- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Apple performed poorly in the first quarter, but the market is still optimistic about its prospects!

Apple has always been a leader in the technology field, but recent financial reports show that this tech giant is facing some challenges.

Among them, the decline in sales of iPhone has undoubtedly brought considerable pressure to Apple. However, it is in this context that Apple seems to be quietly laying out and preparing to release a big move - AI strategy. This strategy is not only expected to reshape the market pattern, but also may bring new growth points to Apple.

iPhone sales are cold, revenue is falling, but Apple’s confidence has not diminished

On May 3rd, Apple released its Q2 financial report for fiscal year 2024. The report showed that Apple’s Q1 revenue was $90.753 billion, a year-on-year decrease of 4.31%, and its Net Profit was $23.636 billion, a year-on-year decrease of 2.17%.

Among them, as the core product of Apple, iPhone has always been the focus of the market. However, this financial report shows the weakness of the iPhone business.

The iPhone business revenue in the first quarter was $45.963 billion, a year-on-year decrease of 10.46%. This data undoubtedly raises concerns about the future of iPhone. At the same time, market research firm Counterpoint’s data shows that iPhone sales in the Chinese market have also experienced a significant decline, a year-on-year decrease of 19.1%. The decline in iPhone sales not only affects Apple’s revenue, but may also have a profound impact on the entire market pattern.

