- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Google's era has come! Market value breaks through 2 trillion, reaching a new historical high

Just one day ago, social media giant Meta, also one of the “Seven Giants” of the US stock market, released a solid first-quarter financial report. However, the expected increase in AI capital expenditures has worried investors, causing the company’s stock price to fall more than 15% in after-hours trading, and also brought considerable pressure to Google, which released its financial report a day later.

Under the pressure of the stock price plummeting more than 10% after Meta’s financial report, tech giant Google’s parent company Alphabet handed in a satisfactory answer sheet and announced the first dividend in history, as well as increased stock buybacks.

On April 26th, Alphabet released its financial report for Quarter 1 of 2024. After the release of the first quarter financial report, the stock price of Alphabet, the parent company of Google, rose more than 10% after the market closed. According to the multi-asset trading wallet BiyaPay, Google’s A-share price closed at $171.95 on April 26th.

Google crushed expectations comprehensively, and the after-market value exceeded 2 trillion

In the past half year, the market has been constantly criticizing Google. From the absolute leader in the field of artificial intelligence being overtaken by OpenAI, the highly anticipated Gemini model continuously failing and being mocked by netizens, to the recent rapid rise of AI search stars such as Perplexity impacting its pillar business, and so on. Google, which is considered to have contracted the big company disease, has even rumored that the management team will undergo a major overhaul.

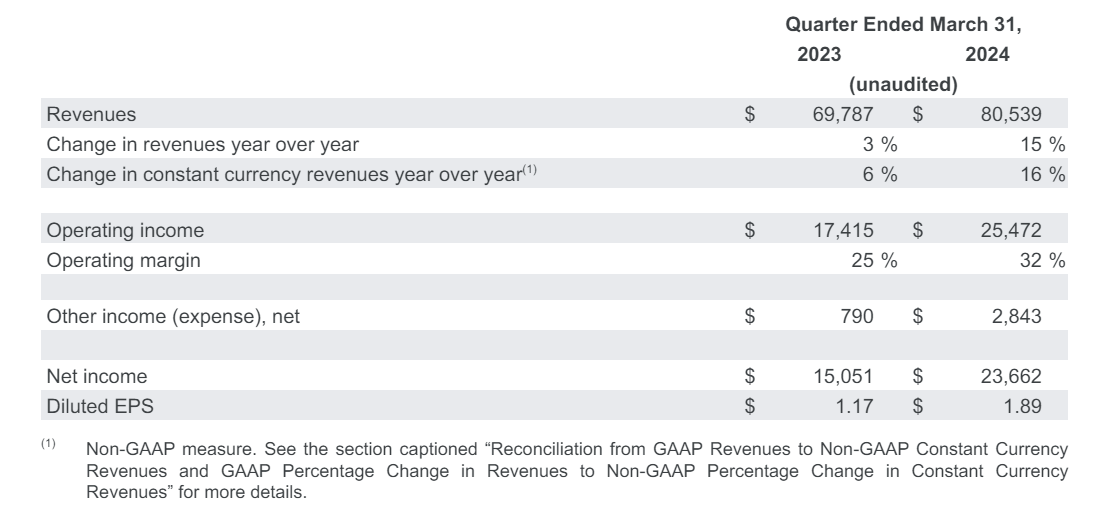

However, Google’s release of its Q1 financial report after hours can be said to have swept away the gloom of the past few months, greatly boosting the market’s confidence in it. The financial report data shows that Google’s Q1 revenue was $80.54 billion, not only exceeding the market’s expected $79.04 billion, but also achieving the fastest growth rate since early 2022 with a year-on-year growth of 15%. The earnings per share were $1.89, exceeding the market’s expected 25%.

From the perspective of sub-businesses, Google did not have any lags this time. Among them, the most critical advertising business seems to have not been affected by similar AI products at all, recording a revenue of $61.66 billion, a year-on-year increase of 13%, far higher than the expected value of $60.18 billion. YouTube’s advertising revenue has returned to the positive growth range, exceeding market expectations with a revenue of $8.09 billion.

In addition, with the help of generative AI, Google Cloud continued to maintain a high growth rate of 28%, recording a revenue of $9.57 billion, higher than the expected $9.37 billion. Currently, Google Cloud has gradually developed into Google’s second business growth curve. Its operating profit has more than quadrupled from $190 million in the same period last year to $900 million, which also helps to diversify the business risks of Google’s advertising dominance.

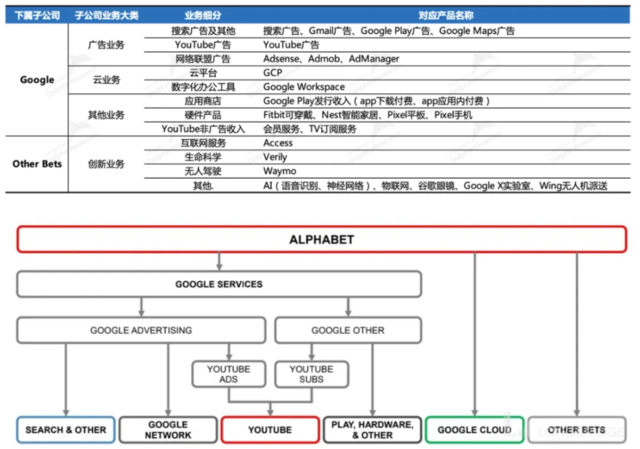

Google Business Specific Analysis

Google’s parent company, Alphabet, has a wide range of businesses and its financial report structure has changed multiple times. For those who are not familiar with Alphabet, you can first take a look at its business structure.

