- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Meta, Google, and Amazon are competing in the AI market, but how does Meta gain the upper hand?

Summary

- Meta Platforms’ stock got battered post-earnings, whereas rivals Google and Amazon saw their stocks rallying, despite all three tech companies guiding that they will be engaging in heavy AI-related capex.

- The top three advertising platforms are in a tight race to offer new, powerful generative AI features to capture future ad dollars.

- Meta holds a particular advantage over its key rivals that it is now leveraging to win in the era of AI.

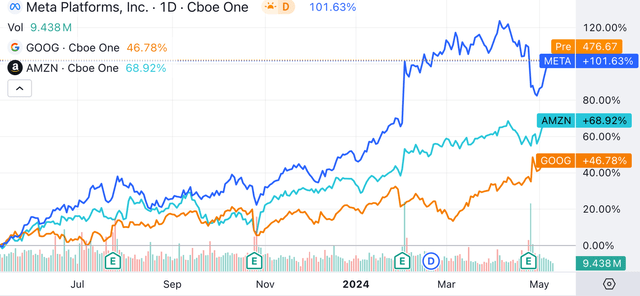

Meta Platforms’ (NASDAQ:META) stock had plummeted by over 13% following its Q1 2024 earnings report in late April, whereas rivals Google and Amazon saw their stocks rallying post-earnings, despite all three tech companies guiding that they will be engaging in heavy AI-related capex over the next year. Meta’s less positive revenue outlook relative to Google (GOOG) and Amazon’s (AMZN) core businesses indeed made investors wary. While the three tech giants run different kinds of businesses, they all have enormous advertising revenue segments, and will be competing ferociously for future ad dollars in the new era of AI.

In this article, we will be delving into how Meta is evolving its business messaging feature in the era of generative AI to drive returns for shareholders. Amid the tightening competition between the top three advertising platforms, Meta holds a particular advantage as generative AI-powered chatbots become increasingly prevalent in facilitating various forms of commercial activities.

Generative AI transforming tech platforms

With the generative AI revolution in full swing following the rise of ChatGPT, all three major advertising giants, Meta, Google and Amazon, are striving to transform the consumer experiences on their platforms through chatbot-based search and discovery features. This includes the Meta AI assistant, Google’s Gemini and Search Generative Experience [SGE], and Amazon’s Rufus.

Google and Amazon have been sharing examples of how they intend to show ads in their chatbot-based services, in order to convince shareholders that their search-based advertising businesses can be sustained amid the AI revolution.

Meta’s executives, on the other hand, have not yet felt the need to offer details into how they will show ads in the Meta AI assistant, given that Meta’s platforms like Instagram and Facebook are more discovery-oriented as opposed to search-oriented. The market considers generative AI to be less disruptive to the social media giant than Alphabet’s Search business, while Amazon is still trying to catch up against Meta and Google in the AI model race. These factors have been partly responsible for why the META stock price has outperformed GOOG and AMZN over the past year.

Meta’s business messaging advantage

For several years now, Meta has been leveraging the popularity of its communication apps like WhatsApp and Messenger to also facilitate business messaging through ‘Click to message’ ads, whereby shoppers can directly contact merchants to learn more about products of interest.

Enabling advertisers to directly communicate with prospective customers enables businesses to better understand shoppers’ needs, and also gives merchants an opportunity to cross-sell more products. In fact, a study by Forrester Research in 2022 had revealed that:

At the composite organizations, orders resulting from a Meta Business Messaging interaction have values 20% higher than their average order values.

Such positive business outcomes indeed benefit Meta investors in the form of higher demand for Meta’s advertising solutions, increasing revenue and profits for shareholders.

However, until now, such business messaging features have been more widely adopted in countries with low labor costs like India, where businesses can afford to hire staff to respond to online messages from potential customers. It has not been as popularly adopted by merchants in North American countries, where the cost of labor is higher.

Meta is automating business messaging

Now amid the generative AI revolution, Meta has been experimenting with automated business chatbots, powered by its own ‘Llama 3’ Large Language Model [LLM], that can respond to consumers’ queries and encourage them to buy various products on behalf of the merchants. Meta’s executives refer to these chatbots as “Business AIs”.

