- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

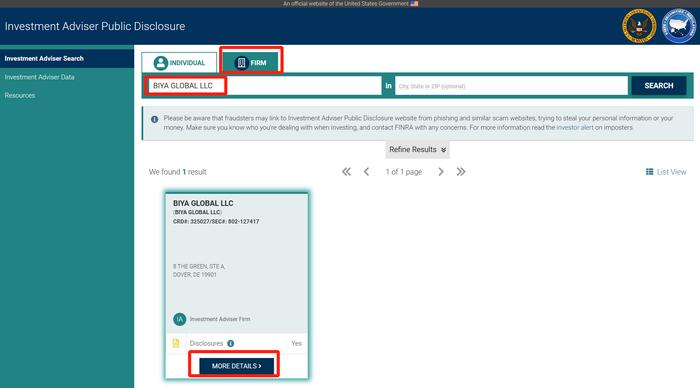

BiyaPay has registered as a Registered Investment Advisor (RIA) with the U.S. Securities and Exchang

BiyaPay’s U.S. entity, BIYA GLOBAL LLC, successfully registered as a Registered Investment Advisor (RIA) with the U.S. Securities and Exchange Commission (SEC) on January 31, 2023, and is regulated by the SEC or state securities departments. BiyaPay users can verify this registration on the SEC’s official website by entering the company name: BIYA GLOBAL LLC.

A Registered Investment Advisor (RIA) is a company or individual that provides investment advisory services and is regulated by the SEC or state securities departments. RIAs are primarily governed by the Investment Advisers Act of 1940, which emphasizes that RIAs must always place the interests of their clients above their own. Under this Act, RIAs are required to fully disclose information regarding their compensation, conflicts of interest, and any other relevant matters. Any form of improper benefit transfer is deemed illegal.

Regulatory Scope

In the U.S., providing paid securities investment advice requires registration as an investment advisor with the SEC or the state securities authority where the advisor’s main business is located, i.e., registering as an RIA.

The scope of securities investment advice in the U.S. is quite broad, encompassing asset management, account management, and financial services across the entire securities market. This includes common securities such as stocks, bonds, digital currencies, mutual funds, and commodity futures, as well as hedge fund management and financial planning services. Professionals in these areas are required to register as an RIA.

SEC Regulatory Requirements

The SEC requires registered investment advisors to act in the best interest of their clients, avoiding any deceptive practices. Advisors must maintain transparency, fully disclose information, and provide impartial investment advice suitable for their clients. Asset management must be conducted through third-party custodians, and any use of investment funds must be communicated to and approved by clients. This “fiduciary duty” is mandated by relevant legislation, ensuring the protection of clients’ interests when working with registered investment advisors.

Additionally, the SEC conducts regular examinations of RIAs, focusing on risk management related to portfolio valuation, performance, and asset audits; the legality of compliance policies and procedures; and the public release of examination results.

About BiyaPay

BiyaPay was established in 2019 and is a global multi-asset trading wallet. Headquartered in Singapore, it has established subsidiaries and expanded its business coverage in the US, Canada, Hong Kong, Singapore and other places. The number of registered users has reached 509,000, and users cover various countries and regions around the world.

BiyaPay supports online real-time exchange of more than 20 mainstream legal currencies and more than 200 mainstream digital currencies, helping users achieve local transfers in most countries or regions around the world, with fast arrival speed and unlimited credit limits.

At the same time, BiyaPay is also a professional deposit and withdrawal tool. You can recharge USDT and exchange it for USD/HKD, withdraw it to your personal bank account, and deposit it to major securities firms. The deposit is fast and unlimited. You can also directly invest in US/Hong Kong stocks with USDT without offshore accounts. You can participate in real-time stock trading and deposit and withdrawal in real time, which not only solves users’ deposit and withdrawal problems, but also saves time and costs. With one account and one fund, you can invest in global markets.