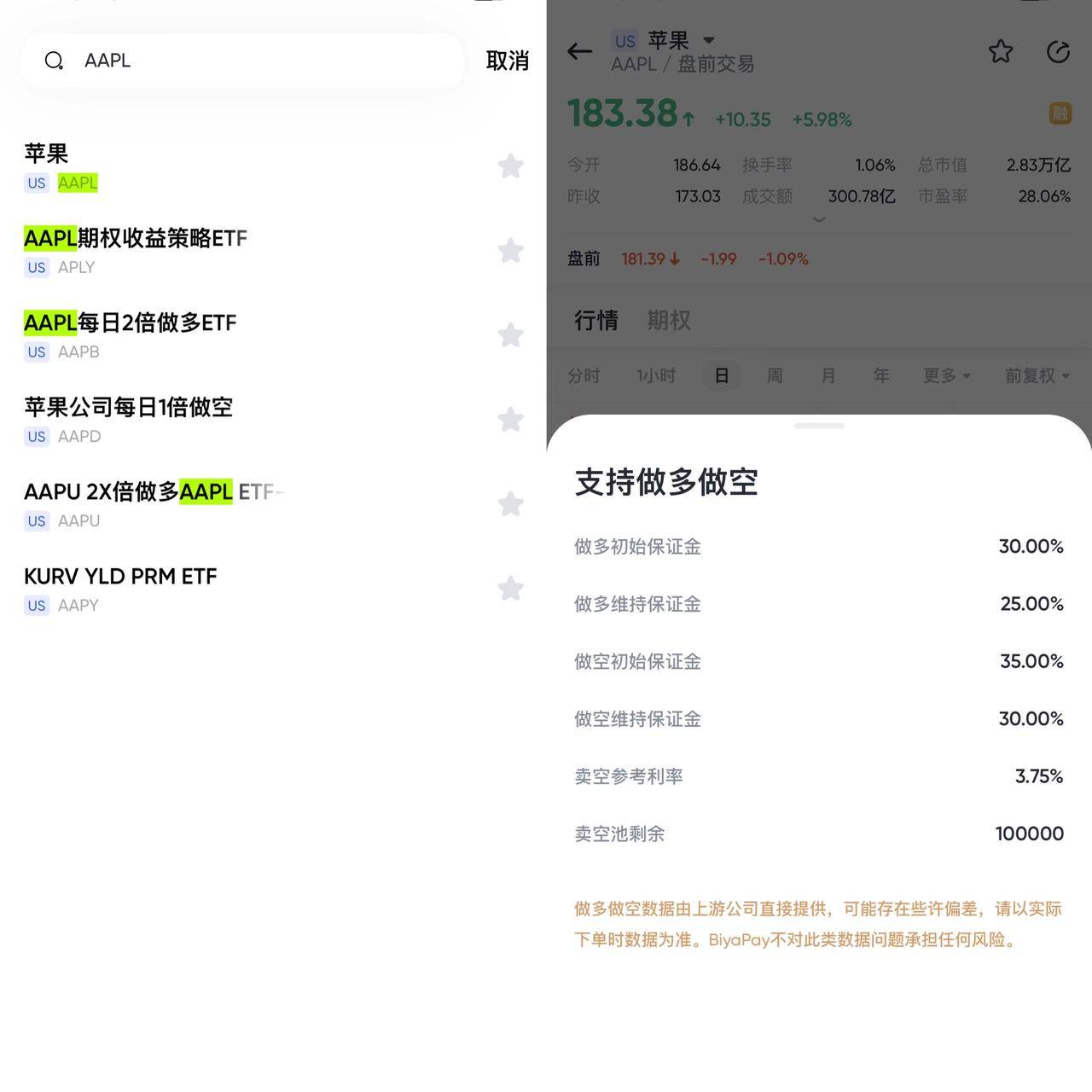

Despite the lower-than-expected financial report, Apple’s board of directors approved an additional $110 billion share buyback plan, which undoubtedly injected confidence into the market. Through the multi-asset trading wallet BiyaPay App, it can be seen that Apple’s stock price surged more than 7% after the financial report was released, indicating investors’ optimistic attitude towards Apple’s future development.

Meanwhile, Buffett stated at the Shareowners Conference on May 4th that Apple is still Berkshire’s largest holding company.

Apple has always been Berkshire’s largest heavy stock, but in the fourth quarter of last year, Berkshire reduced its holdings of Apple 10 million. As of the end of the first quarter of this year, Berkshire’s market value of Apple was $135.40 billion, a decrease of $38.90 billion from the end of last year, a decrease of about 22%. However, Apple fell nearly 11% in the first quarter, which means that Buffett may further reduce his Apple positioning in the first quarter.

However, at the 2024 Buffett Shareowner Conference, Buffett responded to the question of reducing his holdings of Apple stocks, stating that despite the recent decline in Apple’s sales, he will still hold Apple stocks for the long term. Regarding why he sold Apple, Buffett stated that it was due to tax reasons, as the investment had generated considerable returns, rather than his long-term judgment of the stock. Our tax rate this year is 21%, and the tax rate will be higher in the future. I think you won’t mind that we sold a little bit of Apple this year.

Buffett said that despite the recent slowdown in Apple’s sales, it is “highly likely” that Apple will still be one of Berkshire’s largest holdings. Unless there are significant changes, Apple will be the largest investment, and we will still hold the stocks of Apple, Coca-Cola, and US Express for the long term. Apple’s business model is “even better than US Express and Coca-Cola”.

It is worth noting that Apple CEO Tim Cook also attended the annual meeting. Cook stated that he had previously discussed reducing his holdings with Buffett. Cook stated that they had a long conversation and that Berkshire is still Apple’s largest shareholder, which he feels good about. Cook emphasized that having a shareholder like Berkshire is an honor.

The key to Apple’s reshaping of the market landscape - AI

Against the backdrop of declining iPhone sales, Apple seems to be actively seeking new growth points. Among them, AI strategy is undoubtedly an important part.

According to Morgan Stanley, the Apple Worldwide Developers Conference in June this year will be the focus of market attention, and the top priority may be the new artificial intelligence software features launched by Apple.

In fact, Apple has been laying out in the field of AI for a long time. As early as several years ago, Apple began to invest heavily in generative artificial intelligence.

Bloomberg reported in April that Apple has been in discussions with ChatGPT maker OpenAI and Google to provide support for the upcoming artificial intelligence chatbot in the iOS 18 update.

This may become interesting because we believe that “AI Agents” are the next important AI competition landscape.

What is AI Agent?