In fact, on the Q1 2024 Meta Platforms earnings call, when discussing the AI opportunities ahead, CEO Mark Zuckerberg proclaimed that:

The thing that I actually think is probably the biggest clear opportunity is all the work around business messaging.

If Meta succeeds at effectively automating chat-based interactions between merchants and shoppers, it could be conducive to greater demand for Meta’s ad solutions and translate to higher advertising revenue for shareholders.

This differs from Google and Amazon’s current deployment of LLMs on their platforms, whether that’s Google’s SGE or Amazon’s Rufus, which strives to connect shoppers and merchants through a single, universal chatbot. So when shoppers tell the chatbots what they are looking for, Google/ Amazon will try to show relevant product ads within or around the results. The market is still cautiously observing whether these new ad formats will be as profitable as the traditional ad solutions.

Now, to be clear, Meta will likely have to take a similar approach with its Meta AI assistant if consumers decide to start their product searches through this universal conversational AI feature.

However, Meta’s real advantage lies in its ability to facilitate direct conversations between consumers and a merchant’s customized AI chatbot, or “business AIs”. Such conversational features would be specifically trained using a merchant’s data to sell products/ services from that business when shoppers initiate a conversation via ‘click to message’ ads upon discovering traditional image/ video ads appearing on Instagram/ Facebook feeds.

So while Google and Amazon experiment with ad formats for their universal chatbot services, I believe Meta’s customized chatbot-based sales solutions for each individual merchant could potentially offer greater value for advertisers. Although that being said, we don’t know whether/ how much Meta would charge businesses for training and deploying their own tailored chatbots, which would indeed also play a role in businesses’ willingness to adopt these new generative AI solutions.

At present, Meta is still far from deploying automated business messaging features across its platform, as CFO Susan Li shared on the earnings call (emphasis added):

The longer-term piece here is around business AIs. We have been testing the ability for businesses to set up AIs for business messaging that represent them in chats with customers starting by supporting shopping use cases such as responding to people asking for more information on a product or its availability…we’re hearing good feedback with businesses saying that the AIs have saved them significant time while customer – consumers noted more timely response times. And we’re also learning a lot from these tests to make these AIs more performant over time as well. So we’ll be expanding these tests over the coming months and we’ll continue to take our time here to get it right before we make it more broadly available.

Hence, while the ad revenue opportunities from these generative AI-powered, customized business AIs are promising, Susan Li’s remarks suggest that

there is substantial iterative work to be done before these business AIs can be fully deployed and monetized. Hence, AI-driven revenue streams from these initiatives will be gradual and take time to realize.

Nonetheless, one of Meta’s key strategies to stand out from competition is to make its series of Llama models open source, while Google’s Gemini and Amazon’s Titan models remain closed source. Making the Llama code open-source should enable the social media giant to benefit from third-party developers innovating around the large language models. This should not only allow for faster additions of new functionalities to Meta’s chat-based services, but should also help uncover new ways of running its AI models more cost-efficiently, as CEO Mark Zuckerberg mentioned on the last earnings call (emphasis added):

The 8B and 70B parameter models that we released are best-in-class for their scale. The 400+B parameter model that we’re still training seems on track to be industry-leading on several benchmarks. And I expect that our models are just going to improve further from open source contributions.

We’re also going to continue to be very focused on efficiency as we scale Meta AI and other AI services. Some of this will come from improving how we train and run models. Some improvements will come from the open source community – where improving cost efficiency is one of the main areas I expect that open sourcing will help us improve, similar to what we saw with Open Compute.

Running the AI models more, and more cost efficiently is not just essential to improving profitability for shareholders, but will also play a key role in making Meta’s AI tools affordable for merchants and advertisers to adopt, conducive to top-line revenue growth as well as META investors.

Furthermore, aside from the innovative contributions from the third-party developer community, Meta’s own developers have also been impressively advancing the capabilities of Llama 3, as Mark Zuckerberg shared on the earnings call:

Now in addition to answering more complex queries, a few other notable and unique features from this release. Meta AI now creates animations from still images and now generates high quality images so fast that it can create and update them as you are typing, which is pretty awesome. I’ve seen a lot of people commenting about that experience online and how they’ve never seen or experienced anything like it before.

