of valuation and dividends, the editor believes that Alibaba represents the highest value, especially suitable for investors who want to diversify their investments and invest in another e-commerce giant besides Amazon.

Finally, the editor reminds everyone that investment involves risks. We hope all investors will consider carefully and wish everyone a good investment return!

Source: Seeking Alpha

Editor: BiyaPay Finance