AI Agent, also known as artificial intelligence agent, is an intelligent entity with the ability to perceive the environment, make autonomous decisions, and perform tasks. It is like an intelligent assistant that exists in your phone or computer, such as Xiao Ai colleague or Siri, with certain intelligence and observation abilities.

Imagine that when you say to an AI Agent, “Siri, I’m not feeling well.” It will perform a magic trick by analyzing your status, body temperature, and recent activity trajectory, combined with a large amount of data and information on the internet, and through a series of complex calculations, conclude that you may be infected with a virus in just one second.

Next, the AI Agent will actively generate a leave request for you. You just need to tap confirm and the leave request will be automatically sent to your supervisor.

Not only that, it will also remind you thoughtfully that there is a shortage of fever-reducing medicine and mineral water in your home, and the products have been selected for you. With just one command, they can be delivered to your doorstep within 30 minutes.

In addition, the AI Agent realized that it was not wise to drive home now, so it automatically booked a car for you to go home and waited downstairs in 10 minutes. You just need to leave as soon as possible.

The above scenario shows the results of multiple AI agents working together to complete a series of tasks, fully reflecting the application prospects of artificial intelligence in life.

Sam Altman, CEO of OpenAI, said: ‘Useful artificial intelligence assistants (AI Agents) have the potential to become the Killer-App of artificial intelligence.’

For most other companies, implementing AI agents may be more challenging because they require at least two key components:

- A well-integrated hardware ecosystem;

- And the fundamental trust of users, allowing artificial intelligence assistants to access their data and behavioral patterns.

In the era of AI Agents, Apple has unique advantages in both aspects, which has become an important reason for the market and even investors to be optimistic about Apple.

Operate like Buffett, analyst: Apple stock is the right time to buy!

One analyst said, ‘Investors should hold onto Apple stock because it looks cheap.’

Even investment firm Bernstein has upgraded Apple’s stock rating from “neutral” to “outperform the market”, a rating it has held since 2018. The company has set a target price of $195 unchanged, which means there is a lot of room for the stock price to rise relative to the current stock price.

The company’s analysts wrote in a report, “To be like Buffett,” although he is known for buying and holding investments for the long term, Warren Buffett has shown great principles in his holdings of Apple, increasing holdings when it is relatively cheap and reducing holdings when it is relatively expensive.

For investors, this means increasing holdings at 25 times or less of Price-To-Earnings Ratio, and reducing holdings at 30 times or more. The current forward Price-To-Earnings Ratio for the stock in 2024 is 26.4. Therefore, investors can monitor its stock trend at any time through BiyaPay and buy or sell stocks at the appropriate time. They only need to deposit digital currency (USDT) into the multi-asset wallet BiyaPay, and then withdraw fiat currency to Jiaxin Securities to invest in US stocks. At the same time, BiyaPay holds relevant financial licenses or qualifications in the US, New Zealand, Canada and other places, and can safely and confidently search for AAPL for investment in BiyaPay.

Although Apple is currently facing sales difficulties, in Bernstein’s view, this problem is more cyclical than structural.

In the future, Apple is worth looking forward to

Although the current iPhone sales decline has put some pressure on Apple, the market believes that iPhone sales are likely to recover.

Weekly sales are slowly but steadily improving, so the momentum is turning around. For the second quarter, iPhone may introduce new color schemes and aggressive sales plans, which are expected to bring the brand’s sales back to positive growth.

Meanwhile, with the gradual advancement of Apple’s AI strategy, the editor has reason to believe that Apple will be able to achieve greater breakthroughs in the future. Whether it is in the fields of smart home, health monitoring, or autonomous driving, Apple is expected to bring consumers more intelligent and convenient products and services with its unique ecosystem and innovation capabilities. This will bring new growth points to Apple and is expected to reshape the market pattern.

In short, although the decline in iPhone sales has brought certain challenges to Apple, Apple has not been discouraged. On the contrary, they are actively laying out in the AI field and preparing to make a big move. This strategy is not only expected to reshape the market pattern, but also may bring new growth points to Apple.