The reason such incredible functionalities are worth highlighting is that these capabilities offer great commercial value. For instance, it should enable business AIs to better and more swiftly understand what the consumer is looking for, allowing merchants to better grasp customers’ tastes/preferences, and potentially improving customer satisfaction rates. If Meta can better connect and facilitate richer conversations between merchants and shoppers than its rivals, then it could indeed lead to more ad dollars flowing towards its platforms, resulting in higher advertising revenue and profits for shareholders.

Could Google and Amazon also offer automated business messaging?

Now with Google and Amazon embracing chat-based services on their respective platforms amid the generative AI revolution, these competitors could also potentially offer automated communication services between consumers and merchants/ advertisers directly, to stay competitive against Meta. Although, simply introducing similar capabilities may not necessarily warrant a competitive threat.

Take Amazon as an example. The e-commerce giant had introduced its Rufus chatbot in beta mode to U.S. mobile app users on 1st February 2024, right before the Q4 2023 Amazon earnings call. And on that call, they had spent a notable amount of time talking about how they see Rufus enhancing shopping experiences on the platform.

However, on the Q1 2024 Amazon earnings call last month, there was not a single mention of Rufus. Amazon did not offer any details into how many people used the new shopping chatbot feature or the type of feedback they are getting. This raises questions about consumer usage volumes and/or usage experiences with Amazon Rufus.

If they had something positive to share for this feature, they indeed would have done so, given the company’s eagerness to convince markets that they are not falling behind in the AI race.

The absence of insights provided for this new generative AI feature suggests problems/ poor user experiences that need addressing before they have something positive to share with shareholders.

This indeed can be considered testament to Meta’s prowess in the AI race, which has been offering insights into users’ experiences with the Meta AI assistant, as well as proudly proclaiming the advancements of Llama 3. On the other hand, Amazon hasn’t even disclosed which AI model powers its Rufus chatbot.

Therefore, even if rival Amazon decided to start offering direct business messaging features for its shoppers using generative AI, it may not be an immediate threat to Meta. We would also need to consider the underlying models powering the tech giants’ respective chat features, as not all models are made equal. The more superior AI model would be able to facilitate richer user experiences.

Currently, Meta seems to be in a better position than Amazon when it comes to AI models, though it is worth keeping in mind that Amazon is developing a 2-trillion parameter LLM code-named ‘Olympus’ to try and catch up against rivals.

Google, on the other hand, already offers click-to-message ad solutions to merchants on its platform as well since 2016. However, unlike Meta Platforms, Google has not discussed the popularity of this feature on its earnings calls. Whereas on the Q3 2023 Meta earnings call, CEO Mark Zuckerberg had shared that:

Business messaging also continues to grow across our services and I believe will be the next major pillar of our business. There are more than 600 million conversations between people and businesses every day on our platforms.

Nonetheless, Alphabet is already competitively challenging Meta with its multimodal AI model ‘Gemini’. The search giant has not yet disclosed any ambitions to facilitate automated business messaging between consumers and merchants directly. Although, Google’s ability to challenge Meta here should not be underestimated.