Briefly explain the long-term logic of Google’s fundamentals:

Advertising business, as the main source of revenue, contributes to the company’s main profits. Search ads are facing a crisis of being eroded by in-feed ads in the medium to long term, and the high-growth Streaming Media YouTube is filling the gap.

Cloud business is the second growth curve of the company, which has turned losses into profits. The recent signing momentum has been strong in the past year. As advertising continues to be dragged down by weak consumption, the development of cloud business is becoming increasingly important to support the company’s performance and valuation imagination.

The three pillars of revenue are expected to be conservative

In the first quarter, Google’s overall revenue 80.50 billion, an increase of 15.4% year-on-year, exceeding the market consensus 79 billion, low base + strong consumption, supporting Google’s advertising revenue continued to accelerate year-on-year growth.

(1) Advertising: YouTube is strong, Search is questioning

The advertising revenue in the first quarter 61.70 billion, with an overall growth of 13%. The low base accelerated compared to the previous quarter, which is in line with the strong macro environment and the overall industry performance. However, the market expectations are conservative (believing that Google’s marginal trend is weaker than its peers), and the growth expectations for YouTube and search have slightly decreased compared to the previous quarter. Later, after seeing the good performance of the third-party data platform YouTube, it only increased the growth rate by 1pct, making the growth rate flat compared to the previous quarter.

YouTube has the highest growth rate due to its low base, but compared to the previous period, its improvement is also the largest, with a year-on-year growth rate of 20%, while the market expectation is only 15%.

In fact, third-party data shows that YouTube user data has performed well recently. For example, according to Nielsen, YouTube’s proportion of time in US Streaming Media TV increased by 2pct year-on-year in March, which may be related to the weak content of its film and television peers. At the same time, according to Sensor Tower, the user growth of YouTube in the US region in the first quarter was more stable than that of its peers. Although some institutions have raised their revenue expectations for YouTube in the past month, the actual performance is still better.

(2) Search is the main area where market expectations are relatively conservative.

In the first quarter, search ads increased by 14% year-on-year, while the market expected only 11-12%. It may still be worried about the erosion of new AI entry points.

In the long run, this problem may ultimately be unavoidable. However, in the short term, Google still has defensive power (leading global AI technology), and there is also a process of budget migration for advertisers, which requires weighing user usage scenarios, usage stickiness, and advertising conversion effects. Currently, on Similarweb, Google’s search share is relatively stable.

Currently, AI Q & A platforms led by GPT are mainly used by users in work and study scenarios (GPT traffic will quickly decline during holidays), and the space for advertising monetization is still limited. However, due to the rapid development of this round of AI industry revolution, it is still necessary to closely monitor marginal changes.

(3) Cloud: It is a real AI dividend. It achieved 9.60 billion revenue in the first quarter, with a year-on-year growth rate of 28% and a month-on-month increase. Although there are some base effects, Cloud as a Service does not have obvious seasonality, and customer demand is consistent (the renewal rate is generally higher without significant changes). In addition, in early April, the management of the Next conference introduced the recent situation of the cloud business, so there should be a lot of AI bonuses for the accelerated growth in Q1.

Cloud business is To B, so the long-term trend may be related to its own product competitiveness, but short-term changes are more susceptible to changes in the current or previous contract scale.

Therefore, we usually use Google’s Revenue Backlog indicator to judge short-term trends. Most of this indicator comes from cloud business, so its trend can also be regarded as the trend of unfulfilled contract volume in cloud business.

As of the fourth quarter (first quarter data needs to be found in the SEC’s complete quarterly report, although the data lags behind, the overall trend can still be seen), Google Cloud’s backlog of contracts continued to increase by 14.2% compared to the previous quarter. Combined with industry changes, the AI bonus is very obvious.

(4) Other businesses: The growth rate in the first quarter unexpectedly slowed down, with a year-on-year increase of 18%. This part of the revenue is mainly composed of YouTube subscriptions (TV, music, etc.), Google Play, Google, One, hardware (mobile Pixel and smart home appliance Nest), etc. This may be mainly due to the impact of the current Google Play revenue cut and the sluggish hardware sales.

However, YouTube subscriptions (TV & Music) should still be very good. Data from third-party Nielsen shows that YouTube’s TV time share has significantly increased in March.

Alphabet pays its first quarterly dividend in history

Another driving force behind Google’s after-hours stock price surge to new highs is the company’s decision to issue its first quarterly dividend. The company approved a cash dividend of 20 cents per share to shareholders registered as of June 10th on June 17th, stating that it will “continue to pay quarterly cash dividends in the future.” In addition, it announced a $70 billion stock buyback plan. Under the dual effects of impressive performance and dividend news, Google’s after-hours stock price soared, rising nearly 16% at one point, and its market value increased by $300 billion, breaking through the 2 trillion market value mark.

For such good information, how should investors invest in Google stocks? The editor suggests that you can choose a more reliable securities firm for investment, such as Jiaxin Wealth Management, which is a globally renowned investment securities firm. By opening an account with Jiaxin Wealth Management, you can get a bank account with the same name. You can deposit digital currency (USDT) into the multi-asset wallet BiyaPay, and then withdraw fiat currency to Jiaxin Securities for investment in US stocks. You can also search for its code on the platform to make purchases: investors can regularly monitor stock prices according to their investment strategies and buy or sell stocks at the appropriate time.

Summary

Google’s after-hours increase has pushed the company’s stock price to a historic high. Dividends and buybacks are just one sign of the company’s reasonable valuation. With financial reports showing close synergies between various business sectors and continuous development and investment in AI, Google’s stock still has “huge potential for growth”.