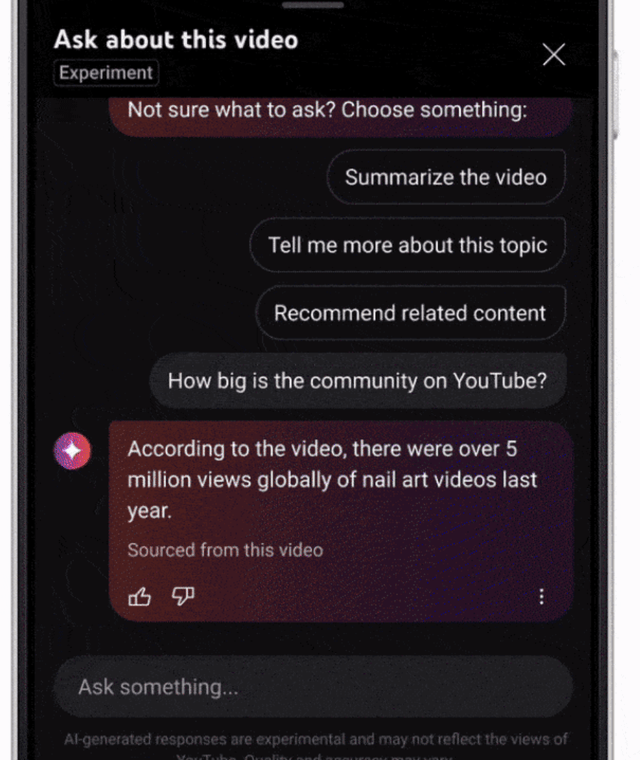

In fact, in November 2023, YouTube introduced an experimental, generative AI-powered chatbot for U.S.-based Premium subscribers. The conversational AI tool appears below videos and can be used to ask questions about the content, or even ask it to recommend similar content.

Similar to Instagram and Facebook, YouTube has also been evolving into a social commerce platform, with brands partnering with YouTube creators for endorsement deals and live shopping events. Therefore, there is certainly the potential for YouTube, and Google more broadly, to also leverage the power of its LLMs to facilitate automated business messaging between shoppers and brands, which would pose a challenge to Meta.

Although that being said, it could be difficult for Alphabet to challenge Meta in this space given that Zuckerberg’s social media giant already offers the most popular messaging apps in the world, Messenger and WhatsApp. Both of these apps are already widely and habitually used for friends and family to communicate with each other. So it becomes a natural transition to also start messaging businesses within these apps.

Google, on the other hand, does not offer any meaningful competitor chat-based service for people to communicate with each other. In fact, YouTube had introduced a chat service back in 2017 for users to communicate with each other and share videos, but was shortly shut down in 2019, testament to Meta’s dominance in the social communication services space.

META Financial Performance and Valuation

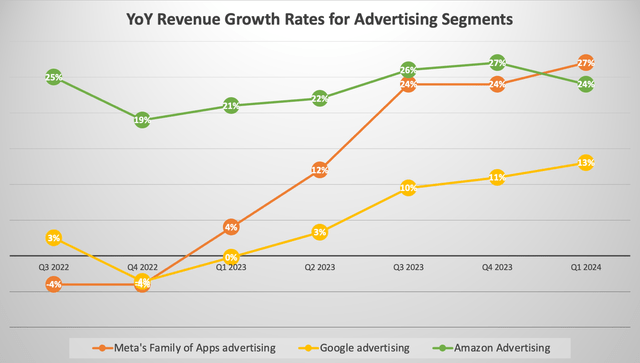

Broadly across the company, Meta Platforms delivered robust revenue growth of around 25-26% in Q1 2024, driven indeed by Family of Apps ad revenue growth of about 26-27%.

The chart below compares YoY growth rates of Meta’s Family of Apps ad revenue to those of Google advertising revenue and Amazon advertising revenue.

It is unsurprising for the ‘Amazon Advertising’ segment to witness such high growth rates given that it is the smallest of the big three advertising platforms, generating nearly $12 billion last quarter. Keeping this in mind, it is impressive that Meta’s key advertising segment, which generated $35.6 billion in Q1 2024, grew at an even faster pace than Amazon’s advertising segment last quarter, and had been growing almost just as fast in the preceding two quarters.

This robust revenue growth is partly attributable to Meta finding solutions around Apple’s iOS app tracking policy changes in 2022, enabling stronger YoY growth in 2023 after the revenue declines in 2022. Rising Chinese e-commerce companies Temu and Shein spending heavily on Meta’s ad solutions has also helped boost the social media giant’s ad revenue over the past several quarters.

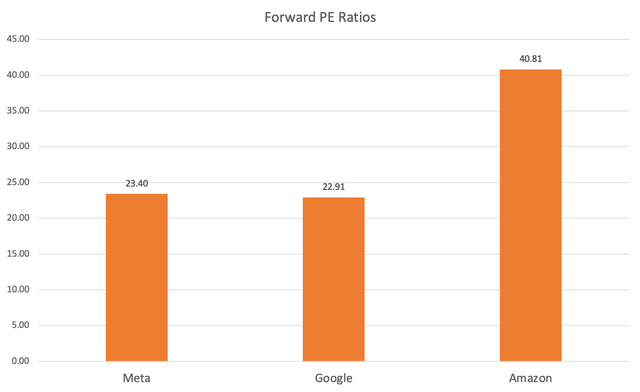

In terms of stock valuations, Meta and Google stock trade at more reasonable valuations of 23x forward earnings. For context, this is in line with META’s 5-year average forward PE of 23x.

Although the Forward PE ratio does not take into consideration the anticipated future growth rates of a company’s earnings, which plays an important role in an investor’s decision-making. That is why the Forward Price-Earnings-Growth (Forward PEG) ratio offers a better assessment of a stock’s valuation, as it adjusts the Forward PE by the projected EPS growth rate going forward.

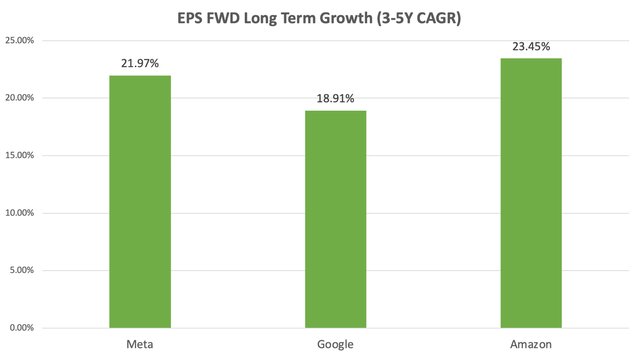

As per Seeking Alpha’s growth rate projection data, the EPS FWD Long-Term Growth (3-5Y CAGR) for Meta, Google and Amazon are as follows:

Meta offers the second highest EPS growth potential among the three tech giants, and not too far from Amazon’s estimated EPS growth projections, making Meta’s forward PE ratio of 23.40x even more appealing.

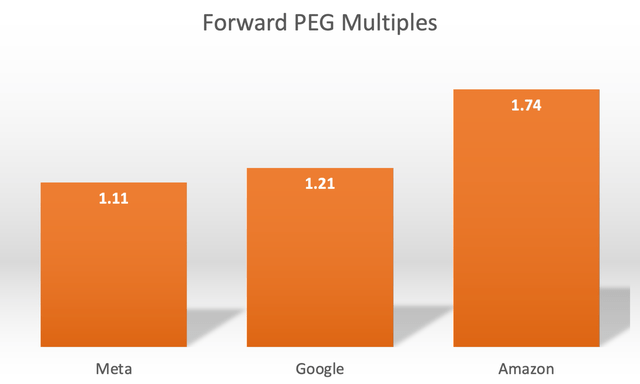

Now taking these growth projections to determine the Forward PEG ratios of these stocks, the multiples are as follows:

A forward PEG of 1 would imply that the stock is trading at fair value relative to future growth potential. Though highly popular, tech stocks tend to trade at a premium to fair value. Nonetheless, the closer the Forward PEG is to 1, the more appealing the stock’s valuation is as an investment opportunity.

Meta has the lowest Forward PEG multiple out of the three tech titans at 1.11, and well below its 5-year average Forward PEG of 1.52. From this perspective, META appears as an attractive investment opportunity.

Summary

Overall, in the era of artificial intelligence development, Meta has unique advantages compared to the other two ad platforms. It has a clear development direction, is good at seizing its own advantages, and has broad prospects, which is worth investors’ attention. However, investment carries risks. The editor believes that we can choose a more credible securities firm for investment, such as Jiaxin Wealth Management, which is a globally renowned investment securities firm. By opening an account with Jiaxin Wealth Management, you can get a bank account with the same name. You can deposit digital currency (USDT) into the multi-asset wallet BiyaPay, and then withdraw fiat currency to Jiaxin Securities for US stock investment. Of course, the editor suggests that you first search for the Meta stock code on the platform, regularly monitor the stock price, choose suitable opportunities, and then make the above transactions.

Source: Seeking Alpha

Editor: BiyaPay Finance